alliance outcomes

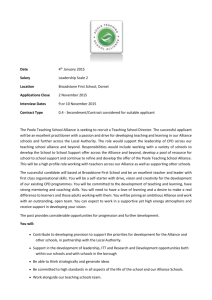

advertisement

Alina Lavinia Persa, Monika Poorova, Ksenia Anna Boroszko, Andrej Matta © This paper examines the effects of partner and relationship characteristics on alliance outcomes. The research involved analysis of 98 alliances (covering eight countries and several different types of alliance) through a twostage survey design. Findings support a positive relationship between partner firms’ benefits from alliance participation and partner reputation, shared decision making, and strategic similarities between partners. BACKGROUND ALLIANCE OUTCOMES Previous alliance research has progressed along two main paths: 1. Partner characteristics → explanation for alliance behaviour and outcomes. 2. Relationship characteristics → the link between the firms. This study incorporates both economic traditions emphasizing the value of a resource per se and behavioral traditions emphasizing the relationship in which a firm is embedded to develop a more complete understanding of the factors alliance outcomes. HYPOTHESES 1. PARTNER CHARACTERISTICS • REPUTATION quality; reflect the partner’s management, product or financial gives a firm better access to scarce resources; A positive reputation presents itself as an indicator of what partnering firm can expect from a firm. In addition, it acts as a factor that breaks down the distrust sometimes formed from firm relationships . 2. CHARACTERISTICS OF RELATIONSHIPS • PRIOR AFFILIATION relationship build trust and better knowledge of partner’s capability. A prior affiliation with a firm should positively affect the outcome of a joint venture or an alliance. With familiarity comes synergy and economies of scale, which may not be created in a new relationship. A prior relationship speeds up the alliance process because there is little or no honeymoon period in which the partners get accostumed to each other. Prior affiliation influences a firm’s prosperity to align itself with a particular partner. It has not yet been specifically linked to satisfaction with the outcome of an alliance. • SHARED DECISION MAKING suggest close interaction signifying both commitment to outcomes and reduced information asymmetry The degree to which partners trust each other and are committed to a relationship is a result of their investment and involvement in that relationship. The close interaction and the investment partners make through shared decision making signify two things: 1 a commitment to and interest in outcomes, which decrease the perceived likelihood of opportunistic behaviour; 2 the likelihood that a parner’s opportunistic behaviour will be recognized. Information assimetry is thereby reduced when both partners have high participation in and knowledge of strategic decisions and actions. A high degree of mutual involvement in the strategic decision making of the alliances will positevely affect outcomes as such involvement buids trust and enhances the appropriability of knowledge. • SIMILARITIES BETWEEN PARTNERS makes it easier to identify a partner’s potential contribution, and also to appropriate knowledge from one another. On the basis of this characteristic, the notion of ‘fit’ is important: fit may reflect perceived degree of agreement or commonality between partners. The more partner-firms complement one another, the greater the probability that an alliance will be successful (resource complementarity). Two factors comprise strategic fit: congruence of partners’ objectives, and complementary resources. Cultural fit is also comprised of two components: cultural compatibility (further bifurcated into national and corporate cultures), and the quality of managerial communications between partners (a more indirect measure of cultural compatibility). Organizational fit is divided into two defining elements: equity (ownership) structure of an alliance, and the extent of harmony in the top management team’s decision making processes. In order to enjoy espected synergies, organizations must have similar cultures and approaches to strategic decisions. Using of methods is very important to measure pretransaction variables . Target reputation, prior relationship, performance, similarities between targets and initial satisfaction in the first year of each alliance. Measures The most important is to determinate dependent variable which is usually alliance outcome. Measurement of alliances can be problematic because of the time-frame for payoffs may be different for different types of relationships. Measurement of pretransation variables • Performance - is deemed to be the fulfillment of an obligation, in a manner that releases the performer from all liabilities under the contract • Similarity - if they both have the same behaviour, or one has the same goals as the mirror image of the other • Initial satisfaction - compering partner expectations of new relationship with real satisfation in first year • Prior-relationship – what was the previous relationship between partners Measurement of performance Using of performance scale, respondents who represent partners measure overal satisfaction with alliance by questionnaire. 1. 2. 3. Overall, we are very satisfied with the performance of this alliance. The alliance bas realized the goals we set out to achieve. The alliance has contributed to our core competencies and competitive advantage. Similarity scale Respondents answer to indicate similarities between their firm and its partner. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Marketing Manufacturing Raw materials Accounting systems Information systems Structure Technology Customers Culture Human resources These types of similarities parallel the distinction between strategic and organizational fit. Measurement of prior-relationship Prior relationship between partners was measured by seven items indicating the extent to which the two firms had a prior affiliation as customer and supplier, competitors, or partners of another type. 1. 2. 3. 4. 5. 6. 7. Customer Supplier Competitor Alliance partner Licensee/licensor Distributor Other Measurement of intial satisfaction This single item asked partners to assess their level of satisfaction in the first year of an alliance. The three hypothesis dimensions include: 1. Product quality: Return rate, quality, technology, repeat husiness, reliahility, value, and customer relationships. 2. Management: Experience, integrity, ability to attract, retain, and train employees, decisionmaking capabilities, good neighbor in community, environmental responsibility, and innovativeness. 3. Financial performance: Effective use of assets, value as a long-term investment, and financial soundness. Scales are based on items that asked respondents to indicate cooperation between their firm and its partner. All of this scales were created to examine, that this choice of partner, was the right decision to cooperate with. The question is whether respondents in the final sample are representative of the population, and whether respondents to the first survey reflecte a bias toward alliances with either good or poor performance. Results Results • Model 1 captures the effects of the reputation dimensions on alliance performance .This model is significant at the p < .05 level [F = 2.73, R^ = .16 ->table). Coefficients for management reputation and the dummy variable for cross-border alliance are significant. Because the reputation dimensions of product quality and management are highly correlated. • Model 2, isolating the effects of the relationship variables including prior affiliation, degree of shared decision making, and similarities in strategic content and organizational processes, is also significant at p < .05 (F = 2.41, R^ = .18 ->table). The coefficient for shared decision making is. • Models 1 and 2 demonstrate that partner and relationship characteristics each have separate, significant effects on alliance outcomes. • Model 3 is the full model with all independent variables. This model offers a stronger, multivariate test of the hypotheses and allows examination of how partner and relationship characteristics simultaneously affect alliance performance. • Model 3 is significant (F = 3.08, p < .01 ->table). Individual coefficients for the management-quality reputation and for degree of shared decision making are significant. • These findings offer additional support for Hypotheses 1, 3, and 4, respectively predicting positive relationships between alliance outcomes and reputation, shared decision making, and similarities between partners. Relationship characteristics and trust in particular are the most important aspects for explaining alliance behavior and success. A firms initial satisfaction with an alliance can be predicted from the relationship characteristics, but some researches suggest that both prespectives alliance behaviour and outcome offer a better explanation of the benefits that partners can get from an alliance. The results show, that partner and relationship characteristics are very important in an alliances. The positive relationship between reputation and alliance outcomes gave benefits to partner firms. Theoretically, reputation represents a commodity, that can be traded in a market. The fact that reputation is positively related to alliance success suggests that the value of reputation is not completely bargained away in the transaction. On the other hand, reputation was not related to initial satisfaction and this suggest, that the benefits may change over time. A surprising finding is that prior affiliation can give initial satisfaction but not to longerterm benefits to partners. This can be explained by the fact that, even if affiliation has been demonstrated to affect alliance behaviour, it does not have a consistent impact on the future performance. In this study, prior affiliation was operationally defined as any type of preexisting relationship or market contact. It was find that firms can be in an alliance only when that affiliation is positive. We examined the relationship between the performance scale and any type of prior affiliation except competitor contact. This relationship was not significant ( r = .29, p < .05 ). Only an alliance with a supplier was significantly related to this alliance outcome ( r = .29, p < .05 ). From variables we can find that, companies may be more likely to ally with past partners and more satisfacied initialy, so past partnership is not predictive over successful relationship in the long run. The findings do affirm positive relationships between the degree of shared decision making and strategic similarities between partners and alliance performance. These variables were done to reflect trust and commitment, but trust has not been well defined in the research. We can underestand the role of trust in an alliance success using direct and indirect measures. Another interesting finding is that similarities between partners with organizational characteristics, including, culture and human resources, were negatively related to alliance outcomes, and that organizational process similarities were negatively related to initial satisfaction. The results also contradict the popular idea that "culture clash” negatively influences alliance potential. The negative relationship suggests that although similarities in strategic factors such as manufacturing activities and markets are important to alliance success, it is not as important for a company to pick a partner that thinks in the same way. It is also possible, that these relationships are not linear, there is a certain degree for understanding a partner. Too much similarity, though, could limit the benefits because nothing new is being brought to the relationship. In conclusion, this research on alliances by integrating two approaches to understanding alliance behavior and testing their separate and combined effects on alliance outcomes. We examined an alliance behavior based on resource dependence, game theoretic and organizational learning perspectives to hypothesize the effects of partner and relationship characteristics on alliance outcomes. The results suggest that although initial satisfaction may be explained by relationship characteristics, including a prior relationship with a partner and similarities between partners, but a combination of various cultures and habits and other ways of thinking offers the stronger explanation of more sustain, stronger and more successful alliances. Partner reputation, degree of shared decision making, and strategic similarities between partners were all found to have a significant, positive relationship to benefits to partner firms from alliance participation.