Notes Receivable Student

advertisement

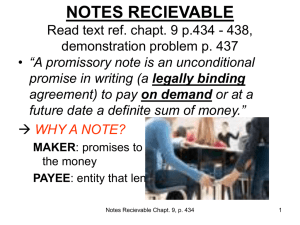

NOTES RECIEVABLE Read text ref. chapt. 9 p.434 - 438, demonstration problem p. 437 • “A promissory note is an unconditional promise in writing (a legally binding agreement) to pay on demand or at a future date a definite sum of money.” MAKER: PAYEE: Notes Recievable Chapt. 9, p. 434 1 INTEREST • Notes bare interest; the payee expects to not only receive the _____________ of the note receivable but also an _______________. I Pr t P = r= t = I = Notes Recievable Chapt. 9, p. 434 2 NOTES • Notes Receivable have a ________ ______, the date that payment on the note is due. All notes other than those payable on demand, are legally due 3 days after the maturity date “three days of grace”. However, interest is still charged on the three days of grace. Notes Recievable Chapt. 9, p. 434 3 Example: Jim-Bob Inc., unable to pay his $100,000 AR to Slim Co., negotiates prolonged payment as a Note journalize it! Acceptance of a note $100,000, 9.5% p/a from Jim-Bob Inc. Why would Slim Co. accept a note instead of demanding the AR from Jim-Bob? Notes Recievable Chapt. 9, p. 434 4 HONOUR OF NOTES RECEIVABLE • A note is honoured when it is paid in full at its maturity date. • Wolder Co. lends Higly Inc. $10,000 on June 1, accepting a 4.5% interest-bearing note, due in 4 months, on September 30. • Wolder collects the maturity value of the note from Higley on September 30. GENERAL JOURNAL Date Account Title and Explanation Sept. 30 Cash Notes Receivable - Higly Interest Revenue To record collection of Higly note. Notes Recievable Chapt. 9, p. 434 Debit Credit 10,150 10,000 150 5 Example: An “_____________” - A 90 day $100,000 note receivable from Jim-Bob Inc. is due August 30th. The interest rate is 9.5% pa. The note was for settlement of a $100,000 A/R from Jim-Bob. Full payment is received Sept. 2. journalize receipt of payment To record payment of $100,000, 9.5% note Notes Recievable Chapt. 9, p. 434 6 DISHONOUR (DEFAULT) OF NOTES • A dishonoured note is a note that is not paid in full at maturity. • A dishonoured note receivable is no longer negotiable. • Since the payee still has a claim against the maker of the note, the balance in Notes Receivable is usually transferred to Accounts Receivable. GENERAL JOURNAL Date Account Title and Explanation Sept. 30 Accounts Receivable - Higly Notes Receivable - Higly Interest Revenue To record the dishonour of Higly note. Notes Recievable Chapt. 9, p. 434 Debit Credit 10,150 10,000 150 7 DEFAULT & RENEWAL DEFAULT • If the A/R (note) will ultimately not be collected, it will be ___________ by debiting the _______________ _______________ and no interest would be recorded. RENEWAL OF A NOTE: • The maker and the payee of a note may agree that the note shall be renewed rather than paid at the maturity date. • Notes Recievable Chapt. 9, p. 434 8