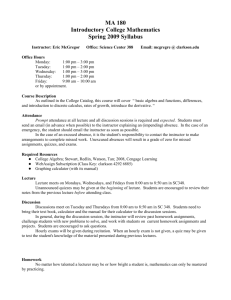

Syllabus - Illinois Valley Community College

advertisement

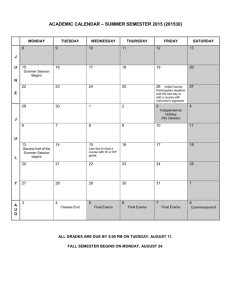

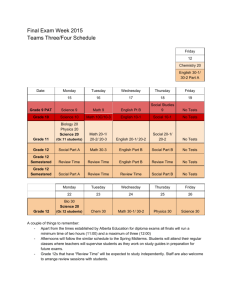

ACCOUNTING 2200-01 TAX ACCOUNTING CLASS SYLLABUS - FALL 2014 (Subject to Change) Instructor: Class time: Location: Email: Office: Office phone: Office hours: I. II. III. IV. V. VI. VII. VIII. IX. X. XI. XII. XIII. XIV. XV. XVI. XVII. XVIII. XIX. XX. XXI. XXII. Rick Serafini, CPA, CMA, MAC T, TH: 8:00 – 9:15 A 321 rick_serafini@ivcc.edu A 327 815-224-0392 Monday 8:45-9:15, 6:00-6:30 Tuesday 9:30-11:00 Wednesday 8:45-9:15 Thursday 9:30-11:00 Friday 8:15-9:15 Also By Appointment TABLE OF CONTENTS Course Description Prerequisite Expected Learning Outcomes Required Materials Assessment of Student Learning Grading Scale Contesting of Grades Structure of Class Classroom Rules Instructor Expectations Assessment Guidelines Attendance Policy Late Submission Policy Extra Credit Policy Plagiarism & Cheating Special Needs Withdrawal Policy & Financial Aid Communicating with the Instructor Student Email On-line Requirements Assignments & Due Dates Class Schedule 1 I. COURSE DESCRIPTION This course is designed to give the student an introduction into federal income taxation in the United States. Various topics are discussed including working with the tax law, determining gross income, deductions, tax credits, and property transactions. II. PREREQUISITE ACT 1210 III. EXPECTED LEARNING OUTCOMES Upon successful completion of the course, the student will have covered; ● ● ● ● ● ● ● ● ● ● ● ● ● ● An Introduction to Tax Tax Compliance, the IRS and Tax Authorities Tax Planning Strategies and Related Limitations Individual Income Tax Overview Gross Income and Exclusions Individual Deductions Individual Income Tax Computation and Tax Credits Business Income, Deductions, and Accounting Methods Property Acquisition and Cost Recovery Property Dispositions Investments Compensation Retirement Savings and Deferred Compensation Tax Consequences of Home Ownership IV. COURSE MATERIALS REQUIRED - Taxation of Individuals, Spilker, 2015 Edition CONNECT access code V. ASSESSMENT OF STUDENT LEARNING Point Distribution Exams 4 LearnSmart 12 Chapter Assignments 12 Comprehensive Tax Problems 2 Total 630 points 150 points 180 points 40 points 1,000 points 2 VI. GRADING SCALE 90% - 100% 80% - 89% 65% - 79% 55% - 64% < 55% (900 – 1,000) pts (800 – 899) pts (650 – 799) pts (550 – 649) pts < 550 A B C D F The instructor reserves the right to apply a class curve to points awarded. Final grades are based on points, not percentages! VII. CONTESTING OF GRADES Any student wishing to contest a grade for any assignment must do so within 48 hours of the posting of the grade on Blackboard – days when the college is closed do not count. All grades after this time are final and not subject to change! VIII. STRUCTURE OF THE CLASS Class time is important in the sense that we have a limited amount of time to cover a great deal of material; as such time is of the premium so we will try to stick to our schedule and cover the material in an organized fashion. Class time will be split between lecture, both by demonstrating the concepts covered at the board as well as the use of PowerPoint slides and other visual aids. The material is very detailed and can be confusing so essentially my lectures are more of a “walkthrough” of the chapter material. You should be prepared to take detailed notes and mark your text as I go along pointing out what I feel are important facts that you should concentrate on. We will also spend time examining the examples the author has scattered throughout the text. We will review these as we go along to be sure you have a sound understanding of each topic covered. In addition, we will be working through some of the discussion questions that can be found at the end of each chapter as a supplement to my lectures. Finally, be sure to bring your homework with you that you completed in CONNECT since we will be reviewing the correct solutions in class the day following the due date of the assignment. I encourage you to ask questions as we go along. Your participation will be of benefit not only to you but also to your fellow students as it is an aid in the overall learning process. 3 IX. CLASSROOM RULES A few rules for the classroom are; 1) All cell phones are to be turned OFF and PUT AWAY during class. 2) Professionalism - Professionalism is an important part of the business world and is demanded of those who choose accounting as their career. Part of the learning process involves understanding what is expected of you in class including your behavior and attitudes toward your instructor and fellow students. As part of this class you will be required to be respectful of others, to show courtesy, and to conduct yourself in a professional manner. 3) Promptness – You are expected to be in class ON TIME. If you arrive late it can be a distraction to others in class. I reserve the right to ask you to leave if you continue to arrive late for class. X. INSTRUCTOR EXPECTATIONS The reading material in a typical tax course can be difficult and extremely detailed. Tax law is complicated and application of that law is dependent upon a number of factors unique to each situation. You will be required to familiarize yourself with a number of situations that require you to use your research and interpretive capabilities to properly apply the law as it relates to each problem. We will be covering 14 chapters in total, or nearly one chapter per week. Each week you should at a minimum read through the complete chapter once, then go back and read the chapter again outlining those areas of the chapter that you feel are most important. Do not try to memorize all the various laws and regulations, instead attempt to gain an understanding as to how the laws are applied. Exams will be open book; however you MUST understand the material and know how to apply the tax code given each situation. When preparing tax returns for the public, tax preparers have at their disposal various reference materials and their ability to find the appropriate tax code and apply that law to their situation determines their effectiveness as a preparer. Likewise, in order to do well on the exams, you should have a sound understanding of the material and be able to quickly use your text as a resource guide to look up a particular area when answering a tax question. You must understand the material and how to find what you’re looking for in an efficient manner, much like real-world tax preparers. 4 You should also review solutions to the homework, quizzes, and problems each week. You will be required to use a great deal of self discipline in order to keep up with the assignments and be prepared for the four exams throughout the semester; therefore you should expect to devote (10) hours or more per week to the material and assignments. Some students may find that more or less time is required depending upon their grasp of the material. XI. ASSESSMENT GUIDELINES (1) Chapter Assignments You will have 14 chapter assignments with only the highest 12 counting. Questions will be in the form of problem solving. Each chapter assignment consists of around 12 problems for a total of 15 points. The due dates for all homework can be found under the file mentioned above entitled “Assignments and Due Dates”. All submissions will be made through the CONNECT program and will be graded automatically. The points assigned by CONNECT will be converted for each assignment to 15 points in Blackboard. Answers to all of the chapter assignments will be made available in CONNECT one day after the due date of the assignment. To view the solutions to the homework go to your grade book tab and click on the assignment after the due date; there you will see the correct solutions. This should be done after each assignment so you can see where you had difficulty and what areas you should go back and review. We will review the homework in class to give you time to ask questions and review your solutions. After reviewing the solutions, carefully go back to the text and make sure you understand where the author came up with his logic for the answer. Should you need further clarification on specific homework questions please contact the instructor. (2) LearnSmart You will be required to complete a LearnSmart module for each of the 14 chapters with the highest 12 scores counting. You may use whatever materials you need in order to complete the LearnSmart module. Each module is worth 12.5 points. The due dates for all quizzes can be found under the file mentioned above entitled “Assignments and Due Dates”. All submissions will be made through the CONNECT program and will be graded automatically. The points assigned by CONNECT will be converted for each assignment to 12.5 points in Blackboard. 5 (3)Exams There will be four exams totaling 630 points. The exams with their relative point value and coverage area are as follows: Exam #1 Exam #2 Exam #3 Exam #4 Chapters 1, 2, 3, 4 Chapters 5, 6, 7, 8 Chapters 9, 10, 11 Chapters 12, 13, 14 180 points 180 points 135 points 135 points Exams will be open book. A calculator will be provided to you for the exams. Exams will consist of multiple choice with both theory and problem solving questions. Exams will have a time limit of 1 hour and 15 minutes per exam. Your ability to complete the exams in a timely manner will depend upon how well you have mastered the chapter material that has been assigned to you. Exams will be reviewed on the next scheduled class date. Should you wish to review the results with your instructor in detail please contact me and we can set up a time to meet. (4)Comprehensive Tax Problems You will be assigned two comprehensive tax problems that will require you to use material covered throughout the course. The tax problems will require you to complete an actual tax return similar to what you might encounter in the real world. Both problems are worth a total of 40 points. 6 XII. ATTENDANCE POLICY You are expected to attend class regularly. It is imperative that you attend class as much as possible in order to improve your chances of success in this course. In order to impress upon you the importance of attendance, you will be limited to the amount of absences allowed, both excused and unexcused, during the semester. There are a total of 32 class meetings with 23 prior to and including the withdrawal date and another 9 beyond that. You may not miss more than 5 classes for any reason during the period 8/18/15 to and including 11/03/15. If you do, the instructor reserves the right to withdraw you from class without prior notification! As a final note, absences will negatively affect any borderline grades! XIII. LATE SUBMISSION POLICY All assignments are due on the date indicated under the section entitled “Assignments and Due Dates” found in this Class Syllabus. ALL ASSIGNMENTS ARE DUE ON THE DATE IDENTIFIED IN THIS DOCUMENT WITH NO EXCEPTIONS WHATSOEVER. The following are specific guidelines for each of the assessment types: (1) Chapter Assignments, and LearnSmart Assignments; I realize that there can always be unforeseen circumstances outside of the control of the student which will make it impossible to meet a due date for a given assignment; therefore I will drop the (2) lowest chapter assignments, and the (2) lowest LearnSmart assignments. This will allow for most any unforeseen circumstances that might arise. No late submissions for the comprehensive problems will be allowed under any circumstances. (2) Exams; Exams are due on the date specified under “Assignments and Due Dates”. Reproduced here are the dates for each of the exams; Exam 1 Exam 2 Exam 3 Exam 4 09-10-15 10-13-15 11-12-15 12-10-15 There will be no makeup tests unless the student contacts the instructor before the date shown above for each of the exams. If the student does not contact the instructor before this date they will receive a zero (0) for that exam! If the student does contact 7 the instructor with a legitimate reason as determined by the instructor as to why they cannot take the exam during the time allotted, the student will be granted a 1 day extension. This will be done only under extreme circumstances! I reserve the right to give the student a completely different exam in the case of a makeup. The makeup exam will be dropped off at the Assessment Center by 8:00AM following the date of the scheduled exam. It is the student’s responsibility to contact the Assessment Center to make arrangements to take the exam by the next school day. Please call the Assessment Center at 815-224-0542 to make the necessary arrangements. (3) Tax Problems; Tax Problems are due on the dates specified under the document Assignments and Due Dates. No late submissions will be allowed for any tax problems assigned. THERE WILL BE NO EXCEPTIONS BEYOND THIS POLICY FOR ANY REASON! XIV. EXTRA CREDIT POLICY No extra credit is given in this course; however the instructor reserves the right to add additional assignment(s) as extra credit should it be considered beneficial to the learning process. XV. PLAGIARISIM AND CHEATING POLICY Plagiarism involves using another person’s exact words or thoughts without citing the source in your work. Plagiarism is therefore an illegal act that constitutes a type of theft from another individual. Such actions are not tolerated in the business world and will not be tolerated in class. Whenever exact quotes are used, citing the source of the original material is required. Illinois Valley Community College prohibits plagiarism in any form. Students found plagiarizing or cheating in any way will result in automatically failing the course and/or dismissal from the college. XVI. SPECIAL NEEDS This course is designed to support diversity of learners. My hope is to create a safe environment for all students. If you want to discuss your learning experience, please talk to me as early in the term as possible. If you know you have, or suspect you have a disability (learning disability, physical disability, or psychiatric disability such as anxiety, depression, AD/HD, or others) for which you may need accommodations, please contact the Disability Services Office in C-211. Tina Hardy tina_hardy@ivcc.edu, 2240284) can help determine if you are eligible for support. 8 XVII. WITHDRAWAL POLICY AND FINANCIAL AID You may be withdrawn from the class in one of two ways; Instructor initiated – Based on the attendance requirement outlined above, I reserve the right to withdraw a student from class without prior notification if the student misses the number of classes identified under the Attendance Policy outlined above. Student initiated - Effective Summer 2011, students will have the ability to initiate a withdrawal from classes. By completing the form in the Records Office or at www.ivcc.edu/withdraw, the student is authorizing IVCC to remove him/her from the course. Entering the student ID number serves as the student’s electronic signature. IVCC has the right to rescind a withdrawal in cases of academic dishonesty or at the instructor’s discretion. Students should be aware of the impact of a withdrawal on full-time status for insurance purposes and for financial aid. It is highly recommended that students meet with their instructor or with a counselor before withdrawing from a class to discuss if a withdrawal is the best course of action for that particular student. The last day to withdraw for this class is November 4, 2015. Any student who has not withdrawn from the class after this date will receive a letter grade! XVIII. COMMUNICATING WITH THE INSTRUCTOR The instructor’s contact information is listed above. You may contact me by phone, in person or email. Whenever contacting the instructor using email, be sure to place your full name in the subject line along with your class number and section. Contact by email is limited over the weekend and evenings. XIX. STUDENT EMAIL Please note: Effective Summer 2011, all students will be responsible for checking their IVCC email. All electronic college correspondence will only be sent to the IVCC email. For information on accessing this account, go to http://www.ivcc.edu/studenthelpdesk.aspx?id=16712.” 9 XX. ON-LINE REQUIREMENTS BLACKBOARD I will enroll you in Blackboard based on the class roster. While the use of Blackboard is optional unless stated as otherwise for this class, I will provide and make available to you certain materials, communication, grades, and course documents, through Blackboard. Please be sure to check Blackboard often for announcements from me concerning important information for this class. Also, please make sure to verify that your student email account is working. Important announcements may also be emailed to you through Blackboard. It is the student’s responsibility to insure that their student email is correct and working properly. CONNECT All homework (with the exception of the chapter mentioned above), quizzes, and comprehensive problems will be completed using the on-line learning platform CONNECT offered through the publisher. It is your responsibility to register and monitor your use of this online system. For any problems with the CONNECT system please contact CONNECT TECHNICAL SUPPORT! Your instructor cannot trouble shoot problems with their system or program! You may contact technical support through their contact link in your course home page or you may contact them by phone at 1-800-331-5094. TECHNICAL ASSISTANCE - IVCC The center provides individualized academic assistance to all students utilizing computer technology. The Help Desk Support Staff provides assistance to students in person, on the phone, and via e-mail. Phone: Location: Email: Web Page: Contact Person: 815-224-0318 D201 crc@ivcc.edu http://www.ivcc.edu/crc Michelle Story - Michelle_Story@ivcc.edu 10 If you need assistance with communication tools or software issues, contact our staff. If you are having trouble with your computer, you will need to contact the manufacturer or the store where you bought it. If you are having trouble with your Internet connection, you should contact your Internet Services Provider (ISP). In case you are having difficulty logging into Blackboard or accessing your student email, IVCC has set up a “Known Technical Issues” Page for your convenience. This page is located at http://www.ivcc.edu/its/students/KnownIssues.html. Please call 224-0555 as soon as you detect a problem during regular campus hours. NETIQUETTE In the virtual classroom, you communicate with your classmates and Instructor primarily in writing through the public course bulletin board, e-mail, and sometimes chat sessions. “Online manners” are generally known as “netiquette”. As a general rule, you should adhere to the same classroom conduct that you would “off-line” in a face-to-face course. Some examples of proper netiquette are: ● ● ● ● ● ● ● Avoid writing messages in all capital letters. THIS IS GENERALLY UNDERSTOOD AS SHOUTING. Be careful what you put in writing. Even if you are writing an e-mail message to one person, assume that anyone could read it. Though you may send an e-mail to a single person, it is very easy to forward your message to hundreds or thousands of people. Students use of grammar and spelling matter in all classrooms whether face-to-face or online. Never use profanity in any area of an online course. The transcripts of online course bulletin boards, email, and chat sessions are savable. When responding to messages, only use “Reply to All” when you really intend to reply to all. Avoid unkindly public criticism of others. Publicly criticizing others in an inappropriate way is known as “flaming”. Use sarcasm cautiously, In the absence of nonverbal cues such as facial expressions and voice inflections, the context for your sarcasm may be lost, and your message may thus be misinterpreted. In a face-to-face setting, our tone and facial expressions may convey as much of our meaning as the words we use. In a written message, the subtext of your meaning may be confused or misinterpreted. Please do not use Internet slang abbreviations (e.g., “lol”, “brb”, etc.). Not everyone may understand. 11 Source: How to Succeed in an Online Course: Study Skills and Survival Tips. 6.2.05 http://www.distancelearning.org/howtosucceed.html VIRTUAL CLASSROOM To log in the First Time: 1. Go to http://blackboard.ivcc.edu 2. Follow the instructions. 3. Do Not Forget to Change Your Password once you have logged in successfully! FINAL SPECIAL NOTE: As stated earlier, it is the student’s responsibility to initiate in a withdrawal from this class. The final date for withdraw is November 4, 2015. Anyone remaining after that date will receive a letter grade according to the point structure listed above. 12 XXI. ASSIGNEMENTS AND DUE DATES DUE DATE CHP PROBLEM LS TAX RET EXAM DELIVERY DAY DATE TIME METHOD AUGUST 1 34,35,39,40,44,47,48,51,52,53,54,60 LS 1 SUN 08/23/15 11:59PM CONNECT 2 44,45,46,47,48,50,52,53,54,55,58,59 LS 2 WED 08/26/15 11:59PM CONNECT 3 38,39,40,41,42,43,44,45,51,53,57,58 LS 3 MON 08/31/15 11:59PM CONNECT LS 4 MON 09/07/15 11:59PM CONNECT THU 09/10/15 8:00 AM PAPER SEPTEMBER 4 26,29,31,33,35,36,43,44,45,46,47,49 EX 1 - CHP 1, 2, 3, 4 5 46,48,51,55,56,57,60,61,64,67,68,71 LS 5 WED 09/16/15 11:59PM CONNECT 6 36,38, 40,41,44,50,51,52,54,58,60,63 LS 6 WED 09/23/15 11:59PM CONNECT 7 32,33,34,38,40,43,44,49,52,56,57,61 LS 7 WED 09/30/15 11:59PM CONNECT LS 8 WED 10/07/15 11:59PM CONNECT TUE 10/13/15 8:00 AM PAPER MON 10/19/15 11:59PM CONNECT OCTOBER 8 50,53,54,57,66,69,72,73,75,76,80,83 EX 2 - CHP 5, 6, 7. 8 9 46,47,48,49,51,54,57,61,65,70,72,76 LS 9 #4 10 41,43,46,48,52,53,57,60,62,66,71,73 LS10 WED 10/28/15 11:59PM CONNECT LS11 MON 11/09/15 11:59PM CONNECT TUE 11/12/15 8:00 AM PAPER MON 11/18/15 11:5 PM CONNECT #5 MON 11/30/15 11:59PM CONNECT TBD THU 12/03/15 8:00 AM PAPER MON 12/07/15 11:59PM CONNECT THU 12/10/15 8:00 AM PAPER NOVEMBER 11 32,39,40,41,43,45,46,48,56,60,62,67 EX 3 - CHP 9, 10, 11 12 25,27,28,31,32,35,37,40,42,44,45,49 LS12 13 50,53,58,61,63,64,67,69,70,73,78,81 LS13 DECEMBER COMPREHENSIVE TAX RETURN 14 38,44,46,49,51,55,57,58,60,63,66,69 LS14 EX 4 - CHP 12, 13, 14 13 XXII. CLASS SCHEDULE Class WEEK 1 2 Meeting # 1 2 3 4 Day Tuesday Thursday Tuesday Thursday Date Lecture Chapter 08/18/15 08/20/15 08/25/15 08/27/15 CH 1 CH 2 CH 3 CH 3 Exam AUGUST Other SEPTEMBER 3 4 5 6 7 5 6 7 8 9 10 11 12 13 Tuesday Thursday Tuesday Thursday Tuesday Thursday Tuesday Thursday Tuesday 09/01/15 09/03/15 09/08/15 09/10/15 09/15/15 09/17/15 09/22/15 09/24/15 09/29/15 CH 4 CH 4 CH 5 EXAM 1 CH 5 CH 6 CH 6 CH 7 CH 7 OCTOBER 8 9 10 11 14 15 16 17 18 19 20 21 22 Thursday Tuesday Thursday Tuesday Thursday Tuesday Thursday Tuesday Thursday 10/01/15 10/06/15 10/08/15 10/13/15 10/15/15 10/20/15 10/22/15 10/27/15 10/29/15 CH 8 CH 8 CH 9 EXAM 2 CH 9 CH 10 CH 10 CH 10 CH 11 NOVEMBER 12 13 14 15 23 24 25 26 27 28 29 Tuesday Wednesday Thursday Tuesday Thursday Tuesday Thursday Tuesday Thursday 11/03/15 11/04/15 11/05/15 11/10/15 11/12/15 11/17/15 11/19/15 11/24/15 11/26/15 OPEN LAST DAY FOR WITHDRAW CH 11 CH 12 EXAM 3 CH 12 CH 13 CH 13 THANKSGIVING BREAK - COLLEGE CLOSED DECEMBER 16 17 30 31 32 Tuesday Thursday Thursday 12/01/15 12/03/15 12/10/15 CH 14 CH 14 EXAM 4 14