CH9

advertisement

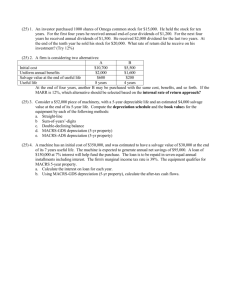

Chapter 9 Depreciation Principles of Engineering Economic Analysis, 5th edition Systematic Economic Analysis Technique 1. Identify the investment alternatives 2. Define the planning horizon 3. Specify the discount rate 4. Estimate the cash flows 5. Compare the alternatives 6. Perform supplementary analyses 7. Select the preferred investment Principles of Engineering Economic Analysis, 5th edition Questions about Depreciation • What is depreciation? Depreciation is a bookkeeping method reflecting the reduction in the value of an asset based on age, use, or output. • Is depreciation a cash flow? Depreciation is not a cash flow. • Why do we consider depreciation? Depreciation is of interest to us because of its impact on income taxes (which are cash flows!) Principles of Engineering Economic Analysis, 5th edition Engineers need to learn about depreciation because their design decisions can affect the way investments and annual operating costs are treated from an income tax perspective. Principles of Engineering Economic Analysis, 5th edition Depreciation Amount “The amount of the annual depreciation depends upon several factors, including (1) cost basis or investment in the property, (2) date placed in service, (3) property class or estimated useful life, (4) salvage value for certain methods, and (5) method of depreciation used.” Department of Treasury Internal Revenue Service Principles of Engineering Economic Analysis, 5th edition Business expenditures are either expensed or depreciated. Expensing an expenditure is akin to depreciating it fully in the year in which it occurs. Expenditures for labor, materials, and energy are examples of items that are fully deducted from taxable income. Expenditures for production equipment, vehicles, and buildings, on the other hand, cannot be fully deducted from taxable income in the year in which they occur; instead, they must be spread out or distributed over some allowable recovery period. Principles of Engineering Economic Analysis, 5th edition Depreciable Assets Depreciable property (1) must be used in business or be held for the production of income, (2) must have a life longer than a year and be determinable, (3) must be something that wears out, decays, is consumed, becomes obsolete, or loses value from natural causes. Depreciable property may be tangible or intangible; tangible property may be real or personal. Land is “never” depreciable. Principles of Engineering Economic Analysis, 5th edition Depreciation Terminology cost basis: taxpayer’s investment (purchase price plus improvements, additions, and/or installation) – also called unadjusted basis depreciation allowance: the depreciation charge or deduction for a given year book value: cost basis less capital recovered, such as depreciation allowances – also called unrecovered investment, adjusted cost basis, and adjusted basis Principles of Engineering Economic Analysis, 5th edition Depreciation Terminology (cont’d) recovery period: time over which the cost basis can be recovered, keyed to 3, 5, 7, 10, 15, 20, 27.5, or 31.5 years, depending on type of property involved. salvage value: estimated market value at the end of the asset’s useful life useful life: estimate of duration of use of the asset by the taxpayer Principles of Engineering Economic Analysis, 5th edition Straight-Line (SLN) Depreciation Let P = cost basis F = salvage value n = recovery period dt = depreciation allowance for year t Bt = book value at the end of year t dt = (P – F)/n =SLN(P,F,n) Bt = P - tdt Principles of Engineering Economic Analysis, 5th edition Example 9.2 A surface mount placement machine is being purchased for $500,000; it has an estimated useful life of 10 years and a salvage value of $50,000 at that time. Determine the depreciation allowance for the 5th year and the book value at the end of the 5th year using SLN. P = $500,000; F = $50,000; n = 10; t = 5 d5 = ($500,000 - $50,000)/10 = $45,000 =SLN(500000,50000,10) = $45,000 B5 = $500,000 – 5($45,000) = $275,000 Principles of Engineering Economic Analysis, 5th edition Example 9.2 A surface mount placement machine is being purchased for $500,000; it has an estimated useful life of 10 years and a salvage value of $50,000 at that time. Determine the depreciation allowance for the 5th year and the book value at the end of the 5th year using SLN. P = $500,000; F = $50,000; n = 10; t = 5 d5 = ($500,000 - $50,000)/10 = $45,000 =SLN(500000,50000,10) = $45,000 B5 = $500,000 – 5($45,000) = $275,000 Principles of Engineering Economic Analysis, 5th edition Notice: no minus signs Declining Balance (DB) Depreciation In addition to the previously defined notation, let p = declining balance percentage, rate, or fraction, e.g. 1.5/n, 2/n* =-RATE(n,,-P,F) dt = pP(1 – p)t-1 = (1 – p)dt-1 Bt = P(1 – p)t DB(cost,salvage,life,period,month) DDB(cost,salvage,life,period,month) VDB(cost,salvage,life,start_period,end_period, factor,no_switch) *When p = 2/n, called double declining balance (DDB) Principles of Engineering Economic Analysis, 5th edition Example 9.3 A surface mount placement machine is being purchased for $500,000; it has an estimated useful life of 10 years and a salvage value of $50,000 at that time. Determine the depreciation allowance for the 5th year and the book value at the end of the 5th year using declining balance depreciation. P = $500,000; F = $50,000; n = 10; t = 5 p =-RATE(10,,-500000,50000) = 20.5672% d5 = 0.205672($500,000)(1.0 – 0.205672)5-1 = $40,939.70 =DB(500000,50000,10,5) = $40,937.30 B5 = $500,000(1.0 – 0.205672)5 = $163,840.00 Principles of Engineering Economic Analysis, 5th edition Depreciation allowances and book values for Examples 9.2 and 9.4 t 0 1 2 3 4 5 6 7 8 9 10 SLN d t $45,000.00 $45,000.00 $45,000.00 $45,000.00 $45,000.00 $45,000.00 $45,000.00 $45,000.00 $45,000.00 $45,000.00 SLN B t $500,000.00 $455,000.00 $410,000.00 $365,000.00 $320,000.00 $275,000.00 $230,000.00 $185,000.00 $140,000.00 $95,000.00 $50,000.00 DB d t $103,000.00 $81,782.00 $64,934.91 $51,558.32 $40,937.30 $32,504.22 $25,808.35 $20,491.83 $16,270.51 $12,918.79 DB B t $500,000.00 $397,000.00 $315,218.00 $250,283.09 $198,724.78 $157,787.47 $125,283.25 $99,474.90 $78,983.07 $62,712.56 $49,793.77 DDB d t $100,000.00 $80,000.00 $64,000.00 $51,200.00 $40,960.00 $32,768.00 $26,214.40 $20,971.52 $16,777.22 $13,421.77 d5 = DDB(500000,50000,10,5) = $40,960.00 d5 = VDB(500000,50000,10,4,5,2) = $40,960.00 Principles of Engineering Economic Analysis, 5th edition DDB B t $500,000.00 $400,000.00 $320,000.00 $256,000.00 $204,800.00 $163,840.00 $131,072.00 $104,857.60 $83,886.08 $67,108.86 $53,687.09 VDB d t $100,000.00 $80,000.00 $64,000.00 $51,200.00 $40,960.00 $32,768.00 $26,214.40 $20,971.52 $16,943.04 $16,943.04 VDB B t $500,000.00 $400,000.00 $320,000.00 $256,000.00 $204,800.00 $163,840.00 $131,072.00 $104,857.60 $83,886.08 $66,943.04 $50,000.00 Switching from DDB to SLN with VDB Excel’s VDB worksheet function includes an optional feature: it can switch from using a specified declining balance rate to a straight-line rate when optimum to do so. But, what criterion is used to define optimum? Assuming a TVOM > 0%, since depreciation charges can be deducted from taxable income, ATPW is maximized when the PW of depreciation charges is maximized. Hence, we prefer to depreciate an asset sooner, rather than later. Therefore, accelerated depreciation methods are preferred to SLN depreciation, but only up to a point, and VDB determines that point. Principles of Engineering Economic Analysis, 5th edition Double Declining Balance Switching to Straight Line Depreciation The optimum time to switch from DDB to SLN is when, for the first time, the depreciation allowance with SLN is greater than the depreciation allowance with DDB allowance, i.e., switch the first year for which (Bt-1 – F)/(n – t + 1) > pBt-1 where p = 2/n for DDB Principles of Engineering Economic Analysis, 5th edition Example 9.4 For the surface mount placement machine, when should a switch from DDB to SLN occur? Switch at the smallest value of t for which (Bt-1 – F)/(n – t + 1) > pBt-1 Principles of Engineering Economic Analysis, 5th edition t 0 1 2 3 4 5 6 7 8 9 10 VDB B t $500,000.00 $400,000.00 $320,000.00 $256,000.00 $204,800.00 $163,840.00 $131,072.00 $104,857.60 $83,886.08 $66,943.04 $50,000.00 SLN d t $45,000.00 $38,888.89 $33,750.00 $29,428.57 $25,800.00 $22,768.00 $20,268.00 $18,285.87 $16,943.04 DDB d t $100,000.00 $80,000.00 $64,000.00 $51,200.00 $40,960.00 $32,768.00 $26,214.40 $20,971.52 $16,777.22 Principles of Engineering Economic Analysis, 5th edition SLN dt > DDB dt? No No No No No No No No Yes VDB d t $100,000.00 $80,000.00 $64,000.00 $51,200.00 $40,960.00 $32,768.00 $26,214.40 $20,971.52 $16,943.04 $16,943.04 (Bt-1 – F)/(n – t + 1) > pBt-1 t 0 1 2 3 4 5 6 7 8 9 10 VDB B t SLN d t DDB d t SLN dt > DDB dt? VDB d t $500,000.00 $400,000.00 $45,000.00 $100,000.00 No $100,000.00 $320,000.00 $38,888.89 $80,000.00 No $80,000.00 $256,000.00 $33,750.00 $64,000.00 No $64,000.00 $204,800.00 $29,428.57 $51,200.00 No $51,200.00 $163,840.00 $25,800.00 $40,960.00 No $40,960.00 $131,072.00 $22,768.00 $32,768.00 No $32,768.00 ($256,000 - $50,000)/(10 – 3) $104,857.60 $29,428.57 $20,268.00 = $26,214.40 No $26,214.40 $83,886.08 $18,285.87 $20,971.52 No $20,971.52 $66,943.04 $16,943.04 $16,777.22 Yes $16,943.04 $50,000.00 $16,943.04 Since $29,428.57 < $51,200, don’t switch! Principles of Engineering Economic Analysis, 5th edition (Bt-1 – F)/(n – t + 1) > pBt-1 t 0 1 2 3 4 5 6 7 8 9 10 VDB B t $500,000.00 $400,000.00 $320,000.00 $256,000.00 $204,800.00 $163,840.00 $131,072.00 $104,857.60 $83,886.08 $66,943.04 $50,000.00 SLN d t $45,000.00 $38,888.89 $33,750.00 $29,428.57 $25,800.00 $22,768.00 $20,268.00 $18,285.87 $16,943.04 DDB d t $100,000.00 $80,000.00 $64,000.00 $51,200.00 $40,960.00 $32,768.00 $26,214.40 $20,971.52 $16,777.22 SLN dt > DDB dt? No No No No No No No No Yes VDB d t $100,000.00 $80,000.00 $64,000.00 $51,200.00 $40,960.00 $32,768.00 $26,214.40 $20,971.52 $16,943.04 $16,943.04 $16,943.04 = ($83,886.08 - $50,000)/(10 – 8) Since $16,943.04 > $16,777.22, switch! Principles of Engineering Economic Analysis, 5th edition Modified Accelerated Cost Recovery System SLN is the most commonly used depreciation method for financial reporting MACRS is the most commonly used depreciation method for computing income tax liability MACRS is the only depreciation method approved for use in the U.S. for income tax purposes Two forms of MACRS General Depreciation System (GDS) MACRS-GDS uses 200% and 150% DB switching to SLN depreciation Alternative Depreciation System (ADS) MACRS-ADS uses SLN depreciation (Unless stated otherwise, when we refer to MACRS, we are referring to MACRS-GDS) Principles of Engineering Economic Analysis, 5th edition Modified Accelerated Cost Recovery System GDS is based on DDB switching to SLN ADS is based on SLN Both have pre-established recovery periods for most property Both include a half-year convention, whereby it is assumed that a property is bought and sold at mid-year Principles of Engineering Economic Analysis, 5th edition MACRS GDS Property Classes 3-year property: class life of 4 years or less, e.g., over-the-road-tractors, special tools for manufacture of automobiles, etc. 5-year property: class life between 4 and 10 yrs, e.g., automobiles, computers & peripherals, office equipment, and general – purpose trucks 7-year property: class life between 10 and 16 yrs, property without class life, and not included in 27.5 – and 39-year classes, e.g., office furniture and wide range of production equipment Principles of Engineering Economic Analysis, 5th edition MACRS GDS Property Classes 3-year property: class life of 4 years or less, e.g., over-the-road-tractors, special tools for manufacture of automobiles, etc. 5-year property: class life between 4 and 10 yrs, e.g., automobiles, computers & peripherals, office SMP machines: 5-year property equipment, and general – purpose trucks 7-year property: class life between 10 and 16 yrs, Theme park and park in property without classamusement life, and not included equipment: 7-year property 27.5 – and 39-year classes, e.g., office furniture and wide range of production equipment Principles of Engineering Economic Analysis, 5th edition MACRS GDS Property Classes 10-year property: class life of 16 or more and less than 20 years, e.g., vessels, tugs 15-year property: class life of 20 or more and less than 25 years, e.g., sidewalks, roads 20-year property: class life of 25 or more yrs other than real property with a class life of 27.5 years or more, plus municipal sewers, e.g. farm buildings 27.5-year residential rental property 39-year nonresidential real property: class life of 27.5 or more years and not residential rental property Principles of Engineering Economic Analysis, 5th edition MACRS In general, a half-year depreciation charge is allowed by the IRS, regardless of when an asset is placed in service or disposed of during the year. The exceptions are a) 27.5-Year and 39-Year property and b) when a midquarter convention applies. The latter applies to all property, other than nonresidential real property and residential rental property, if more than 40% of the cumulative depreciation charges for property placed in service and disposed of during a year occur during the last three months of a tax year. In the examples and endof-chapter problems, we assume exception b) does not occur. To be consistent with end-of-year cash flow assumptions in previous chapters and assumptions made by authors of other engineering economics texts, we assume investments occur at the end of year zero and the first, half-year, depreciation charge occurs at the end of year one. We do so, realizing that in practice, the half-year depreciation charges and investments generally occur in the same tax year. Principles of Engineering Economic Analysis, 5th edition Computing MACRS Allowance For 3-, 5-, 7-, and 10-year classes. MACRS allowances are determined by using double declining balance and switching to straight line depreciation at the optimum time with a half-year convention (200% DBSLH) For 15- and 20-year classes, 150% DB with switching to SLN depreciation at the optimum time with a half-year convention is used (150% DBSLH) For 27.5- and 39-year class, SL with a mid-month convention (SLM) is used Principles of Engineering Economic Analysis, 5th edition MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% DBSLH and 15- and 20-year property are 150% DBSLH EOY 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Property Property Property Property Property Property 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52 12.49 11.52 7.70 6.177 5 11.52 8.93 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 Principles of Engineering Economic Analysis, 5th edition MACRS-GDS percentages for 27.5-year residential rental property using mid-month convention Month in Tax Year Property Placed in Service Year 1 2 3 4 5 6 7 8 9 10 11 1 3.485% 3.182% 2.879% 2.576% 2.273% 1.970% 1.667% 1.364% 1.061% 0.758% 0.455% 2-9 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 10-26* 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 11-27** 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 28 1.970% 2.273% 2.258% 2.879% 3.182% 3.485% 3.636% 3.636% 3.636% 3.636% 3.636% 29 0.152% 0.455% 0.758% 1.061% 1.364% MACRS-GDS percentages for 39-year nonresidential real property using mid-month convention Month in Tax Year Property Placed in Service Year 1 2 3 4 5 6 7 8 9 10 11 1 2.461% 2.247% 2.033% 1.819% 1.605% 1.391% 1.177% 0.963% 0.749% 0.535% 0.321% 2-39 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 40 0.107% 0.321% 0.535% 0.749% 0.963% 1.177% 1.391% 1.605% 1.819% 2.033% 2.247% * even-numbered year ** odd-numbered year Principles of Engineering Economic Analysis, 5th edition 12 0.152% 3.636% 3.637% 3.636% 3.636% 1.667% 12 0.107% 2.564% 2.461% Computing MACRS Allowance Tables 9.4 and 9.5 can be used to calculate the MACRS depreciation allowance Given the allowance, pt, dt = ptP Bt = P(1 - p1 - p2 - … - pt-1 - pt) The Excel® VDB worksheet function can be used to calculate the MACRS depreciation rates Example 9.6 illustrates the use of the Excel® VDB worksheet function Principles of Engineering Economic Analysis, 5th edition From the text 5-Year Property: Recall, VDB(cost,salvage,life,start_period,end_period,factor,no_switch) Let cost = 1, salvage = 0, life = 5, and factor = 2. For start_period = 0 and end_period = 0.5, =VDB(1,0,5,0,0.5,2) = 20%, which is the beginning half-year rate. For start_period = 0.5, end_period = 1.5, =VDB(1,0,5,0.5,1.5,2) = 32%. For start_period = 1.5, end_period = 2.5, =VDB(1,0,5,1.5,2.5,2) = 19.2%. For start_period = 2.5, end_period = 3.5, =VDB(1,0,5,2.5,3.5,2) = 11.52%. For start_period = 3.5, end_period = 4.5, =VDB(1,0,5,3.5,4.5,2) = 11.52%. For start_period = 4.5, end_period = 5, =VDB(1,0,5,4.5,5,2) = 5.76%, which is the final half-year rate. Principles of Engineering Economic Analysis, 5th edition Example 9.7 The IRS classifies surface mount placement machines as 5-year equipment. What are the depreciation charges and book values for a $500,000 SMP machine? d1 = 0.20($500,000) = $100,000 d2 = 0.32($500,000) = $160,000 d3 = 0.192($500,000) = $96,000 d4 = 0.1152($500,000) = $57,600 d5 = 0.1152($500,000) = $57,600 d6 = 0.0576($500,000) = $28,800 B1 = $500,000 - $100,000 = $400,000 B2 = $400,000 - $160,000 = $240,000 B3 = $240,000 - $96,000 = $144,000 B4 = $144,000 - $57,600 = $86,400 B5 = $86,400 - $57,600 = $28,800 B6 = $28,800 - $28,800 = $0 Principles of Engineering Economic Analysis, 5th edition Example 9.8 Compare SLN, DDB, and MACRS for the SMP machine, assuming a negligible salvage value. Consider SLH, 200%DBH, MACRS, SLN, DDB, and DDB/SLN. Compute the present worth of the depreciation allowances, based on a 10% MARR. Which depreciation method maximizes the PW? Principles of Engineering Economic Analysis, 5th edition Depreciation Allowances for Example 9.8. EOY 0 1 2 3 4 5 6 PW = EOY 0 1 2 3 4 5 6 SLH d $50,000.00 $100,000.00 $100,000.00 $100,000.00 $100,000.00 $50,000.00 $361,847.83 B $500,000.00 $450,000.00 $350,000.00 $250,000.00 $150,000.00 $50,000.00 $0.00 200%DBH d $100,000.00 $160,000.00 $96,000.00 $57,600.00 $34,560.00 $12,960.00 $363,382.91 B $500,000.00 $400,000.00 $240,000.00 $144,000.00 $86,400.00 $51,840.00 $38,880.00 MACRS d $100,000.00 $160,000.00 $96,000.00 $57,600.00 $57,600.00 $28,800.00 $386,630.21 B $500,000.00 $400,000.00 $240,000.00 $144,000.00 $86,400.00 $28,800.00 $0.00 SLN d $100,000.00 $100,000.00 $100,000.00 $100,000.00 $100,000.00 $0.00 $379,078.68 B $500,000.00 $400,000.00 $300,000.00 $200,000.00 $100,000.00 $0.00 $0.00 Principles of Engineering Economic Analysis, 5th edition DDB d $200,000.00 $120,000.00 $72,000.00 $43,200.00 $25,920.00 $0.00 $380,686.86 B $500,000.00 $300,000.00 $180,000.00 $108,000.00 $64,800.00 $38,880.00 $38,880.00 DDB/SLN d $200,000.00 $120,000.00 $72,000.00 $54,000.00 $54,000.00 $0.00 $405,498.88 B $500,000.00 $300,000.00 $180,000.00 $108,000.00 $54,000.00 $0.00 $0.00 SLH SLN 200%DBH DDB MACRS DDB/SLN $500,000 Book Value $400,000 $300,000 $200,000 $100,000 $0 0 1 2 3 End of Year Principles of Engineering Economic Analysis, 5th edition 4 5 6 Sum of Years’ Digits (SYD) Depreciation Let P = cost basis F = salvage value n = recovery period dt = depreciation allowance for year t Bt = book value at the end of year t dt = 2(n – t + 1)(P – F)/[n(n + 1)] =SYD(cost,salvage,life,per) Bt = F + (P – F)(n – t)(n – t + 1)/[n(n + 1)] Principles of Engineering Economic Analysis, 5th edition Example 9.A.1 Calculate the SYD depreciation allowances and book values for the $500,000 surface mount placement machine, including a useful life of 10 years and a salvage value of $50,000. t 0 1 2 3 4 5 6 7 8 9 10 SYD dt $81,818.18 $73,636.36 $65,454.55 $57,272.73 $49,090.91 $40,909.09 $32,727.27 $24,545.45 $16,363.64 $8,181.82 Bt $500,000.00 $418,181.82 $344,545.45 $279,090.91 $221,818.18 $172,727.27 $131,818.18 $99,090.91 $74,545.45 $58,181.82 $50,000.00 Principles of Engineering Economic Analysis, 5th edition Pit Stop #9—Avoid the Pot Holes 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. True or False: Straight-line depreciation is the most popular depreciation method used in financial reporting. True or False: The Modified Accelerated Cost Recovery System is the most popular depreciation method used in computing corporate income tax liabilities. True or False: Based on maximizing the present worth of depreciation allowances, MACRS is preferred to SLN for recovery periods greater than 5 years. True or False: Accelerated depreciation plans were adopted after World War II to stimulate capital investment. True or False: Engineers seldom have an opportunity to influence the recovery period for expenditures. True or False: MACRS is equivalent to DDB, switching to SLN, with a midyear convention. True or False: The most popular variation of MACRS is MACRS-ADS. True or False: Sum-of-Years’-Digits depreciation is a popular depreciation method and is most often used to compute income tax liabilities. True or False: When given a choice of depreciation methods to use, choose the one that maximizes the present worth of book value. True or False: Sinking fund depreciation is the only depreciation method described in the book that is based on the time value of money. Principles of Engineering Economic Analysis, 5th edition Pit Stop #9—Avoid the Pot Holes 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. True or False: Straight-line depreciation is the most popular depreciation method used in financial reporting. True True or False: The Modified Accelerated Cost Recovery System is the most popular depreciation method used in computing corporate income tax liabilities. True True or False: Based on maximizing the present worth of depreciation allowances, MACRS is preferred to SLN for recovery periods greater than 5 years. True True or False: Accelerated depreciation plans were adopted after World War II to stimulate capital investment. True True or False: Engineers seldom have an opportunity to influence the recovery period for expenditures. False True or False: MACRS is equivalent to DDB, switching to SLN, with a midyear convention. True True or False: The most popular variation of MACRS is MACRS-ADS. False True or False: Sum-of-Years’-Digits depreciation is a popular depreciation method and is most often used to compute income tax liabilities. False True or False: When given a choice of depreciation methods to use, choose the one that maximizes the present worth of book value. False True or False: Sinking fund depreciation is the only depreciation method described in the book that is based on the time value of money. True Principles of Engineering Economic Analysis, 5th edition