Regulation and Supervision of the Financial System

advertisement

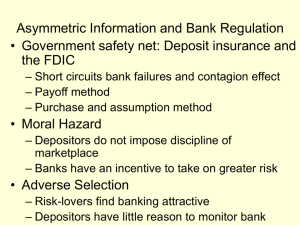

MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Ch 14: Financial Regulation The Need for Financial Regulation The main reason for financial regulation is due to information asymmetry; parties to a financial contract do not have the same information Information asymmetry leads to… adverse selection in which one party has a potential advantage over the other moral hazard in which one party takes more risk at the expense of some other party The factors above compel the govt’ to: protect investors many of whom are unable to judge the soundness of their financial institutions while competition is supposed to discipline all institutions in the industry, in practice, only force of law can ensure a bank’s integrity small investors rely on the govt’ for protection against mismanagement and malfeasance protect bank customers from monopolistic exploitation the tendency for small firms to merge into larger ones reduces competition and ultimately creates monopolies monopolies exploit their customers by raising prices to earn unwarranted profits; reduced competition allows this The govt’ intervenes to prevent financial institutions from becoming too large and force even large banks to face competition 1 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 The Need for Financial Regulation (continued) The factors above compel the govt’ to: (continued) safeguard the stability of the financial system the combination of liquidity risk (what’s this?) and information asymmetry means the financial system is inherently unstable a financial firm can collapse much more quickly than an industrial company a financial firm can create and destroy the value of its assets in an astonishingly short period and a single firm’s failure can bring down the entire system the govt’ provides a safety net for small depositors, i.e. FDIC the govt’ is also the “lender of last resort” to major financial institutions but the lender of last resort option may encourage financial institutions to take on too much risk so the govt’ provides regulation and supervision to minimize this The Government Safety Net The safety net can (and has) stopped bank panics and banks runs The safety net has two parts: Federal Deposit Insurance Corporation (FDIC) and the “lender of last resort” function The FDIC uses two primary methods to handle a failed bank: “payoff method” allows the bank to fail and pays off depositors up to $250k “purchase and assumption method” in which the FDIC reorganizes the bank, typically by finding a willing partner who assumes the bank’s liabilities “Lender of last resort” funds are provided directly from the treasury to the troubled institution institutions requesting such assistance subsequently usually receive considerable govt’ scrutiny 2 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Moral hazard and the govt’ safety net: Since depositors and creditors know they have some measure of “insurance” if a bank fails, they tend not to enforce sufficient discipline on financial institutions Adverse selection and the govt’ safety net: since financial institutions have a safety net upon which to fall back on, they may be tempted to make riskier investments than the would otherwise do; the risk is passed on to the tax payer the existence of the safety net may attract criminals to the financial industry Financial consolidation and the govt’ safety net: the Riegle-Neal Interstate Banking and Branching Efficiency Act of ‘94 and the Gramm-Leach-Bliley Financial Services Modernization Act of ‘99 have lead to larger and more complex financial organizations the increased size of financial institutions as a result of financial consolidation increases the “to big to fail” problem; this increases the moral hazard and adverse selection problem the consolidation of banks with other financial services firms means that the govt’ safety net may be extended to previously uncovered activities such as securities underwriting, insurance and real estate; this extends the scope of the moral hazard and adverse selection problem 3 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Regulation and Supervision of the Financial System Government officials employ two strategies to mitigate the risks created by the government safety net Government Regulation establishes specific rules for financial intermediaries to follow The goal of govt’ regulation is not to eliminate all risks that investors face The goal is to minimize the cost of financial crises to tax payers Banks and other financial intermediaries are regulated by a combination of various federal and state organizations commercial banks: FDIC, Office of the Comptroller of the Currency, the “Fed” and state authorities savings banks/savings & loans: FDIC, Office of the Comptroller of the Currency, and state authorities credit unions: National Credit Union Administrations and state authorities Regulatory competition: regulators force each other to innovate, improving the quality of regulation allows bank manager to “shop” for the most lenient regulators Example: AIG was supervised by the small U.S. Office of Thrift Supervision (OTS) which also supervised Countrywide Mortgage, IndyMac and Washington Mutual, all of which failed during the financial crisis of ‘07’09. OTS had little experience supervising the insurance business. AIG qualified for OTS supervision by buying a small savings bank years earlier 4 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Regulation and Supervision of the Financial System (continued) Government Regulation (continued) Shadow Banking System: These are non-bank financial intermediaries that provide services that compete with or substitute for those provided by traditional banks, i.e. brokerage firms, consumer and mortgage finance firms, insurance firms, investment companies (hedge funds & private equity firms), money-market mutual funds (MMMFs) and bank-created asset management firms called special investment vehicles (SIVs) Emergence of these types of firms is the result of the acts of law cited on p.3 Since these types of firms are relatively new, regulatory agencies have less experience regulating them The Securities Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) provide some regulation of the shadow banking system Asset Holding Restrictions and Minimum Capital Requirements One way to prevent banks from exploiting the safety net is to restrict their balance sheets Restrictions on the type of assets a bank can hold: U.S. banks cannot hold common stock U.S. banks cannot hold bonds rated below “investment grade” (below BBB- S&P and Fitch rating system) holdings from any single bond issuer cannot exceed 25% of the banks total capital size of loans to any single borrower cannot exceed 25% of the banks total capital 5 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Regulation and Supervision of the Financial System (continued) Government Regulation (continued) Asset Holding Restrictions and Minimum Capital Rqmts (continued) Minimum Capital Requirements a bank’s capital represents its net worth to its owners What is “capital” in this context? capital serves as a cushion against declines in the value of the bank’s assets banks are required to keep their ratio of capital to assets (capital divided by total assets) above some minimum level; this is called the “leverage ratio” a leverage ratio of 5% is considered “well capitalized” a leverage ratio of below 3% triggers increased regulatory restrictions on the bank banks are also required to hold capital in proportion to the riskiness of their operations a bank must compute the risk-adjusted level of its assets a capital charge is assessed against this level the rules for this are very complicated banks have learned to “game” this rule; i.e. they buy securities assessed as high grade which really aren’t Disclosure Requirements Banks and other financial intermediaries are required to provide… information to customers about the cost of their products: this is the “small print” on bank products and service agreements this is the nominal interest rate on a loan the fees they will charge for products & services balance sheets and other financial statements to investors and financial markets; this allows regulators and financial markets to asses the quality of the bank and the riskiness of their holdings 6 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Regulation and Supervision of the Financial System (continued) Government Supervision The goal is to reduce adverse selection and moral hazard Supervision is done remotely using detailed reports banks are required to file and through on-site examination Every depository institution that is insured by FDIC is examined at least once a year; examiners arrive unannounced Supervisors use the following criteria to evaluate the financial health of the banks they monitor capital adequacy asset quality management adequacy earnings liquidity sensitivity to risk Challenges to Supervisors and Regulators Due to legislation cited on p. 3 and other legal changes, commercial banks are not just banks; they have become investment banks, insurance companies, and securities firms all rolled into one different bank functions are supervised by different agencies, both functionally and geographically examples include Bank of America, Wells Fargo, JPMorgan Chase and Goldman Sachs 7 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Regulatory Reform: The Dodd-Frank Act of 2010 The Dodd-Frank Wall Street Reform and Consumer Protection Act imposes the most far-reaching changes in U.S. financial regulation since the 1930’s Four main goals: Strengthening the financial system encourage transparency and simplicity forbids depository institutions from engaging in a variety of risky activities such as trading securities for their own accounts, investing in private equity funds and owning hedge funds increases the liability of credit rating agencies for rating errors and compels greater disclosure to limit these agencies’ conflict of interest requires firms that originate and distribute asset-backed securities to have a vested interest in these securities through partial ownership Preventing crises through systemic risk management establishes a “super committee” of top regulators (the Financial System Oversight Council – FSOC) which aims to identify and forestall threats to the system has the authority to designate certain firms as systemically important financial institutions (SIFIs) making them subject to enhanced oversight by the “Fed” has the authority to close down SIFIs if they gravely threaten the financial system establishes the Office of Financial Research (OFR) which expands regulator’s data gathering and analysis capacity to support FSOC Ending “Too Big to Fail” Reducing Moral Hazard 8 MGT 470 Ch 14 Financial Regulation (cs3ed) v1.0 Nov 15 Regulatory Reform: The Dodd-Frank Act of 2010 (continued) Weaknesses: Fails to sufficiently streamline the U.S. regulatory apparatus Many govt’ guarantees still largely come for free; failure to charge fees commensurate with the risk sustains moral hazard The act largely ignores key shadow banks like MMMFs It is unclear whether provisions in the act will substantially reduce the “too big to fail” problem Why should you care about financial regulation? 9