Quantity Price - Cloudfront.net

advertisement

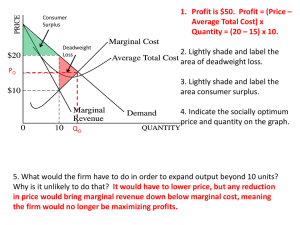

2014 AP Micro FRQ A #1 (Unit 4: Monopoly in Product Market) 1. The graph below shows the demand curve (D), marginal revenue curve (MR), marginal cost curve (MC), average total cost curve (ATC), and long-run average total cost curve (LRATC) for a monopolist. Price (a) Using the numbers given in the graph, identify each of the following for the profit-maximizing monopolist. (i) The quantity produced (ii) The price (iii) The allocatively efficient quantity (b) At the profit-maximizing quantity from part (a)(i), is the monopolist experiencing economies of scale? Explain. $60 $50 $40 $35 $30 $20 $10 0 MC=ATC=LRATC 2 4 5 6 8 MR 10 D QUANTITY 12 (c) Now assume that the monopolist produces 10 units. Using the numbers given in the graph, calculate each of the following. Show your work. (i) The monopolist’s economic profit (ii) The consumer surplus (iii) The deadweight loss (d) At what quantity is demand unit elastic? (e) Suppose the monopolist perfectly price discriminates and chooses the quantity that maximizes profit. Determine the dollar value of each of the following. (i) The monopolist’s profit (ii) The consumer surplus (a)(i) profit-maximizing quantity = 4 (a)(ii) profit-maximizing price = $40 (a)(iii) Allocatively efficient output = 8 (b) The firm is NOT experiencing economies of scale, because the LRATC is NOT downward sloping as output increases or LRATC remains constant as output increases. (c)(i) (P-ATC) X Q = ($10 - $20) X 10 = -$100 Price (c)(ii) CS = ½ ($60 - $10) X 10 = $250 (c)(iii) DWL = ½ ($20 - $10) X (10 – 8) = $10 $60 (d) Quantity = 6 $50 (e)(i) ½ [($60 - $20) X 8] = $160 $40 (e)(ii) Consumer Surplus is zero $35 $30 MC=ATC=LRATC $20 $10 D 0 2 4 5 6 8 MR 10 12 QUANTITY 2014 AP Micro FRQ A #2 (Unit 5: Resource Market) 2. Ray’s Stable hires workers in a perfectly competitive factor market for unskilled labor. (a) Using correctly labeled side-by-side graphs for the labor market and Ray’s Stable, show each of the following. (i) The equilibrium wage and quantity for unskilled labor, labeled WE and QE, respectively . (ii) The wage paid by Ray’s Stable and the quantity of unskilled labor hired, labeled WR and QR, respectively (b) Is the marginal factor cost of unskilled labor for Ray’s Stable greater than, less than, or equal to WE? Explain. (c) Now assume that the government imposes an effective minimum wage for unskilled labor. (i) Show the minimum wage on your graphs in part (a), labeled WMIN. (ii) On the labor market graph in part (a), show the quantity of unskilled labor supplied in the labor market as a result of the minimum wage, labeled QS. (iii) As a result of the new minimum wage, will the marginal revenue product of the last worker hired by Ray’s Stable increase, decrease, or stay the same? (b) Ray’s Stable’s marginal factor cost = WE The firm is a wage taker in the labor market and/or the market sets the wage. (a)(i) WE & QE (a)(ii) WR & QR (c)(i) WMIN (above WE) (c)(ii) QS (c)(iii) Marginal revenue product of last worker hired will increase. Industry Wage WMIN Ray’s Stable S L WE Wage S=MFCMIN WMIN SL=MFC WR QE QS DL Q DL=MRP QR Q 2014 AP Micro FRQ A #3 (Unit 2: Tax) 3. Assume that gasoline is sold in a competitive market in which demand is relatively inelastic and supply is relatively elastic. (a) Draw a correctly labeled graph of the gasoline market. On your graph show the equilibrium price and quantity of gasoline, labeled PE and QE. (b) Suppose the government imposes a $2 per unit tax on the producers of gasoline. On your graph from part (a), show each of the following after the tax is imposed. (i) The price paid by buyers, labeled PB (ii) The after-tax price received by sellers, labeled PS (iii) The quantity, labeled QT (c) Using the labeling on your graph, explain how to calculate the total tax revenue collected by the government. (d) Will the tax burden fall entirely on buyers, entirely on sellers, more on buyers and less on sellers, more on sellers and less on buyers, or equally on buyers and sellers? Explain. (a) PE & QE (b)(i) PB above PE, derived from D at QT (b)(ii) QT < QE (c) Total Tax Revenue = (PB X QT) – (PS X QT) = (PB - PS) X QT = $2 X QT (d) Tax burden will fall more on buyers and less on sellers because the demand curve is more inelastic than the supply curve. Price STax PB S PE PS D QT QE Quantity 2013 AP Micro FRQ A #1 (Unit 4: Monopoly in Product Market) 1. The graph below illustrates the demand, marginal revenue (MR), marginal cost (MC), and average P4 total cost (ATC) curves for a profit-maximizing monopolist. a P3 (a) Assume that the profit-maximizing monopolist is b e P2 unregulated. Using the labeling in the graph, identify MC=ATC f each of the following. P1 c d (i) The monopolist’s quantity of output Demand (ii) The monopolist’s price 0 Q1 Q2 Q3 Q4 (iii) The profit earned by the monopolist Quantity MR (iv) The deadweight loss (b) Now assume that the monopolist can perfectly price discriminate. Using the labeling of the graph, identify each of the following. (i) The quantity produced (ii) The total revenue received by the monopolist (c) Instead, assume the monopolist charges a single price and is regulated to produce the socially efficient quantity. Using the labeling of the graph, identify each of the following. (i) The socially efficient quantity (ii) The consumer surplus at the socially efficient quantity (d) Is the monopolist facing the regulation in part (c) earning a positive economic profit, earning zero economic profit, or incurring a loss? Explain. (e) Is point f in the elastic, inelastic, or unit elastic portion of the demand curve? Explain $/Unit (a)(i) The monopolist’s quantity of output = Q1 (a)(ii) The monopolist’s price = P3 (a)(iii) The profit earned by the monopolist = P1P3ac (a)(iv) The deadweight loss = acf (b)(i) The quantity produced = Q3 (b)(ii) The total revenue received by the monopolist = P4fQ30 (c)(i) The socially efficient quantity = Q3 (c)(ii) The consumer surplus at the socially efficient quantity = P1p4f (d) The monopolist is earning zero economic profit because the price equals ATC. (e) Point f is in the inelastic portion of the demand curve because MR is negative. 2013 AP Micro FRQ A #2 (Unit 4: Oligopoly) PieCrust LaPizza Advertise Not Advertise Advertise $250 , $200 $450 , $300 Not Advertise $180 , $500 $390 , $400 2. There are two pizza restaurants in College Town, PieCrust and LaPizza. Each company must decide whether to advertise or to not advertise. In the payoff matrix below, the first entry in each cell indicates PieCrust’s daily profit, and the second entry indicates LaPizza’s daily profit. Both firms have complete information. (a) What strategy should PieCrust choose if LaPizza chooses to advertise? Explain using the dollar values in the payoff matrix. (b) What is the dominant strategy, if any, for LaPizza? Explain using the dollar values in the payoff matrix. (c) In the Nash equilibrium, determine each of the following. (i) PieCrust’s daily profit (ii) LaPizza’s daily profit (d) Suppose that advertising costs increase by $60 per day. Redraw the payoff matrix to reflect the effect of the higher advertising costs. (a) PieCrust should advertise because it makes greater profit by advertising: $250> $180. (b) LaPizza does not have a dominant strategy. LaPizza’s best choice depends on the strategy chosen by PieCrust. When PieCrust advertises, LaPizza does better by not advertising ($300>$200); When PieCrust does not advertise, LaPizza does better by advertising ($500 >$400). (c) Daily profit for PieCrust is $450, and for LaPizza is $300. LaPizza Advertise Not Advertise PieCrust (d) Advertis $190, e Not $180 , $140 $390, $300 $440 $390 , $400 2013 AP Micro FRQ A #3 (Unit 6: Externalities) 3. For special occasions some people purchase and set off fireworks in their backyards. Assume the market for fireworks is perfectly competitive. (a) Draw a correctly labeled graph of the market for fireworks and show the market equilibrium price and quantity, labeled PE and QE. (b) Assume that the noise from the fireworks disturbs all of the neighbors. On your graph in part (a), show each of the following. (i) The marginal social cost curve, labeled MSC (ii) The marginal social benefit curve, labeled MSB (iii) The deadweight loss, if any, shaded completely (c) Now instead assume that all of the neighbors enjoy watching the fireworks. (i) In this case, is the market equilibrium quantity of fireworks greater than, less than, or equal to the socially optimal quantity? Explain. (ii) In this case, if the government bans fireworks, will the deadweight loss increase, decrease, or remain unchanged? (a) PE & QE (b)(i) MSC curve above the supply curve. (b)(ii) Labeling the demand curve MSB. (b)(iii) Shading the area of deadweight loss. (c)(i) Market equilibrium quantity is less than the socially optimal quantity because the fireworks generate a positive externality or provide an external benefit to third parties. (c)(ii) the deadweight loss will increase. Price($) MSC Supply Deadweight Loss PE Demand=MSB QE Quantity 2012 AP Micro FRQ A #1 (Unit 4: Monopoly in Product Market) 1. Steverail, the only provider of train service operating between two cities, is currently incurring economic losses. (a) Using a correctly labeled graph, show each of the following. (i) Steverail’s loss-minimizing price and quantity, labeled Pm and Qm , respectively (ii) The area of economic losses, shaded completely (iii) The allocatively efficient quantity, labeled Qe (b) If Steverail raised the price above Pm identified in part (a)(i), would total revenue increase, decrease, or not change? Explain. (c) Assume a per-unit subsidy is provided to Steverail. (i) Will Steverail’s quantity increase, decrease, or not change? Explain. (ii) Will consumer surplus increase, decrease, or not change? (d) Assume instead that a lump-sum subsidy is provided to Steverail. For the short run, answer the following. (i) Will the deadweight loss increase, decrease, or not change? Explain. (ii) Will Steverail’s economic losses increase, decrease, or not change? Price ATC Pm (a)(i) 3 points: • Demand & MR. • Qm. (MR=MC) • Pm. (a)(ii) Shading the area of economic loss. (a)(iii) Allocatively efficient quantity, Qe (MC = D) D Qm Qe MR Quantity (b) Total revenue would decrease because the demand is price elastic in that range of the demand curve where MR > 0. (c)(i) Quantity will increase because the subsidy will cause the MC curve to shift downward and intersect the MR curve at a larger quantity. (c)(ii) consumer surplus will increase. (d)(i) Deadweight loss will not change because the lump-sum subsidy does not change the profit-maximizing quantity. (d)(ii) Economic losses will decrease. 2012 AP Micro FRQ A #2 (Unit 2: Consumer Choice) 2. Theresa consumes both bagels and toy cars. Quantity of Bagels Marginal Utility from Bagels (util) Quantity of Toy Cars Marginal Utility from Toy Cars (utils) 1 8 1 10 2 7 2 8 3 6 3 6 4 5 4 4 5 4 5 3 6 3 6 2 (a) The table above shows Theresa’s marginal utility from bagels and toy cars. (i) What is her total utility from purchasing three toy cars? (ii) Theresa’s weekly income is $11, the price of a bagel is $2, and the price of a toy car is $1. What quantity of bagels and toy cars will maximize Theresa’s utility if she spends her entire weekly income on bagels and toy cars? Explain your answer using marginal analysis. (b) Assume that the price of wheat, an input for the production of bagels, increases. Will Theresa’s demand for bagels increase, decrease, or not change? Explain. (c) Suppose that Theresa’s income elasticity for bagels is –0.2. Does the value of Theresa’s income elasticity indicate that bagels are normal goods, inferior goods, substitutes, or complements? (d) Suppose that when the price of toy cars increases by 10 percent, Theresa buys 5 percent fewer toy cars and 4 percent less of a different toy, blocks. Calculate the cross-price elasticity for toy cars and blocks and indicate if it is positive or negative. (a) 3 points: (a)(i) total utility is 24. (a)(ii) 3 bagels and 5 toy cars will be purchased, because with this combination of bagels and toys, the marginal utility per dollar spent on bagels equals the marginal utility per dollar spent on toy cars. (b) Theresa’s demand for bagels will not change because the increase in the price of wheat will affect the supply of bagels, not the demand. (c) bagels are inferior goods. (d) the cross-price elasticity for toy cars and blocks: -0.04/0.10 = -0.4 2012 AP Micro FRQ A #3 (Unit 2- Supply and Demand) Price Domestic Supply $9 $8 $6 $5 $4 PW Domestic Demand $2 0 2 6 8 10 Millions of Pounds 14 3. Sugar is freely traded in the world market. Assume that a country, Loriland, is a price taker in the world market for sugar. Some of the sugar consumed in Loriland is produced domestically while the rest is imported. The world price of sugar is $2 per pound. The graph below shows Loriland’s sugar market, and PW represents the world price. (a) At the world price of $2 per pound, how much sugar is Loriland importing? (b) Suppose that Loriland imposes a per-unit tariff on sugar imports and the new domestic price including the tariff is $4. (i) Identify the new level of domestic production. (ii) Calculate the domestic consumer surplus for Loriland. You must show your work. (iii) Calculate the total tariff revenue collected by the government. You must show your work. (c) Given the world price of $2, what per-unit tariff maximizes the sum of Loriland’s domestic consumer surplus and producer surplus? (a) Loriland is importing 12 million pounds. (b)(i) the new level of domestic production as 6 million pounds. (b)(ii) the domestic consumer surplus as $25 million and showing the work: ½ [($9 - $4) × 10] = $25 (b)(iii) the revenue from the tariff as $8 million and showing the work: ($4 - $2) (10 - 6) = $8. (c) the per-unit tariff that maximizes the sum of consumer and producer surplus as $0. 2011 AP Micro FRQ A #1 (Unit 4 – Monopoly in Product Market) Price($) 40 Marginal Cost Average Total Cost 24 22 20 18 16 12 0 Demand Quantity 8 9 10 11 12 14 (Units) Marginal Revenue 1. A monopolist’s demand, marginal revenue, and cost curves are shown in the diagram below. (a) Assume that the monopolist wants to maximize profit. Using the labeling on the graph, indicate the monopolist’s price. (b) When the output is 8 units, what is the profit per unit? (c) Assume that the monopolist is maximizing profit. Is allocative efficiency achieved? Explain. (d) Between the prices of $16 and $18, is the monopolist in the elastic, inelastic, or unit elastic portion of its demand curve? Explain. (e) Assume that regulators set an output of 11 units. (i) Is the monopolist earning positive economic profit? Explain. (ii) Is the monopolist earning positive accounting profit? (f) Assume instead that regulators impose a price ceiling of $22. (i) What is the marginal revenue for the eighth unit? (ii) What quantity will be produced? (g) Assume instead that the monopolist practices perfect price discrimination (also called first-degree price discrimination). (i) What quantity will be produced? (ii) What will be the value of the consumer surplus? (a) the profit-maximizing price as $24. ($22 is also acceptable.) (b) the profit per unit as $6. (c) allocative efficiency is not achieved because Price ≠ MC or MC ≠ Demand. (d) demand is inelastic because total revenue increases as price increases; or because the price elasticity of demand within the price range is less than 1, or because marginal revenue is negative. (e)(i) the monopolist is not earning positive economic profit, because price equals average total cost. (e)(ii) the monopolist is earning positive accounting profit. (f)(i) the marginal revenue of the 8th unit is $22. (f)(ii) 9 units will be produced. (g)(i) 10 units will be produced. (g)(ii) the consumer surplus is zero. 2011 AP Micro FRQ A #2 (Unit 3&5: Perfect Competition in Product & Resource Market) 2. Assume that the market for avocados is perfectly competitive. The typical firm is earning positive economic profit in the short-run equilibrium. (a) Draw a correctly labeled graph for the typical firm, illustrating the short-run equilibrium and labeling the equilibrium market price and output PE and QE, respectively. (b) Assume there is an increase in the market wage rate for labor, a variable input. Show on your graph in part (a) the effect of the wage increase on the marginal cost curve in the short run. (c) Assume that avocado producers hire workers from a perfectly competitive labor market. Draw a graph of labor supply and demand for the typical firm and label the supply curve MFC and the demand curve MRP. Assume the market wage rate increases from w1 to w2. Show the effect of the wage increase on the graph, labeling the initial quantity of labor hired QL1 and the new quantity of labor hired QL2. (a) 3 points: • a horizontal demand curve at the equilibrium price, PE. • the equilibrium quantity, QE, at MR = MC. • ATC is below demand or MR at Q. (b) a leftward shift of the MC (c) 2 points: • a horizontal MFC1 curve at w1 and a MRP curve and showing QL1. • shifting the MFC curve up to w2 and showing the new equilibrium quantity of labor hired, QL2 (smaller than QL1). 2011 AP Micro FRQ A #3 (Unit 6: Externality) 3. Assume that the market for good X is perfectly competitive and that the production of good X creates a negative externality. (a) Draw a correctly labeled graph of the market for good X and show each of the following. (i) The marginal private cost and marginal social cost of good X, labeled MPC and MSC, respectively (ii) The market quantity, labeled Qm (iii) The allocatively efficient quantity, labeled Qs (iv) The area of deadweight loss, shaded completely (b) Assume that a lump-sum tax is imposed on the producers of good X. What happens to the deadweight loss? Explain. Price($) MSC MPC Deadweight Loss Demand=MSB QS QM Quantity (a)(i) MSC above MPC. (a)(ii) correctly labeled graph with MPC & MSB and the private market equilibrium, Qm. (a)(iii) the allocatively efficient quantity QS with QS < Qm. (a)(iv) shading the area representing the deadweight loss. (b) the deadweight loss does not change because marginal cost does not change. 2011 AP Micro FRQ B #1 (Unit 3: Perfect Competition in Product Market) 1. Suppose that roses are produced in a perfectly competitive, increasing-cost industry in long-run equilibrium with identical firms. (a) Draw correctly labeled side-by-side graphs for the rose industry and a typical firm and show each of the following. (i) Industry equilibrium price and quantity, labeled Pm and Qm, respectively (ii) The firm’s equilibrium price and quantity, labeled Pf and Qf, respectively (b) Is Pm larger than, smaller than, or equal to Pf? (c) Assume that there is an increase in the demand for roses. On your graphs in part (a), show each of the following. (i) The new short-run industry equilibrium price and quantity, labeled Pm2 and Qm2, respectively (ii) The new short-run profit-maximizing price and quantity for the typical firm, labeled Pf2 and Qf2, respectively (d) As the industry adjusts to a new long-run equilibrium, (i) what will happen to the number of firms in the industry? Explain. (ii) will the firm’s average total cost curve shift upward, shift downward, or remain unchanged? (e) In the long run, compare the firm’s profit-maximizing price to each of the following. (i) Pf in part (a)(ii) (ii) Pf2 in part (c)(ii) (a)(i) market graph and Pm & Qm. (a)(ii) Pf & Qf, at MC = MR with a horizontal demand curve. (a)(ii) minimum ATC intercepts demand curve at Qf. (b) Pm is equal to Pf. (c)(i) market demand shifts to the right, and Pm2 & Qm2. (c)(ii) Pf2 and Qf2. (d)(i) the number of firms increases because of short-run profits attracts new firms to enter the industry. (d)(ii) the firm’s ATC curve will shift upward. ATC stays the same (e)(i) the long-run profit-maximizing price will be higher than Pf. Pf stays the same (e)(ii) the long-run profit-maximizing price will be lower than Pf2. P Industry Pm2 Pm S P Firm ATC Pf2 2 Pf 1 MC 2 1 D’ D Qm Qm2 Q Qf Qf2 Q 2011 AP Micro FRQ B #2 (Unit 6: Externality) 2. Suppose research shows that the more college education individuals receive, the more responsible citizens they become and the less likely they are to commit crimes. (a) Draw a correctly labeled graph for the college education market and show each of the following. (i) Private market equilibrium quantity and price of college education, labeled Qm and Pm, respectively (ii) Socially optimal quantity of education, labeled Qs (iii) Deadweight loss at the market equilibrium, completely shaded (b) Assume that the government imposes an effective (binding) price ceiling on the price of college education. (i) Show the price ceiling on your graph in part (a), labeling the price ceiling Pc. (ii) Does this price ceiling increase, decrease, or have no impact on the deadweight loss in this industry? Explain. (c) Assume that instead of the price ceiling, the government grants each student a subsidy for each unit of college education purchased. Will the new equilibrium quantity of college education purchased be greater than, less than, or equal to Qm from part (a) ? Price Of A College Education Deadweight Loss S=MSC PL PM PC D2=MSB D1=MPB QM QS Quantity Of College Educations (a)(i) a correctly labeled market graph and Pm & Qm. (a)(ii) MSB above MPB and the socially optimal quantity, Qs. (a)(iii) shading the area of the deadweight loss. (b)(i) an effective price ceiling (PC) is below Pm. (b)(ii) price ceiling will increase the deadweight loss, because providers will decrease the quantity of education offered. (c) the new equilibrium quantity will be greater than Qm. 2011 AP Micro FRQ B #3 (Unit 5: Monopsony in Resource Market) Wage($) 25 Marginal Factor Cost Supply of Labor 20 17.5 15 12.5 10 Marginal Revenue Product 25 50 100 150 200 250 300 Quantity of Labor 3. Woodland is a small town in which everyone works for TreeMart, the local lumber company. TreeMart is a monopsonist in the labor market and a perfect competitor in the lumber market. In the short run, labor is the only variable input. The labor market for TreeMart is given in the graph above. (a) Identify the profit-maximizing quantity of labor for TreeMart. (b) Identify the wage rate TreeMart pays to hire the profit-maximizing quantity of labor. (c) Identify the quantity of labor hired in each of the following situations. (i) TreeMart operates in a competitive labor market. (ii) The government imposes a minimum wage of $12.5. Explain. (a) the profit-maximizing quantity of labor as 100 units. (b) the wage rate TreeMart pays as $10. (c)(i) the quantity of labor in a competitive labor market as 200 units. (c)(ii) quantity of labor, 150 units, given a minimum wage of $12.5. MFC curve (or the supply curve for labor) becomes horizontal at the minimum wage up to a quantity of 150. Price/Cost($) 2010 AP Micro FRQ B #1 (Unit 4: Monopoly in Product Market) 8 7 1. The diagram above shows the cost and revenue curves for a bridge to a popular island. The marginal cost of crossing the bridge is zero and is indicated in the diagram as the horizontal axis. The price is the toll to cross the bridge, and the output is the number of autos that cross the bridge each day. (a) Assume that a private firm owns the bridge and maximizes profits. Based on the diagram, determine each of the following. (i) Output (ii) Price 2 Average Total Cost (b) Now assume that a municipality owns the 1 Marginal cost=0 bridge and sets the price to achieve allocative 0 Q1 Q2 Q3 Q4 Output efficiency. Based on the diagram, determine Marginal Revenue each of the following. (i) Output (ii) Price (c) At a price of $1, is the municipality’s accounting profit positive, negative, or zero? Explain. (d) Suppose that the municipality sets a break-even price that generates revenues to just cover all economic costs. (i) Based on the diagram, determine the break-even output. (ii) At the output you determined in part (d)(i), is the demand relatively elastic, relatively inelastic, unit elastic, perfectly elastic, or perfectly inelastic? (e) If a company begins to provide access to the island via commercial watercraft, what will happen to each of the following in the diagram? (i) The demand curve for bridge crossings (ii) The profit-maximizing output (f) Suppose the long-run average total cost is strictly downward sloping. Would it be efficient to build a second bridge? Explain. Demand= Marginal Social Benefit (a)(i) output = Q2. (a)(ii) price = $7. (b)(i) output = Q4. (b)(ii) price = $0. (c) the accounting profit is positive, because the firm earns zero economic profit. (Economic profit = Total revenue - Explicit costs - Implicit costs.) (d)(i) break-even quantity as Q3. (d)(ii) demand at Q3 is relatively inelastic. (e)(i) demand curve for bridge crossings will shift down or to the left. (e)(ii) the profit-maximizing output will fall. (f) building a second bridge would be inefficient, because there are economies of scale, building a second bridge would raise the ATC. 2010 AP Micro FRQ B #2 (Unit 5: Perfect Competition in Resource Market) Number of Workers Marginal Revenue Product per day 1 $450 2 $500 3 $450 4 $400 5 $300 6 $100 2. The table above gives the short-run marginal revenue product of labor per day for a perfectly competitive firm. The firm is currently selling its product at the market price of $5. (a) Calculate the marginal (physical) product of the third worker. (b) Define the law of diminishing marginal returns and explain why it occurs. (c) Diminishing marginal returns first occur with the hiring of which worker for the firm? (d) What is the highest daily wage that the firm is willing to pay to hire the fifth worker? (e) What will happen to the demand for labor if the market price of the product increases? Explain. (a) marginal product of the 3rd worker: $450/$5 per unit = 90 units. (b) 2 points: • the law of diminishing returns: as more and more units of a variable input are added to a fixed input, the output increases at a decreasing rate. • diminishing returns occur because of the overuse of the fixed input. (c) diminishing marginal returns first occur with the hiring of the 3rd worker. (d) $300. (e) the demand for labor will increase because the increase in the product price raises the marginal revenue product of labor. 2010 AP FRQ B #3 (Unit 2: Supply and Demand: Elasticity) 3. (a) The table below gives the quantity of good X demanded and supplied at various prices. Price (dollars) Quantity Demanded (units) Quantity Supplied (units) 30 1 3 20 3 3 10 4 3 (i) Is the demand for good X relatively elastic, relatively inelastic, unit elastic, perfectly elastic, or perfectly inelastic when the price decreases from $30 to $20 ? Explain. (ii) Is the supply of good X relatively elastic, relatively inelastic, unit elastic, perfectly elastic, or perfectly inelastic when the price decreases from $30 to $20 ? Explain. (iii) If a per-unit tax is imposed on good X, how is the burden of the tax distributed between the buyers and sellers of good X? (b) Assume that the income elasticity of demand for good Y is –2. Using a correctly labeled graph of the market for good Y, show the effect of a significant increase in income on the equilibrium price of good Y in the short run. (a)(i) the demand for good X is relatively elastic, because the elasticity coefficient > 1 OR because total revenue rises as price decreases from $30 to $20. (a)(ii) supply is perfectly inelastic, because there is no change in the quantity supplied as the price changes OR because the supply elasticity is zero. (a)(iii) all of the burden of a per-unit tax falls on sellers (b) 2 points: • a correctly labeled graph of supply & demand. • showing a leftward shift of the demand curve and a decrease in the equilibrium price. 2010 AP Micro FRQ A #1 (Unit 3: Perfect Competition in Product Market) 1. Assume that corn is produced in a perfectly competitive market. Farmer Roy is a typical producer of corn. (a) Assume that Farmer Roy is making zero economic profit in the short run. Draw a correctly labeled side-by side graph for the corn market and for Farmer Roy and show each of the following. (i) The equilibrium price and quantity for the corn market, labeled as PM1 and QM1, respectively (ii) The equilibrium quantity for Farmer Roy, labeled as QF1 (b) For Farmer Roy’s corn, is the demand perfectly elastic, perfectly inelastic, relatively elastic, relatively inelastic, or unit elastic? Explain. (c) Corn can be used as an input in the production of ethanol. The demand for ethanol has significantly increased. (i) Show on your graph in part (a) the effect of the increase in demand for ethanol on the market price and quantity of corn in the short run, labeling the new equilibrium price and quantity as PM2 and QM2, respectively. (ii) Show on your graph in part (a) the effect of the increase in demand for ethanol on Farmer Roy’s quantity of corn in the short run, labeling the quantity as QF2. (iii) How does the average total cost for Farmer Roy at QF2 compare with PM2? (d) Corn is also used as an input in the production of cereal. What is the effect of the increased demand for ethanol on the equilibrium price and quantity in the cereal market in the short run? Explain. (a) 4 points: • a correctly labeled graph of the corn market (S, D, PM1, QM1). • graph of the firm with a horizontal demand curve at PM1. • profit-maximizing quantity, QF1, at MC = MR. • minimum ATC on the horizontal demand curve at QF1. (b) demand curve for Farmer Roy’s corn is perfectly elastic because Farmer Roy is a price taker or because he can sell all that he wants at the market price. (c) 4 points: • shifting the market demand curve to the right and showing PM2 and QM2. • shifting the firm’s demand curve upward to the level of PM2. • the profit-maximizing quantity, QF2, at MC = new MR. • ATC at QF2 is lower than PM2. (d) equilibrium quantity will decrease and the equilibrium price will increase, because the increase in the price of corn causes a decrease in the supply of cereal. 2010 AP Micro FRQ A #2 (Unit 3&5: Perfection Competition in Product & Resource Market) 2. The John Lamb Company, a profit-maximizing firm producing widgets, is in a perfectly competitive widget market. Assume John Lamb employs a fixed number of employees and rents a machine for a variable number of hours from a perfectly competitive market. (a) Using correctly labeled side-by-side graphs of the factor market for machines and the John Lamb Company, show each of the following. (i) The equilibrium rental price of machines in the factor market, labeled as PR (ii) John Lamb’s equilibrium rental quantity of machines, labeled as QL (b) Assume that the popularity of widgets declines, decreasing the demand for widgets. What will happen to each of the following? (i) Marginal product curve for machine-hours (ii) Marginal revenue product curve for machine-hours. Explain. (c) John Lamb is employing the cost-minimizing combination of inputs. The marginal product of labor is 28 widgets per worker hour and the wage rate is $14 per hour. The marginal product of the machine is 60 widgets per machine-hour. What is the hourly rental price of a machine? (a)(i) correct side-by-side graphs with a horizontal machine supply curve for John Lamb (S, D, PR, SM). (a)(ii) the equilibrium rental quantity of machines, QL, at the intersection of MRP and the horizontal supply curve. (b)(i) there will be no change to the marginal product curve for machine-hours. (b)(ii) MRP curve for machine-hours will decrease (shift to the left) because the decrease in demand decreases the price of widgets. (c) calculating the rental price of a machine: MPL/w = MPK/r = 28/14 = 60/r. Therefore, r = $30. 2010 AP Micro FRQ A #3 (Unit 3&6: Perfect Competition & Externality) PRICE Supply=MPC J 3. The graph above shows the perfectly competitive market for hard candies in Country Alpha. In the graph the letters correspond to points, not areas. MPC denotes marginal private cost and MSB denotes marginal social benefit. P5 P4 P3 P2 P1 K U L N M T R q1 S q2 q3 Demand=MSB q4 q5 QUANTITY (a) Using the labeling on the graph, identify the area representing each of the following at the market equilibrium. (i) The consumer surplus (ii) The producer surplus (b) Assume that the production of each unit of candy creates a negative externality equal to (P5-P2). Using the labeling on the graph, identify the socially optimal quantity. (c) Assume that the government imposes a per-unit tax of (P5-P2) to correct for the negative externality. Using the labeling on the graph, identify the area representing each of the following. (i) The consumer surplus (ii) The deadweight loss 2010 AP Micro FRQ A #3 (Unit 3&6: Perfect Competition & Externality) (a)(i) consumer surplus as P3JM. (a)(ii) producer surplus as P1P3M. (b) socially optimal quantity as q1. (c)(i) consumer surplus as P5JK. (c)(ii) there is no deadweight loss. PRICE Supply=MPC J P5 P4 P3 P2 P1 K U L N M T R q1 S q2 q3 Demand=MSB q4 q5 QUANTITY 2009 AP Micro FRQ B #1 (Unit 4: Monopolistic Competition) 1. Mary & Company, operating in a monopolistically competitive industry, produces a cleaning product called BriteKlean. The company currently produces the profit-maximizing quantity of BriteKlean but is operating at a loss. (a) Draw a correctly labeled graph for Mary & Company and show each of the following. (i) The profit-maximizing output and price, labeled as QM and PM, respectively (ii) The area of loss, shaded completely (b) What must be true in the short run for the company to continue to produce at a loss? (c) Assume now that the demand for cleaning products increases and that the company is now earning short-run economic profits. Relative to this short-run situation, how does each of the following change in the long run? (i) The number of firms (ii) The company’s profit (d) In the long run, if the company continues to produce, will it produce the allocatively efficient level of output? Explain. (e) In the long run, will the company be operating in a region where economies of scale exist? Explain. (a) 4 points: • correctly labeled graph with a demand and MR below demand. • the profit-maximizing output, QM, at MC = MR. • PM on the demand curve above QM. • shaded the area of loss. (b) price is greater than average variable cost, or total revenue is greater than total variable cost. (c)(i) the number of firms will increase. (c)(ii) economic profits will fall to zero or fall to a normal profit. (d) 2 points: • No. The firm’s price is greater than marginal cost. (e) 2 points: • Yes. The firm produces a quantity of output in the declining portion of its long-run ATC. 2009 AP Micro FRQ B #2 (Unit 2: Consumer Choice) 2. Sasha is a utility-maximizing consumer who spends all of her income on peanuts and bananas, both of which are normal goods. (a) Assume that the last unit of peanuts consumed increased Sasha’s total utility from 40 utils to 48 utils and that the last unit of bananas consumed increased her total utility from 52 utils to 56 utils. (i) If the price of a unit of peanuts is $1 and Sasha is maximizing utility, calculate the price of a unit of bananas. (ii) If the price of a unit of peanuts increases and the price of a unit of bananas remains unchanged from the price you determined in part (a)(i), how will Sasha’s purchase of peanuts change? (b) Assume that the cross-price elasticity of demand between peanuts and bananas is positive. A widespread disease has destroyed the banana crop. What will happen to the equilibrium price and quantity of peanuts in the short run? Explain. (c) Assume that the price of bananas increases. (i) Will the substitution effect increase, decrease, or have no effect on the quantity of bananas demanded? (ii) What happens to Sasha’s real income? (a)(i) calculating the price of a unit of bananas, $4/8 = $0.50. (a)(ii) Sasha will purchase fewer peanuts. (b) 2 points: • the equilibrium price and quantity of peanuts will both increase. • peanuts and bananas are substitutes, and since the price of bananas increased, it would cause the demand for peanuts to increase. (c)(i) the substitution effect causes the quantity of bananas demanded to decrease. (c)(ii) Sasha’s real income will decrease. 2009 AP Micro FRQ B #3 (Unit 4: Oligopoly) Easy Ride 3. Two interdependent bus companies—City Wheels and Easy Ride—provide transportation services in the same city. Following a change in costs that affects both companies, each company must decide whether to lower its fare or maintain its current fare. In the payoff matrix below, the first entry in each cell indicates the daily profit to Easy Ride and the second entry indicates the daily profit to City Wheels. Both companies know all of the information in the matrix Maintian Fare Lower Fare City Wheels Maintian Fare Lower Fare $150 , $180 $130 , $120 $120 , $130 $140 , $110 (a) If Easy Ride chooses to maintain its current fare, which strategy is better for City Wheels? Explain. (b) Is there a dominant strategy for Easy Ride? Explain. (c) Assume that the companies must make their decisions simultaneously and do not cooperate. What will be the daily profit for each firm? (d) If these two firms could cooperate, which strategy would each firm choose? (e) Suppose that the local government decides to provide a subsidy of $40 per day to the bus companies. However, only a company that agrees to lower its fare is eligible to receive the subsidy. Draw a new payoff matrix to reflect the change in government policy. (a) City Wheels maintains its current fare, since $180 > $120. (b) 2 points: • Easy Ride does NOT have a dominant strategy. • Easy Ride’s best move depends on City Wheels’ move. (c) profit to Easy Ride is $150 and the profit to City Wheels is $180. (d) the cooperative solution is for both to maintain their current fares. Easy Ride (e) City Wheels Maintian Fare Lower Fare $150 , $180 $130 , $160 Lower Fare $160 , $130 $180 , $150 Maintian Fare 2009 AP Micro FRQ A #1 (Unit 4: Monopoly in Product Market) 1. CableNow is the only supplier of cable TV services offering a wide range of TV channels. CableNow is an unregulated firm and is currently earning an economic profit. Assume that CableNow does not practice price discrimination. (a) Draw a correctly labeled graph for CableNow and show each of the following. Make sure your graph is large enough to be legible. (i) The profit-maximizing quantity of cable services, labeled as Q* (ii) The profit-maximizing price, labeled as P* (iii) The area of economic profit, completely shaded (iv) The socially optimal level of cable services, assuming no externalities, labeled as QS (b) Assume that the government grants CableNow a lump-sum subsidy of $1 million. Will this policy change CableNow’s profit-maximizing quantity of cable services? Explain. (c) Instead of granting a subsidy, assume now that the government chooses to require CableNow to produce the quantity at which CableNow earns zero economic profit. On the graph you drew in part (a), label this quantity QR. (d) At QR, is the firm’s accounting profit positive, negative, or zero? Explain. (e) Assume that a new study reveals there are external benefits associated with watching TV. Will the socially optimal quantity of cable services now be larger than, smaller than, or equal to the QS you identified in part (a)(iv) ? (a) 5 points: • a correctly labeled graph for CableNow, demand and MR below the demand curve. • profit-maximizing quantity, Q*, at MC = MR. • profit-maximizing price, P*, on the demand curve above Q*. • shaded the area of economic profit, completely. • the socially optimal quantity, QS, where MC intersects demand (b) 2 points: • the lump-sum subsidy will have no impact on the quantity of services CableNow produces. • lump-sum subsidy will not affect MC. (c) quantity of cable services, QR, where the ATC curve intersects the demand curve. (d) 2 points: • accounting profit is positive. • accounting profit excludes implicit costs. (e) socially optimal quantity will be larger than QS 2009 AP Micro FRQ A #2 (Unit 2: Tax & Elasticity) Price($) S+Tax $8 S $6 $5 $4 $2 0 60 90 2. The graph above illustrates the market for calculators. S denotes the current supply curve, and D denotes the demand curve. (a) Calculate the producer surplus before the tax. (b) Now assume a per-unit tax of $2 is imposed D whose impact is shown in the graph above. Quantity (i) Calculate the amount of tax revenue. (ii) What is the after-tax price that the sellers now keep? (iii) Calculate the producer surplus after the tax. (c) Is the demand price elastic, inelastic, or unit elastic between the prices of $5 and $6 ? Explain. (d) Assuming no externalities, how does the tax affect allocative efficiency? Explain. (a) producer surplus: (1/2) × $3 × 90 = $135. (b)(i) tax revenue: $2 × 60 = $120. (b)(ii) after-tax price received by sellers: $4. (b)(iii) producer surplus: (1/2) × $2 × 60 = $60. (c) demand price is elastic AND showing the correct calculation of the elasticity coefficient using endpoint or midpoint method, or the correct calculation using the total revenue formula. (d) owing to the tax, the market is no longer allocatively efficient AND that total surplus decreases or the tax creates a dead-weight loss. 2009 AP Micro FRQ A #3 (Unit 4: Oligopoly) 3. Two competing retail firms, Red Shop and Blue Mart, are studying potential locations for new stores in the suburbs of a major city. Each firm must choose between a location north of the city and a location south of the city. The payoff matrix is shown below, with the first entry in each cell indicating Red Shop’s daily profit and the second entry indicating Blue Mart’s daily profit. Both firms know all of the information in the payoff matrix. Red Shop Blue Mart North North $900 , South $5,000 , South $1,800 $3,000 , $3,500 $4,000 $1,500 , $1,000 (a) If Red Shop chooses a location south of the city, which location is better for Blue Mart? Explain. (b) Is choosing a location to the south of the city a dominant strategy for Red Shop? Explain. (c) If the two firms cooperate in choosing locations, where will each firm locate? (d) Assume that the south suburb has enacted an incentive package to attract new business. Any firm that locates south of the city will receive a subsidy of $2,000 per day. Redraw the payoff matrix to include the subsidy. (a) 2 points: • Onorth will be better for Blue Mart. • Blue Mart earns a higher profit by locating north than it does by locating south ($4,000 versus $1,000). (b) 2 points: • choosing south is not a dominant strategy for Red Shop. • if Blue Mart chooses south, Red Shop is better off choosing north. (Red Shop’s best strategy depends on Blue Mart’s move.) (c) Red Shop chooses south and Blue Mart chooses north. Red Shop (d) Blue Mart North North $900 , South $7,000 , South $1,800 $3,000 , $5,500 $4,000 $3,500 , $3,000 2008 AP Micro FRQ B #1 (Unit 4: Monopoly in Product Market) Price/Cost (Per Unit) 1. The graph above shows the demand and cost curves of a firm that does not price discriminate. P7 P6 a (a) Suppose the firm produces at the profit-maximizing output. Using the labeling on the graph, identify each of the following. Marginal Cost Average c d (i) Level of output. Explain. (ii) Price e f Total Cost (b) Suppose the firm produces at the revenue-maximizing g h output. Using the labeling on the graph, identify each of the Demand=Marginal following. Benefit (i) Level of output. Explain. (ii) Price 0 Q1 Q2 Q3 Q4 Q5 Output Marginal Revenue (c) Suppose the government regulates the firm’s price to produce the allocatively efficient level of output. Using the labeling on the graph, identify each of the following. P5 P4 P3 P2 P1 b (i) The price the government would require the firm to set (ii) The allocatively efficient level of output (d) Suppose the firm produces at the allocatively efficient level of output. (i) Would it be earning a profit or incurring a loss? Explain. (ii) Using the labeling on the graph, identify the area of the profit or loss at the allocatively efficient level of output. (e) Using the labeling on the graph, identify the consumer surplus at the allocatively efficient level of output. (f) Suppose the regulators establish a price that allows the firm to just cover all its opportunity costs. Using the labeling on the graph, identify the price the regulators would set to achieve this objective. (a)(i) profit-maximizing output, Q2, because MC=MR at Q2. (a)(ii) P5 on the demand curve above MC = MR. (b)(i) the revenue-maximizing output, Q3, since MR is zero at Q3, TR is at the maximum. (b)(ii) P3 is the price corresponding to Q3. (c)(i) the price the government would require, P1 (c)(ii) the allocatively efficient output, Q4. (d)(i) 2 points: the firm would incur a loss, because ATC > price, P1. (d)(ii) the area of loss, P1P2eg. (e) the consumer surplus, P1P7g. (f) the price, P3 2008 AP Micro FRQ B #2 (Unit 2&6: Supply and Demand & Externality) 2. Vaccinations for contagious diseases benefit the consumers as well as others in the community. Assume that vaccines are produced in a competitive market. (a) Draw a correctly labeled graph of supply and demand, and (i) label the market price “Pm ”, and label the market output “Qm ”. (ii) label the socially efficient level of output “Qs”. (iii) shade the area of the deadweight loss. (b) Is marginal social cost greater than, less than, or equal to marginal social benefit at the market output? (c) How will a tax on producers of the vaccines affect the deadweight loss that you identified in part (a) (iii)? Explain. (a)(i) correctly labeled graph with Qm & Pm. (a)(ii) correctly identifying QS. (a)(iii) shading the area of the deadweight loss. (b) MSC is less than the marginal social benefit. (c) 2 points: • tax will increase the deadweight loss. • tax raises the cost and causes output of vaccine to fall. 2008 AP Micro FRQ B #3 (Unit 5: Resource Market) 3. GW Company produces and sells hats in a perfectly competitive market at a price of $2 per hat. Assume that labor is the only variable input and the wage rate is $15 per unit of labor per day. The table below shows GW’s short-run production function for hats. Number of workers per day 0 1 2 3 4 5 6 Output of hats per day 10 26 36 44 49 52 0 (a) After which worker do diminishing marginal returns begin? (b) Calculate the marginal physical product of the fifth worker. (c) Calculate the marginal revenue product of the third worker. (d) How many workers will GW hire to maximize profit? (e) If GW Company has fixed costs equal to $20, what will be the company’s short-run economic profits from hiring two workers? (f) If the price of hats increases, what will happen to the number of workers hired in the short run? Explain. (a) the second worker. (b) MP of the fifth worker is five units. (c) calculating the MRP of the third worker: $20. (d) GW will hire four workers. (e) profit: $2. (f) 2 points: • more workers will be hired. • increase in the price of hats raises the marginal revenue product, hence the demand for labor. 2008 AP Micro FRQ A #1 (Unit 3: Perfect Competition in Product Market & Lump-Sum Subsidy) 1. Callahan’s Orchard grows apples and operates in a constant-cost, perfectly competitive apple industry. Callahan’s Orchard is currently in long-run equilibrium. (a) Draw correctly labeled side-by-side graphs for the apple market and Callahan’s Orchard, and show each of the following. (i) Market output and price, labeled as “QM” and “PM”, respectively (ii) Callahan’s output and price, labeled as “QF” and “PF”, respectively (b) Now assume that the government provides farm support to apple growers by granting an annual lump-sum subsidy to all apple growers. Indicate the effect the subsidy would have on each of the following in the short run. (i) Callahan’s quantity of output. Explain. (ii) Callahan’s profit (iii) The number of firms in the industry (c) Indicate how each of the following will change in the long run as a result of the lump-sum subsidy. (i) The number of firms in the industry. Explain. (ii) Price (iii) Industry output (a)(i) 2 points: • a correctly labeled graph of the apple market, with PM and QM • firm’s price equals the market price. (a)(ii) 2 points: • the tangency of flat firm demand (PF) and ATC. • QF is where MR (P) = MC. (b)(i) 2 points: • lump-sum subsidy will have no impact on Callahan’s output. • lump-sum subsidy will not affect MC (or MR). (b)(ii) Callahan’s profit will increase. (b)(iii) number of firms in the industry will not change. (c)(i) 2 points: • the number of firms in the industry will increase. • the existence of profits attracts new firms. (c)(ii) price will fall. (c)(iii) industry output will increase. 2008 AP Micro FRQ A #2 (Unit 2: Tax & Consumer Choice) 2. Utility and price elasticity of demand are important concepts in explaining consumer behavior. (a) Define marginal utility. (b) The table below shows the quantities, prices, and marginal utilities of two goods, fudge and coffee, which Mandy purchases. Fudge Coffee 10 pounds 7 pounds Price per pound $2 $2 Marginal utility of last pound 12 20 Quantity of purchase Mandy spends all her money and buys only these two goods. In order to maximize her utility, should Mandy purchase more fudge and less coffee, purchase more coffee and less fudge, or maintain her current consumption? Explain. (c) Assume that consumers always buy 20 units of good R each month regardless of its price. (i) What is the numerical value of the price elasticity of demand for good R? (ii) If the government implements a per-unit tax of $2 on good R, how much of the tax will the seller pay? (a) marginal utility as the extra satisfaction received from consuming an additional unit of a good or service. (b) 2 points: • Mandy should purchase more fudge and less coffee. • per dollar MU for fudge is greater than per dollar MU for coffee. (c)(i) price elasticity of demand for good R is zero. (c)(ii) none of the tax will be paid by the seller of good R, or that buyers pay all of the tax. 2008 AP Micro FRQ A #3 (Unit 2&4: Supply & Demand & Monopoly) (a) For a competitive market for which there is a binding (effective) price ceiling, draw a correctly labeled graph and label the price ceiling “PC”, the quantity sold “QA”, and the socially efficient output “QB”. (b) The graph above shows a natural monopoly. (i) Using the labeling in the graph, identify each of the following. (1)The profit-maximizing output (2)The socially efficient output (ii) At the socially efficient output, is the monopoly making a profit or incurring a loss? Using the labeling on the graph, identify the area of profit or loss. Price/Cost (Dollars) 3. Social efficiency is affected by government policy and the structure of markets. P6 A P5 B P4 P3 P2 P1 0 Marginal Cost CD E Average Total Cost F Demand Q1 Q2 Q3 Q4 Quantity Marginal (units) Revenue (a) 3 points: • a correctly labeled supply and demand graph with a price ceiling below the market equilibrium. • QA . • QB. (b)(i) 2 points: • Q1 as the profit-maximizing output. • Q3 as the socially efficient output. (b)(ii) 2 points: • Q3, the monopolist incurs a loss. • the area of loss, P1P3DF. 2007 AP Micro FRQ A #1 (Unit 4: Monopoly in Product Market) 1.A patent gives inventors the exclusive right to produce and market a product for a period of time. GCR Company is a profit-maximizing firm. It has a patent for a unique antispyware computer program called Aspy. (a)Assume that GCR is making economic profit. Draw a correctly labeled graph and show the profit-maximizing price and quantity. (b) Assume that the government imposes a lump-sum tax on GCR. (i) What will happen to output and market price? Explain. (ii) What will happen to GCR’s profits? (c) Assume instead that the government grants a per-unit subsidy to GCR for Aspy. (i) What will happen to output and market price? Explain. (ii) What will happen to GCR’s profits? (d) Now assume that GCR’s patent on Aspy expires. What will happen to GCR’s economic profits in the long run? Explain. 2007 AP Micro FRQ A #2 (Unit 5: Resource Market) Number of unskilled Workers Hired Quantity of Radios Produced (per day) 0 1 2 3 4 5 6 7 0 20 45 60 70 75 79 80 2. Assume that HZRad Company produces clock radios as shown in the short-run production function in the table above. HZRad can sell all the clock radios it produces at a market price of $20 each and can hire all the unskilled labor it needs at a wage of $90 per day per worker. Assume also that labor is the only variable input. (a) Using the specific information above, draw a correctly labeled graph of HZRad’s current supply curve for unskilled labor. (b) What is HZRad’s profit-maximizing output level? Explain. (c) Suppose that HZRad is the first company to use a new technology that increases the productivity of its unskilled workers. (i) How will the new technology affect the quantity of unskilled labor HZRad hires? Explain. (ii) How will the new technology affect the wage paid to HZRad’s unskilled workers? 2007 AP Micro FRQ A #3 (Unit 4: Oligopoly) Roadway 3. Two bus companies, Roadway and Rankin Wheels, operate a route from Greensboro to Spring City, transporting a mix of passengers and freight. They must file their schedules with the local transportation board each year and cannot alter them during that year. Those schedules are revealed only after both companies have filed. Each company must choose between an early and a late departure. The relevant payoff matrix appears below, with the first entry in each cell indicating Roadway’s daily profit and the second entry in each cell indicating Rankin Wheels’ daily profit. Blue Rankin Wheels Early Late Early $1,000 , Late $750 , $900 $950 , $850 $650 $700 , $800 (a) In which market structure do these firms operate? Explain. (b) If Roadway chooses an early departure, which departure time is better for Rankin Wheels? (c) Identify the dominant strategy for Roadway. (d) Is choosing an early departure a dominant strategy for Rankin Wheels? Explain. (e) If both firms know all of the information in the payoff matrix but do not cooperate, what will be Rankin Wheels’ daily profit? 2007 AP Micro FRQ B #1 (Unit 4: Monopolistic Competition) 1.Assume that the cellular telephone industry is monopolistically competitive. (a) Assume that cellular telephone manufacturers are earning short-run economic profits. Draw a correctly labeled graph for a typical firm in the industry and show each of the following. (i) The profit-maximizing output and price (ii) The area representing economic profit (b) At the profit-maximizing price you identified in part (a), would the typical firm’s demand curve be price inelastic? Explain. (c) Given the information in part (a), what happens to the demand curve for the typical firm in the long run? Explain. (d) Using a new correctly labeled graph, show the profit-maximizing output and price for the typical firm in the long run. (e) Does the typical firm produce an output level that minimizes its average total cost in the long run? (f) In long-run equilibrium, does the typical firm produce the allocatively efficient level of output? Explain. 2007 AP Micro FRQ B #2 (Unit 4: Oligopoly) 2. Two airline companies, Airtouch and Windward, operate a route from City X to City Y, transporting a mix of passengers and freight. They must file their schedules with the National Transportation Board each year and cannot alter them during that year. Those schedules are revealed only after both companies have filed. Each airline must choose between a morning and an evening departure. The relevant payoff matrix appears below, with the first entry in each cell indicating Airtouch’s daily profit and the second entry in each cell indicating Windward’s daily profit. Airtouch Windward Morning Morning $1,000 , Evening $750 , Evening $700 $700 , $600 $950 $900 , $800 (a) In which market structure do these firms operate? Explain. (b) If Windward chooses an evening departure, which departure time is better for Airtouch? (c) Identify the dominant strategy for Windward. (d) Is choosing an evening departure a dominant strategy for Airtouch? Explain. (e) If both firms know all of the information in the payoff matrix but do not cooperate, what will be Windward’s daily profit? 2007 AP Micro FRQ B #3 (Unit 3: Perfect Competition in Product Market) 3. For each of the following statements, indicate whether it is true, false, or uncertain and explain why. (a) Average total cost is always greater than average variable cost by a constant amount. (b) In the short run, a perfectly competitive firm always maximizes profit when average total cost is at minimum. (c) If a firm shuts down in the short run, its profits will equal zero. 2007 AP Micro FRQ B #3 (Unit 3: Perfect Competition in Product Market) 3. For each of the following statements, indicate whether it is true, false, or uncertain and explain why. (a) Average total cost is always greater than average variable cost by a constant amount. (a)Average total cost is always greater than average variable cost by a constant amount. (b) In the short run, a perfectly competitive firm always maximizes profit when average total cost is at minimum. (b) In the short-run, a perfectly competitive firm always maximizes profit when average total cost is minimum. (c) If a firm shuts down in the short run, its profits will equal zero. (c) If a firm shuts down in the short run, its profits will equal to zero. Price/Cost 2006 AP Micro FRQ A #1 (Unit 4: Monopoly in Product Market) P6 P5 P4 P3 P2 Marginal Cost Average Total Cost P1 Demand 0 Q1 Q3 Q5 Q6 Q2 Q4 1. There is one art museum on the island of Watsonia. The museum’s demand and cost curves are shown in the graph above. The museum currently relies on an admission charge for some of its funding. Its directors are debating about how to set the admission charge. (a) Using the labeling of the graph above, identify the price and quantity associated with the following objectives. Q7 Attendance Marginal Revenue (i) The museum maximizes its profit. (ii) The museum maximizes its total revenue. (iii) The museum maximizes the sum of consumer and producer surplus. (iv) The museum maximizes its attendance, as long as it breaks even. (b) When the attendance is Q , is the demand price elastic, inelastic, or unit elastic? Explain. (c) Assume that the price is set at P. Assuming the existence of an opportunity cost, indicate whether the 2 museum’s accounting profits would be positive, negative, or zero. Why. (d) Assume that the government decides the museum should charge no admission and agrees to subsidize the museum for any losses. (i) Using the labeling in the graph, identify the museum’s attendance under that circumstance. (ii)Would the outcome be allocatively efficient? Explain. 2006 AP Micro FRQ A #2 (Unit 3: Perfect Competition in Product Market & Tax) Short-Run Total Cost Function Quantity Total Cost Produced (in Dollars) 0 20 1 27 2 38 3 53 4 72 5 95 6 122 2. The table above gives the short-run total cost function for a typical firm in a perfectly competitive industry. (a) What is the dollar value of the firm’s total fixed cost? (b) Calculate the marginal cost of producing the first unit of output. (c) If the price the firm receives for its product is $20, indicate the firm’s profit-maximizing quantity of output and explain how you determined your answer. (d) Given your results in part (c), explain what will happen to the number of firms in the industry in the long run. (e) Assume that this firm operates in a constant-cost industry and has reached long-run equilibrium. If the government imposes a per-unit tax of $2, indicate what will happen to the firm’s profit-maximizing output in the long run. Price 2006 AP Micro FRQ A #3 (Unit 2&6: Supply and Demand & Externality) Supply Pe Demand 0 Qe Quantity of Land for Residential Development (Acres) 3. The supply and demand for land for residential development is shown in the diagram above. The land supplied for such development comes from privately held open-space land or privately held farmland. (a) Redraw the graph above and show how an increase in income will affect the equilibrium price and quantity of land converted into residential development, assuming that land for residential development is a normal good. (b) Redraw the graph above and show how a decrease in government per-unit subsidies to farmers will affect the equilibrium price and quantity of land converted into residential development. (c) Assume that the conversion of open-space land and farmland imposes costs on the general population, which can no longer enjoy the scenic vistas. (i) Indicate whether the marginal social cost of converting land is greater than, less than, or equal to the marginal private cost of converting land. (ii) Explain whether the private market quantity of land converted into residential development is socially optimal. 2006 AP Micro FRQ B #1 (Unit 4: Monopoly in Product Market) 1. Assume that Clark Electronics has a monopoly in the production and sale of a new device for detecting and destroying a computer virus. Clark Electronics currently incurs short-run losses, but it continues to operate. (a) What must be true for Clark to continue to operate in the short run? (b) Draw a correctly labeled graph, and show each of the following for Clark. (i) The profit-maximizing price and output (ii) Area of loss (c) Assume Clark is maximizing profit. What will happen to its total revenue if Clark raises its price? Explain. (d) If demand for the new device increases, explain what will happen to each of the following in the short run. (i) Profit-maximizing output (ii) Total cost 2006 AP Micro FRQ B #2 (Unit 3: Perfect Competition in Product Market) 2. Assume that the market for home security systems is perfectly competitive and currently in equilibrium. (a) Using a correctly labeled graph of supply and demand, show each of the following. (i) The equilibrium price and quantity, labeled as P* and Q*, respectively (ii) The area representing consumer surplus, labeled as CS (iii) The area representing producer surplus, labeled as PS (b) Suppose that the government imposes an effective (binding) price ceiling. Redraw your graph in part (a), and label the ceiling price as P2. Completely shade the area representing the sum of the consumer surplus and the producer surplus after the imposition of the price ceiling. (c) Suppose the demand for home security systems decreases and the price ceiling remains binding. Indicate what will happen to each of the following. (i) Consumer surplus (ii) Producer surplus 2006 AP Micro FRQ B #3 (Unit 5: Perfect Competition in Resource Market) 3. Pride Textiles produces and sells towels in a perfectly competitive market. Pride Textiles hires its workers in a perfectly competitive labor market. Assume that the market wage rate for workers is $80 per day. (a) State the conditions necessary for hiring the profitmaximizing amount of labor. (b) At the profit-maximizing level of output, suppose that the marginal product of the last worker hired is 20 towels per day. Calculate the price of a towel. (c) Draw a correctly labeled graph of the labor supply and demand curves for Pride Textiles, and show the equilibrium amount of labor hired. (d) Given your answer to part (b), if the price of a towel increases, explain how Pride’s profit-maximizing quantity of labor will be affected. 2005 AP Micro FRQ A #1 (Unit 3: Perfect Competition in Product Market) 1. Bestmilk, a typical profit-maximizing dairy firm, is operating in a constant-cost, perfectly competitive industry that is in long-run equilibrium. (a) Draw correctly labeled side-by-side graphs for the dairy market and for Bestmilk and show each of the following. (i) Price and output for the industry (ii) Price and output for Bestmilk (b) Assume that milk is a normal good and that consumer income falls. Assume that Bestmilk continues to produce. On your graphs in part (a), show the effect of the decrease in income on each of the following in the short run. (i) Price and output for the industry (ii) Price and output for Bestmilk (iii) Area of loss or profit for Bestmilk (c) Following the decrease in consumer income, what must be true for Bestmilk to continue to produce in the short run? (d) Assume that the industry adjusts to a new long-run equilibrium. Compare the following between the initial and the new long-run equilibrium. (i) Price in the industry (ii) Output of a typical firm (iii) The number of firms in the dairy industry 2005 AP Micro FRQ A #2 (Unit 2: Tax) Price($) 2. The graph above shows the market for a good that is subject to a per-unit tax. The letters in the graph Supply +Tax represent the enclosed areas. (a) Using the labeling on the graph, identify each of the Supply 13 A B C F following. 12 (i) The equilibrium price and quantity before the tax G D 11 Demand (ii) The area representing the consumer surplus before E 10 the tax 0 80 100 Quantity (iii) The area representing the producer surplus before the tax (b) Assume that the tax is now imposed. Based on the graph, does the price paid by the buyers rise by the full amount of the tax? Explain. (c) Using the labeling on the graph, identify each of the following after the imposition of the tax. (i) The net price received by the sellers (ii) The amount of tax revenue (iii) The area representing the consumer surplus (iv) The area representing the deadweight loss 2005 AP Micro FRQ A #3 (Unit 5: Resource Market) Number of Number of workers Shirts per Day 0 0 1 10 2 25 3 45 4 60 5 72 6 80 7 85 8 82 3. P & L is a profit-maximizing shirtmanufacturing firm. The firm can sell all the shirts it can produce to retailers at a price of $20 each. P & L can hire all of the workers it wants at a market wage of $120 per day per worker. The table below shows the firm’s short-run production function. (a) In what kind of market structure does this firm sell its output? How can you tell? (b) In what kind of market structure does this firm hire its workers? How can you tell? (c) Calculate the marginal revenue product of the third worker. Show your work. (d) How many workers should the firm hire to maximize profit? Explain. 2005 AP Micro FRQ B #1 (Unit 4&5: Monopoly in Product & Resource Market ) Petsall Corporation is a profit-maximizing monopolist. It sells a patented rabies vaccine for pets and earns economic profits. (a) Draw a correctly labeled graph that shows each of the following for Petsall. (i) Output and price of the vaccine (ii) Area of economic profits (b) Assume that Petsall hires its production workers in a perfectly competitive labor market at the wage rate of $20 per hour. (i) State the marginal conditions for hiring the profit-maximizing amount of labor. (ii) Draw a correctly labeled graph that shows the labor supply and demand curves for Petsall and indicate the profit-maximizing quantity of labor. (c) Suppose that the market wage rate now falls to $15 per hour. Show on your diagram in (b) (ii) how each of the following would be affected. (i) The supply of labor to Petsall (ii) The amount of labor Petsall would hire (d) Given the lower wage rate in (c), indicate how each of the following would change. (i) Total fixed cost (ii) Marginal cost (iii) Price of the product 2005 AP Micro FRQ B #2 (Unit 3: Perfect Competition in Product Market) 2. The graph above shows the short-run cost structure of a firm in a perfectly competitive industry. (a) Identify the cost curves that are denoted by each of the following labels. (i) Curve 1 (ii) Curve 2 (iii) Curve 3 (b) Explain why curve 1 does each of the following as output increases. (i) Initially decreases (ii) Finally increases (c) What measure of cost is represented by the vertical distance between curve 2 and curve 3? (d) Explain why the vertical distance between curve 2 and curve 3 decreases as output increases. (e) Using the letters on the graph, identify two points on the firm’s shortrun supply curve. 2005 AP Micro FRQ B #3 (Unit 2: Related Goods) 3. Assume that bread and butter are complementary goods. The government begins to subsidize the production of wheat, which is an input in the production of bread. (a) For each of the following markets, draw correctly labeled supply and demand graphs and show the effect of the subsidy on the equilibrium price and quantity in the short run. (i) The wheat market (ii) The bread market (iii) The butter market (b) If the demand for bread is price elastic, how will total revenues for the bread producers change as a result of the government subsidy?