Auditing &

Assurance

Services,

6e

Copyright © 2015 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

Module G

Variables Sampling

USA Today has come out with a new survey – apparently, three

out of every four people make up 75 percent of the population.

David Letterman, American comedian and television host

Mod G-2

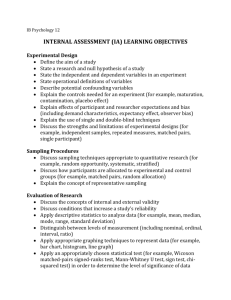

Module G Objectives

1.

Define variables sampling and understand when it is used in the audit.

2.

Understand the basic process underlying monetary unit sampling

(MUS) and when to use it.

3.

Identify the factors affecting the size of an MUS sample and calculate

the sample size for an MUS application.

4.

Evaluate the sample results for an MUS by calculating the projected

misstatement, incremental allowance for sampling risk, and basic

allowance for sampling risk.

5.

Understand the basic process underlying classical variables sampling

and the use of classical variables sampling in the audit.

6.

Understand the use of nonstatistical sampling for variables sampling.

Mod G-3

Variables Sampling

• Variables sampling is used to estimate the amount (or value) of

a population

• Substantive procedures

– Estimate account balance or misstatement

– Compare estimated account balance or misstatement to recorded

amount or tolerable misstatement

• Approaches

– Monetary unit sampling (MUS)

– Classical variables sampling

Mod G-4

Major Topics

I.

Monetary Unit Sampling (MUS)

− Basics of MUS

− Determining Sample Size

− Selecting and Measuring Sample Items

− Evaluating Sample Results

II. Classical Variables Sampling

III. Nonstatistical Sampling

Mod G-5

Monetary Unit Sampling

(MUS)

• Defines the sampling unit as an individual dollar (or

other monetary unit) in an account balance

• Auditor will select individual dollars (or monetary

units) for examination

• Auditor will verify the entire “logical unit”

containing the selected dollar (or monetary unit)

– Accounts receivable: Customer account

– Inventory: Inventory item

Mod G-6

Advantages of MUS

• Results in more efficient (smaller) sample sizes

• Selects transactions or components reflecting

larger dollar amounts

• Effective in identifying overstatement errors

– Asset and revenue accounts

• Generally simpler to use than classical

variables sampling

Mod G-7

Disadvantages of MUS

• Provides a conservative (higher) estimate of

misstatement

• Not effective for understatement or omission errors

– Liabilities and expenses

• Expanding sample is difficult if initial conclusion is

to reject the account balance

• Requires special consideration for accounts with

zero or negative balances

Mod G-8

Major Topics

I.

Monetary Unit Sampling (MUS)

− Basics of MUS

− Determining Sample Size

− Selecting and Measuring Sample Items

− Evaluating Sample Results

II. Classical Variables Sampling

III. Nonstatistical Sampling

Mod G-9

Effect of Factors on Sample

Size

Factor

Effect

How Determined

Sampling risk (risk of incorrect

acceptance)

Inverse

Using the audit risk model and based on prior

assessments of audit risk, risk of material

misstatement, and analytical procedures risk

Tolerable misstatement

Inverse

Based on recorded account balance and

relationship between the recorded account

balance and important financial statement

subtotals

Expected misstatement

Direct

Based on prior experience with the client (for

recurring audits) or a pilot sample (for initial

audits)

Population size

Direct

Based on the recorded balance in the account

balance or class of transactions

Mod G-10

Summary: Sampling Risks

Under Variables Sampling

Decision Based on Population

Decision

Based on

Sample

Account is not

misstated

(AM ≤ TM)

Account is misstated

(AM > TM)

Account is not

misstated

(ULM ≤ TM)

Correct decision

Risk of incorrect

acceptance

Account is

misstated

(ULM > TM)

Risk of incorrect

rejection

Correct decision

AM

TM

ULM

= Actual misstatement

= Tolerable misstatement

= Upper limit on misstatements

Mod G-11

Using MUS Tables

• See Exhibit G.2 for Sample Size Table

• Inputs

– Risk of incorrect acceptance

– Expected misstatement

– Tolerable misstatement

– Population size

Mod G-12

Example

• Parameters

– Risk of incorrect acceptance = 5%

– Expected misstatement = $100,000

– Tolerable misstatement = $500,000

– Population size = $1,000,000

• Calculations

– Ratio of expected to tolerable misstatement: $100,000 ÷ $500,000 = 0.20

– Tolerable misstatement as a percentage of population: $500,000 ÷

$1,000,000 = 50%

Mod G-13

Step 3: Select column for TM as % of

population = 50%

Step 1: Select entries for risk

of incorrect acceptance = 5%

Risk of

Ratio of

incorrect

Expected to

acceptance Tolerable

Misstatement

Tolerable Misstatement as a Percentage of

Population

50%

30%

10%

8%

5%

-

6

10

30

38

5%

0.10

8

13

37

46

5%

0.20

10

16

47

58

5%

0.30

12

20

60

75

5%

0.40

17

27

81

102

Step 2: Select row for ratio

of EM to TM = 0.20

Step 4: Read sample

size at junction of row

and column

Mod G-14

Major Topics

I.

Monetary Unit Sampling (MUS)

− Basics of MUS

− Determining Sample Size

− Selecting and Measuring Sample Items

− Evaluating Sample Results

II. Classical Variables Sampling

III. Nonstatistical Sampling

Mod G-15

MUS: Selecting Sample Items

• Use systematic random sampling

• Calculate sampling interval as:

Population size ÷ Sample size

• Process

– Identify random start

– Skip number of items equal to sampling interval

– Select item (dollar in account) and examine entire logical

unit containing that item (customer account)

– May select same logical unit multiple times

Mod G-16

MUS: Measuring Sample

Items

Mod G-17

Major Topics

I.

Monetary Unit Sampling (MUS)

− Basics of MUS

− Determining Sample Size

− Selecting and Measuring Sample Items

− Evaluating Sample Results

II. Classical Variables Sampling

III. Nonstatistical Sampling

Mod G-18

MUS: Evaluating Sample

Results

• Determine the upper limit on misstatements,

which has a (1 – Risk of incorrect acceptance) of

equaling or exceeding the true amount of

misstatement

• Components:

– Projected misstatement

– Incremental allowance for sampling risk

– Basic allowance for sampling risk

Mod G-19

Projected Misstatement

• Assumes entire sampling interval contains same

percentage of misstatement as the logical unit

examined by auditors

• Calculated for each misstatement as:

Sampling interval x Tainting %

• Do not project misstatements if the logical unit >

sampling interval

Mod G-20

Incremental Allowance for

Sampling Risk

• Adjusts the projected misstatement to control exposure to risk of

incorrect acceptance

• Allows for the possibility that the remainder of the sampling

interval might be misstated by a higher percentage than the

logical unit

• Procedure:

– Rank all projected misstatements in descending order

– Determine incremental confidence factor for each misstatement

– Multiply projected misstatement by (incremental confidence factor – 1)

Mod G-21

Basic Allowance for Sampling

Risk

• Provides a measure of the misstatement that might

exist in sampling intervals in which a misstatement

was not detected

• Calculated as:

Sampling interval x Confidence factor

Mod G-22

MUS: Evaluating Sample

Results

1

Projected Misstatement

2

Incremental allowance for sampling risk

XX,XXX

3

Basic allowance for sampling risk

XX,XXX

Upper limit on misstatements

$ XX,XXX

$XXX,XXX

Mod G-23

Upper Limit on

Misstatements

• If ULM = $50,000 and risk of incorrect

acceptance = 5%

$50,000

$0

95% probability (1 – risk of incorrect

acceptance)

5% probability (risk of

incorrect acceptance)

Mod G-24

MUS: Making the Decision

Upper Limit on

Misstatement

Upper Limit on

Misstatement

≤

>

Tolerable

Misstatement

Tolerable

Misstatement

Account

balance is

not

misstated

Account

balance is

misstated

Mod G-25

Decisions under MUS

• Account balance is not misstated

– Suggest correction of identified misstatements

– Investigate cause of misstatements

• Account balance is misstated

– Increase sample size to attempt and reduce upper limit

on misstatements

– Recommend adjustment to reduce misstatement below

tolerable misstatement

Mod G-26

Major Topics

I.

Monetary Unit Sampling (MUS)

− Basics of MUS

− Determining Sample Size

− Selecting and Measuring Sample Items

− Evaluating Sample Results

II. Classical Variables Sampling

III. Nonstatistical Sampling

Mod G-27

Classical Variables Sampling

• Uses normal distribution theory and the central limit

theorem to provide an estimated range of

– Recorded account balance or class of transactions

– Misstatement in an account balance or class of transactions

• Basic methodology

– Determine estimated range of account balance or

misstatement

– Evaluate using tolerable misstatement

Mod G-28

Additional Considerations in

Classical Variables Sampling

• Consider the following additional factors in

determining sample size

– Risk of incorrect rejection

– Population variability

• To reduce population variability, auditors

may choose to stratify the population

Mod G-29

Example

• Assume

– Recorded balance = $300,000

– Tolerable misstatement = $10,000

– Estimated balance = $292,500

– Precision = $2,275

– Risk of incorrect acceptance = 10%

– Risk of incorrect rejection = 15%

Mod G-30

Example (continued)

• Estimate ± Precision

$292,500 ± $2,275 = $290,225 to $294,775

$290,225

$294,775

$300,000

90% probability of including true

recorded balance

Difference between recorded balance and far end of interval <

Tolerable misstatement

Mod G-31

Classical Variables Sampling

Approaches

•

•

•

Mean-per-unit:

–

Assumes each item in population (component of account) has similar balance

–

Estimates recorded balance by multiplying number of components by average audited value

Difference estimation:

–

Assumes each item in population (component of account) has similar difference between

recorded and audited value

–

Estimates the amount of misstatement by multiplying number of components by average

misstatement

–

Estimates recorded balance using estimated misstatement

Ratio estimation:

–

Assumes a constant percentage misstatement in population

–

Estimates recorded balance by multiplying recorded balance by ratio of audited value to

recorded balance

Mod G-32

Sampling Methods

MUS

Classical Variables Sampling

Overstatement errors are greatest

concern

Both overstatement and

understatement errors are of concern

Standard deviation difficult to estimate

Standard deviation can be estimated

Smaller number of misstatements

anticipated

Larger number of misstatements

anticipated

Population has high degree of

variability and large dollar components

exist

Population is homogenous (in terms of

dollar balances) and large dollar

components do not exist

Mod G-33

Major Topics

I.

Monetary Unit Sampling (MUS)

− Basics of MUS

− Determining Sample Size

− Selecting and Measuring Sample Items

− Evaluating Sample Results

II. Classical Variables Sampling

III. Nonstatistical Sampling

Mod G-34

Nonstatistical Sampling

• Permissible under GAAS

• Does not permit auditors to control

exposure to sampling risk

• Major differences in:

– Determining sample size

– Selecting sample items

– Evaluating sample results

Mod G-35