File

advertisement

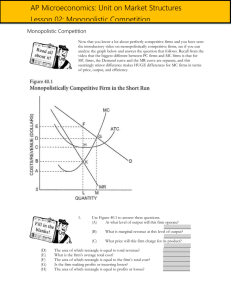

Economics 111.3 Winter 14 April 4th, 2014 Lecture 32 Ch. 13: Pure monopoly Final Exam: FINAL EXAM is based on chapters 3, 4, 5 (up to p. 116), 6 (up to p. 138), 8, 9, 10 (up to p. 230, 11, 12, 13, and 14 Its format: 100 Multiple-Choice Questions When and Where: April 21, from 7:00 p.m. to 10:00 p.m; STM 140 Extra Office Hours: April 19, from 1:00 p.m. to 3:00 p.m. A recap: The Price-Discriminating Monopolist • A price-discriminating monopolist can charge customers with more inelastic demands a higher price. • It can charge customers with more elastic demands a lower price • As a result, a price discriminating monopolist earns more profit than a normal monopolist • Example: Aspirin sold in airports is much more expensive than the Aspirin sold in grocery stores Examples of price discrimination: • Airlines charge high fares to executive travelers (inelastic demand) than vacation travelers (elastic demand). • Electric utilities frequently segment their markets by end uses, such as lighting and heating. (Lack of substitutes for lighting makes this demand inelastic). • Long-distance phone service has higher rates during the day, when businesses must make their calls (inelastic demand), and lower rates at night and on week-ends, when less important calls are made. • Movie theatres and golf courses vary their charges on the basis of time and age. • Discount coupons are a form of price discrimination, allowing firms to offer a discount to price-sensitive customers. • International trade has examples of firms selling at different prices to customers in different countries. Suppose Global Air has identifiable customer groups: – last-minute business travelers, willing to pay up to $1800 per trip – scheduled business travelers, willing to pay up to $1600 per trip, no weekend layovers – other travelers, willing to pay up to $1400, no weekend layovers – vacationers, willing to pay up to $1200, and to stay over Saturday night Perfect Price Discrimination Perfect price discrimination refers to the situation when the monopolist knows exactly the willingness to pay of each customer and can charge each customer a different price. Perfect Price Discrimination With perfect price discrimination, output increases to the point at which price equals marginal cost — where the marginal cost intersects the demand curve. Output is identical to that of perfect competition. Perfect Price Discrimination and Efficiency • Perfect price discrimination pushes consumer surplus to zero but increases producer surplus to equal the sum of consumer surplus and producer surplus in perfect competition. • Deadweight loss is zero: perfect price discrimination achieves efficiency. True-False Questions 1. In the long run the pure monopolist must produce at that output where average total cost is at a minimum. 2. The supply curve for a monopolist is the upsloping portion of the marginal cost curve that lies above the average variable cost curve. 3. Monopolistic producers always earn economic profits. 4. A monopolist practicing perfect price discrimination will produce at a socially optimal level of output 5. A monopolist practicing price discrimination will charge a higher price in the market with the higher elasticity of demand Ch. 14: Monopolistic Competition Four Market Structures Market structure involves the number of firms in the market and the barriers to entry Monopolistic competition is a market structure in which there are many firms selling differentiated products but competing with other firms selling similar products Oligopoly is a market structure in which there are a few interdependent firms Pure Competition Monopolistic Competition Oligopoly Market Structure Continuum Pure Monopoly A concentration ratio is the percentage of industry sales by the top few firms of the industry Competitive and Monopolistic aspects • The “many sellers” characteristic gives monopolistic competition its competitive aspect. As a result: • firms do not take into account their rivals’ responses to their decisions. • collusion (price fixing) is difficult (due to a large number of firms) • there is easy entry of new firms in the long run • Its monopolistic aspect comes from product differentiation based upon: • product attributes, service, location, brand names, packaging • perceived quality • competitive advertising. Easy Entry of New Firms in the Long Run • There are no significant barriers to entry in monopolistic competition. • The existence of economic profits induces other firms to enter, bringing long-run profit down to zero. expect new competitors Price and Costs P p MC ATC economic profit D MR Q Q demand curve shifts left Price and Costs P MC ATC p Economic profits decrease D MR Q Q in theMC long run, profits ATC are zero Price and Costs P p D Q MR Q ATC expectMCfewer competitors Price and Costs P p loss D MR Q Q some firms exit MC ATC D shifts right losses get smaller Price and Costs P p D MR Q Q MC run, ATC in the long profits are zero Price and Costs P p D MR Q Q Easy Entry of New Firms in the Long Run Complications: • persistent positive profits may persist if: – there is continuing & significant product differentiation – entry is somewhat limited by the financial investment required to establish product differentiation • overall, we still expect the general results