File

advertisement

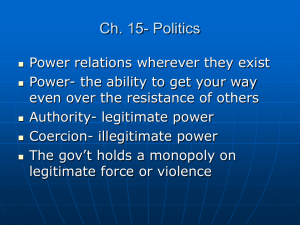

News Analysis • M&S • 2010 • Does news matter • Is it science Case Fundamental • Alchemy or; • Child’s play? Technical Analysis Analysis • Data or • Dialogue? • But then what? Behavioural Managed? • How to lose money £150,000,000,000 Enough to fund 20million HE students £130,000,000,000 £110,000,000,000 £90,000,000,000 £1,790,000,000,000 £70,000,000,000 £50,000,000,000 £30,000,000,000 £10,000,000,000 -£10,000,000,000 News Analysis Marks & Spencer Group PLC 30 July 2010 The Company's capital consists of 1,582,902,704 ordinary shares with voting rights. Therefore, the total number of voting rights in the Company is 1,582,902,704. Up 0.51% 31 August 2010 The Company's capital consists of 1,582,917,001 ordinary shares with voting rights. Therefore, the total number of voting rights in the Company is 1,582,917,001. Up 4.16% 01 November 2010 The Company's capital consists of 1,583,507,776 ordinary shares with voting rights. Therefore, the total number of voting rights in the Company is 1,583,507,776. Down 1.91% http://www.londonstockexchange.com/exchange/prices-and-markets/stocks/exchangeinsight/news-analysis.html?fourWayKey=GB0031274896GBGBXSET1 M&S finds favour as Footsie volumes slow for Christmas Financial Times December 16th 2010 “M&S seems to have the strongest momentum among the majors, with industry data still supportive,” said analyst Andrew Hughes. He estimated M&S to show “scarily good” same-store sales growth of 4 per cent for general merchandise and 3 per cent for food. By comparison, sales at Next and Argos stores may fall by 4.5 per cent and 6 per cent respectively, he forecast. December 16 2010 M&S finds favour as Footsie volumes slow for Christmas Financial Times December 16th 2010 Technical Analysis • • • • • • Last year, United lost at home only twice: to Chelsea Settlement as of 24/12/2010, at 5:45 p.m. and to Aston Villa. That loss Marks & Sp. fractionally up, achieving a modest profit of +0.43%. The day started well for the stock, to peaks Villa was this very which approached the previous session's with aduring first price of 376.2, and stayed on a plateau during the entire session. The weekly analysis of the security and the FTSE 100 of fixtures a year shows Marks & Sp. losing relative strength against theweekend index. Status and Trend Analysis ago While the medium-term scenario still looks bearish, the short-term structure shows some promising signs, with support at 372 holding strong. The positive movement in the short term indicates a potential reversal of the bearish trend, with the possibility of prices flirting with the key resistance level of 378. Thus there is a good chance of the bullish phase continuing towards the 384 level. Risk Analysis The security's level of risk is currently under control, with daily volatility at 1.641, whilst daily volume remains high, having risen above the 1-month volume moving average in the last session. Marks & Sp.'s stable movement suggests that institutional investors have an interest in the security, to the extent that they can exert a high degree of control over its trend, which appears orderly and without strong fluctuations. DOW v FTSE r=0.96 12000 11500 DOW 11000 10500 10000 9500 9000 4700 5200 5700 6200 FTSE data from yahoo.finance Fundamental Analysis M&S Performance 130 120 110 100 90 80 70 60 2007 2008 Revenue 2009 PAT EPS 2010 Conditions are 'right' Buy and hold in the short run, the market is a voting machine, not a weighing machine Growth stocks ‘Quants’ "being greedy when other people are fearful and fearful when other people are greedy." value investing > If you spend more than 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes Peter Lynch 15% Cash flow •Sales volume •Retail price •Inflation •Interest •Exchange rates •Costs •Inflation •Interest •exchange •Exchange rates Dn Pn D1 D2 P0 ... 1 2 (1 i ) (1 i ) (1 i ) n WACC Cost of equity Beta Market return Risk free return Dividend Share price Cost of debt Behavioural Heuristics applied to surfing • Rule of 72. divide the number 72 by whatever yield you are getting to see how long it would take for your investment to double. • “120 Minus Your Age” Rule. That is your percentage of stock allocation. • The Long Term Inflation Average Is 4% • Very Few Years Are “Average”. • You Need 20x Your Gross Annual Income to Retire. • Save and Invest 10% of Your Pre-Tax Income. • 10, 5, 3 Rule. You can expect a nominal return of 10% from equities, 5% return from bonds and 3% return on highly liquid cash • Required Return. Required return = risk free rate + beta (historical market return – risk free rate). http://etfdb.com/2009/top-10-investing-rules-of-thumb/ Stereotypes and anecdotes mis-pricings and return anomalies http://funds.ft.com/UKUnitTrustsandOEICS/Act iveManaged http://www.londonstockexchan ge.com/exchange/prices-andmarkets/stocks/indices/summar y/summary-indiceschart.html?index=UKX Same Different http://www.msnbc.msn.com/id/13560741/ns/technology_and_science-science/ 1-ten-2 2-ten-4 3-ten-6