McGraw-Hill/Irwin

1-1

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

27-1

Chapter

27

Job Order

Cost Accounting

Section 1: Cost Accounting

Section Objectives

1.

Explain how a job order cost accounting system

operates.

27-2

Types of Cost Accounting

Systems

A job order cost accounting system is used

by businesses that produce special orders or

produce more than one product in batches.

A process cost accounting system is used when

standard products are manufactured using a

continuous process.

A standard cost accounting system, in which

standard costs of production are measured, can be

used with a job order or a process cost system.

27-3

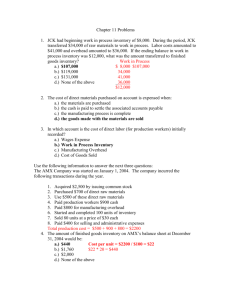

Flow of Costs through a Job Order Cost

Accounting System

Procurement

Production

Warehousing

Raw Materials

Inventory

Work in Process

Inventory

Finished Goods

Inventory

Purchases

Issued

Materials

Labor

Transferred

out

Transferred

in

Transferred

out

Selling

Cost of Goods Sold

Transferred

in

Overhead

Wages

Payable

Charged to

Work in

Process

Manufacturing

Overhead

Indirect

Materials

Indirect

Labor

Applied

to Work in

Process

Other

27-4

Perpetual Inventory System

The perpetual inventory system tracks

inventories on hand at all times.

The following accounts are involved in a

perpetual inventory system:

Raw Materials Inventory

Wages Payable

Manufacturing Overhead

Work in Process Inventory

Finished Goods Inventory

Cost of Goods Sold

27-5

Computing the Balance of the

Work in Process Inventory

Beginning inventory of work in process

Add direct materials, direct labor, and manufacturing

overhead charged to production

Deduct cost of goods completed

Ending inventory of work in process

xx

xx

xx

xx

xx

Reflects the cost of partially completed units

27-6

Computing the Balance of

Finished Goods Inventory

Beginning inventory of finished goods

Add cost of goods manufactured

Deduct cost of goods sold

Ending inventory of finished goods

xx

xx

xx

xx

xx

Represents the cost of finished goods on hand

27-7

Just-in-Time Inventory Systems

Used by companies who wish to eliminate raw

materials inventory.

Raw materials ordered to arrive just in time to be

placed into production.

Costs of arriving materials placed immediately

into Work in Process Inventory.

Reduces amount of capital tied up in inventory.

Reduces inventory storage space.

Reduces costs for storeroom personnel,

insurance, and recordkeeping.

27-8

Chapter

27

Job Order

Cost Accounting

Section 2: Job Order Cost

Accounting System

Section Objectives

2.

3.

4.

5.

6.

Journalize the purchase and issuance of direct and indirect

materials.

Maintain perpetual inventory records.

Record labor costs incurred and charge labor into production.

Compute overhead rates and apply overhead to jobs.

Compute overapplied or underapplied overhead and report it in

the financial statements.

27-9

Cost Basis

When pricing the raw materials inventory, three

common methods are used:

FIFO

LIFO

Average Cost

Each method reflects a different valuation of

raw materials inventory.

Each company determines its own pricing

policy.

27-10

Labor Costs

Workers complete a

separate time ticket

for each job.

All labor time tickets

are sorted by job,

summarized at end of

the payroll period, and

entered on job order

cost sheets.

The total charged to

all cost sheets must

agree with direct labor

debited to Work in

Process Inventory.

27-11

Recording Labor Costs

27-12

Objective 5

Compute overhead rates and apply

overhead to jobs

Manufacturing Overhead

Includes all manufacturing costs except

direct materials and direct labor.

Examples:

Indirect materials

Indirect labor

Depreciation

Insurance

Utilities

Rent

27-13

Applying Overhead to Jobs

Overhead costs are applied to specific jobs

based on an overhead application rate.

Several different bases can be used to develop

the overhead application rate. Some of more

common bases for allocating overhead are:

Based on direct labor costs.

Based on direct labor hours

Based on machine hours.

27-14

Compute overapplied or underapplied overhead

Objective 6 and report it in the financial statements

Determining Overapplied

or Underapplied Overhead

At month-end, compare the total credits in Manufacturing

Overhead Applied to the total debits in Manufacturing

Overhead.

If credits in Manufacturing Overhead Applied are less than

debits in Manufacturing Overhead, overhead has been

underapplied.

If debits in Manufacturing Overhead are less than credits in

Manufacturing Overhead Applied, overhead has been

overapplied.

27-15

Chapter

27

Job Order

Cost Accounting

Section 3: Accounting for

Job Orders

Section Objectives

7.

Maintain job order cost sheets.

8.

Record the cost of jobs completed and the cost of

goods sold under a perpetual inventory system.

27-16

Objective 7

Maintain job order cost sheets

Job Order Cost Sheet

Each job started in production has its own job order cost

sheet.

The cost sheets constitute the subsidiary ledger for the Work

in Process account. The job cost sheet totals should equal the

general ledger account balance.

The cost sheet shows:

Direct materials

Direct labor

Overhead

27-17

Job Order Cost Sheet

Enter materials used

Enter labor costs

Apply overhead

using predetermined

rate

Total the costs when

the job is completed

27-18

Cost of Goods Sold

(Perpetual Inventory)

Instead of showing overapplied or underapplied overhead on

the income statement, the accountant might prefer to show

actual manufacturing costs on the statement of cost of goods

manufactured.

27-19