Process Costing Chapter 17

advertisement

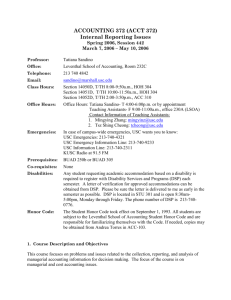

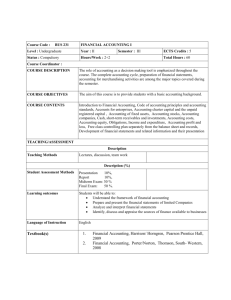

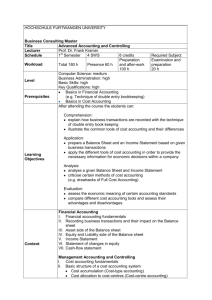

Process Costing Chapter 17 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 1 Learning Objective 1 Identify the situations in which process-costing systems are appropriate. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 2 Illustrating Process Costing Direct Materials, Direct Labor Indirect Manufacturing Costs Department A Department B Finished Goods Cost of Goods Sold ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 3 Learning Objective 2 Describe the five steps in process costing. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 4 Five Steps in Process Costing Step 1: Summarize the flow of physical units of output. Step 2: Compute output in terms of equivalent units. Step 3: Compute equivalent unit costs. Step 4: Summarize total costs to account for. Step 5: Assign total costs to units completed and to units in ending work in process inventory. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 5 Learning Objective 3 Calculate equivalent units and understand how to use them. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 6 Physical Units (Step 1) Physical units Flow of Production Work in process, beginning Started during current period To account for Completed and transferred out during current period Work in process, ending (100%/20%) Accounted for ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 0 35,000 35,000 30,000 5,000 35,000 17 - 7 Compute Equivalent Units (Step 2) Equivalent units Direct Conversion Flow of Production Materials Costs Completed and transferred out 30,000 30,000 Work in process, ending 5,000 (100%) 1,000 (20%) Current period work 35,000 31,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 8 Compute Equivalent Unit Costs (Step 3) Total production costs are $146,050. Equivalent units Cost per equivalent unit Direct Conversion Materials Costs $84,050 $62,000 35,000 31,000 $2.4014 $2.00 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 9 Summarize and Assign Total Costs (Steps 4 and 5) Step 4: Total costs to account for: $146,050 Step 5: Assign total costs: Completed and transferred out 30,000 × $4.4014 $132,043 Work in process, ending (5,000 units) Direct materials 5,000 × $2.4014 12,007 Conversion costs 1,000 × $2.00 2,000 Total $146,050 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 10 Learning Objective 4 Prepare journal entries for process-costing systems. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 11 Journal Entries Example Assume that Omaha, Inc. has two processing departments – Assembly and Finishing. Omaha, Inc., purchases direct materials as needed. What is the journal entry for materials? Work in Process, Assembly 84,050 Accounts Payable Control 84,050 To record direct materials purchased and used ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 12 Journal Entries Example What is the journal entry for conversion costs? Work in Process, Assembly 62,000 Various accounts 62,000 To record Assembly Department conversion costs What is the journal entry to transfer completed goods from Assembly to Finishing? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 13 Journal Entries Example Work in Process, Finishing 132,043 Work in Process, Assembly 132,043 To record cost of goods completed and transferred from Assembly to Finishing during the period ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 14 Flow of Costs Example Accounts Payable 84,050 Various Accounts 62,000 WIP Assembly 84,050 132,043 62,000 14,007 WIP Finishing 132,043 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 15 Learning Objective 5 Use the weighted-average method of process costing. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 16 Physical Units (Step 1) Work in process, beginning: 100% material 60% conversion costs 1,000 Units started in process 35,000 Units transferred out: 31,000 Units in ending inventory: 100% material 20% conversion costs 5,000 36,000 36,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 17 Compute Equivalent Units (Step 2) Completed and transferred Ending inventory Equivalent units Materials Conversion 31,000 31,000 5,000 1,000 36,000 32,000 100% 20% ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 18 Compute Equivalent Unit Costs (Step 3) Materials Beginning inventory $ 2,350 Current costs 84,050 Total $86,400 Equivalent units 36,000 Cost per unit $2.40 Conversion $ 5,200 62,000 $67,200 32,000 $2.10 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 19 Summarize and Assign Total Costs (Steps 4 and 5) Work in process beginning inventory: Materials $ 2,350 Conversion 5,200 Total beginning inventory $ 7,550 Current costs in Assembly Department: Materials $ 84,050 Conversion 62,000 Costs to account for $153,600 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 20 Summarize and Assign Total Costs (Steps 4 and 5) This step distributes the department’s costs to units transferred out: 31,000 units × $4.50 = $139,500 And to units in ending work in process inventory: $12,000 + $2,100 = $14,100 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 21 Summarize and Assign Total Costs (Steps 4 and 5) Costs transferred out: 31,000 × ($2.40 + $2.10) Costs in ending inventory: Materials 5,000 × $2.40 Conversion 1,000 × $2.10 Total costs accounted for: $139,500 12,000 2,100 $153,600 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 22 Journalizing: Weighted-Average What are the journal entries in the Assembly Department? Work in Process, Assembly 84,050 Accounts Payable Control 84,050 To record direct materials purchased and used Work in Process, Assembly 62,000 Various accounts 62,000 To record Assembly Department conversion costs ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 23 Journalizing: Weighted-Average Work in Process, Finishing 139,500 Work in Process, Assembly 139,500 To record cost of goods completed and transferred from Assembly to Finishing during the period ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 24 Key T-Account: Weighted-Average Work in Process Inventory, Assembly Beg. Inv. 7,550 Transferred Materials 84,050 to Finishing Conversion 62,000 139,500 Balance 14,100 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 25 Learning Objective 6 Use the first-in, first-out (FIFO) method of process costing. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 26 Compute Equivalent Units (Steps 1 and 2) Quantity schedule (Step 1) is the same as the weighted-average method. Materials Conversion Completed and transferred: From beginning inventory 0 400 Started and completed 30,000 30,000 Ending inventory 5,000 1,000 35,000 31,400 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 27 Compute Equivalent Units (Step 2) Materials Conversion Completed and transferred: Ending inventory 31,000 31,000 5,000 (100%) 1,000 (20%) 36,000 32,000 Beginning inventory 1,000 (100%) 600 (60%) Equivalent units 35,000 31,400 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 28 Compute Equivalent Unit Costs (Step 3) Current costs Equivalent units Cost per unit Materials $84,050 35,000 $2.40 Conversion $62,000 31,400 $1.975 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 29 Summarize and Assign Total Costs (Steps 4 and 5) Work in process beginning inventory: $ 7,550 Current costs: Material Conversion Total 84,050 62,000 $153,600 Same as using weighted-average ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 30 Summarize and Assign Total Costs (Steps 4 and 5) Costs transferred out: From beginning inventory: $7,550 Conversion costs added: 1,000 × 40% × $1.975 790 From current production: 30,000 × $4.375 Total $ 8,340 131,250 $139,590 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 31 Summarize and Assign Total Costs (Steps 4 and 5) Work in process ending inventory: Materials: 5,000 × $2.40 $12,000 Conversion: 5,000 × 20% × $1.975 Total 1,975 $13,975 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 32 Summarize and Assign Total Costs (Steps 4 and 5) Costs transferred out + = $139,590 Cost in ending inventory $ 13,975 $153,565 ($35 rounding error) An alternative approach: Costs to account for – = $153,600 Cost in ending inventory $ 13,975 Costs transferred out $139,625 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 33 Key T-Account: FIFO Work in Process Inventory, Assembly Beg. Inv. 7,550 Transferred Materials 84,050 to Finishing Conversion 62,000 139,625 Balance 13,975 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 34 Comparison of WeightedAverage and FIFO Methods Weighted Average Costs of units completed and transferred out Work in process, ending Total costs accounted for FIFO Difference $139,500 $139,625 +$125 14,100 13,975 –$125 $153,600 $153,600 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 0 17 - 35 Learning Objective 7 Incorporate standard costs into a process-costing system. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 36 Standard-Costing Method of Process-Costing Example Process-costing systems using standard costs usually accumulate actual costs incurred separately from the inventory accounts. Assume that actual materials cost is $84,050 and standard materials cost is $84,250 What are the journal entries in the Assembly Department? ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 37 Standard-Costing Method of Process-Costing Example Direct Materials Control 84,050 Accounts Payable Control 84,050 Work in Process 84,250 Direct Material Variances 200 Direct Materials Control 84,050 To record direct materials purchased and used in production during the period and variances ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 38 Learning Objective 8 Apply process-costing methods to cases with transferred-in costs. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 39 Transferred-In Costs Weighted-Average Example Finishing Department beginning WIP inventory: 4,000 units (60% materials) (25% conversion) Ending work in process inventory: 2,000 units (100% materials) (40%) conversion) 31,000 units transferred-in from Assembly. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 40 Physical Units (Step 1) Beginning inventory Units started in process Units completed and transferred to finished goods Ending inventory 4,000 31,000 35,000 33,000 2,000 35,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 41 Compute Equivalent Units (Step 2) Equivalent units for transferred-in costs: Transferred to finished goods Ending inventory 33,000 2,000 35,000 Inventory is 100% complete for the work performed in the Assembly Department. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 42 Compute Equivalent Units (Step 2) Equivalent units for direct materials costs: Transferred to finished goods 33,000 Ending inventory (100%) 2,000 35,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 43 Compute Equivalent Units (Step 2) Equivalent units for conversion costs (ending inventory 2,000): Transferred to finished goods 33,000 Ending inventory (40%) 800 33,800 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 44 Compute Equivalent Unit Costs (Step 3) Assume the following costs in the Finishing Department: Work in process beginning inventory from: Assembly Department $30,200 Direct materials 9,400 Conversion costs 8,000 Total cost in beginning inventory $47,600 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 45 Compute Equivalent Unit Costs (Step 3) Current costs in Finishing Department are as follows: Costs received from the Assembly Department $139,500 Direct materials 9,780 Conversion 42,640 Total $191,920 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 46 Compute Equivalent Unit Costs (Step 3) (Transferred-in costs $30,200 + Costs transferred in from the Assembly Department $139,500) ÷ 35,000 units $4.85 (Direct materials $9,400 + $9,780) ÷ 35,000 units $0.55 (Conversion costs $8,000 + $42,640) ÷ 33,800 units $1.50 Total unit cost $6.90 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 47 Summarize and Assign Total Costs (Steps 4 and 5) Total costs in beginning inventory Current costs in Finishing Department $ 47,600 191,920 $239,520 Costs to account for: $47,600 + $ 191,920 = $239,520 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 48 Summarize and Assign Total Costs (Steps 4 and 5) Costs in work in process ending inventory: Transferred-in costs: 2,000 × $4.85 $ 9,700 Direct materials: 2,000 × $0.55 1,100 Conversion: 2,000 × 40% × $1.50 1,200 Total cost in ending inventory $12,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 49 Summarize and Assign Total Costs (Steps 4 and 5) Costs to account for: $239,520 Costs transferred to finished goods inventory: 33,000 × $6.90 $227,700 Costs in ending work in process inventory: $12,000 – $180 rounding error 11,820 Total $239,520 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 50 T-Account Finishing Department Work in Process Inventory, Finishing Beg. Inv. 47,600 Transferred to Transferred-in 139,500 Finished Goods Materials 9,780 227,700 Conversion 42,640 Balance 11,820 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 51 Transferred-In Costs FIFO Method The physical units (Step 1) is the same as in weighted-average. Beginning inventory 4,000 Units started in process 31,000 35,000 Units transferred to finished goods 33,000 Ending inventory 2,000 35,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 52 Compute Equivalent Units FIFO (Step 2) Equivalent units for transferred-in costs: From beginning work in process 0 Started and completed 29,000 Work in process, ending (100%) 2,000 Total equivalent units 31,000 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 53 Compute Equivalent Units FIFO (Step 2) Equivalent units for transferred-in costs: Transferred to finished goods 33,000 Ending work in process inventory 2,000 Total 35,000 Beg. work in process inventory – 4,000 Equivalent units 31,000 Inventories are 100% complete for the work performed in the Assembly Department. ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 54 Compute Equivalent Units FIFO (Step 2) Equivalent units for materials costs: From beginning work in process 1,600 Started and completed 29,000 Work in process, ending (100%) 2,000 Total equivalent units 32,600 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 55 Compute Equivalent Units FIFO (Step 2) Equivalent units for material costs (beginning inventory 4,000): Transferred to finished goods 33,000 Ending inventory (100%) Total Beginning inventory (60%) 2,000 35,000 –2,400 Equivalent units 32,600 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 56 Compute Equivalent Units FIFO (Step 2) Equivalent units for conversion costs: From beginning work in process 3,000 Started and completed 29,000 Work in process, ending (40%) 800 Total equivalent units 32,800 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 57 Compute Equivalent Units FIFO (Step 2) Equivalent units for conversion costs (beginning inventory 4,000, ending inventory 2,000): Transferred to finished goods 33,000 Ending inventory (40%) Total Beginning inventory (25%) 800 33,800 –1,000 Equivalent units 32,800 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 58 Compute Equivalent Unit Costs FIFO (Step 3) Cost per equivalent unit: Transferred-in: $139,590 ÷ 31,000 $4.50 Direct materials: $9,780 ÷ 32,600 0.30 Conversion: $42,640 ÷ 32,800 1.30 Total unit cost $6.10 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 59 Summarize and Assign Total Costs FIFO (Steps 4 and 5) Current costs in Finishing Department: $192,010 Work in process beginning inventory: 47,600 Costs to account for:(same as weighted-average) $239,610 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 60 Summarize and Assign Total Costs FIFO (Steps 4 and 5) Work in process ending inventory: Transferred-in: 2,000 × $4.50 $ 9,000 Direct materials: 2,000 × $0.30 Conversion: 800 × $1.30 Total 600 1,040 $10,640 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 61 Summarize and Assign Total Costs FIFO (Steps 4 and 5) Costs transferred out: From beginning inventory: $47,600 Direct materials added: 4,000 × 40% × $0.30 480 Conversion costs added: 4,000 × 75% × $1.30 3,900 Total $51,980 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 62 Summarize and Assign Total Costs FIFO (Steps 4 and 5) Total costs transferred out: From beginning inventory $ 51,980 From current production: 29,000 × $6.10 176,900 Total $228,880 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 63 Summarize and Assign Total Costs FIFO (Steps 4 and 5) Total costs accounted for: Transferred to finished goods: $176,900 + $51,980 $228,880 Work in process ending inventory 10,640 Rounding error Total 90 $239,610 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 64 Summarize and Assign Total Costs FIFO (Steps 4 and 5) Costs to account for $239,610 Work in process ending inventory – 10,640 Transferred to finished goods $228,970 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 65 End of Chapter 17 ©2003 Prentice Hall Business Publishing, Cost Accounting 11/e, Horngren/Datar/Foster 17 - 66