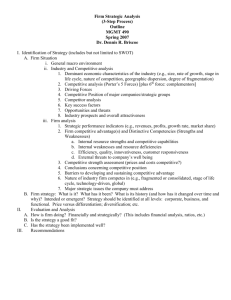

Four Strategic Questions

advertisement

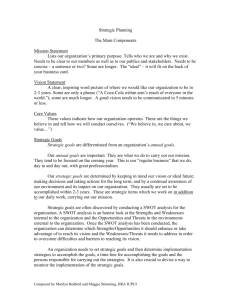

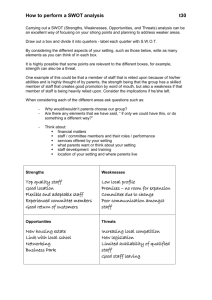

Chapter 2 The Organizational Context: Seeing the Big Picture The Need for Strategy • When Lou Gerstner took over as Chairman and CEO of IBM, he faced monumental challenges. Critics saw IBM as bureaucratic, slow, bloated, and self-absorbed. • Gerstner was an outsider to the computer industry and lacked technical knowledge, but was a strong manager who could bring fresh perspectives. • He said, “What IBM needs now is a series of very toughminded, market-driven, highly effective strategies in each of its businesses.” • The chapter considers the “big picture” facing firms, and how highly effective strategies are developed in the face of environmental demands. Four Strategic Questions • How do we respond to new opportunities in the environment, lessen the impact of threats from the environment, and strengthen the mix of the organization’s activities by doing more of some things and less of others? • How do we assign resources among the various subunits, divisions, and activities of the organization? • How do we compete with other organizations for customers through allocation of existing or new products and services? • How do we effectively manage organizational activities at the departmental, divisional, and corporate levels of the organization? Environmental Domains of an Organization (Figure 2-1) Economic Political Technological Organization Competitive Physical Social The Economic Domain • Many economic factors, such as interest rates, trade deficits, inflation rates, gross domestic product indicators, and the money supply, may influence an organization’s activities. • Factors in the economic domain influence the ability of managers to get resources needed to produce goods and services and distribute them to a market. • Also, employees are likely to behave differently depending on the nature of the economic environment. The Political Domain • The political domain of the organization environment rests on the laws and regulations passed by governmental agencies and legislative bodies. • Legislation has been directed toward: – – – – – – – eliminating discrimination based on gender, race, and age ending sexual harassment in the workplace preventing unfair pricing in markets restricting pollution protecting customers discouraging unethical behavior regulating corporate taxation • As corporations are more global, they must consider political risk associated with foreign governments. The Social Domain • The social domain of an organization’s environment consists of societal values, attitudes, norms, customs, and demographics. • Values are what people believe to be proper goals for members of society to maintain or achieve. • Attitudes reflect what individuals think about issues and behaviors that occur within a society. • Values and attitudes may change over time. Examples in the U.S. include changing attitudes toward mothers in the workplace and toward providing benefits to samesex partners of employees. The Technological Domain • The technological domain, or technology, refers to the application of knowledge to the production and distribution of goods and services. • Technology is greatly affected by innovation; innovation is the creation or modification of a process, product, or service. • Technology transfer involves the application of innovation to processes, products, or services either within or between industries. • Technology and technological change are transforming organizations. The Competitive Domain • Organizations can face a wide variety of competitive conditions in their environment. • Some large organizations compete only with small organizations, often giving them an advantage in pricing of their products. • Other competitive conditions arise from different mixes of the strategies that competitors pursue. • Within a capitalistic system, organizations can compete in one of four competitive market structures. • Deregulation -- relaxation of government controls to encourage greater competition -- is transforming many industries. Competitive Market Structures • Monopoly exists when an organization has sole access to the market for its goods and services. • Oligopoly exists when only a few firms are in competition to provide goods and services to a market. • Monopolistic competition exists when many firms offer a similar good or service with only minor price differentials. • Perfect competition exists when many organizations offer essentially the same good or service; price thus becomes the primary discriminator. The Physical Domain • All organizations must respond in some manner to their physical domains. • Weather conditions, for instance, may greatly influence the activities of a firm. This is especially true, for instance, of airlines, construction companies in the upper Midwest, and orange growers. • The physical domain may also influence things such as the availability of qualified talent. For instance, companies located in one of the “Best Places to Live” may find themselves at an advantage. Environmental Dimensions • Three important environmental dimensions are munificence, dynamism, and complexity: – Munificence of an organization’s environment refers to the level of resources available to the organization. – Dynamism refers to the rate of change in environmental factors. – Complexity is the number of components in an organization’s environment and the degree to which they are similar or different. • High levels of dynamism and complexity result in perceived environmental uncertainty (PEU). When PEU is high, firms may have to emphasize creativity and flexibility over efficiency. Perceived Environmental Uncertainty Environmental Dynamism Perceived Environmental Uncertainty Environmental Complexity Organizational Effectiveness • Organizational effectiveness can be defined as the degree to which an organization achieves its goals, maintains its health, secures resources needed for survival, and satisfies parties that have a stake in it. • This definition suggests that effectiveness has many dimensions. Approaches to Assessing Organizational Effectiveness • Goals assessment is concerned with whether the organization reaches the growth, sales, profitability, or other goals management has set for it. • Internal process assessment focuses on organizational health. According to this approach, an unhealthy organization cannot be considered effective. • Systems resource assessment considers whether an organization is able to acquire the resources it needs to survive and prosper. • Strategic constituencies assessment considers whether an organization satisfies important its constituencies. Approaches to Assessing Organizational Effectiveness (Figure 2-2) CONSTITUENTS (Strategic Constituencies Assessment) INPUTS (Systems Resource Assessment) ACTIVITIES (Internal Process Assessment) OUTPUTS (Goals Assessment) America’s Most Admired and Least Admired Companies (Figure 2-3) The Top Ten The Bottom Ten 1. General Electric 495. Humana 2. Microsoft 496. Revlon 3. Dell Computer 497. Trans World Airlines 4. Cisco Systems 498. CKE Restaurants 5. Wal-Mart Stores 499. CHS Electronics 6. Southwest Airlines 500. Rite Aid 7. Berkshire Hathaway 501. Trump Resorts 8. Intel 502. Fruit of the Loom 9. Home Depot 503. Amerco 10. Lucent Technologies 504. Caremark Rx The Malcolm Baldrige Quality Award • The Malcolm Baldrige National Quality Award was established in 1987 to enhance U.S. competitiveness by promoting quality awareness, recognizing quality and business achievements of U.S. companies, and publicizing those companies’ successful performance. • The award is based on rated performance on seven criteria. Malcolm Baldrige Award Criteria Leadership Customer Focus and Satisfaction Business Results Information and Analysis Baldrige Award Criteria Process Management Strategic Planning HR Development and Management Strategies • Strategies are methods of competition. • The strategic plan of an organization is a comprehensive plan that reflects the longer-term needs and directions of the organization or subunit. • Strategic planning consists of several components, as shown in Figure 2-5. The Strategic Planning Process (Figure 2-5) Strategic Analysis Establish the Purpose, Vision, and Mission Evaluate the Strategic Plan Define Strategic Objectives Implement the Strategic Plan Focus on Management: Alagasco Puts Customers Second • Alagasco, Alabama’s largest utility -- and the only utility on Fortune magazine’s 100 Best Companies to Work for in America list -- is proud of its philosophy of “putting customers second.” • Alagasco believes that by putting employees first and treating them well, good service to customers will naturally follow. • Each year Alagasco employees at all levels meet to refine the corporate strategic plan for the coming year. SWOT Analysis Internal Strengths Weaknesses External Opportunities Threats SWOT Analysis Questions Regarding Internal Strengths • • • • • • • A distinctive competence? Adequate financial resources? Good competitive skills? Well thought of by buyers? An acknowledged market leader? Well-conceived functional strategies? Access to economies of scale? SWOT Analysis Questions Regarding Internal Strengths (Continued) • • • • • • • Insulated from competitive pressures? Technology leader? Cost advantages? Competitive advantages? Product innovation abilities? Proven management? Other? SWOT Analysis Questions Regarding Internal Weaknesses • • • • • • • • • No clear strategic direction? A deteriorating competitive position? Obsolete factories? Subpar profitability? Lack of managerial depth and talent? Missing any key skills or competencies? Poor track record in implementing strategy? Plagued with internal operating problems? Vulnerable to competitive pressures? SWOT Analysis Questions Regarding Internal Weaknesses (Continued) • • • • • • • Falling behind in research? Too narrow a product line? Weak market image? Competitive disadvantages? Below-average marketing skills? Unable to finance needed changes in strategy? Other? SWOT Analysis Questions Regarding External Opportunities • Serve additional customer groups? • Enter new markets or segments? • Expand product line to meet broader range of customer needs? • Diversify into related products? • Vertical integration? • Ability to move to better strategic group? • Complacency among rival firms? • Faster market growth? • Other? SWOT Analysis Questions Regarding External Threats • • • • • • • • • • Likely entry of new competitors? Rising sales of substitute products? Slower market growth? Adverse government policies? Growing competitive pressures? Vulnerability to recession and business cycle? Growing power of customers or suppliers? Changing buyer needs and tastes? Adverse demographic changes? Other? Focus on Management: SWOT Analysis at Ruby Tuesday • As the first step in a thorough strategic planning process, Ruby Tuesday conducted a SWOT analysis. • Strengths identified included “growth rate of 20%,” “strong technical skills,” and “fast reaction time from management team.” • Weaknesses included “lack of proactive approach,” “internal communications could be improved,” and “need comprehensive review of compensation system.” • Opportunities and threats were also identified. Purpose, Vision, and Mission • The purpose of the organization is the reason for the organization’s existence. • Vision is a vivid description of a preferred future. • The organizational mission is the path managers choose to achieve the purpose and vision. • The mission is often written down in the form of a mission statement. Focus on Management: Ben & Jerry’s Mission Statement • Product: “To make, distribute and sell the finestquality all-natural ice cream and related products in a wide variety of innovative flavors made from Vermont dairy products.” • Economic: “To operate the company on a sound financial basis of profitable growth, increasing value for our shareholders, and creating career opportunities and financial rewards for our employees.” • Social: “To operate the company in a way that actively recognizes the central role that business plays in the structure of society by initiating innovative ways to improve the quality of life of a broad community -local, national, and international.” Bottom Line: Developing a Mission Statement Identify the Basic Reasons Why the Organization Exists List the Core Values of the Organization That Drive How It Will Do Business Identify the Primary Business or Businesses of the Organization Finalize the Mission Statement in a Way That is Understandable and Inspiring Draft the Mission Statement in Writing, Evaluate It, and Modify It As Needed Identify the Primary Customers of the Organization Focus on Management: Strategic Objectives at Dana Corporation • Dana Corporation, one of the world’s largest independent suppliers to vehicle and engine manufacturers, was selected as a “Most-Admired Manufacturer” in the U.S. by Start Magazine. • Start emphasized Dana’s strategic objectives, focus on technology, employee involvement, and reputation. • In 1998, Dana had 41% of its sales outside the U.S. and 44% from diversified (as opposed to highway vehicle sales) markets. Among its key strategic objectives are to have 50% international sales and 50% diversified sales. Choose Corporate-Level Strategies • Corporate-level strategies provide direction for the total organization. • Managers at the corporate level define a strategic direction that includes business units and departments within those business units. • Managers often select either grand strategies or portfolio strategies for guiding their company. Grand Strategies • A grand strategy is a broad plan to guide the organization toward reaching its goals. • Managers may choose to implement one of three grand strategies: – A growth strategy is common in new, emerging industries or industries that are undergoing rapid growth and gaining new external opportunities. – A stability strategy is selected when managers want to protect the existing market share of the firm from external threats or have just completed a phase of rapid growth or divestment. – A retrenchment strategy is often selected when managers are faced with declining performance due to internal weaknesses and external threats. Focus on Management: The Risks of “Growth at Any Cost” • The danger of “growth at any cost” was dramatically evident in the crash of ValuJet Flight 592 in the Florida Everglades. • ValuJet -- which had grown from its inception to serve 17 states -- was only two years old. • ValuJet had attempted to achieve growth through aggressive efforts to cut costs. It paid low salaries, used planes averaging older than 26 years, and turned planes around so fast that FAA inspection was difficult. • ValuJet pictured itself as the Wal-Mart of airlines but, as noted by one writer, “Wal-mart does not conduct business 35,000 feet above the ground.” Global Perspectives: Retrenchment of the Chaebols • Korea’s largest family-owned conglomerates, or chaebols, have fallen on hard times. • These conglomerates pursued growth at any cost. • They sprawl across industries, have heavy debt loads, and are bloated, making little attempt to focus on core businesses. • In the face of Korea’s economic crisis, smaller chaebols have had to radically downsize to raise cash. • For the larger chaebols, the crisis -- and government and bank pressure -- is forcing downsizing and streamlining. Grand Strategy Selection Matrix (Figure 2-7) Stability Growth Retrenchment Stability Major Environmental Threats Substantial Internal Strengths Critical Internal Weaknesses Numerous Environmental Opportunities Portfolio Strategies • A portfolio strategy considers the business mix of the firm -- that is, the types of business units and product lines the firm controls. • The BCG matrix and the GE matrix are two models used by many corporations in selecting a portfolio strategy. The BCG Portfolio Matrix (Figure 2-8) Relative Market Share High High Low Stars Question Marks Cash Cows Dogs Market Growth Rate Low Strategic Types in the BCG Matrix • A star is a business unit that has both a high market growth rate and a relatively large share of the market. • A cash cow has a large share of the market, but there is little growth. • Question marks exist in a rapidly growing market but have a small market share. • A dog is a poor performer because of little growth in the market and a small market share. Implications of the Strategic Types • Stars typically need large amounts of cash to support rapid growth. Stars have the potential to increase sales and generate large amounts of profit in the future. • Large amounts of cash can be “milked” from cash cows and channeled into stars. • Managers must decide whether to invest more cash into question marks to take advantage of high growth opportunities (and transform them into stars) or to divest it to emphasize other business units and products in the portfolio. • Management must sell dogs to another company or liquidate their assets. The GE Matrix (Figure 2-9) Strong Attractiveness Long-Term Industry Business Strength/Competitive Position Average Weak High Medium Low Investment Growth Selective Investment Divestment The Adaptation Model • Raymond Miles and Charles Snow developed the adaptation model of organizational strategy. • The model contends that a major thrust of strategic management should be the aligning organizational activities with key dimensions of the organizational environment. • To do this, managers must set up a strategy that will adapt to environmental conditions and also manage internal organizational activities to support the selected strategy. • Adaptation is accomplished by simultaneously solving three critical strategic problems: entrepreneurial, engineering, and administrative. Critical Strategic Problems in the Adaptation Model • The entrepreneurial problem considers what managers believe to be their market. • The engineering problem is one of deciding which methods are appropriate for the production and distribution of goods or services. • The administrative problem addresses the need to develop an appropriate administrative system within the organization. Organizational Types in the Adaptation Model • The defender strategy is carried out when management seeks or creates an environment that is stable. • The prospector strategy -- the opposite of the defender strategy -- seeks or creates an unstable environment in the form of rapid change and high growth rate in the market. • The analyzer strategy exists between the two extremes of defender and prospector. It involves adapting solutions from both the defender and prospector strategies to the three problems. • The reactor strategy is adopted in an organization that has experienced strategic failure. Lighten Up: Ambushes and Golden Parachutes Some of the language of mergers and acquisitions: • • • • Afterglow: Postmerger euphoria of acquirer and/or acquiree, but soon lost. Cyanide pill: Antitakeover finance strategy in which the potential target arranges for long-term debt to fall due immediately and in full if it is acquired. Golden parachute: Provision in the employment contract of top executives that ensures them a lucrative financial landing if the firm is acquired in a takeover. Mushroom treatment: Postmerger problems from an acquired executive’s viewpoint: “First they buried us in manure, then they left us in the dark awhile, then they let us stew, and finally they canned us.” The Competitive Model • The competitive model of organizational strategy was developed by Michael Porter. • This model contends that the nature and degree of competition in an industry determine the strategy that is appropriate for managers to formulate and implement. • The model considers five industry forces and three competitive strategies. Industry Forces in the Competitive Model • The threat of new entrants to compete in the industry. • The bargaining power of suppliers in the industry. • The bargaining power of customers in the industry. • The threat of substitute products or services from potential competitors. • Competitive rivalry among existing firms. Strategies in the Competitive Model • Overall cost leadership. This strategy requires management to formulate and implement a strategic plan that will lead to an efficient and low-cost organization. • Differentiation. This strategy recognizes that a firm’s product is unique in relation to other products produced in the industry. • Focus. This strategy pursues either an overall cost leadership strategy or a differentiation strategy by focusing on a narrow customer group, product line, or geographic market. Implement the Strategic Plan • Vince Lombardi said, “The best game plan in the world never blocked or tackled anybody.” • Managers must see that strategic plans are converted into action. • To do this, they must: – effectively communicate the plan – assign responsibility and authority for activities within the plan – motivate employees to achieve the plan – develop methods for measuring the results of activities – develop procedures for taking any corrective action Evaluate the Strategic Plan • Since there are many facets of effectiveness, we must assess effectiveness of the strategic plan on those multiple facets. • The balanced scorecard (BSC) is a conceptual framework for translating an organization’s vision into a set of performance indicators distributed among four perspectives: – – – – financial customer internal business processes learning and growth • Using the BSC, companies can monitor both their current performance and their efforts to learn and improve. Balanced Scorecard Indicators • Financial-based measures. Examples: return on investment, cost reduction, profits. • Customer-based measures. Examples: customer satisfaction, retention, market share. • Internal business process measures. Examples: quality, response time, new product introductions. • Learning- and growth-based measures. Examples: employee satisfaction, employee productivity, employee retention.