Amortization

advertisement

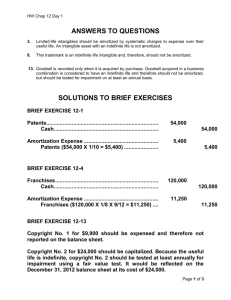

2014 Amortization FINANCIAL MANAGEMENT HEATHER REITH ACC2355_010 AMORTIZATION Assets wear out their useful life over a period of time, or their technology becomes obsolete, as nothing lasts forever. This ‘wearing out’ needs to be deducted from the value of the asset and recorded, giving a book value of the asset. “Depreciation (amortization) is the process of matching (or allocating) the depreciable cost of an asset in a rational and systematic manner over the asset’s estimated useful life”1 It is a noncash expense that effects Financial Statements, Income Statements, Balance Sheet, Statement of Cash Flows as well as the Cash Budget. There are also specific, principles in accounting for Capital Assets and depreciation. Before 2011, when Canada adopted IFRS, the term Amortization was used for both tangible (property, plant & equipment) assets and intangible (patent, copyright, trademarks) assets. Now under IFRS, tangible assets are depreciated and intangible assets are amortized. The accounting principles for each are the same. An Amortization expense account is set up and amortization is deducted from the assets value per accounting period; monthly, quarterly etc. It appears on the Balance Sheet as a credit to the asset account and lowers the value of the asset, thus achieving its book value. Notes appear in the Financial Statements as to the method used and the calculation of the depreciation/amortization. On the Income Statement, the amortization appears as an expense under Operating Expenses and is deducted from the revenues. On the Statement of Cash Flows, amortization is added back to the income for the period under Cash Flow From Operating Activities, as it is actually a noncash expense, and only used to determine a book value for the assets, and not actually a cash expense. On the Cash Budget, amortization is hidden in the Fixed Overhead as it is a regular cost, not affected by output. This is usually calculated on a quarterly basis. Capital Assets is not a term used by IFRS. They instead use Property, Plant & Equipment, and Intangible Assets, to describe the tangible and intangible assets used in business operations. This being said, the accounting principles are the same whatever you call them. There are three factors relevant to determining depreciation/amortization: 1. Cost 2. Residual Value 3. Useful Life 1 IFRS 2009, IAS 16, para. 50 A company will decide which method it is going to use and must stick with this method. There are three basic types of calculating depreciation: Straight-Line Method Units of Production Method Declining Balance Method With depreciation/amortization, there are also three guidelines to be followed: 1. The depreciation/amortization expense is the same every period. 2. Accumulated depreciation/amortization is the sum of the current and previous period’s depreciation expenses. 3. The book value of an asset with continue to decline until it reaches the predetermined residual value at the end of its useful life. Amortization or Depreciation is the process of writing down an asset at a predetermined rate over the course of its useful life in order produce a book value. This method adheres to matching principle and subsequently effects all of the Financial Statements in a Business. BIBLIOGRAPHY Beechy, Conrod, Farrell. 2011. Intermediate Accounting 5th Edition. USA: McGraw-Hill Ryerson. Larson, Jenson. 2010. Fundamental Accounting Principles VOL 1 13th CDN Edition. USA: McGrawHill Ryerson. —. 2010. Fundamental Accounting Principles VOL 2 13th CDN Edition. USA: McGraw-Hill Ryerson. Mowan, Hansen, Heitger, Gekas, McConomy. 2012. Cornerstones of Managerial Accounting 1st CDN Edition. USA: Nelson. APPENDIX 1 Amortization does not affect the Cash Budget in a way that we can easily see it. There is no actual line for it under ‘Cash Disbursements’. However, it would have already been factored into the Fixed Overhead charges. Adding it as a charge in the Cash Disbursement section would essentially double charge the amortization and this would be wrong.