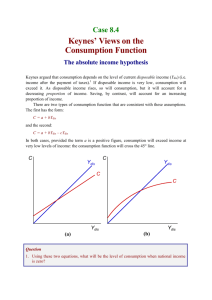

The consumption function

1. Autonomous versus induced expenditure

2. The consumption function

3. The theory of investment

4. Government purchase function

5. The net export function

Autonomous versus induced

Expenditure

•Autonomous expenditure : The components of aggregate expenditure that do not change when real

GDP changes.

•Induced expenditure: The components of aggregate expenditure that change when real GDP changes.

The consumption function reveals the relationship between consumption and disposable income, other things constant.

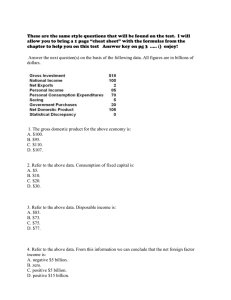

Disposable income, consumption, and saving in US

4

US consumption depends on disposable income

5

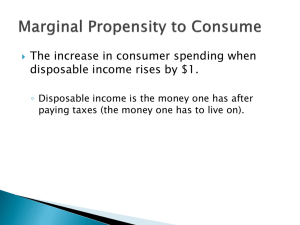

People show a tendency, as a rule and on average, to increase their consumption when their income increases—but not by as much as the increase in income.

MPC: The fraction of the change in income that is spent on consumption.

MPC

C

DI

Keynes’s fundamental law implies that:

0

MPC

1

MPS: The fraction of the change in income that is saved

MPS

S

DI

The consumption function

C

11

10

9

6

5

8

7

2

1

4

3

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14

Real disposable income (trillions of dollars)

The consumption function, C, shows the relationship between consumption and disposable income, other things constant.

8

Marginal propensities to consume and save

(a) Consumption function

MPC=∆C/∆DI=0.4/0.5=4/5

(b) Saving function a b

∆C=0.4

MPS=∆S/∆DI=0.1/0.5=1/5 d c

∆S=0.1

0

∆DI=0.5

∆DI=0.5

0 Real disposable income (trillions of dollars)

The slope of the C function equals the marginal propensity to consume.

For the straight-line C function in (a), the slope is the same at all levels of income and is given by the change in consumption divided by the change in disposable income that causes it: MPC=4/5.

The slope of the S function in (b) equals the marginal propensity to save, MPS=1/5.

9

Consumption

Disposable

Income

Net Wealth

Interest Rates

Expectations

Shifts of the consumption function

C’’

C

C’

An upward shift, such as from C to C’’, can be caused by an increase in net wealth, a decrease in the price level, an favorable change in consumer expectations, or a decrease in the interest rate.

Real disposable income

A downward shift of the consumption function, such as from C to C’, can be caused by a decrease in net wealth, an increase in the price level, an unfavorable change in consumer expectations, or an increase in the interest rate.

11

Let’s take out a loan so we can “cash out” some home equity .

Rising home values have stimulated household borrowing and consumption in the past decade.

Consumer Confidence has fluctuated lately

Theory of Investment

Why do firms purchase things like new offshore drilling platforms, food processing plants, or bulldozers? Because they expect they can make a profit by doing so.

Investment Function

Let

I

f (

, r )

Where:

•I is gross investment

•

is the expected profit of investment; and

•r is the interest rate.

The Investment Decision

Acquisition cost of a tractor–trailer rig . . . . . . . . $150,000.

00

Useful life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 years

Expected (extra) sales revenue per year from the use of the asset . . . . . . . . . . . . . . . . . 200,000.

00

Expected costs per year to operate the asset . . $180,000.

00

Diesel fuel $38,000

Driver salary & benefits 68,000

Depreciation 50,000

Repairs (including tires) 19,000

Misc. (fees, fines, etc.) 5,000

Expected net sales revenue per year from the use of the asset . . . . . . . . . . . . . . . . . . $20,000.

00

Computing expected profit (

)

To compute expected profit in percentage terms:

Expected Net Sales Revenue Per Year

100

Acquisitio n Cost of the Capital Good

Thus we have:

$ 20 , 000

$ 146 , 000

100

13 .

7 %

We would consider the tractor-trailer rig a sound investment if the interest rate were less than 13.7 percent.

Rates of return on golf carts and the opportunity cost of funds

25

20

15

10

8

5

0

Expected rate of return

$2,000 $4,000 $6,000 $8,000 $10,000

Investment

Market rate of interest

An individual firm invests in any project with a rate of return that exceeds the market interest rate.

At an interest rate of 8%,

Hacker Haven purchases three golf carts, investing

$6,000.

21

Investment demand curve for the economy

10

8

6

0

D

0.9 1.0 1.1

Investment

(trillions of dollars)

The investment demand curve for the economy sums the investment demanded by each firm at each interest rate.

At lower interest rates, more investment projects become profitable for individual firms, so total investment in the economy increases.

22

1.1

1.0

0.9

0

Investment function

I

I’’

I’

2.0

4.0

6.0

8.0

10.0

12.0 14.0

Real disposable income

(trillions of dollars)

A decrease in the interest rate or more upbeat business expectations would increase investment at every level of income, as shown by the upward shift from I to I’’.

An increase in the interest rate or less favorable business expectations would decrease investment at every level of income, as shown by the downward shift from I to I’.

Investment is assumed to be independent of income, as shown by horizontal lines.

Thus, investment is assumed to be autonomous.

23

24

Annual percentage change in US real GDP, consumption, and investment

Because government purchases are controlled by public officials, we treat them as

autonomous—that is, determined independent of income

Net export function

0

-380

-400

-420

2.0

4.0

6.0

8.0

10.0

12.0 14.0

Real disposable income

(trillions of dollars)

X’’-M’’

X-M

X’-M’

A decrease in the value of the dollar would increase net exports at each level of income, as shown by the shift up to

X’’-M’’.

An increase in the value of the dollar relative to other currencies would decrease net exports at each level of income, as shown by the shift down to X’-

M’.

Net exports here are assumed to be independent of disposable income, as shown by the horizontal lines. X-M is the net export function when autonomous net exports equal -$400 billion.

26

US spending components as percentages of

GDP since 1959

27