Exam 2c

advertisement

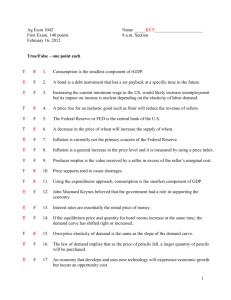

Ag Econ 1042 Second Exam, 140 points March 22, 2012 Name ______KEY_________________________ 11 a.m. Section True/False – one point each T F 1. Dr. Bernanke warned Congress about bad results in the short run from raising taxes and reducing spending. T F 2. A graduated income tax has marginal rates that are higher than the average or effective rate across all income earned. T F 3. The federal deficit is a measure of the debt created during a particular year. T F 4. Productivity is essential for long term inflation to persist. T F 5. Adjusted gross income is larger than taxable income in the U.S. tax system. T F 6. A reduction in input costs will decrease supply. T F 7. The U.S. has had economic growth since the middle of 2009. T F 8. Expectations of citizens and firms as well as fiscal and monetary policy are items that have a big influence on the level of aggregate demand. T F 9. Increases in natural gas production have reduced natural gas prices. T F 10. The opportunity cost of increased aggregate demand is the impact on the price level. T F 11. Unemployment will generally increase after a decline in income and profits. T F 12. Total revenue declines when price falls and demand is elastic. T F 13. Incentives are provided with the hope of changing others’ behaviors. T F 14. The U.S. income tax system is complicated because of the number of deductions and credits available. T F 15. Social Security payments will eventually fall to about 30% of today’s payments in real terms, if nothing changes. T F 16. Energy prices are important because energy is the second largest input or resource used by the U.S. and most other economies. T F 17. Social Security was designed to be the only retirement program needed by workers. 1 T F 18. The business cycle measures the increase and decrease in economic growth. T F 19. The circular flow model describes the flow of income that is exchanged for final goods and factors of production. T F 20. If demand is inelastic, then a price increase will benefit sellers. T F 21. Current technology and resource availability are two general items that determine the location of aggregate supply. T F 22. A decrease in the rate of unemployment suggests there has been a decrease in rGDP. T F 23. An increase in the minimum wage will only increase income to the entire group of unskilled workers if demand for their services is inelastic. T F 24. Real GDP has been adjusted for changes in the price level. T F 25. Producer surplus is the net benefit accruing to a buyer of a good. T F 26. The Social Security system will not have any dollars to distribute after the trust fund is exhausted. T F 27. An increase in the productivity of labor will likely decrease real GDP. T F 28. Gross domestic product is used to measure inflation changes in the macroeconomy. T F 29. Budget deficits may result from an effort to stimulate the economy in an effort to increase current standards of living in the U.S. T F 30. The current rate of unemployment, 8.3%, is rather high for the U.S. in historical terms. Multiple choice – two points each __c___ 31. If a price floor is set above the equilibrium price, then a) The quantity demanded is still equal to the quantity supplied b) There is a shortage c) There is a surplus d) The price must remain below equilibrium e) None of the above 2 __d___ 32. Consumer surplus is a) The overall value of a good to the buyer b) The price of a good plus the opportunity cost of producing it c) The price of the good minus the opportunity cost of producing it d) The value of a good minus the price paid for it e) A demand determinant __e___ 33. The U.S. budget deficit a) Is forecast to be smaller next year b) Is adding to the U.S. debt c) Should be highest during recessions d) Is smaller than the U.S. debt e) All of the above __e___ 34. In the fourth quarter of 2011, U.S. real GDP increased by a) Enough to decrease unemployment b) Less than the growth in China c) A rate of 3.0 percent d) More than originally estimated e) All of the above __d___ 35. A balanced federal budget a) Means the country has no debt b) Suggest the economy is growing c) Makes the most sense during a contraction d) Will not cause a deficit e) All of the above Short answers are valued at five points each 36. How would economic growth be determined for 2010 if we know the real GDP values for every year. Showing the formula is the easiest way to answer the question. Economic growth = rGDP10 – rGDP09(100) rGDP09 37. What do we call government’s effort to impact the economy by its spending and taxation? Fiscal policy 3 38. Diagram the ideal situation for an economy from one year to the next. Think of this as what we want to happen for the economy next year. PL AS AS1 PL1 PL0 AD 0 Q0 Q1 AD1 rGDP 39. What can the government do if it wants to lower the unemployment rate in the short run? 1. increase spending 2. lower taxes 40. How is the unemployment rate measured? What two groups make up the labor force? Unemployment rate = # unemployed (100) # in labor force employed, unemployed 41. What is the term for economic policies meant to offset negative changes in the economy? Expansionary or stimulus 42. Diagram the immediate change caused by increased government spending and investment on the overall economy. PL AS PL1 PL0 AD1 AD 0 Q0 Q1 rGDP 4 43. Diagram the likely effect of an increase in personal income on the smart phone market. P S P1 P0 D 0 Q0 Q1 D1 Q 44. Draw the business cycle. Be sure to specify the variables on the axes and identify recessions and troughs. rGDP or Economic Growth Time 45. What group of workers are returning to the labor force as the economy improves? This return slows the decline in the unemployment rate. Discouraged workers 46. What would be the impact on aggregate demand of the federal government balancing its budget next year. Only consider this change. AD would decrease 47. What happened to the real wages of workers in February? They fell 5 48. Diagram what is happening or has happened in the macroeconomy if unemployment is falling and more people are employed. PL AS AS1 PL1 PL0 AD1 AD 0 Q0 Q1 rGDP 49. List the three types of unemployment. Which is most likely to be caused by workers? Cyclical, Structural, Frictional Frictional The following questions are valued at 10 points each 50. Diagram the result of the federal government enacting a minimum wage above the equilibrium price for unskilled labor. Show final producer surplus. a) Why will some unskilled workers be happy with the result of a higher minimum wage? Wages will be higher b) Who won’t be happy with the results of a higher minimum wage? Those with fewer hours to work or no job P or $/Q S Mw PS D 0 Qd Qs Q 6 51. Current workers’ payments into Social Security can go to four places, some of which are groups of people. a) Where do these payments go? (who or what receives them) Retired workers, disabled workers, dependents, social security trust fund b) What will the payout rate be to those who retire after the trust fund is exhausted, if nothing else changes? ≈ 76% ± 3% c) Where is the money in the trust fund invested? U.S. treasury bonds d) What is a COLA? Cost of living adjustmeent 52. What is the a) Current unemployment rate in the U.S.? ___8.3% ±0.2%_______________ b) Current overall tax rate supporting Social Security? ___12.4%_________________ c) Economic growth rate in the U.S.? ___3.0%___________________ d) Trend for unemployment? _down___________________ e) Name of the central bank for the U.S.? _Federal Reserve_______________ 7