Fed Update_FinalNCSC

Federal Update

Anthony Jones

Office of Postsecondary Education

Dan Klock

Federal Student Aid

Secretary’s Commission on the Future of Higher

Education

Agenda

Secretary’s Commission on the Future of Higher

Education

FY 2007 Budget Request and Appropriations

Update on Recent and Pending Legislation

Recent Title IV Program Regulations

Selected ACG/National SMART Grant Issues

General Provisions, Loans, and Need Analysis

Hot Topics

Operational Update

Issues on the Horizon

3

Secretary’s Commission on the Future of Higher Education

Final Report — “A Test of Leadership:

Charting the Future of Higher Education”

“U.S. higher education needs to improve in dramatic ways,” changing from “a system primarily based on reputation to one based on performance.” http://www.ed.gov/about/bdscomm/list/hiedfuture/index.

html

4

Secretary’s Action Plan

Accessibility

“There are far too many Americans who want to go to college but cannot—because they're either not prepared or cannot afford it.”

Affordability

“There is little to no information on why costs are so high and what we're getting in return.”

Accountability

“No current ranking system of colleges and universities directly measures the most critical point—student performance and learning.”

5

Secretary’s Action Plan: Accessibility

Strengthen K-12 preparation and align high school standards with college expectations.

Work with Congress to expand the successful principles of the No Child Left Behind Act to high schools.

Redesign the 12th-grade NAEP test to provide state-level estimates of college and workforce readiness.

Raise awareness and mobilize leadership to address the issue of adult literacy as a barrier to national competitiveness and individual opportunity.

Develop a federal research agenda for adult literacy to identify strategies, models and programs that work.

6

Secretary’s Action Plan: Affordability

Simplify the aid process by using existing income and tax data to help students complete the FAFSA in half the time.

Notify students of their estimated aid eligibility before spring of their senior year in high school.

Work with Congress to provide new funds for need-based aid through the federal financial aid system.

Commission an independent management consultant review of the federal financial aid system.

Revitalize FIPSE to promote innovation and productivity.

Encourage organizations that report annual college data to develop consistent affordability measures.

7

Secretary’s Action Plan: Accountability

Work with states to build on and link together the 40 existing, privacy-protected higher education information systems.

Explore incentives for states and institutions that collect and report student learning outcome data.

Convene members of the accreditation community to recommend changes to the standards for recognition that will place a greater emphasis on results.

Redesign the Department of Education's college search website to allow consumers to weigh and compare institutions based on their individual interests and needs.

8

Status of Fiscal Year 2007

Budget Request and

Appropriations

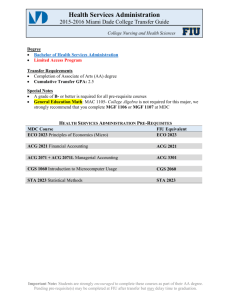

Title IV Program Budgets

Appropriations

FY 2005 FY 2006 FY 2007*

Program

(AY 05-06) (AY 06-07) (AY 07-08)

Pell Grant $12,364,997,280 $13,045,230,000 $12,738,770,000

(Max Award) $4,050 $4,050 $4,050

FSEOG $ 778,720,000 $ 770,932,800 $ 770,932,800

FWS $ 990,257,056 $ 980,354,485 $ 980,354,485

Perkins $ 66,131,680 $ 65,470,363 $ -

LEAP

Acad Comp

$ 65,643,000 $ 64,987,000 $ -

& SMART $ - $ 790,000,000 $ 850,000,000

* President's FY 2007 Budget Submission

10

Title IV Program Budgets

Aid Available

Program

Pell Grant

(Max Award)

FY 2006

(AY 06-07)

FY 2007*

(AY 07-08)

$ 12,745,900,000 $ 12,986,000,000

$4,050 $4,050

FSEOG $ 975,900,000 $ 975,900,000

FWS $ 1,172,000,000 $ 1,172,000,000

Perkins $ 1,135,000,000 $ 133,000,000

LEAP $ 165,000,000 $ -

AC/SMART $ 790,000,000 $ 850,000,000

Loans $ 60,577,000,000 $ 66,082,000,000

TOTAL $ 77,560,800,000 $ 82,198,900,000

* President's FY 2007 Budget Submission

11

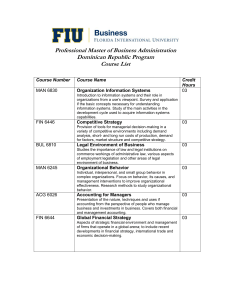

Title IV Program Budgets

Status of Appropriations

FY 2006 FY 2007* FY 2007*

Program

(AY 06-07) House Senate

Pell Grant $13,045,230,000 $13,009,000,000 $12,606,713,000

(Max Award) $4,050 $4,150 $4,050

FSEOG $ 770,932,800 $ 770,933,000 $ 770,933,000

FWS $ 980,354,485 $ 980,354,000 $ 980,354,000

Perkins $ 65,470,363 $ 65,471,000 $ 65,471,000

LEAP

Acad Comp

$ 64,987,000 $ 64,987,000 $ 64,987,000

& SMART $ 790,000,000 $ 850,000,000 $ 850,000,000

* Committee-passed Bills

12

Update on Higher Education

Legislation

(Recent and Pending)

Legislation

Higher Education Reconciliation Act of 2005

Emergency Supplemental Appropriations Act for

Defense, the Global War on Terror, and Hurricane

Recovery, 2006

Continuing Appropriations Resolution, 2007 (Included in Department of Defense Appropriations Act, 2007)

Through November 17, 2006

Third Higher Education Extension Act of 2006

Through June 30, 2007

14

Third Higher Education Extension Act

New Restrictions on Eligible Lender Trustee

Arrangements with Postsecondary Institutions

Definition of Hispanic-Serving Institution

Clarification of GA Account Maintenance Fees

New Loan Discharge for Survivors of 9/11 Victims

15

Title IV Program

Regulations

Title IV Program Regulations

Interim Final Regulations with Comments Invited

• ACG/National SMART Grants – July 3, 2006

• Other HERA Issues – August 9, 2006

Final Regulations

• ACG/National SMART Grants – November 1, 2006

• Other HERA Issues – November 1, 2006

Final Regulations

• Title IV Programs – anticipate by November 1, 2007

17

Title IV Program Regulations

• Major policies and changes in Nov. 1 Final

Regulations from Interim Final Regulations:

– Duration of student eligibility under ACG/SMART

– Receipt of Pell Grant during award year not same payment period for ACG/SMART

– Clarification of what ‘previously enrolled’ means

– Early implementation

– 9.5% Special Allowance Payment clarification

– Timing of Disaster Withdrawal & Overpayment

Waiver

18

Negotiated Rulemaking

Federal Register Notice, August 18, 2006

Regulatory Issues

ACG and National SMART Grants

Recent Legislation, including HERA

Secretary’s Higher Education Commission

Up to Four Negotiating Committees

Committed to discussing ACG and National SMART

Grants

Could Include other HERA changes

Title IV Programs including student loans

Institutional Eligibility

General Provisions

19

Higher Education

Reconciliation Act of 2005:

ACG/National SMART Grant

(Academic Year Progression and

Determining Financial Need)

Academic Year

Student’s progress and duration of eligibility in an eligible program is measured in Title IV academic years. A Title IV academic year is defined in the HEA to be –

A minimum of either:

Twenty-four semester credit hours, or

Thirty-six quarter credit hours, or

900 clock hours.

--AND—

A minimum of 30 weeks of instruction (26 for clock hours)

21

Academic Year - Credit Hours

Regardless of how many credit hours an institution uses to define a program’s academic year, full-time for an undergraduate is a minimum of:

12 semester hour credits for a semester or trimester; or

12 quarter hour credits for a quarter.

Title IV Academic Year is often not the same as grade level progression for institutional purposes and loan limits (i.e., 30 credit hours to progress from grade level

1 to grade level 2)

22

Academic Year - Weeks of Instruction

For the 2006-2007 and 2007-2008 award years, an institution with a 30 week academic year and standard terms ( Formula 1) may –

Determine the actual

- OR number of weeks of instruction that were included for the student to complete the number of credit hours in the institution’s Title IV academic year definition.

Assume that there were 30 weeks of instructional time for each increment of credit hours that comprises the institution’s Title IV academic year definition.

23

Academic Year – Weeks of Instruction

May exercise option –

On a student by student basis;

For same student for different terms;

For transfer credits differently than for home earned credits

24

Academic Year - Weeks of Instruction

NOTE: An institution must determine the actual number of weeks of instruction for a student that requests that such a determination be made or questions whether they have completed an academic year.

See DCL GEN-06-18

25

ACG and National SMART Grant

Examples for determining academic year progression and financial need

Example 1: What courses/credits that do not count in weeks of instructional time?

• When tracking actual weeks of instructional time, courses that are not part of an eligible program of postsecondary education or courses not at the postsecondary level such as:

– Remedial Coursework;

– Advanced Placement (AP) or International Baccalaureate

(IB) courses/exams;

– College Level Examination Program (CLEP);

– Credit for life experience;

– Courses taken when not enrolled as a regular student; and

– Courses that are not part of an eligible program.

27

Example 2: Advanced Placement courses

• Student graduated high school May 2006. Enrolls at School A for Fall 2006. Student has 45 AP credits, all with a score of 3 or higher.

• School A’s definition of academic year is 24 credit hours and 30 weeks of instructional time.

• If School A assumes weeks of instructional time, this student would be in his/her second academic year.

• 45/24 = 1.875

28

Example 2: AP courses

(cont’d)

• However, student has no GPA from “first academic year” and would therefore not be eligible to receive

ACG funds for his/her “second academic year.

• If School A chose to track actual weeks, then the student would still be in his/her first academic year as AP credits carry no weeks of instructional time.

This student would be eligible for first year ACG award assuming all other eligibility criteria are met.

29

Example 3: Academic Year

• Student completes 36 credit hours at School X and has 3.50

GPA. School Y accepts only 24 hours upon transfer.

• School Y is only required to use credit hours that transfer in determining academic year (hours and weeks), but the school may look at transcript (i.e., all 36) to determine weeks of instructional time completed.

• School Y chooses to use only the hours accepted to determine weeks. Therefore, School Y must use GPA for 24 hours transferred in to determine if student eligible for 2 nd year ACG award.

30

Example 4: Academic Year

• Student enrolls at School A for 2006-07 award year.

Student completes 24 semester hours over three terms

(part-time enrollment) and receives no ACG..

• Student transfers to School B for 2007-08 award year.

School B only accepts 18 semester hours of the courses taken at School A. School B defines its academic year as 24 semester hours and 30 weeks of instructional time.

• School B chooses to assume weeks of instructional time instead of tracking actual weeks of enrollment.

31

Example 4: Academic Year

(cont’d)

• School B determines student has completed 18 credit hours and instead of tracking actual weeks of instructional time assumes 75% of academic year’s weeks (18/24) completed. Student is still in first academic year at School B.

– Year 1 is 0-24 hours and 30 weeks, Year 2 is 25-48 hours and weeks 31-60 …

• School B awards half of ACG award ($375) for Fall

2007

32

Example 4: Academic Year

(cont’d)

• Student completes 15 hours in Fall 2007 and now has completed 33 semester hours. Student has cumulative GPA of 3.25.

• School B assumes weeks, which means student has completed 1.375 academic years (33/24). Student has completed year 1 and is in academic year 2.

• For Spring 2008, school may award half of second year

ACG ($650).

• Student received total of $1,025 in ACG funds for 2007-

2008.

33

Example 5: Academic Year

• Same student as in ‘Academic Year: Example 4’.

• Student enrolls at School A for 2006-07 award year.

Student completes 24 semester hours over three terms (part-time enrollment) and receives no ACG.

• Student transfers to School B for 2007-08 award year. School B only accepts 18 semester hours of the courses taken at School A. School B defines its academic year as 24 semester hours and 30 weeks of instructional time.

34

Example 5: Academic Year

(cont’d)

• School B determines student has completed 18 credit hours and has policy to track actual weeks of instructional time

• School B may look at transcript and determine that student has completed the weeks in a full academic year, because student completed two semesters at

School A, but will only have 18 hours “completed” at

School B.

35

Example 5: Academic Year

(cont’d)

• Note that the regulations and guidance will allow

School B to assume weeks of instructional time for hours transferred in and then track actual weeks of instructional time from that point on.

• Nothing prevents a school from using the assumption method for transfer hours then tracking actual weeks of instructional time at the school, unless the student requests that all weeks of instructional time be tracked rather than assumed.

36

Example 5: Academic Year

(cont’d)

• For the first semester (Fall 2007) at School B, the student can be awarded $375 in ACG funds.

• Student completes 15 hours in Fall 2007 and has a cumulative GPA of 3.25. This GPA represents only the 15 hours taken in Fall 2007.

– If school policy is to include GPA for courses transferred in, then the cumulative GPA at the end of Fall 2007 would also include the GPA for those courses.

• At the end of Fall 2007, the student will have completed the weeks for 1 ½ academic years and have 33 hours. The school may award $650 in ACG funds for Spring 2008.

37

Example 6: Academic Year

• At School C, student completes 12 credit hours. Student was only enrolled full-time one semester and received only one disbursement ($375) of ACG funds.

• Student transfers to School D and none of the 12 credits transfer. School D assumes weeks of instructional time.

With zero hours, School D reviews NSLDS and notes the student has already been awarded ACG funds (which serves as documentation of completion of rigorous secondary school program of study).

• School D awards this student $375 ACG award.

38

Example 6: Academic Year

(cont’d)

• Student completes 14 credit hours in Fall. Although student is still in first academic year at School D, there are no remaining ACG funds for Spring.

– With no transfer hours, no weeks of instructional time were assumed.

• Even if School D chose to track actual weeks, this student would have completed the weeks of instructional time for an academic year but still not have the credit hours.

– Student must meet both measures before funds can be awarded for next academic year.

39

Example 7: Academic Year Progression

Student graduates high school and enrolls at school that tracks actual weeks of instructional time.

•

Fall 2006: 15 hours, 15 weeks

– Awarded ½ of 1 st academic year ACG

– Ends term with 15 hours and 3.66 GPA

•

Spring 2007: 18 hours, 15 weeks

– Awarded ½ of 1 st academic year ACG

– Ends term with 33 hours and 3.58 GPA

•

Summer 2007: 9 hours, 15 weeks*

– Receives no ACG (less than full-time)

– Ends term with 42 hours and 3.63 GPA

*Certain programs allowed to treat summer term as 15 weeks

40

Example 7: Academic Year Progression (cont’d)

•

Fall 2007: 18 hours, 15 weeks

– Awarded ½ of 2 nd academic year ACG

– Ends term with 60 hours and 3.67 GPA

•

Spring 2008: 18 hours, 15 weeks

– Awarded ½ of 3 rd academic year Nat’l SMART Grant (beyond

2 nd yr in wks & hrs; SMART-eligible major declared)

– Ends term with 78 hours and 3.72 GPA

• Summer 2008: 9 hours, 15 weeks*

– Receives no ACG (less than full-time)

– Ends term with 87 hours and 3.69 GPA

*Certain programs allowed to treat summer term as 15 weeks

41

Example 7: Academic Year Progression (cont’d)

•

Fall 2008: 15 hours, 15 weeks

– Awarded ½ of 4 th academic year Nat’l SMART Grant

– Ends term with 102 hours and 3.67 GPA

• Spring 2009: 18 hours, 15 weeks

– Awarded ½ of 4 th academic year Nat’l SMART Grant

– Ends term with 120 hours and 3.64 GPA

•

Total ACG received: $1,400

• Total National SMART Grant received: $6,000

42

Example 8: Academic Year Progression

Student graduates high school and enrolls at school that assumes weeks of instructional time based on credits.

•

Fall 2006: 15 hours, 15 actual weeks

– Awarded ½ of 1 st academic year ACG

– Ends term with 15 hours and 3.66 GPA (assumes 0.625 ac.yrs.)

• Spring 2007: 18 hours, 15 actual weeks

– Awarded ½ of 1 st academic year ACG

– Ends term with 33 hours and 3.58 GPA (assumes 1.375 ac.yrs.)

•

Summer 2007: 9 hours, 15 weeks*

– Receives no ACG (less than full-time)

– Ends term with 42 hours and 3.63 GPA (assumes 1.75 ac.yrs.)

*Certain programs allowed to treat summer term as 15 weeks

43

Example 8: Academic Year Progression (cont’d)

•

Fall 2007: 18 hours, 15 weeks

– Awarded ½ of 2 nd academic year ACG

– Ends term with 60 hours and 3.67 GPA (assumes 2.5 ac.yrs.)

•

Spring 2008: 18 hours, 15 weeks

– Awarded ½ of 3 rd academic year Nat’l SMART Grant because eligible major declared

– Ends term with 78 hours and 3.72 GPA (assumes 3.25 ac.yrs.)

• Summer 2008: 9 hours, 15 weeks

*

– Receives no ACG (less than full-time)

– Ends term with 87 hours and 3.69 GPA (assumes 3.625 ac.yrs.)

44

Example 8: Academic Year Progression (cont’d)

•

Fall 2008: 15 hours, 15 weeks

– Awarded ½ of 4 th academic year Nat’l SMART Grant

– Ends term with 102 hours and 3.67 GPA (assumes 4.25 ac.yrs.)

•

Spring 2009: 18 hours, 15 weeks

– Awarded ½ of 4 th academic year Nat’l SMART Grant

– Ends term with 120 hours and 3.64 GPA (graduates)

•

Total ACG received: $1,400

•

Total National SMART Grant received: $6,000

45

Example 9: Change in Academic Year

• Student completes 49 semester hours at School A over three award years then transfers to School B.

School B reviews NSLDS and see that the student received a full scheduled award for ACG for the

2008-09 award year for academic year 2.

• School B only accepts 22 semester hours as applicable toward a degree at its institution.

• Student is not eligible for academic year 1 ACG because history shows year 2 already received.

46

Associate’s Degree Second Academic Year

For the 2006-2007 and 2007-2008 Award Years –

For a student enrolled in an associate’s degree program the second academic year ends when the student has completed the credits required for completion of that academic program, as published in the institution’s official academic publications.

See DCL GEN-06-18

47

Bachelor’s Degree Fourth Academic Year

For the 2006-2007 and 2007-2008 award years, for a student enrolled in a bachelor’s degree program the fourth academic year ends when the student has completed the credits required for completion of that academic program, as published in the institution’s official academic publications.

See DCL GEN-06-18

48

Example 10: Financial Need

Student Profile

COA: $19,500

EFC: 0

Need: $19,500

Original Determinations

Merit Scholarship $15,000

Federal Pell Grant $ 4,050

ACG: $ 750

Packaging Options

Merit Scholarship: $14,700

Federal Pell Grant: $ 4,050

ACG: $ 750

--OR--

Merit Scholarship: $15,000

Federal Pell Grant: $ 4,050

ACG: $ 450

49

Example 11: Financial Need

Student Profile

COA: $25,500

EFC: 0

Need: $25,500

Packaging Options

Veterans Benefits $21,970

Federal Pell Grant: $ 4,050

ACG: $ 0

Original Determinations

Veterans Benefits $21,970

Federal Pell Grant $ 4,050

ACG: $ 750

Student cannot receive any

ACG funds because need has already been met. No overaward for Pell and VA only.

50

Higher Education

Reconciliation Act of 2005:

General Provisions, Loans, and Need Analysis

Institutional and Program Eligibility

Weeks in academic year for clock hour programs reduced to 26

50% rules do not apply to telecommunications

Programs of distance education must be specifically accredited

Short-term telecommunications programs are eligible

Provision for programs using assessment to measure progress

FFEL and Direct Loans

PLUS Loan Eligibility to Graduate Students

Extends eligibility for PLUS Loans to graduate and professional students

Eligibility criteria is the same as for a parent, including credit checks and no in-school status.

However, student would be eligible for an in-school deferment.

Student must file FAFSA

Effective for any loan certified or originated on or after July 1, 2006

FFEL and Direct Loans

Annual Loan Limits

Increases annual base loan limits for –

First year students from $2,625 to $3,500

Second year students from $3,500 to $4,500

Increases annual additional unsubsidized for -

Graduate students to $12,000

Prep for Grad Program $7,000

Teacher Certification to $7,000

Effective for loans first disbursed on or after

July 1, 2007 (

Aggregate loan limits are not increased)

FFEL and Direct Loans

Interest Rates

Fixed rate of 6.8% for new Stafford loans first disbursed or after July 1, 2006

Fixed rate of 8.5% for new FFEL PLUS loans first disbursed or after July 1, 2006

Fixed rate of 7.9% for new Direct Loan PLUS loans first disbursed or after July 1, 2006

FFEL and Direct Loans

Origination Fees

Phases out the 3 percent FFEL origination and reduces the Direct Loan loan fee (which represents both an origination fee and a one percent insurance premium) to one percent

FFEL and Direct Loans

Guaranty Fee

Requires that the one percent default fee be deposited into the federal fund of the FFEL guaranty agency.

Requires the agency to either deduct from loan proceeds or pay with non-Federal sources.

FFEL and Direct Loans

Consolidation Loans

Generally no re-consolidation

Applies within and across programs

FFEL Loans to Direct only if FFEL application denied or certain defaults

Eliminates In-School consolidations in Direct

Loans and “early conversion to repayment” consolidations in FFEL

Eliminates Joint Consolidations

FFEL and Direct Loans

Low-Default Disbursement Waivers

An institution with cohort default rates of less than 10 percent for the three most recent years is exempted from the requirement that FFEL and Direct Loans --

Be issued in at least two disbursements for one term loans;

Be delayed for 30-day for first time students.

FFEL and Direct Loans

Teacher Loan Forgiveness

Permanently and retroactively extends the authorization of the increased loan forgiveness of

$17,500 for "highly qualified" math, science, and special education teachers at qualified low-income schools. (Effective on date of enactment, retroactive to October 1, 2005)

FFEL and Direct Loans

FFEL School as Lender

No new school lenders after April 1, 2006

Can only make Stafford Loans

No Parent or Grad PLUS

Must use proceeds for grant aid

Must offer reduced interest or fees

FFEL, Direct Loans, and Perkins

Loans

Active Duty Military Deferment

Provides for a military deferment of up to three years for FFEL, Direct Loan, and Perkins Loans that were first disbursed on or after July 1, 2001.

Includes definitions of “active duty”.

Cost of Attendance

Cost of Attendance (COA) for less than half-time students may include room and board costs, at school’s option.

Cost of Attendance (COA) may include, at school’s option, the one-time cost of obtaining the first professional license or certification

Calculation of EFC

(begins with 2006-2007)

Simplified Needs Test and Auto Zero EFC

Increases to $20,000 the threshold under which a family would automatically have an EFC of zero

Eliminates consideration of dependent student’s tax return for both SNT and Auto-Zero EFC

Tax return alternative if family received benefits from a Federal means-tested program

Calculation of EFC

(begins with 2006-2007)

Other EFC Changes

Treats all 529 Pre-Paid and Tuition Savings Plans as assets of the owner, unless the owner is the dependent student

Excludes small-businesses from assets

Adds active duty military to the criteria that makes a student independent

Calculation of EFC

(begins with 2007-2008)

Other EFC Changes

Increases Income Protection Allowances

Decreases Asset Assessment Rates

Drug Convictions and Title IV

Eligibility

Provides that an applicant loses eligibility for Title IV aid only if the drug related offence for which he or she was convicted occurred while the student was receiving Title IV aid

Return of Title IV Aid (R2T4)

Excludes LEAP/SLEAP/GEAR-UP/SSS from calculations

Specifies that scheduled clock hours are used to determine earned aid

Clarifies that multiple leaves of absence are permitted.

Limits a grant overpayment due from a student to the amount by which the original overpayment amount exceeds half of the total grant funds received by the student

Hot Topics:

Preferred Lender Lists and

Processing Alternative

Loans

Preferred Lenders

Preferred Lenders Lists are OK

No Automatic Referrals

Must process any loan request made by a student or parent regardless of lender.

May not have unreasonable delays.

Publications, scripts, and staff training should comply.

Violations could bring sanctions

Does not apply to FFEL/DL choice.

70

Alternative Loans

Alternative loans must be included as “estimated financial assistance” if --

School is aware of the loan

Condition of loan is enrollment

Does not matter where loan proceeds are sent or whether school “certified” enrollment

Think about it like an outside scholarship

71

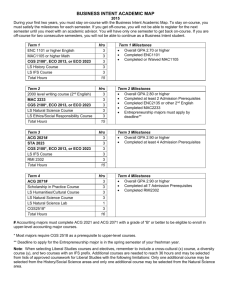

Operational Update

11,931,071

Application Processing Statistics

FAFSA Filing

2005-2006 vs 2006-2007

2005-06 FAFSAs filed as of Week 50

88.5% electronic

13,000,000

11,000,000

9,000,000

7,000,000

12,068,379

2006-07 FAFSAs filed as of Week 50

94.3% electronic

5,000,000

3,000,000

1,000,000

-1,000,000

2005-06 2006-07

FOTW EDE Paper Apps

73

Federal Student Aid Assessments

Where to find the Federal Student Aid

Assessments

•

IFAP http://ifap.ed.gov

•

School Portal http://Federal Student

Aid4schools.ed.gov

75

Policies and Procedures

76

FY 2004

FFEL and Direct Loan

Default Rates

77

78

School Type

Public – 2 Year

Public – 4 Year

Private – 2 Year

Private – 4 Year

Proprietary

Foreign

National Rate

Default Rates by Sector

FY 2002 FY 2003

8.5% 7.6%

4.0%

6.1%

3.1%

8.7%

2.0%

5.2%

3.3%

6.3%

2.6%

7.3%

1.8%

4.5%

FY 2004

8.3%

3.6%

7.4.%

2.9%

8.8%

1.5%

5.2%

79

On the Horizon

Secretary’s Commission Report

Engaging low-income, disadvantaged traditional students who never apply for financial aid

Paperless FAFSA

Estimate financial aid for Juniors in High School

Link outreach with Upward Bound programs

Revising the Application Process

Total Student Experience

Customizable for Each Student

Federal government assuming the responsibility for verification

81

Upcoming Training

HERA Training

Stand Up Training

More than 50 sites across country

Began late September

Will offer a Spring series also

82

Thank you!

Questions? Comments?

Anthony.Jones@ed.gov

Dan.Klock@ed.gov

83