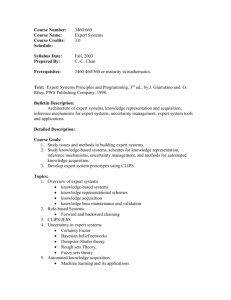

3460.02 gold standard

advertisement

Chapter 2, International Financial Mgmt, Eun et al 3460.02 notes by A.P. Palasvirta, PhD Bronze Silver Gold U.S. Dollar Standard 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 2 Bank of Amsterdam (15th century) 100% reserves of gold and silver Depositors brought gold, silver Were given warehousing certificates for the amount of gold, silver minus a charge Depositors would use the warehousing certificates as money Lower transactions costs Easier to use 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 3 Assets Gold 100% 3460.02 gold standard notes: a.p. palasvirta, ph.d. Liabilities Warehouse receipts March 22, 2016 4 Queen Created the Bank of England Elizabeth I 1563 to 1603 Held partial reserves of gold and silver The rest were in treasury bills This was not a strict gold standard, but a gold exchange standard This bank could not refund all claims for gold with gold 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 5 Assets Liabilities Gold 30 – 40% currency T-bills 60 – 70% http://www.gata.org/node/104 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 6 Fix the value of the unit of account Something immutable Ounce of silver Ounce of gold Gold standard Unit of account the troy ounce Medium of exchange Coinage Gold certificates 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 7 If the cost of mining gold increases deflation If Value of gold increases Value of other goods remain constant Prices decrease the cost of mining gold decreases Inflation Value of gold decreases Value of other goods remain constant Prices increase 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 8 1/P Supply Demand Gold 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 9 1/P Supply Demand Demand Gold 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 10 Two markets for gold official government market Legal unofficial private markets Parity Price greater than market price government’s price (parity) the high price external markets price the low price trader buys low sells high buys externally sells to government 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 11 Pg Private Market S2 S1 Government Market Par Pg D2 D1 Qg 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 12 Private market gold supplies decrease holders of gold will sell first to the government arbitrageurs will buy up stocks and sell to the government excess supply will dry up bringing market price to equal the parity price Government gold supplies will increase increases the money supply decrease the value of money (inflation) 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 13 Countries fix parity price of gold usd parity price = $20.67/ounce uk parity price = 4.2474£/ounce usd/uk£ = 4.8665$/£ They allow arbitrage between two markets parity price of gold at Central Bank free market price of gold De facto single currency the ounce of gold many units of account periodic falling off of the gold standard Balance gold of Payments deficits settled with 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 14 Mechanism which mitigates BOT surplus gold is paid to pay for excess of exports to imports gold coming into the central bank increases money supply inflation in the economy your goods now more expensive in foreign markets foreign goods less expensive to you Price-specie flow mechanism BOP balances settled in gold Money adjusts Prices adjust International prices converge 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 15 Liabilities Assets cash Gold currency T-bills gold increases due to BOT surplus 3460.02 gold standard notes: a.p. palasvirta, ph.d. Money supply increases March 22, 2016 16 Gold backs all money prices move relative to excess demand for gold (economic growth) deflation excess supply of gold (new gold finds) inflation Treasuries have no independent monetary policy 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 17 Fixed parity price (not fixed value) Unit of account varied with the cost of mining gold Often the unit of account appreciated (increased in value) as gold supplies were harder to mine With new gold discoveries, the unit of account depreciated (decreased in value) as the cost of mining gold decreased 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 18 All currencies fixed to gold Gold is the de facto currency single world wide currency all international trade is denominated in gold No need to hedge exchange rate volatility since exchange rates are constant 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 19 When CBs execute a monetary policy discipline of the gold standard is gone after WWII governments ran inflationary policies interest rate policies employment policies inflation sometimes running at 200% or more Exchange rates fluctuate creating uncertainty for trade 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 20 Colonizers (France, Spain, England, Portugal) Gold standard Colonies Silver standard Gresham’s Law Bad money drives out good 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 21 Germany reparations heavy and denominated in Deutsche Marks not gold Germany inflated their currency in order to reduce the cost of reparations Inflation 1 trillion% United France, England paid for war materials bought from the U.S. in gold Stock States had most of the gold market crash of 1929 Led to protectionism Sterilization polices Depression 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 22 WWII U.S. again the supplier of arms got most of the gold in the world 1944 end of the was the Gold Exchange Standard The U.S. dollar became the reserve currency Traded at par value with all currencies part of system Balance of payments imbalances were cleared with U.S. dollars instead of gold Cheaper to ship dollars instead of gold Countries could earn interest on their foreign exchange reserves Special Drawing Rights (SDRs) 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 23 Creation of the International Monetary Fund (IMF) International clearing house for exchange transactions with SDRs and dollars Special Drawing Rights Exchange reserves held at the IMF Value weighted average of basket of major currencies Deutsche Mark (20%), franc (12%), pound (12%), yen (16%), us dollar (42%) The SDR as well as the U.S. dollar became the reserve currencies 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 24 U.S. had to run a chronic BOP deficit to supply us dollars to the worlds economies The fixed parities between currencies dependent on certain assumptions for all economies Monetary policies aligned Fiscal policies aligned Revaluations necessary periodically Monetary policies of many countries very expansionary 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 25 US running inflationary monetary policy to finance Vietnamese war US increase the dollar parity price (devalued) twice DeGaulle demanded payment of BOP surplus with the U.S. in gold 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 26 January 1976 All currencies will float with respect to each other 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 27 Gold = Silver = Platinum Paladium $1,212.1 $18.411 = $1,548.7 = $462.7 3460.02 gold standard notes: a.p. palasvirta, ph.d. March 22, 2016 28