Presentation

advertisement

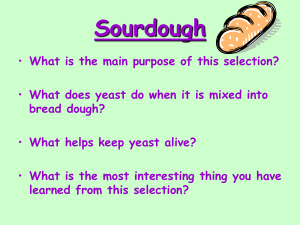

Nicole Boyson Northeastern University Jean Helwege University of South Carolina Jan Jindra Menlo College Empirically, a bad financial system is correlated with worse recessions ◦ Bordo and Haubrich (2009), Berger and Bouwman (2010), Bernanke and Gertler (1989) and Bernanke and Lown (1991) Ivashina and Scharfstein (2010) argue that lending fell sharply in the past recession because the banks were funding constrained ◦ Suggests recession was much worse due to unusually low lending and frozen debt markets A potential explanation for the link between recessions and financial crises involves funding shortfalls at financial institutions Recent theories focus on liquidity shocks as a source of financial crises that create problems for lending and thus the real economy. ◦ Allen and Carletti (2006), Adrian and Shin (2008, 2009), Brunnermeier and Pedersen (2009), Diamond and Rajan (2009), Froot (2009), Geanakoplos (2010), Gromb and Vayanos (2002),Krishnamurthy (2009), Korinek (2009) Crisis starts when financial firms experience a liquidity shock, and is amplified via asset sales. ◦ ◦ ◦ ◦ ◦ ◦ ◦ Liquidity shock affects banks Lost funding is dealt with by selling off assets Asset sales cause price to drop Losses from fire sales reduce capital Lower capital drives feedback loop (asset price spiral) Illiquidity may lead to bank insolvency Capital shortage leads to pullback in lending that hurts nonfinancial firms and exacerbates recession Plenty of empirical studies show support for idea that liquidity shocks lead to asset spirals in financial crises: ◦ Adrian and Shin (2009) show that I-bank growth is related to leverage; Adrian and Brunnermeier (2009) provide evidence on feedbacks and correlations among large financial firms ◦ Gorton and Metrick (2009) and Brunnermeier (2009) point to problems in the repo market, suggesting the banks that relied on short term capital markets funding were hurt most when liquidity shocks hit ◦ Hedge fund studies show that funding liquidity and market liquidity appear to be related. He, Khang and Krishnamurthy (2010), Ben-David, Franzoni, and Moussawi (2010), Billio, Getmansky, and Pellizon (2009), Sadka (2010), and Aragon and Strahan (2009) Why would banks put themselves in such a precarious situation? ◦ Beltratti and Stulz (2009) show that commercial banks that got into the most trouble in the last crisis were those most focused on maximizing shareholder value ◦ Is exposure to liquidity shocks an undesirable side effect of optimal bank strategy? Previous research suggests there are alternative ways to deal with liquidity shocks besides fire sales ◦ Greater use of deposits (Gatev, Schuermann and Strahan (2009) ◦ Equity issuance (Berger, DeYoung, Flannery, Lee, and Oztekin (2008) and Cornett and Tehranian (1994)) ◦ “Cherrypick” assets (Beatty, Chamberlain and Magliolo (1995)) ◦ Discount window (Furfine (2001)) Previous literature also provides some evidence that liquidity shocks do not amplify price spirals: ◦ Kashyap and Stein (2000): Lending at largest banks doesn’t fall when money is tight, due to better access to capital markets. ◦ Gatev and Strahan (2006): Deposit flows increase in troubled times, acting as a hedge when demand for bank credit rises. ◦ He, Khang and Krishnamurthy (2010): Commercial banks were rare among financial firms in their purchases of MBS in the last crisis. ◦ Demsetz (1993, 2000): Loan sales go down in bad times. ◦ Cao, Chen, Liang and Lo (2009): Hedge funds seem to be able to time market liquidity ◦ Anand, Irvine, Puckett and Venkataraman (2010): institutions sell off liquid assets in a crisis ◦ Ambrose, Cai, Helwege (2009): Prices don’t fall just because an asset is sold What is the role of liquidity shocks for financial institutions during financial crises? Theory suggests that the more heavily a firm relies on funding from the capital markets, the more likely it will need to sell assets into a falling market. ◦ Hedge funds should be more affected than investment banks (IB) and commercial banks (CB), and IB would be more affected than CB. Large commercial banks that use the repo market and commercial paper should suffer more than banks with strong deposit networks. Hedge funds with short lockups and large outflows should suffer the most. When liquidity shocks occur, cheaper alternatives to fire sales used first: ◦ Deposits and discount window for CB ◦ Equity issuance or dividend cuts for CB and IB ◦ Sale of assets that are least affected by crisis (cherrypicking to boost equity) ◦ Sale of liquid assets rather than illiquid ones Identify crises and investigate changes in funding and assets at commercial banks (CB), I-banks (IB) and hedge funds: ◦ Does financing for IB and CB decline in a crisis? ◦ Do IB and CB engage in fire sales? When assets are sold, which ones? ◦ How do hedge funds respond to the crisis? During crises, how much do funds with short lockup periods and large redemption requests (constrained funds) sell off compared to funds with long lockup periods and small redemption requests (unconstrained funds) Commercial bank data from Compustat bank quarterly data 1980; I-bank data from 1980 but publicly traded I-banks limited in early part of sample ◦ Only largest commercial banks (about 100 each quarter) Hedge funds identified from TASS, matched with funds that report with13-f forms to SEC (Thomson-Reuters) ◦ 13-f reports are quarterly ◦ Start with data in 1998 to keep sufficient sample size Identify crises from NBER recessions, bank failures, stock returns, flight to quality, known events like LTCM Crisis and Boom Periods Crisis 1/1980 - 11/1982 12/1988 - 12/1992 8/1998 - 1/1999 3/2001 - 11/2001 3/2007 - 12/2008 Boom 11/1993 - 10/1997 6/1999 - 5/2000 1/2003 - 2/2004 Funding Shocks at Commercial Banks All High Deposit Banks Ave Med 0.58% 0.26% 0.88% 0.42% -0.30% -0.17% 49.03% 36.20% 12.83% 39.91% 33.71% 6.20% Period Crisis Boom Diff. Ave 0.45% 0.96% -0.50% Crisis Boom Diff. 43.11% 36.32% 6.79% Net L-T Debt Issuance/ TA Crisis Boom Diff. 0.19% 0.56% -0.38% -0.00% 0.02% -0.02% 0.21% 0.73% -0.52% 0.00% 0.22% -0.22% 0.22% 0.43% -0.21% 0.00% 0.00% 0.00% Change in Deposits/ TA Crisis Boom Diff. 1.69% 1.97% -0.28% 0.83% 0.78% 0.05% 1.79% 2.18% -0.39% 0.89% 0.96% -0.07% 1.71% 1.17% 0.54% 0.80% 0.37% 0.43% Change in Deposits < 0 Crisis Boom Diff. 37.00% 35.39% 1.61% Net Debt Issuance/ TA Net Debt Issuance < 0 Med 0.27% 0.61% -0.33% Low Deposit Banks Ave Med 0.18% 0.04% 1.02% 0.64% -0.84% -0.60% 34.85% 29.82% 5.02% 36.91% 43.44% -6.53% Funding Shocks at Commercial Banks All High Equity Banks Ave Med 0.47% 0.26% 0.88% 0.41% -0.41% -0.15% 48.41% 35.75% 12.66% 42.36% 31.91% 10.45% Period Crisis Boom Diff. Ave 0.45% 0.96% -0.50% Crisis Boom Diff. 43.11% 36.32% 6.79% Net L-T Debt Issuance/ TA Crisis Boom Diff. 0.19% 0.56% -0.38% 0.00% 0.02% -0.02% 0.12% 0.86% -0.74% 0.00% 0.28% -0.28% 0.20% 0.47% -0.27% -0.00% 0.00% -0.00% Change in Deposits/ TA Crisis Boom Diff. 1.69% 1.97% -0.28% 0.83% 0.78% 0.05% 1.02% 1.98% -0.96% 0.58% 0.99% -0.41% 2.00% 1.75% 0.25% 1.06% 0.78% 0.27% Change in Deposits < 0 Crisis Boom Diff. 37.00% 35.39% 1.61% Net Debt Issuance/ TA Net Debt Issuance < 0 Med 0.27% 0.61% -0.33% Low Equity Banks Ave Med 0.22% 0.07% 1.34% 0.81% -1.12% -0.74% 39.74% 34.67% 5.07% 32.46% 36.55% -4.09% Asset Changes at Commercial Banks Change in Assets Change in Assets < 0 Change in Loans / TA Change in Loans < 0 Net Charge-Offs/ TA Inv. Securities Gain/ CE Period Crisis Boom All Banks Ave Med 2.63% 1.49% 3.51% 1.82% Low Deposit Banks Ave Med 2.70% 1.42% 3.83% 2.17% High Deposit Banks Ave Med 2.66% 1.35% 2.35% 1.27% Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. -0.87% 32.23% 27.81% 4.42% 1.27% 2.25% -0.99% 32.48% 22.31% 10.16% 0.13% 0.09% 0.04% 0.04% 0.09% -0.05% -1.13% 35.48% 24.76% 10.72% 1.20% 2.12% -0.92% 36.94% 22.93% 14.01% 0.15% 0.11% 0.04% 0.02% 0.15% -0.13% 0.31% 29.61% 32.35% -2.74% 1.25% 1.98% -0.72% 32.86% 20.59% 12.27% 0.13% 0.07% 0.06% 0.08% 0.06% 0.02% -0.33% 0.78% 1.28% -0.50% 0.08% 0.06% 0.02% 0.00% 0.01% -0.01% -0.75% 0.66% 1.13% -0.47% 0.08% 0.06% 0.02% 0.00% 0.02% -0.02% 0.07% 0.70% 1.29% -0.60% 0.08% 0.05% 0.03% 0.00% 0.00% -0.00% Asset Changes at Commercial Banks Change in Assets Change in Assets < 0 Change in Loans / TA Change in Loans < 0 Net Charge-Offs/ TA Inv. Securities Gain/ CE Period Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. All Banks Ave Med 2.63% 1.49% 3.51% 1.82% -0.87% -0.33% 32.23% 27.81% 4.42% 1.27% 0.78% 2.25% 1.28% -0.99% -0.50% 32.48% 22.31% 10.16% 0.13% 0.08% 0.09% 0.06% 0.04% 0.02% 0.04% 0.00% 0.09% 0.01% -0.05% -0.01% Low Equity Banks Ave Med 1.78% 0.97% 3.75% 2.37% -1.98% -1.40% 39.89% 28.26% 11.63% 0.82% 0.58% 2.22% 1.12% -1.40% -0.54% 37.50% 24.69% 12.81% 0.15% 0.08% 0.10% 0.07% 0.05% 0.01% -0.04% 0.00% 0.19% 0.03% -0.23% -0.03% High Equity Banks Ave Med 3.04% 1.76% 3.14% 1.77% -0.10% -0.01% 25.87% 26.62% -0.75% 1.31% 0.77% 2.05% 1.33% -0.74% -0.56% 28.18% 24.12% 4.06% 0.13% 0.08% 0.11% 0.05% 0.02% 0.03% 0.02% 0.01% 0.05% 0.00% -0.03% -0.01% FAS115 (1993), gain/loss account reflects actual sales of securities and write-downs of “available-for-sale” securities that are “other-than-temporarily-impaired” (OTTI). Reported in footnotes. SEC filings in 2007 and 2008: ◦ 2007: Gain of $300 million = $1.9 billion gain on sales and -$1.6 billion OTTI write-downs ◦ 2008: Loss of $1.5 billion: $9.8 gain on sales and $11.3 billion in OTTI write-downs Also examine other gains and losses: net realized gains of $3.0 billion in 2007 and $1.1 billion in 2008 Together, these results provide strong evidence of cherrypicking in recent crisis. Bank Divested Asset Gain ($b.) Date JP Morgan Chase Paymentech Solutions (credit card processor) 1.0 12/08 Citigroup German banking operations 3.9 12/08 Merrill Lynch Bloomberg, L.P. 4.3 12/08 Bank of America Marsico Capital Management 1.5 12/07 PNC Hilliard Lyons (asset management) 0.1 6/07 Equity Changes at Commercial Banks Period Net Equity Issuance / TA Crisis Boom Cash Dividend/ TA All Banks Ave Med Low Deposit Banks Ave Med High Deposit Banks Ave Med 0.13% 0.06% 0.01% 0.00% 0.12% 0.07% 0.01% 0.00% 0.18% 0.09% 0.00% 0.00% Diff. 0.07% 0.01% 0.05% 0.01% 0.09% 0.00% Crisis Boom 0.08% 0.10% 0.07% 0.09% 0.06% 0.08% 0.06% 0.07% 0.09% 0.11% 0.08% 0.11% Diff. -0.02% -0.02% -0.02% -0.01% -0.02% -0.03% Equity Changes at Commercial Banks Period Net Equity Issuance / TA Crisis Boom Cash Dividend/ TA All Banks Ave Med Low Equity Banks Ave Med High Equity Banks Ave Med 0.13% 0.06% 0.01% 0.00% 0.12% 0.12% 0.01% 0.01% 0.15% 0.04% 0.00% 0.00% Diff. 0.07% 0.01% 0.00% 0.00% 0.11% 0.00% Crisis Boom 0.08% 0.10% 0.07% 0.09% 0.05% 0.05% 0.04% 0.05% 0.11% 0.12% 0.10% 0.12% Diff. -0.02% -0.02% 0.00% -0.01% -0.01% -0.02% Alternatives to Fire Sales at Commercial Banks Frequency of Actions During Crises Issued Equity Increased Deposits Sold Assets Decreased Dividends All Low Banks Deposits 1108/2874 294/724 High Deposits 262/699 Low Equity 254/694 High Equity 294/720 71% 66% 53% 53% 73% 67% 60% 51% 68% 67% 47% 53% 72% 63% 60% 46% 69% 68% 47% 60% Debt Shortfall & No Equity Issuance Increased Deposits Sold Assets Decreased Dividends 320 66% 55% 58% 80 64% 65% 50% 85 64% 52% 62% 70 64% 63% 53% 92 68% 58% 63% Debt Shortfall & No Equity Issuance & Deposits Decreased Sold Assets Decreased Dividends 109 98% 61% 29 93% 52% 31 100% 55% 25 96% 72% 29 100% 52% Alternatives to Fire Sales at Commercial Banks Median Ratio of Dollars Raised to Shortfall During Crises Increased Deposits Used only deposits Asset Sales Equity Issued Decreased Dividends All Low Banks Deposits 1108/2874 294/724 High Deposits 262/699 Low Equity 254/694 High Equity 294/720 72.4% 492 13.5% 0.6% 0.0% 59.3% 109 42.2% 0.4% 0.0% 99.7% 131 -18.5% 0.6% 0.0% 50.0% 99 43.7% 0.7% 0.0% 98.0% 145 -19.4% 0.5% 0.0% Increased Deposits Partially Increased Deposits Asset Sales Equity Issued 243 49.9% 41.0% 0.3% 89 49.7% 48.1% 0.2% 45 52.9% 41.0% 0.3% 62 49.6% 43.7% 0.1% 56 53.4% 46.0% 0.0% Decreased Dividends 0.0% 0.0% 0.0% 0.0% 0.0% 373 198.5% 0.7% 96 185.5% 0.5% 86 281.5% 0.3% 93 176.8% 1.2% 93 225.3% 0.8% Decreased Deposits Asset Sales Equity Issued Alternatives to Fire Sales at Commercial Banks Median Ratio of Dollars Raised to Shortfall During 2007-2008 Crisis Increased Deposits Used only deposits Asset Sales Equity Issued Decreased Dividends All Banks 126/300 84.3% 59 -10.4% 0.4% 0.0% Increased Deposits Partially Increased Deposits Sold Assets Equity Issued 33 56.9% 31.5% 15.3% Decreased Dividends 0.0% Decreased Deposits Sold Assets Equity Issued 34 195.5% 1.7% Alternatives to Fire Sales at Commercial Banks Shortfalls During Crises Average Debt Shortfall (millions) Median Debt Shortfall (millions) Average Assets (millions) Changes in the RHS of Balance Sheet (deposits, equity, dividends/debt) No Decline in Assets Asset Sales Debt Shortfall Leads to Asset Sales Asset Sales Shortfall Met Completely with Asset Sales All Low Banks Deposits 1108/2874 294/724 High Deposits 262/699 Low Equity 254/694 High Equity 294/720 $1,575 $137 $58,949 $4,418 $407 $139,700 $158 $42 $13,364 $4,831 $458 $137,831 $205 $48 $13,885 80.6% 63.8% 108.7% 53.9% 106.0% 515 13.5% 115 42.2% 138 -18.5% 105 43.7% 150 -19.4% 593 128.9% 179 103.8% 124 187.0% 149 135.9% 144 126.3% 347 94 83 90 83 Debt Issuance at Commercial Banks Boom and Crisis Crisis 0.18 Low Equity Bank -0.13 High Equity Bank -0.25 Net Charge-Offs 0.75 Low Deposit Bank 0.29 High Deposit Bank -0.08 Change in Deposits -0.42 Net Equity Issuance -0.24 Change in Loans 0.55 Change in Inv. Securities 0.55 Inv. Securities Gain, Loss 1.62 Extraord and Discont. Items 15.27 Crisis x : Net Charge-Offs -1.45 Low Deposit Bank -0.40 High Deposit Bank 0.03 Change in Deposits 0.31 Net Equity Issuance -0.05 Change in Loans -0.36 Crisis 1/80 11/82 -0.13 -0.25 -0.70 -0.10 -0.05 -0.11 -0.29 0.18 0.54 -0.07 0.82 -0.19 -0.28 -1.18 -0.42 -0.09 -0.19 -0.66 0.37 0.54 -3.03 16.74 12/88 12/92 8/98 1/99 3/01 11/01 3/07 12/08 -0.19 -0.23 0.28 0.29 0.07 -0.26 -0.45 0.43 0.42 1.49 -0.13 -3.02 -0.83 -0.02 -0.66 -0.22 -0.30 0.20 0.30 0.78 6.66 -1.50 0.01 0.40 1.35 0.63 -0.59 -0.42 -0.46 0.67 0.57 8.25 -22.83 -0.31 -0.03 -1.66 -0.76 0.12 -0.07 -0.36 -0.11 0.76 0.30 2.52 Change in Assets at Commercial Banks Boom and Crisis Crisis -0.12 Low Equity Bank -0.27 High Equity Bank 0.25 Net Charge-Offs -0.50 Low Deposit Bank -0.04 High Deposit Bank -0.02 Change in Deposits 0.93 Net Debt Issuance >0 0.87 Net Debt Issuance <0 0.81 Net Equity Issuance 0.96 Change in Loans 0.17 Change in Inv. Securities 0.12 Extraord and Discont. Items 1.77 Crisis x : Low Deposit Bank 0.12 High Deposit Bank -0.02 Change in Deposits -0.39 Change in Loans 0.53 Change in Inv. Securities 0.33 Crisis 1/80 11/82 -0.27 0.25 0.05 0.08 -0.03 0.54 0.68 0.54 0.67 0.70 0.44 -0.34 -0.06 0.00 -0.95 -0.04 0.02 1.03 1.02 1.00 0.68 0.02 -0.01 -0.39 12/88 12/92 8/98 1/99 3/01 11/01 3/07 12/08 0.03 -0.02 -0.31 -0.10 0.00 0.99 0.99 0.98 0.76 0.09 0.05 0.09 -1.43 0.13 1.45 0.79 -0.30 1.19 1.11 1.13 0.61 -0.16 -0.06 -0.99 0.08 0.03 0.68 0.30 -0.14 0.92 0.99 0.83 0.77 0.10 0.20 -1.61 1.20 1.02 -0.98 -0.53 -0.04 0.70 0.47 0.31 1.01 1.32 0.82 -4.02 Equity Ratio Changes at Commercial Banks Boom and Crisis Crisis 0.07 Net Charge-Offs 0.22 Low Deposit Bank 0.02 High Deposit Bank 0.00 Change in Deposits -0.06 Net Debt Issuance -0.06 Net Equity Issuance 0.45 Change in Dividends 0.24 Change in Loans 0.05 Change in Inv. Securities -0.01 Inv. Securities Gain, Loss 0.03 Extraord and Discont. Items 1.32 Crisis x : Net Charge-Offs -0.72 Low Deposit Bank -0.04 High Deposit Bank 0.00 Change in Deposits 0.04 Net Debt Issuance 0.03 Change in Dividend -0.56 Change in Loans -0.07 Crisis 1/80 11/82 -0.49 -0.03 0.00 -0.03 -0.03 0.53 -0.32 -0.02 -0.01 0.96 0.91 -0.24 0.01 0.02 -0.05 -0.05 0.50 -0.19 0.01 0.01 0.28 1.05 12/88 12/92 8/98 1/99 3/01 11/01 3/07 12/08 -0.29 0.01 -0.01 -0.06 -0.05 0.47 -0.17 0.04 0.01 0.12 0.76 0.14 0.18 -0.10 0.02 -0.02 0.31 -0.41 -0.05 -0.01 -3.39 -0.61 0.07 -0.12 -0.02 -0.05 -0.06 0.58 -0.73 -0.01 0.01 -0.69 0.72 -1.23 -0.11 0.06 -0.10 -0.03 0.58 -0.30 -0.06 0.01 1.18 1.16 Liquidity Shocks & Fire Sales at I-Banks All Net Debt Issuance / TA Net Debt Issuance < 0 Net L-T Debt Issuance / TA Change in Assets Change in Fin. Instr. Owned /TA Change in Fin. Instr. Owned < 0 Period Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Ave 1.13% 2.31% -1.18% 44.68% 29.76% 14.92% 0.55% 0.75% -0.20% 4.24% 4.59% -0.35% 0.17% 1.33% -1.15% 45.79% 30.87% 14.92% Low S-T Debt Med 0.45% 1.50% -1.05% 0.18% 0.54% -0.36% 1.92% 3.65% -1.73% 0.03% 0.97% -0.93% Ave 0.48% 1.85% -1.36% 50.00% 28.57% 21.43% 0.34% 0.94% -0.60% 4.81% 4.63% 0.18% -0.69% 0.57% -1.25% 51.43% 29.55% 21.88% Med 0.03% 0.87% -0.84% 0.05% 0.33% -0.29% 1.17% 2.69% -1.51% -0.01% 0.42% -0.43% High S-T Debt Ave 1.95% 2.76% -0.81% 37.14% 29.13% 8.02% 0.82% 0.74% 0.08% 3.45% 4.77% -1.32% 1.44% 1.72% -0.28% 39.05% 30.10% 8.95% Med 2.72% 3.75% -1.02% 0.32% 0.65% -0.33% 3.11% 4.91% -1.79% 1.21% 1.75% -0.54% Liquidity Shocks & Fire Sales at I-Banks All Change in Cash & S-T Inv. Change in Trading Assets Net Equity Issued Dividends Extra. Items Period Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Crisis Boom Diff. Ave 0.77% 0.91% -0.14% 1.31% 1.88% -0.57% 0.04% -0.02% 0.06% 0.05% 0.03% 0.02% 0.00% -0.02% 0.02% Low S-T Debt Med 0.20% 0.56% -0.36% 0.86% 1.07% -0.21% -0.01% -0.03% 0.02% 0.03% 0.03% 0.00% Ave 0.07% 0.25% -0.18% 2.31% 2.46% -0.15% 0.09% 0.00% 0.08% 0.06% 0.04% 0.02% 0.00% 0.06% -0.06% Med 0.02% 0.25% -0.23% 0.50% 0.71% -0.21% 0.00% -0.03% 0.03% 0.02% 0.03% -0.01% High S-T Debt Ave 1.42% 1.13% 0.29% 0.21% 1.84% -1.63% -0.01% -0.04% 0.03% 0.03% 0.02% 0.01% 0.00% -0.07% 0.07% Med 0.23% 0.84% -0.61% 1.57% 1.74% -0.17% -0.03% -0.04% 0.01% 0.03% 0.02% 0.01% Debt Issuance at I-Banks Crisis Net Charge-Offs High S-T Debt Banks Net Equity Issuance Finc'l Instr. Owned Change in Finc'l Instr. Owned Change in Trading Related Assets Extraord and Discont. Items Crisis x : Net Charge-Offs High S-T Debt Banks Net Equity Issuance Finc'l Instr. Owned Change in Finc'l Instr. Owned Change in Trading Related Assets Extraord and Discont. Items Boom and Crisis 5.17 16.41 -0.45 -2.18 0.08 1.03 0.52 -3.91 -23.90 1.04 1.04 -0.14 -0.02 -0.32 1.86 Crisis -7.49 0.60 -1.14 -0.06 1.01 0.20 -2.05 12/88 - 12/92 3/07 - 12/08 -5.78 1.56 -3.56 -0.11 1.30 0.15 -6.18 -11.25 -0.58 -1.21 -0.02 0.58 0.41 5.18 Changes in Assets at I-Banks Crisis Net Charge-Offs High S-T Debt Banks Net Debt Issuance > 0 Net Debt Issuance < 0 Net Equity Issuance Change in Finc'l Instr. Owned Change in Trading Related Assets Extraord and Discont. Items Crisis x : Net Charge-Offs High S-T Debt Banks Net Debt Issuance > 0 Net Debt Issuance < 0 Net Equity Issuance Finc'l Instr. Owned(t-1) Change in Finc'l Instr. Owned Change in Trading Related Assets Extraord and Discont. Items Boom and Crisis 0.31 2.80 0.50 0.30 -0.01 -0.96 0.86 0.79 22.44 -1.35 0.72 0.40 0.96 2.25 -0.01 -0.32 -0.54 -38.15 Crisis 12/88 12/92 1.42 1.23 0.70 0.95 1.28 0.54 0.25 -17.78 1.48 1.20 1.00 0.99 1.49 0.07 0.09 1.42 3/07 - 12/08 41.22 2.63 -0.12 0.86 1.02 0.83 0.84 -47.44 Change in Equity Ratio at I-Banks Crisis Net Charge-Offs High S-T Debt Banks Net Debt Issuance Net Equity Issuance Change in Dividend Finc'l Instr. Owned Change in Finc'l Instr. Owned Change in Trading Related Assets Extraord and Discont. Items Crisis x : Net Charge-Offs High S-T Debt Banks Net Debt Issuance Net Equity Issuance Change in Dividend Finc'l Instr. Owned(t-1) Extraord and Discont. Items Boom and Crisis 0.08 -0.63 0.03 0.01 0.16 0.00 0.00 -0.03 -0.01 -0.38 0.34 -0.14 -0.04 0.31 0.67 0.01 -10.12 Crisis -0.29 -0.12 -0.04 0.47 0.68 0.00 -0.06 0.00 -10.51 12/88 12/92 -0.12 -0.08 -0.05 0.40 6.05 0.00 0.02 0.00 -8.46 3/07 - 12/08 -1.43 -0.17 -0.08 0.38 0.86 0.00 -0.14 0.04 -10.56 Hedge Fund Flows and Performance Constrained Hedge Funds Ave Median Ave Median 0.00 0.01 -0.14 -0.07 0.03 0.01 -0.11 -0.05 -0.03 -0.00 -0.03 -0.02 0.00 0.01 -0.02 -0.01 0.05 0.03 0.04 0.02 -0.05 -0.02 -0.06 -0.03 All Fund Quarterly Flow Fund Quarterly Return Crisis Boom Diff Crisis Boom Diff Unconstrained Hedge Funds Ave Median 0.03 0.03 0.06 0.04 -0.03 -0.01 0.09 0.04 0.13 0.07 -0.04 -0.03 Difference: Con. – Un. Ave Median -0.17 -0.10 -0.17 -0.09 -0.11 -0.09 -0.05 -0.06 Characteristics of Stocks held by Hedge Funds All Prior Year Annual Return Total Assets ($ Million) Tobin’s Q Market Cap, Prior Qtr. Amihud Illiquidity*106 Bid/Ask Spread Crisis Boom Diff Crisis Boom Diff Crisis Boom Diff Crisis Boom Diff Crisis Boom Diff Crisis Boom Diff Ave 0.00 0.11 -0.11 5,324 5,488 -164 2.93 3.66 -0.73 12,625 10,551 2,074 0.15 0.09 0.06 0.013 0.012 0.001 Median -0.05 -0.07 0.02 704 577 127 1.72 1.81 -0.09 1,957 1,394 563 0.02 0.10 -0.08 0.004 0.012 -0.008 Constrained Hedge Funds Ave Median -0.01 -0.05 0.11 -0.09 -0.12 0.04 7,553 1,145 8,342 1,331 -789 -186 2.83 1.77 3.91 1.94 -1.08 -0.17 10,928 1,891 10,643 1,548 285 343 0.07 0.06 0.01 0.05 0.00 0.01 0.010 0.003 0.011 0.011 -0.001 -0.008 Unconstrained Hedge Funds Ave Median 0.08 0.05 0.32 0.03 -0.24 0.02 13,481 2,191 11,005 1,719 2,476 472 3.23 2.03 4.39 2.06 -1.16 -0.03 17,448 2,569 13,796 1,681 3,652 888 0.05 0.03 0.01 0.03 0.04 -0.00 0.006 0.003 0.009 0.010 -0.003 -0.007 Difference: Cons. – Uncons. Ave Median -0.09 -0.10 -0.21 -0.12 -5,928 -2,663 -1,046 -388 -0.40 -0.50 -0.30 -0.10 -6,520 -3,153 -679 -133 0.03 0.02 0.03 0.01 0.004 0.002 0.001 0.001 Hedge Fund Sales and Purchases Proportion Unchanged Proportion Sold Proportion with Increases Increase in Existing Holdings Crisis Boom Diff Crisis Boom Diff Crisis Boom Diff Crisis Boom Diff All Families Constrained Hedge Funds 0.12 0.15 -0.03 0.42 0.41 0.01 0.24 0.23 0.01 0.15 0.14 0.01 0.10 0.15 -0.05 0.49 0.43 0.06 0.19 0.21 -0.02 0.16 0.12 0.04 Unconstrained Difference: Hedge Funds Cons. – Uncons. 0.23 0.19 0.03 0.28 0.34 -0.06 0.28 0.26 0.02 0.14 0.15 -0.01 -0.12 -0.04 0.21 0.09 -0.09 -0.04 0.02 -0.03 Characteristics of Stocks Sold and Not Sold by Hedge Funds Sold Period Prior Year Return Crisis Boom Diff Market Cap. Crisis Boom Diff Amihud Illiquidity Crisis Boom Diff Bid/Ask Spread Crisis Boom Diff Cons. -0.01 0.11 -0.12 8,162 8,054 108 0.08 0.06 0.02 0.01 0.01 -0.00 Diff.: Cons.Uncons. Uncons. 0.08 -0.09 0.39 -0.28 -0.31 17,448 -9,286 13,796 -5,742 3,652 0.05 0.03 0.05 0.01 0.00 0.01 0.00 0.01 0.00 -0.00 Not Sold Cons. 0.02 0.08 -0.06 9,079 8,445 643 0.06 0.08 -0.02 0.01 0.01 0.00 Difference: Sold Diff.: Not Sold Cons. – Sold Not Sold Uncons. Unc. (Cons.) (Unc.) 0.09 -0.07 -0.03 -0.01 0.25 -0.17 0.03 0.14 -0.16 20,367 -11,288 -917 -2,919 14,466 -6,021 -391 -670 5,901 0.04 0.03 0.01 0.01 0.07 0.02 -0.03 -0.02 -0.03 0.01 0.01 0.00 0.00 0.01 0.00 0.00 0.00 -0.00 Figure 1: Stocks Sold and Not Sold 0.2 0.15 0.1 0.05 0 T+18 T+17 T+16 T+15 T+14 T+13 T+12 T+11 T+10 T+9 T+8 T+7 T+6 T+5 T+4 T+3 T+2 T+1 T3 T2 T1 T-1 T-2 T-3 T-4 T-5 T-6 T-7 T-8 T-9 T-10 T-11 -0.05 T-12 Cumulative Return in Excess of VW CRSP Portfolio Rebalancing During the 2007-2008 Crisis Period Event Date Constrained Fund Stocks Sold Unconstrained Fund Stocks Sold Constrained Fund Stocks Not Sold Unconstrained Fund Stocks Not Sold Liquidity shocks do not appear to trigger financial crises: ◦ Debt issuance does not fall in crises at commercial banks and Ibanks ST debt (repo borrowing) does not drop off a cliff ◦ Deposits rise – deposits are likely cheapest funding alternative ◦ Equity issuance increases ◦ Creditworthiness appears to affect borrowing and deposits in a crisis Fire sales do not appear to amplify crises ◦ ◦ ◦ ◦ Assets do not drop on average and few banks only sell assets Asset declines likely reflect revaluations Strong evidence of cherrypicking in most recent crisis Constrained hedge funds buy more stock!