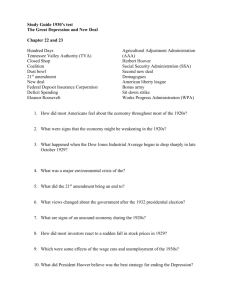

Great Depression

advertisement

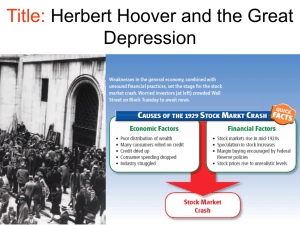

THE GREAT DEPRESSION BEGINS Photos by photographer Dorothea Lange Objectives 1. The learner will understand the causes and consequences of the Great Depression and the futility of Hoover’s actions to limit the damage. 2. The learner will summarize the critical problems threatening the American economy in the late 1920’s. 3. The learner will describe the causes of the stock market crash and Great Depression. 4. The learner will explain how the Great Depression affected the economy in the United States and the world. State Standards 7.7 Determine the possible factors that led to the economic collapse of 1929 (i.e., over production of agriculture and industry, expansion of credit, financial speculation, agricultural crop failures, tariff barriers, laissez- faire). 8.2 Recognize the negative patterns of an economic cycle (i.e., increase of unemployment, decrease of price level, excess inventory, decrease of production, repossession, increase of business failure, and bankruptcy). 8.4 Identify the changes in social and cultural life caused by the Great Depression and the Dust Bowl (i.e., Hoovervilles, Bonus Army, migrations, worldwide economic depression, Democrat victory in 1932, widespread poverty, unemployment, religious revivalism). SECTION 1: THE NATION’S SICK ECONOMY American industries first began to show signs of economic trouble during the 1920’s. One indicator of a weak economy in the late 1920’s was a decline in housing starts As the 1920s advanced, serious problems threatened the economy while Important industries struggled, including: • • • • • • • • • Agriculture Railroads Textiles Steel Mining Lumber Automobiles Housing Consumer goods FARMERS STRUGGLE • • • • • • • Photo by Dorothea Lange No industry suffered as much as agriculture During World War I European demand for American crops soared Causes of the farming crisis of the 1920’s included the fact that demand for crops fell after World War I. After the war demand plummeted Farmers increased production sending prices further downward so the government enacts price support for certain crops. Farmers’ debts increased in the 1920’s. In an effort to curb the financial loss farmers were suffering, congress tried to pass the McNary-Haugen bill, which mandated Price support on key crops. Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. CONSUMER SPENDING DOWN • • • • By the late 1920s, American consumers were buying less Rising prices, stagnant wages and overbuying on credit were to blame Credit is an arrangement in which consumers agree to buy now and pay later for purchases, often on an installment plan that includes interest charges. Most people did not have the money to buy the flood of goods factories produced Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. GAP BETWEEN RICH & POOR • The gap between rich and poor widened • The wealthiest 1% saw their income rise 75% • The rest of the population saw an increase of only 9% • More than 70% of American families earned less than $2500 per year Photo by Dorothea Lange HOOVER WINS 1928 ELECTION • • • • • Alfred E. Smith was the Democrat that lost the presidential election of 1928. Herbert Hoover was the Republican who won the presidential election of 1928. Republican Herbert Hoover ran against Democrat Alfred E. Smith in the 1928 election Hoover emphasized years of prosperity under Republican administrations Hoover won an overwhelming victory Young Hoover supporter in 1928 THE STOCK MARKET • • • • • By 1929, many Americans were invested in the Stock Market The Stock Market had become the most visible symbol of a prosperous American economy The Dow Jones Industrial Average was the barometer of the Stock Market’s worth The Dow Jones Industrial Average is the name of the most widely used measure of the stock market’s health. The Dow is a measure based on the price of 30 large firms Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. Dow Jones Industrial Average – a measure based on the prices of the stocks of 30 large companies, widely used as a barometer of the stock market’s health. STOCK PRICES RISE THROUGH THE 1920s • Through most of the 1920s, stock prices rose steadily • The Dow reached a high in 1929 of 381 points (300 points higher than 1924) • By 1929, 4 million Americans owned stocks New York Stock Exchange SEEDS OF TROUBLE • • By the late 1920s, problems with the economy emerged Speculation: Too many Americans were engaged in speculation – buying stocks & bonds hoping for a quick profit – – – • Margin: Americans were buying “on margin” – paying a small percentage of a stock’s price as a down payment and borrowing the rest – The Stock Market’s bubble was about to break Speculation refers to making extremely risky business transactions on the chance of making quick or considerable profits. Buying stocks on the chance of a quick profit without considering risks is known as speculation. The stock market crash of 1929 was fueled by speculation, unwise investments that people hoped would make them rich overnight. – Buying on Margin refers to paying a small percentage of a stock’s price as a down payment and borrowing the rest. Buying a stock on margin means borrowing money to help pay for the stock. Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. Dow Jones Industrial Average – a measure based on the prices of the stocks of 30 large companies, widely used as a barometer of the stock market’s health. Speculation – an involvement in risky business transactions in an effort to make a quick or large profit. Buying on margin – the purchasing of stocks by paying only a small percentage of the price and borrowing the rest. THE 1929 CRASH • • • In September the Stock Market had some unusual up & down movements On October 24, the market took a plunge . . .the worst was yet to come On October 29, now known as Black Tuesday, the bottom fell out – – • • Black Tuesday specifically refers to the stock market crash of October 29, 1929. Black Tuesday was the day that the stock market crashed. 16.4 million shares were sold that day – prices plummeted People who had bought on margin (credit) were stuck with huge debts Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. Dow Jones Industrial Average – a measure based on the prices of the stocks of 30 large companies, widely used as a barometer of the stock market’s health. Speculation – an involvement in risky business transactions in an effort to make a quick or large profit. Buying on margin – the purchasing of stocks by paying only a small percentage of the price and borrowing the rest. Black Tuesday – a name given to October 29, 1929, when stock prices fell sharply. By mid-November, investors had lost about $30 billion THE GREAT DEPRESSION Alabama family, 1938 Photo by Walter Evans • The Stock Market crash signaled the beginning of the Great Depression • The Great Depression is generally defined as the period from 1929 – 1940 in which the economy plummeted and unemployment skyrocketed • The crash alone did not cause the Great Depression, but it hastened its arrival Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. Dow Jones Industrial Average – a measure based on the prices of the stocks of 30 large companies, widely used as a barometer of the stock market’s health. Speculation – an involvement in risky business transactions in an effort to make a quick or large profit. Buying on margin – the purchasing of stocks by paying only a small percentage of the price and borrowing the rest. Black Tuesday – a name given to October 29, 1929, when stock prices fell sharply. Great Depression – a period, lasting from 1929 to 1940, in which the U.S. economy was in severe decline and millions of Americans were unemployed. FINANCIAL COLLAPSE • After the crash, many Americans panicked and withdrew their money from banks • Banks had invested in the Stock Market and lost money • In 1929- 600 banks fail • By 1933 – 11,000 of the 25,000 banks nationwide had collapsed Bank run 1929, Los Angeles GNP DROPS, UNEMPLOYMENT SOARS • • • • Between 1928-1932, the U.S. Gross National Product (GNP) – the total output of a nation’s goods & services – fell nearly 50% from $104 billion to $59 billion 90,000 businesses went bankrupt Unemployment leaped from 3% in 1929 to 25% in 1933 During the Great Depression, the overall unemployment rate was about 25 percent. • • • • • • • • The U.S. was not the only country gripped by the Great Depression Much of Europe suffered throughout the 1920s In 1930, Congress passed the toughest tariff in U.S. history called the Hawley- Smoot Tariff It was meant to protect U.S. industry yet had the opposite effect The Hawley-Smoot Tariff Act reduced the flow of goods into the United States and prevented other countries from earning American currency to buy American exports. An unintended effect of the Hawley-Smoot Tariff was a substantial decrease in U.S. exports. Other countries enacted their own tariffs and soon world trade fell 40% Within a few years, the HawleySmoot Tariff Act led to a dramatic drop in world trade. HAWLEYSMOOT TARIFF Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. Dow Jones Industrial Average – a measure based on the prices of the stocks of 30 large companies, widely used as a barometer of the stock market’s health. Speculation – an involvement in risky business transactions in an effort to make a quick or large profit. Buying on margin – the purchasing of stocks by paying only a small percentage of the price and borrowing the rest. Black Tuesday – a name given to October 29, 1929, when stock prices fell sharply. Great Depression – a period, lasting from 1929 to 1940, in which the U.S. economy was in severe decline and millions of Americans were unemployed. Hawley-Smoot Tariff Act – a law, enacted in 1930, that established the highest protective tariff in U.S. history, worsening the depression in America and abroad. CAUSES OF THE GREAT DEPRESSION • • • • • Tariffs & war debt policies U.S. demand low, despite factories producing more Farm sector crisis Easy credit Unequal distribution of income – – Tariffs on foreign goods, the availability of easy credit, a crisis in the farm sector were causes of the Great Depression. Both individuals and businesses built up large debts because of easy credit, the federal government did not insure people’s bank accounts, the stock market crashed were important causes of the Great Depression. Section 1 The Nation’s Sick Economy Price support – the maintenance of a price at a certain level through government intervention. Credit – an arrangement in which a buyer pays later for a purchase, often on an installment plan with interest charges. Dow Jones Industrial Average – a measure based on the prices of the stocks of 30 large companies, widely used as a barometer of the stock market’s health. Speculation – an involvement in risky business transactions in an effort to make a quick or large profit. Buying on margin – the purchasing of stocks by paying only a small percentage of the price and borrowing the rest. Black Tuesday – a name given to October 29, 1929, when stock prices fell sharply. Great Depression – a period, lasting from 1929 to 1940, in which the U.S. economy was in severe decline and millions of Americans were unemployed. Hawley-Smoot Tariff Act – a law, enacted in 1930, that established the highest protective tariff in U.S. history, worsening the depression in America and abroad. Objectives 1. The learner will understand the causes and consequences of the Great Depression and the futility of Hoover’s actions to limit the damage. 2. The learner will describe how people struggled to survive during the Depression. 3. The learner will explain how the Depression affected men, women, and children. State Standards 6.3 Identify major urban areas of the United States on a map (i.e., Northeast, upper Midwest, Atlantic Coast, California). 8.4 Identify the changes in social and cultural life caused by the Great Depression and the Dust Bowl (i.e., Hoovervilles, Bonus Army, migrations, worldwide economic depression, Democrat victory in 1932, widespread poverty, unemployment, religious revivalism). SECTION 2: HARDSHIPS DURING DEPRESSION • • • • • The Great Depression brought hardship, homelessness, and hunger to millions Across the country, people lost their jobs, and their homes Some built makeshifts shacks out of scrap material Before long whole shantytowns (sometimes called Hoovervilles in mock reference to the president) sprung up In calling shantytowns “Hoovervilles”, people conveyed their disgust with Hoover Section 2 Hardship and Suffering during the Depression Shantytown – a neighborhood in which people live in makeshift shacks. SOUP KITCHENS • One of the common features of urban areas during the era were soup kitchens and bread lines – During the depression, charitable organizations tried to help the urban poor by opening soup kitchens. Unemployed men wait in line for food – this particular soup kitchen was sponsored by Al Capone • Soup kitchens and bread lines offered free or lowcost food for people Section 2 Hardship and Suffering during the Depression Shantytown – a neighborhood in which people live in makeshift shacks. Soup Kitchen – a place where free or low cost food is served to the needy. Bread Line – a line of people waiting for free food. CONDITIONS FOR MINORITIES • Conditions for African Americans and Latinos were especially difficult • Unemployment was the highest among minorities and their pay was the lowest • Increased violence (24 lynchings in 1933 alone) marred the 1930s • Many Mexicans were “encouraged” to return to their homeland As conditions deteriorated, violence against blacks increased RURAL LIFE DURING THE DEPRESSION Between 1929-1932 almost ½ million farmers lost their land • While the Depression was difficult for everyone, farmers did have one advantage; they could grow food for their families • Thousands of farmers, however, lost their land • Many turned to tenant farming and barely scraped out a living THE DUST BOWL • • • • • A severe drought gripped the Great Plains in the early 1930s Wind scattered the topsoil, exposing sand and grit The resulting dust traveled hundreds of miles Drought, high winds, overproductions of crops. were causes of the Dust Bowl. One storm in 1934 picked up millions of tons of dust from the Plains an carried it to the East Coast Kansas Farmer, 1933 Section 2 Hardship and Suffering during the Depression Shantytown – a neighborhood in which people live in makeshift shacks. Soup Kitchen – a place where free or low cost food is served to the needy. Bread Line – a line of people waiting for free food. Dust Bowl – the region, including Texas, Oklahoma, Kansas, Colorado, and New Mexico, that was made worthless for farming by drought and dust storms during the 1930s. Dust storm approaching Stratford, Texas - 1934 Storm approaching Elkhart, Kansas in 1937 Dust buried cars and wagons in South Dakota in 1936 HARDEST HIT REGIONS • • • Boy covers his mouth to avoid dust, 1935 Kansas, Oklahoma, Texas, New Mexico, and Colorado were the hardest hit regions during the Dust Bowl Many farmers migrated to California and other Pacific Coast states The farmers and sharecroppers who left the Dust Bowl to find work in the west were known as Okies. Photographer Dorothea Lange captures a family headed west to escape the dust storms Effects on the American Family • Hardship and the Family – Family is source of strength for most Americans – Some families break apart under strain of making ends meet • Men in the Streets – Many men used to working, supporting families have difficulty coping • cannot find jobs • The 1930s created the term “hoboes” to describe poor drifters – • • Hoboes was the name given to the men and boys who rode the rails as they searched for work. 300,000 transients – or hoboes – hitched rides around the country on trains and slept under bridges (thousands were teenagers) Injuries and death was common on railroad property; over 50,000 people were hurt or killed HOBOES TRAVEL AMERICA Effects on the American Family • • No federal system of direct relief—cash or food from government Direct relief describes a government system for giving payments or food to the poor. – • President Herbert Hoover opposed direct relief. Women Struggle to Survive – – – Homemakers budget carefully, can food, sew clothes Women work outside home; resented by unemployed men Many women suffer in silence, ashamed to stand in bread lines Section 2 Hardship and Suffering during the Depression Shantytown – a neighborhood in which people live in makeshift shacks. Soup Kitchen – a place where free or low cost food is served to the needy. Bread Line – a line of people waiting for free food. Dust Bowl – the region, including Texas, Oklahoma, Kansas, Colorado, and New Mexico, that was made worthless for farming by drought and dust storms during the 1930s. Direct Relief – the giving of money or food by the government directly to needy people. Effects on the American Family • Children Suffer Hardships – Poor diets, health care lead to serious health problems in children • During the Depression, many children suffered from diet-related diseases – Lack of tax revenue leads to shortened school year, school closings – Teenagers leave home, ride trains in search of work, adventure EFFECTS OF DEPRESSION • • • • • • • Suicide rate rose more than 30% between 1928-1932 – An example of the psychological stress caused by the Great Depression was the rise in the number of people who committed suicide. Alcoholism rose sharply in urban areas Three times as many people were admitted to state mental hospitals as in normal times Many people showed great kindness to strangers Additionally, many people developed habits of savings & thriftiness Many children had a poor diet, many families became homeless, many men became unemployed were effects of the Great Depression. One long-range effect of the Great Depression was that many people developed habits of saving and thriftiness Section 2 Hardship and Suffering during the Depression Shantytown – a neighborhood in which people live in makeshift shacks. Soup Kitchen – a place where free or low cost food is served to the needy. Bread Line – a line of people waiting for free food. Dust Bowl – the region, including Texas, Oklahoma, Kansas, Colorado, and New Mexico, that was made worthless for farming by drought and dust storms during the 1930s. Direct Relief – the giving of money or food by the government directly to needy people. Objectives 1. The learner will understand the causes and consequences of the Great Depression and the futility of Hoover’s actions to limit the damage. 2. The learner will explain Hoover’s initial response to the Depression. 3. The learner will summarize the actions Hoover took to help the economy and the hardship suffered by Americans. 4. The learner will describe the Bonus Army and Hoover’s actions toward it. State Standards 8.4 Identify the changes in social and cultural life caused by the Great Depression and the Dust Bowl (i.e., Hoovervilles, Bonus Army, migrations, worldwide economic depression, Democrat victory in 1932, widespread poverty, unemployment, religious revivalism). SECTION 3: HOOVER STRUGGLES WITH THE DEPRESSION • • • • After the stock market crash, President Hoover tried to reassure Americans He said, “Any lack of confidence in the economic future . . . Is foolish” He recommended business as usual Herbert Hoover’s approach to the Depression’s economy was based on a belief in voluntary cooperation. Herbert Hoover HOOVER’S PHILOSOPHY • • • • • Hoover believed it was the individuals job to take care of themselves, not the governments Hoover was not quick to react to the depression After the stock market crash, President Hoover tried to help the economy by asking businesses not to lay off employees He believed in “rugged individualism” – the idea that people succeed through their own efforts People should take care of themselves, not depend on governmental hand-outs He said people should “pull themselves up by their bootstraps” HOOVER’S SUCCESSFUL DAM PROJECT • • • • Hoover successfully organized and authorized the construction of the Boulder Dam (Now called the Hoover Dam) Boulder Dam, now called Hoover Dam became the world’s tallest and second largest dam, providing the region with electricity, flood control, and a regular water supply. The $700 million project was the world’s tallest dam (726 feet) and the second largest (1,244 feet long) The dam currently provides electricity, flood control and water for 7 western states Section 3 Hoover Struggles with the Depression Boulder Dam – a dam on the Colorado River—now called Hoover Dam—that was built during the Great Depression as part of a public-works program intended to stimulate business and provide jobs. HOOVER TAKES ACTION: TOO LITTLE TOO LATE • • • • • • Hoover’s flurry of activity came too late to save the economy or his job • Hoover gradually softened his position on government intervention in the economy He created the Federal Farm Board to help farmers He also created the National Credit Organization that helped smaller banks His Federal Home Loan Bank Act and Reconstruction Finance Corp were two measures enacted to protect people’s homes and businesses Congress passed the Federal Home Loan Bank Act to lower mortgage for home owners and allows farmers to refinance their loans. The aim of the Federal Home Loan Bank Act was to prevent farmers and homeowners from losing their property The main purpose of the Reconstruction Finance Corporation was to give emergency help to large businesses. Section 3 Hoover Struggles with the Depression Boulder Dam – a dam on the Colorado River—now called Hoover Dam—that was built during the Great Depression as part of a public-works program intended to stimulate business and provide jobs. Federal Home Loan Bank Act – a law, enacted in 1931, that lowered home mortgage rates and allowed farmers to refinance their loans and avoid foreclosure. Reconstruction Finance Corporation – an agency established in 1932 to provide emergency financing to banks, life-insurance companies, railroads, and other large businesses. BONUS ARMY • • • • • • A 1932 incident further damaged Hoover’s image That spring about 15,000 World War I vets arrived in Washington to support a proposed bill The Patman Bill would have authorized Congress to pay a bonus to WWI vets immediately The Patman Bill was intended to pump new life into the economy by providing emergency financing to various types of large businesses. The bonus was scheduled to be paid in 1945 --- The Army vets wanted it NOW World War I veterans and their families made up the Bonus Army that marched on Washington. Section 3 Hoover Struggles with the Depression Boulder Dam – a dam on the Colorado River—now called Hoover Dam—that was built during the Great Depression as part of a public-works program intended to stimulate business and provide jobs. Federal Home Loan Bank Act – a law, enacted in 1931, that lowered home mortgage rates and allowed farmers to refinance their loans and avoid foreclosure. Reconstruction Finance Corporation – an agency established in 1932 to provide emergency financing to banks, life-insurance companies, railroads, and other large businesses. Bonus Army – a group of World War I veterans and their families who marched on Washington, D.C., in 1932 to demand the immediate payment of a bonus they had been promised for military service. BONUS ARMY TURNED DOWN Thousands of Bonus Army soldiers protest – Spring 1932 • Hoover called the Bonus marchers, “Communists and criminals” • On June 17, 1932 the Senate voted down the Putnam Bill BONUS MARCHERS CLASH WITH SOLDIERS • Hoover told the Bonus marchers to go home– most did • 2,000 refused to leave • Hoover sent a force of 1,000 soldiers under the command of General Douglas MacArthur and his aide Dwight Eisenhower AMERICANS SHOCKED AT TREATMENT OF WWI VETS • • • • • MacArthur’s 12th infantry gassed more than 1,000 marchers, including an 11-month old baby, who died Two vets were shot and scores injured Hoover’s image suffered when he ordered the forced removal of 2,000 members of the Bonus Army-World War I veterans who had built a shantytown within a sight of the Capitol building. Americans were outraged and once again, Hoover’s image suffered The 1932 Election was on the horizon. – Herbert Hoover and Franklin D. Roosevelt were the candidates that ran for president in 1932. Hoover had little chance to be re-elected in 1932 Section 3 Hoover Struggles with the Depression Boulder Dam – a dam on the Colorado River—now called Hoover Dam—that was built during the Great Depression as part of a public-works program intended to stimulate business and provide jobs. Federal Home Loan Bank Act – a law, enacted in 1931, that lowered home mortgage rates and allowed farmers to refinance their loans and avoid foreclosure. Reconstruction Finance Corporation – an agency established in 1932 to provide emergency financing to banks, life-insurance companies, railroads, and other large businesses. Bonus Army – a group of World War I veterans and their families who marched on Washington, D.C., in 1932 to demand the immediate payment of a bonus they had been promised for military service.