Housing Market: How has the Housing Market Affected the Economy

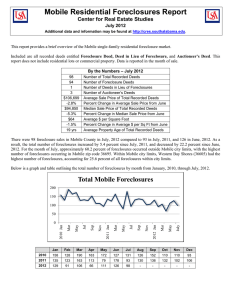

advertisement

Housing Market: How has the Housing Market Affected the Economy? Felicia Meyer, Salt Lake Community College 23 September 2010 Abstract In order to better understand how the housing market has affected the economy, I performed a field research study by researching sources on the internet. I found multiple reliable sources on the internet that introduce when the market first starting going downhill to today’s market. I found that while most people think we are slowly going back up, we are actually still going down. The prices in today’s market are still slightly lower than they were a year ago. Foreclosures have increased 25 percent since last year and even more so since the first time homebuyer tax credit ended in April 2010. I contemplate the outcome of how the housing market has gotten better. How has the housing market affected the economy? Falling home prices and increases in foreclosures have been some of the reasons the economy has fallen. Introduction Many people are talking about whether the economy has gotten better or will it ever get better. Some real estate agents say that it is slowly improving and some say we are in worse condition then we were a year ago. However, ask a mortgage broker and he will tell you differently. The housing market is expected to decline within the next 6 months according to a recent real estate broker. Many economists say that home prices have another 10 percent to fall to bring them into balance with rents and incomes (Kaiser). U.S home sales have collapsed since federal homebuyer tax credits expired in April 2010. Concerns are growing that housing market recovery could stumble amid stubbornly high unemployment, a sluggish recovery and faltering consumer confidence (Veiga). Banks have repossessed a total of 95,364 properties last month, which was up 3 percent from July and an increase of 25 percent from August 2009 (Realty Trac). August makes the ninth month in a row that the pace of homes lost to foreclosure has increased on an annual basis. The previous high was in May (Veiga). The amount of properties that received an initial default notice, slipped 1 percent last month from July. However, this was down 30 percent versus August of last year (Realty Trac). Unemployment and financial instability are now the main catalysts for foreclosure. Below is a graph that shows the percentage of outstanding mortgages and the percentage of foreclosures started. The housing market was officially unstable in 2007. According to a panel of economists the recession began in December 2007 and ended in July 2009 (Associated Press). However, that does not mean that some did not feel it earlier and that some still do not feel it is over quite yet. As the economy slowly goes down everything else gets pulled down with it. Businesses slowly bring in less money, people begin to lose their jobs, housing prices slowly drop, and foreclosures rapidly increase due to a shortage of income. Methodology In order to research for my topic, I researched many different sources on the internet. Researching for the information I needed on the internet made it much easier to access current and up to date information. I knew that the library might not have specific articles in which I needed to complete my research. I first researched the housing market and how it was affecting the economy. Once I was able to get the information I needed I moved onto my next source of information. Since I work in real estate I was able to utilize the tools which were accessible to me. I performed a search that would show me the current market trends and break them down for each quarter. By doing this search showed me how much and when the market had increased and decreased. My next point of research was to sit down with a real estate agent as well as a mortgage broker and interview them in order to get the additional information I needed. I wanted to get an individual’s perspective from each side. I wanted to see if the market was truly going up or was it slowly declining still. I was able to find out that although the market is constantly fluctuating, so far this month it is declining. Results As I was able to gather all my information and put together the research I was able to confirm my hypothesis. While the relationship between the housing market and the entire economy is somewhat complicated, there are some observable factors that can impact the demand for residential real estate. Some of this housing cycle is caused by overbuilding (Wikiinvest). I have broken my results into separate paragraphs of how the slowing housing market is affecting the economy. The slowing of the nation’s housing market is a dramatic turn for not only the industry, but the entire economy. In addition to the effects it has had on the lending and mortgage sector, the slowing housing market has also caused median home prices to decline for the first time in 11 years when the recession first began in 2007 (National Association of Realtors). “As of the second quarter of 2008, the U.S. housing market is unstable due largely to the collapse of the subprime lending industry. The Office of Federal Housing Enterprise Oversight, which tracks mortgage loans bought or backed by Fannie Mae, and Freddie Mac, said that home prices in the first quarter of 2008 fell 3.1% from the same period in 2007 and 1.7% from the fourth quarter of 2007, which is the steepest decline on record” (Wikiinvest). The housing market reflects the state of the economy as a whole. When housing prices and the housing market fall it tends to be a leading factor that there is future financial trouble. The graph below shows the slowing decline in the housing market. My second finding was the slowing housing market has caused an abundance of new and existing home inventory. Sellers are finding that homes sit on the market for a long period of time compared to a short amount of time as it use to be in the past. One of the main reasons for the vastly large inventory is the amount of foreclosures on the market. Many people are finding out that a home they once were able to afford they no longer can afford due to a decline in their financial resources. As people began to lose their jobs, the harder it becomes to afford what you were once able to. Therefore, the amount of foreclosure filings increases. The graph below shows the total foreclosures for each quarter as well as the home appreciation value. Finally, my third finding was how the housing market has slowed the demand for building products. “The lumber industry is suffering the consequences of a slowing housing market. Lumber prices have fallen to their lowest levels in five years” (eFinance). Not only are lumber companies struggling due to the effect the housing market has had on the economy, but such companies as Lowe’s or even Home Depot are struggling. Appliance stores as well as furniture stores, such as Sears and RcWilley have seen a slump in sales. Mortgage companies as well as other financial institutions have seen a significant decline as the value of their mortgage portfolio decreases (Wikinvest). Many businesses have been affected by the slowing housing economy. When businesses start to lose money they began to find ways they can save even more. This includes, cutting benefits, salaries or even jobs to save a little. Discussion Through my research I found lots of interesting and useful information that helped me understand the way this market is going. Many people see a great outcome for 2011 including Warren Buffet, CEO and chairman of Omaha-Based Berkshire. Although it was expected to see the fluctuation in the market, I learned a few interesting facts about how the housing market has been affecting the economy. Interestingly, the housing market seemed to play a big role and a main contributor to the recession as well as the economy. If the financial being of the housing market slumps, everything else goes in a downward slope as well. For example, if the housing market goes down, companies lose business, which results in job losses, which results in an increase in foreclosures, therefore resulting in a large impact on the economy. An interesting factor once I completed my research was the expected decrease in the market for the next 6 months. Home values are not what they use to be, housing prices are still decreasing due to the market and the time it sits on the market, and the amount of foreclosures continues to rise. Due to the economy still slowing, not very many people can afford to buy a home, or are more hesitant about making such a large purchase, that the inventory in the market has infinitely increased. However, this is not the only contributing factor to the large inventory currently on the market; foreclosures also contribute to this inventory. Conclusion There are multiple contributing factors to the falling economy. However, the housing market is one of the main contributors. When the housing market crashes everything falls down with it. Businesses lose money, people lose their jobs, homes go into foreclosure, housing inventory goes up which in turn causes an economic downturn. The housing market is expected to get worse before it gets better. However, there are many people such as Warren Buffet that see a turn around for the year 2011, but only time will tell. Works Cited Frye, Andrew. “Warren Buffet sees housing market bouncing back by 2001”. USAToday. 1 March 2010. Web. 17 September 2010. Hinton, Sean. Cossart, Remi. Matthews, Danny. “U.S. Housing Market”. Wikinvest. Web. 17 September 2010. “How the Slowing Housing Market Is Affecting The Economy”. eFinance Directory. 8 Octobober 2010. Web. 17 September 2010. “Panel of Economists Says Recession Ended in June 2009”. FoxNews. 20 September 2010. Web. 20 September 2010. Veiga, Alex. “US Homes lost to foreclosure up 25 pct on year”. Yahoo Finance. Associated Press. 16 September 2010. Web 17 September 2010. Kaiser, Emily. “U.S. economy depending on housing market”. The New York Times. 25 August 2008. Web. 17 September 2010.