What are the major international issues?

advertisement

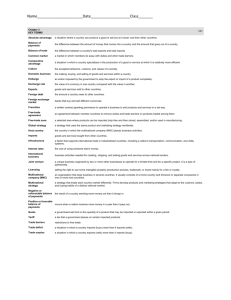

Economics 122a Open-Economy Macroeconomics Topics: 1. International issues 2. Balance of payments accounting 3. Saving and investment in the open economy 4. Determination of the exchange rate What are the major international issues? • International trade and investment increase productivity and growth (standard trade and capital theory) – The need to preserve a free and open trading system • International spillovers (standard macro) – Output affected through trade flows – Financial markets affect exchange rates, interest rates, asset bubbles and bursts • Markets cannot manage themselves. This is why nations need active rules, institutions, and policies: – Coordinate trade and finance policies (Basel III) – Manage crises, such as potential Eurozone collapse – Contain contagion – International institutions to help prevent destructive “prisoners’ dilemma” equilibria (trade, monetary policy, exchange rates,…) 2 Savings and Investment in a Closed Economy We will look at the open economy flows in a S-I framework. We can begin using Mankiw’s loanable funds model (pp. 70—71). This approach examines the sources and uses of saving and investment. Do for closed economy first: Basics: (1) Y=C+I+G (expenditure identity) (2) Spriv = Y – T - C (definition of private saving) (3) Sn = Spriv + (T - G) (definition of national saving) = Spriv + Sgov (4) I = I(r) (investment equation) These imply : (5) Sn = Spriv + Sgov = I(r) 3 Closed Economy S and I equilibrium Real interest rate (r) Sn = Spriv + (T-G) = Spriv + Sgov r* Id (r) I* S, I 4 Essential balancing property of Balance of Payments Current Account Financial Account Net Balance A -A 0 6 Balance of Payments v. National Accounts 1. Macro: NX = Net Exports = exports goods and services – imports g&s 2. Current account: Current account = NX + locational adjustments (domestic v. national product) + unilateral transfers (not current goods/services) Difference = locational stuff + transfers 7 Balance of Payments, 2012 [Billions of current $] Goods and services Exports Imports Net income of foreign investments Unilateral transfers, net -560 2,211 -2,745 224 -130 Balance on Current Account Net change in assets Central banks Other Statistical discrepancy -440 446 390 56 Balance on Financial Account Net exports * I have omitted "capital account," which is trivial in $ terms. -6 440 -547 Globalization in trade of goods and services, US .20 Imports/GDP Exports/GDP .16 Rising trend .12 .08 .04 .00 50 55 60 65 70 75 80 85 90 95 00 05 10 Savings and Investment in the Open Economy ACCOUNTING: Y = output = C + I + G + NX Y = income = C + Spriv + T I + NX = Spriv + Sgov = Sn or NX = Spriv + Sgov – I = Sn – I 10 Classical Small Open Economy 1. Classical economy • Full employment, flex w and p; this implies that domestic output is at potential 2. Small open economy • Too small to affect goods prices or financial markets 3. Mobile financial capital • free flow of funds among countries • Investors therefore compare domestic and foreign interest rates (rd, rw ) • In small economy, rd = rw = world interest rate 11 Open Economy S and I equilibrium Real interest rate (r) Sn = Spriv + (T-G) Net exports > 0 r*=rW China, Japan, OPEC today Id (r) I* S, I 12 Open Economy S and I equilibrium Real interest rate (r) Sn = Spriv + (T-G) US today; LDCs classically rW Net exports < 0 Id (r) I* S, I 13 Shock I: Increase in world interest rate Real interest rate (r) rW’ rW S = Sp + (T-G) NX** NX* Id (r) I** I* S, I 14 Shock II: Increase in G Real interest rate (r) S* S** NX*>0 rW NX**<0 Id (r) I* S, I 15 Key insight: Financial dog wags trade tail Tail of finance Dog of trade Open Economy Macro: The transmission mechanism through the real exchange rate The Transmission Mechanism in Open Economy Macro We saw that changes in domestic saving and investment, or changes in world interest rates, or domestic risk premiums would affect net exports. How does that happen? Through the adjustment of the real exchange rate. Let see how. 18