FINANCIAL ACCOUNTING

THEORY AND ANALYSIS:

TEXT AND CASES

11TH EDITION

RICHARD G. SCHROEDER

MYRTLE W. CLARK

JACK M. CATHEY

CHAPTER 7

FINANCIAL STATEMENTS II:

Introduction

Financial reports can be divided into two

categories

1.

Results of the flows of resources over time (flows)

2.

The status of resources at a point in time (stocks)

Statement

of

Retained

Earnings

Balance

Sheet

Past Emphasis

Income statement

Based on the assumption that flows

were more important than stocks

Frequently resulted in the

measurement of stocks at

residual values

FASB

Asset - Liability approach

Changes in balance sheet amounts becoming

more important in income determination

In this chapter

Balance sheet and the associated measurement

techniques for its elements

Statement of cash flows and its evolution over time

The Balance Sheet

Should disclose wealth of a company at a point in

time

Wealth is present value of all

Resources

Obligations

The Balance Sheet

This measurement technique is limited

Consequently, a variety of measurement techniques are

used to measure the elements of the balance sheet

Historical (Historical cost)

Current oriented (Current value)

Future oriented (Expected realizable value)

Balance Sheet Elements

The elements of the balance sheet were defined in SFAC No. 6 as:

Assets

Liabilities

Equity

Definitions arise from the FASB’s asset - liability approach to

income determination

Departure from previous definitions that resulted in valuations

arrived at via the residual effect of income determination

Components of the Balance Sheet

Assets

Current assets

Investments

Property, plant, and equipment

Intangible assets

Other assets

Liabilities

Current liabilities

Long-term debt

Other liabilities

Stockholder’s Equity

Capital stock

Additional paid-in capital

Retained earnings

Asset Valuation

Asset

Measurement basis

Cash

Current value

Accounts receivable

Expected future value

Marketable securities

Fair value

Inventory

Current or past value

Investments

Fair value, amortized cost, or

equity method

Prepaid items

Historical cost

Property, plant and equipment

Depreciated past value

Liabilities and Their Associated

Measurement Techniques

Liability

Measurement

Current Liabilities

Liquidation Value

Long-term &

Other Liabilities

Liquidation Value

or Present Value

Do measurement techniques

bias statements in favor of

current investors?

Stockholders’ Equity Accounts and Their

Associated Measurement Techniques

Account

Measurement basis

Common Stock

Historical Cost

(Par Value vs Selling Price)

Preferred Stock

Historical Cost

Retained Earnings

& Other

Comprehensive

Income

Dependent upon income

Recognition

Fair Value Measurements under SFAS No. 157

(Now FASB ASC 820)

New definition for fair value

Fair value Hierarchy for sources of

information

New disclosures of assets and liabilities

Modification of presumption of transaction

price

Illustration of Tabular Disclosures for Assets

Remeasured on a Nonrecurring Basis

($ in millions)

Description

Fair Value Measurements Using

Year Ended

12/31/XX

Long-lived

assets held

and used

$75

Goodwill

30

Long-lived

assets held for

sale

26

Quoted Prices

in Active

Markets for

Inputs

Identical 1

Assets

(Level 1)

Significant

Other

Observable

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

$75

$(25)

$30

26

Total Gains

(Losses)

(35)

(15)

$(75)

Modification of Transaction Price Presumption

SFAS No 157 did away with presumption

Entities should consider whether certain

factors might indicate that transaction price

does not represent fair value

FASB Staff Position FAS No. 157-4

Some critics of SFAS No.157 maintained that it

caused or exacerbated the 2007–2008 market

crises by forcing a downward spiral of valuations

based on distressed institutions.

They also raised concerns that as a result of

SFAS No. 157 and SFAS No. 115 financial

institutions were forced to book losses on

securities that may have value after the credit

market crisis has passed.

However, proponents of the standard

maintained that suspending or revising SFAS

No. 157 would be a disservice

FASB Staff Position FAS No. 157-4

As a result of these differing viewpoints, financial institutions,

accounting groups, and others requested guidance from the SEC

and the FASB on how to determine fair value measurements in the

then-current economic climate.

On December 30, 2008, the SEC issued a study on fair value

accounting.

This study recommended that existing fair value accounting and

mark-to-market standards, including SFAS No. 157, should not be

suspended.

Later, after some contentious hearings in Congress, where the

FASB’s standard-setting authority was threatened by some of its

members, the FASB amended SFAS No. 157 by issuing FASB Staff

Position (FSP). FAS 157-4 (see FASB ASC 820-10-65).

FASB Staff Position FAS No. 157-4

FSP FAS 157-4 provided guidance on how to

determine when the volume and level of activity

for an asset or liability has significantly

decreased and identified the circumstances in

which a transaction is not orderly.

Subsequently, after considering the significance

and relevance of each of the factors, judgment

should be used to determine whether the market

is active and if a significant adjustment to the

transactions or quoted prices may be necessary

to estimate fair value.

FASB Staff Position FAS No. 157-4

Although proponents and opponents of the amendment

differed on the economic consequences of its adoption,

both expected it to have a major impact.

The expectation was that it would result in the

revaluation upward of troubled assets, especially

mortgage-based securities, by lowering their fair value

hierarchy measurements from Level 2 to Level 3 and

that bank profits might increase by as much as 20

percent.

However, as noted earlier in Chapter 1, a subsequent

study of the impact of the adoption of FSP FAS 157-4 on

seventy-three of the largest banks in the United States

found that a large majority of the banks reported that

adoption of the new requirements had no material impact

Proposed Format of Statement of

Financial Position

FASB-IASB Project (Phase B)

Groups assets and liabilities together

Operating

Investing

Financing

Provides separate section

for stockholders’ equity

Evaluating A Company’s Financial Position

Return on Assets

Net income

Average total assets

Profit margin

Net income

Net sales

Asset turnover ratio

Net sales

Average total assets

Hershey & Tootsie Roll Return on Assets

Hershey

2011

2010

$628,962

($4,412,199 + 4,272,732)/2

=14.48%

$509,799

($4,272,732 + 3,675,031)/2

=12.83%

Tootsie Roll

2011

2010

$43,938

($857,856 + 857,959)/2

=5.12%

$53,063

($857,959 + 838,247)/2

=6.26%

Hershey and Tootsie: Return on Assets

Return on Assets

16.00%

14.00%

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

0.00%

14.48%

12.83%

6.26%

5.12%

2010

Hershey

2011

Tootsie Roll

Hershey & Tootsie Roll Other Ratios

2011

Profit margin

Asset turnover

Hershey

11.25%

1.40

Tootsie Roll

8.33%

0.62

Evolution of the Statement

of Cash Flows

Prior to 1971

Firms were preparing funds

statements

No guidelines - Methods of preparing statement:

1

2

3

Only two required

financial statements

Cash

Working capital

All financial resources

APB No. 3 - recommended

APB No. 19 - mandatory - all financial resources

APB Opinions 3 and 19

Designed to answer the following questions

1

Where did the profits go?

Why weren’t dividends larger?

How was it possible to distribute dividends

in the presence of a loss?

Why are current assets down when there was a profit?

Why is extra financing required?

How was the expansion financed?

Where did the funds from the sale of securities go?

How was the debt retirement accomplished?

How was the increase in working capital financed?

2

3

4

5

6

7

8

9

Cash Flow Information

Should enable financial statement

users to

Predict the amount of cash that is likely to be

distributed as dividends or interest

Evaluate risk

Presentation of cash flow information assists in

evaluating

Liquidity

Solvency

Nearness to cash

Going concern

Financial flexibility

React to crisis

Historical Perspective

Discussion memorandum

“Reporting Funds Flows, Liquidity, and Financial Flexibility”

Preceded the issuance of SFAS No. 95

Questions raised in this DM included:

1. Which concept of funds should be adopted?

2. How should transactions not having a direct impact on funds be

reported?

3. Which of the various approaches should be used for presenting

funds flow information?

4. How should information about funds flow from operations be

presented?

5. Should funds flow information be separated into outflows for

(a) Maintenance

(b) Expansion of operating capacity, and

(c) Nonoperating purposes

Historical Perspective

Exposure Draft

“Reporting Income, Cash Flows and Financial

Position of Business Enterprises”

SFAC No. 5

“Recognition and

Measurement in Financial

Statements of Business

Enterprises”

Purpose of the Statement of

Cash Flows

Provide relevant information about

cash receipts and cash payments of

an enterprise

Objectives of accounting originally discussed

in SFAC No’s. 1 and 5 led to conclusion

Statement of cash flows should replace the

previously required statement of changes in

financial position

Statement Format

Report changes during an accounting

period in cash and cash equivalents for

Net cash flows from operations

Investing transactions

Financing transactions

Fiscal 2011:

Hershey had a net decrease in cash of

$190,956,000

Tootsie Roll had a net decrease in cash of

$37,364,000

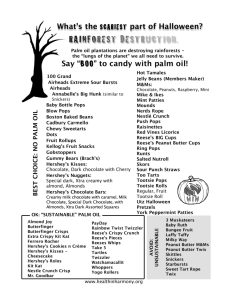

Cash Flows From Operating Activities

Cash effect from transactions

that enter into the determination

of net income

Direct vs Indirect method

SFAS No. 95

exclusive of financing and investing activities

Encouraged companies to report

operating activities in major classes

Hershey vs Tootsie Roll 2011

Hershey $580,867,000

Tootsie $50,390,000

Cash Flows From Investing Activities

Making and collecting loans

Acquiring and disposing of debt

or equity securities of other companies

Acquiring and disposing of property, plant,

and equipment and other productive

resources

Hershey vs Tootsie Roll 2011

Hershey ($333,005,000)

Tootsie Roll ($51,157,000)

Cash Flows From Financing Activities

Results from…

Obtaining resources from owners

Providing owners with a return

of and a return on their investment

Borrowing money and repaying

the amount borrowed

Obtaining and paying for other resources

from long-term creditors

Hershey vs Tootsie Roll 2011

Hershey ($438,818,000)

Tootsie ($36,597,000)

Proposed Format of Statement of Cash Flows

Phase B of FASB-IASB Presentation Project

Expanded version of direct method

Additional disclosures for each category

New schedule, in notes, to reconcile cash

flows to operating income

Proposed Format of Statement of Cash Flows

Categories:

Business

Operating

Investing

Financing

Income Taxes

Discontinued Operations

Equity

Financial Analysis of Cash Flow Information

A major objective of accounting

To provide data allowing the presentation of cash

flows to investors and creditors

To allow evaluation of risk

Net income is not directly

associated with cash

Investors expect return equal to

market rate of interest for investments with

equal risk

discounted future cash flows > investment

Uses of Cash Flow Information

Past cash flows are the best indicators of future cash

flows

Empirical research indicates cash flow information

Has an incremental value over earnings

And is superior to disclosure of changes in working capital

Uses of Cash Flow Information

Net cash provided (used) from operating activities

-Net cash used in acquiring PP&E

Free Cash Flow

Indicator of a company’s ability to pay off debt & maintain growth.

Free Cash Flows

Hershey

Tootsie Roll

2010

2011

2010

2011

$721,855

$256,906

$69,492

$34,039

(in thousands)

Hershey remained positive but metric

deteriorated

Tootsie Roll was also positive in both

years but deteriorated from 2010 to

2011

International Accounting Standards

The IASB has discussed:

1

The statement of financial position

and the various measurement bases used in accounting

Defined assets, liabilities and equity in “Framework for the

Preparation and Presentation of Financial Statements”

The information to be disclosed on the balance sheet and

statement of cash flows in a revised IAS No. 1

The presentation of the statement of cash flows in IAS No. 7,

“Cash Flow Statements”

Discussed the presentation of fair value measurements in

IFRS No. 13, “Fair Value Measurement”

2

3

3

Preparation and Presentation of

Financial Statements

Economic decisions made by users require an evaluation of the ability of

an enterprise to generate cash

Financial position of an enterprise is affected by its

Financial structure

Liquidity and solvency

Capacity to adapt to change (financial flexibility)

Measurement bases include

Historical cost (most common)

Current cost

Realizable value

Present value

Definitions of assets, liabilities and equity are similar to

U. S. GAAP

IAS No. 1: Presentation of

Financial Statements

Recommends disclosures similar

to U. S. GAAP

Revised IAS No. 1

Requires assets to be classified as current and noncurrent

Recognizes that there are differences in the nature and function of

assets, liabilities, and equity

Unless a liquidity presentation provides more relevant and reliable

information

So fundamental that they should be presented on the face of the

balance sheet.

Specifies specific categories of items to be disclosed

IAS No. 7

Operating, financing and investing

activities are to be disclosed

Indirect or direct method of disclosing

operating activities may be used

Stated a preference for the direct method.

Cash flows from extraordinary items

required to be disclosed separately as

operating, investing or financing.

Acquisition or disposal of subsidiaries

Will significantly change presentation of

statement of cash flows.

IFRS No. 13

Applies to IFRSs that require or permit fair value

measurements or disclosures

IFRS No. 13 achieves convergence with U. S.

GAAP. Specifically, it:

Defines fair value

Provides framework for measuring fair value

Requires disclosures about fair value measurements

Attempts to provide consistency and comparability

in fair value measurements and related

disclosures.

IFRS No. 13: Fair Value Hierarchy

Level 1 inputs

Level 2 inputs

Quoted prices in active markets for identical assets or

liabilities

Inputs other than quoted market prices that are observable

for the assets or liability

Level 3 inputs

Unobservable inputs for the asset or liability

Level 3

Level 2

Level 1

End of Chapter 7

Prepared by Kathryn Yarbrough, MBA

Copyright © 2014 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Copyright Act without the

express written consent of the copyright owner is unlawful. Request

for further information should be addressed to the Permissions

Department, John Wiley & Sons, Inc. The purchaser may make backup copies for his/her own use only and not for distribution or

resale. The Publisher assumes no responsibility for errors,

omissions, or damages, caused by the use of these programs or from

the use of the information contained herein.