Chapter 10: Capital Markets and the Pricing of Risk

advertisement

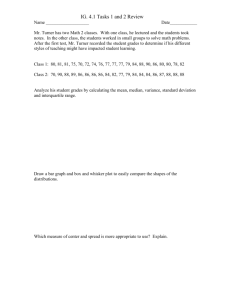

Chapter 10: Capital Markets and the Pricing of Risk-1 Chapter 10: Capital Markets and the Pricing of Risk I. Estimating Risk and Return Basic approaches: 1) peer into the future 2) look at the past and assume future will be like the past. A. Estimates based on forecasts (Review) Key: need probability distributions for investments => probability (pR) of each possible return (R) 1. Expected return: ER R p R R (10.1) => return around which possible returns scattered 2. Variance and Standard deviation: VarR R p R R ER 2 (10.2) SDR VarR (10.3) => measure of how widely scattered are the possible returns => the higher the number, the more widely scattered the possible returns Ex. Given the following possible returns on General Electric (GE) stock, what is the expected return and standard deviation of returns on GE stock? Prob .25 .40 .35 Return -26% 11% 44% E[R] = Var(R) = SD(R) = Corporate Finance Chapter 10: Capital Markets and the Pricing of Risk-2 Ex. Assume that the expected return on General Mills (GIS) is 5% and that the standard deviation of returns on GIS is 10%. => General Mills has a lower expected return but less volatility than GE. Note: if returns were normally distributed, then can compare distributions of GE and GIS. B. Estimates based on historical returns Key assumption: future will be like the past 1. Realized return: Rt 1 Div t 1 Pt 1 Pt Pt Pt (10.4) Notes: 1) 2) Corporate Finance Chapter 10: Capital Markets and the Pricing of Risk-3 Ex. Assume the following prices and dividends for General Electric (GE) stock Date Dividend 12/31 $0.00 2/25 $0.10 6/17 $0.10 9/16 $0.12 12/22 $0.14 12/31 $0.00 Price $15.13 $15.92 $15.91 $16.23 $18.06 $18.29 What is return between 9/16 and 12/22? R12/22 = 2. Realized return over longer periods Key: usually think in terms of annual returns a. => 1+RL = (1+RS1) (1+RS2) (1+RS3)…. (10.5b) Note: Ex. Returns per period (previous GE example): Date 12/31 2/25 6/17 9/16 12/22 12/31 Dividend $0.00 $0.10 $0.10 $0.12 $0.14 $0.00 Price $15.13 $15.92 $15.91 $16.23 $18.06 $18.29 Return n.a. 5.88% 0.57% 2.77% 12.14% 1.27% 1+Ryear = => Ryear = Corporate Finance Chapter 10: Capital Markets and the Pricing of Risk-4 b. Notes: 1) this is not in the book and not in homework from the book, but there are some problems on old exams 2) 3) 4) Ex. Date Dividend 12/31 $0.00 2/25 $0.10 6/17 $0.10 9/16 $0.12 12/22 $0.14 12/31 $0.00 Price $15.13 $15.92 $15.91 $16.23 $18.06 $18.29 Days 0 56 168 259 356 365 => r = 3. Average Annual Returns: R 1 T Rt T t 1 (10.6) where: T = number of historical returns => return around which past returns are scattered 4. Variance and Volatility of Returns Var R 1 T Rt R 2 T 1 t 1 (10.7) Note: dividing by T-1 rather than T gives unbiased estimator Corporate Finance Chapter 10: Capital Markets and the Pricing of Risk-5 Volatility = SDR VarR => gives spread of possible returns => the higher the volatility, the more spread out the returns Ex. Assume that the returns on General Electric (GE) over the last 6 years were as follows: 24%, -2%, -54%, 3%, 9%, -1%. How did the returns on GE compare to those of General Mills (GIS) which had an average return of 9% and a standard deviation of returns of 9%? RGE Var RGE SD(RGE) = 5. Standard Deviation of Averages (Standard Error) Standard Deviation of Averages (Standard Error): SE SD (10.8) N Where: SD = standard deviation of the observations (individual returns) N = number of observations (size of sample) Ex. SE (Average return on GE) = Notes: 1) 2) the standard deviation of an average return is called the standard errror 3) 4) the bigger our sample, the more confident we are in the average we calculated Corporate Finance Chapter 10: Capital Markets and the Pricing of Risk-6 II. Information, risk, and return (Review) 1) Firm-specific news: good or bad news about company itself Risk from firm-specific news called: firm-specific, idiosyncratic, unsystematic, unique, diversifiable risk 2) Market-wide news: about economy and thus impacts all stocks Risk from market-wide news called: systematic, undiversifiable, market risk Notes: 1) individual stocks contain firm-specific risk that averages out in large portfolios 2) investors will only earn a premium for systematic risk => no premium for firm-specific risk since diversifies away in a portfolio Corporate Finance