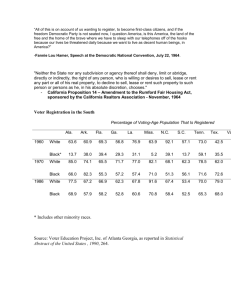

Chapter 5 Comparison Method

advertisement

Comparison method 1 Comparison Method INTRODUCTION 2 Introduction • Valuation is the prediction of human behaviour in the market place • Prediction of human behaviour is commonly done by looking at recent behaviour in similar situations and assuming this will be repeated • In a market place it is assumed that humans adopt a rational economic approach • So we analyse prices/rents that buyers/tenants have paid recently and assume that they would do the same in the future • Valuation paradox: – The built environment is not a laboratory and valuations will vary but the calculations performed in valuations assume ceteris paribus. – No two properties are the same (heterogeneous) yet valuation relies on the comparison of properties to give an indication of value – Solution: the valuer must identify and quantify differences in type, location, legal interest, quality and the state of the market Comparison method • US refers to sales comparison • UK refers to comparison in more general sense as it covers lease pricing as well as capital asset pricing • Comparison is both a method and a principle • Comparison method: – Collect and check evidence – Select and adjust value factors – Reconcile comparables and value subject property 4 Information needed for a comparable • In the light of the above, the valuer needs to know for each comparable. • Locational characteristics • Physical Characteristics • Lease terms (confirmation of terms form…) Type of transaction (new letting, rent review, lease renewal) Rent and any lease incentives (e.g. premiums, rent-free periods) User clauses Tenant fit-outs Service charges Security of tenure Repair obligations Insurance responsibility Example Question • Value an industrial property, S, with a GIA of 325 m2 • A comparable property, C (arm’s length transaction, similar age, condition, location, lease structure and design), has a GIA of 350 m2 – Purchased by an investor for £135,000 – New 15 year lease with 5 year rent reviews at a rent of £12,200 Answer • Devaluation (analysis of a comparable to extract unit of comparison) – Rental Value / m2 = rent / GIA = 12,200 / 350 = £34.85 per m2 – Yield = rental value / capital value = 12,200 / 135,000 = 9% • Valuation – Estimated Rental Value (ERV) of S = area x rental value / m2 = 325 m2 x £34.85 per m2 = £11,325 – Capital Value (CV) of S = ERV / yield = 11,325 / 0.09 = £126,000 Comparison metrics: yields and rents Attributes that might make one property different from another and explain differences in value could be put into three main groups (other groupings are possible) 1. 2. 3. Physical Structure, construction, size condition etc Locational factors, amenities, accessibility, transport Legal constraints, lease terms, planning The two key metrics for commercial real estate are rents and yields: • Rents – data more readily available. Analysis and adjustment is a key skill • Yields - sales are limited and often difficult to analyse especially if let at less then market rent Comparison Method RENTAL ANALYSIS 9 Rental Analysis Units of Comparison • To compare two or more properties we need a common unit of comparison • For rental values use floor area e.g. – Industrial -> Gross Internal Area (GIA) – Offices -> Net Internal Area (NIA) – Retails -> Area in Terms of Zone A (ITZA) – Farms -> Gross Area in hectares • Refer RICS Code of Measuring Practice • The rent for each comparable must be converted to a rent/m2. This can be done before or after adjustment for differences Adjustment of rent comparables • The comparable will need to be adjusted to allow for differences in location, physical factors and lease terms • Procedure is to adjust the rent actually agreed to a rent that might have been agreed if the comparable was in same location, was similar physically and had been let on the same terms as those that are to be assumed for the property to be valued • Must also consider type of transaction • • • new letting rent review lease renewal Adjustment of rent comparables: lease terms The lease terms that are likely to impact on the rent a tenant would offer include: • • • • • • • Lease length: may not have an enormous effect unless very different e.g. 1 year v 25 years Repair obligations and insurance responsibility: the more a tenant has to pay for repairs the less they can afford to pay in rent User clause/restrictions: in general, the greater the restriction on user the lower the rental value Review pattern/frequency/basis: in general, the longer the period between rent reviews, the more the tenant will offer Rent free periods, premiums and other lease incentives: trying to estimate effective rent from headline rents of comparables Security of tenure provisions Additional Benefits e.g. parking Different Review Patterns • The presumption is that a tenant will offer a different amount depending on the frequency of the rent reviews. • In general, the longer the period between rent reviews, the more the tenant will offer. • So if my comparable has 5 year rent reviews but the property I am valuing has 3 year rent reviews I will need to adjust the comparable rent - how do I do this? See handout and spreadsheet on FBEWeb • See Baum, Mackmin and Nunnington pp106-107 Rent Free Periods • A difficult area - various approaches • See Bond and Brown and compare with • www.voa.gov.uk/instructions/chapters/rating_manual/vol4/sect5/fra me.htm • See link from FBEWeb under comparables analysis • Remember we are trying to find the rent that the tenant would have paid if they had not agreed a rent free period Adjustment of rent comparables: comparables matrix Comp Adjustments Agreed Rent Adjusted Rent Rent per Sq.m. A Rent agreed one year ago, increase by 10% 20,000 22,000 120 B One year rent free period 30,000 27,000 100 C No adjustment 25,000 25,000 115 D 3 year review pattern 37,000 38,000 130 E No adjustment 45,000 45,000 112 Adjustment of rent comparables: the valuation • We now need a technique that enables us to take the information from the comparables and form an opinion of value. • Most valuers will go through a subjective thought process • ‘I think the property I am valuing (A) is better than comparable B because it (A) is newer than B’ • ‘A is not as good as C because C has Air Con and A does not’ • To help with this a comparable grid or matrix might be used which might involve ranking Adjustment of rent comparables: comparables matrix (ranked) Comp Attributes Rent per Sq.m. B You could have several columns one for each of the main attributes 100 E that you consider are significant determinants of value 112 C 115 A 120 D 130 Comparison Method: Rental Analysis A first floor office suite of 1,000 m2 has just been let at £15,000 per annum. The landlord is liable for maintaining the structure and the common parts and the insurance of the building. A service charge covers the cost of heating and lighting. The landlord’s liability amounts to £3 / m2. What is the net rent? Admissibility v. Weight of Evidence Recent Nearby Similar use Similar size Same type of tenure Similar covenant Similar condition Open market transaction importance • Some evidence may not be admissible e.g. ‘hearsay’ • Evidence which is closest to the subject property in terms of comparability will carry the greatest weight • Best comparable evidence is: Adjustment of rent comparables: summary • • • • • • Gather as much comparable data as possible Reject any inadmissible comparables Adjust remaining comparables to bring in line with subject property Convert to an appropriate unit of comparison E.g Office Rent Comparable = adjusted rent/NIA You will now have a list of comparables, their attributes and the rents/sq.m. Comparison Method YIELD ANALYSIS 21 Relationship between income and capital value: yield analysis • If investment property is sold and is let at market rent (MR) then (initial) yield = rent/price • If let at less than MR then – Initial yield = rent passing / price – Reversionary yield = MR/price – Can also calculate equivalent yield. See later… • Another way of writing that equation is Valuation – – = 50,000 x 1/0.07 = 50,000 x 14.2857 = 714,286 1/YIELD in the formula is known as the YEAR’S PURCHASE (YP) YP is a multiplier and is the inverse of the yield, it is the present value of £1 per annum 22 Yields: before the 1960s… MR 10,000 YP perpetuity @ 10%* Valuation 10 £100,000 *investor’s target return & therefore comparable with other investments • • • • Negligible growth, no rent reviews, no reversions Freehold valued at growth explicit yield at gilts + risk premium Valuation was a growth explicit (no growth) DCF assuming constant cash flow LH valued assuming static rent - dual rate allowed comparison with FH Yields: after the 1960s FRV 10,000 YP perpetuity @ 8%* 12.5 Valuation £125,000 *growth implicit ARY, not the target rate & not comparable with other investments • Capital & income growth, rent reviews, reversions • Target rate now depended on growth potential as well as opportunity cost and risk • Investors were prepared to accept lower returns today in expectation of higher returns in the future • FH valued at growth implicit ARY at gilts + risk premium - growth • LH can now have varying & geared profit rents Comparison Method: Rent and yield analysis • Value an industrial property with a GIA of 325 m2 • A comparable property, C (arm’s length transaction, similar age, condition, location, lease structure and design), has a GIA of 350 m2 – Purchased by an investor for £135,000 – New 15 year lease with 5 year rent reviews at a rent of £12,200 Comparison Method: Rent and yield analysis • Devaluation (analysis of a comparable to extract unit of comparison) – Rental Value/m2 = rent/GIA = 12,200/350 = £34.85/m2 – Yield = rental value/capital value = 12,200/135,000 = 9% • Valuation – Estimated Rental Value (ERV) of S = area x rental value/m2 = 325m2 x £34.85/m2 = £11,325 – Capital Value (CV) of S = ERV / yield = 11,325 / 0.09 = £126,000 ZONING 27 Comparison Method Zoning • Trading area nearest front of shop is most valuable • Areas are ‘zoned’ on the ground floor, and the value attributed to each zone is ‘halved back’ from front to rear • Area behind Zone C (the ‘remainder’) may be valued at a flat rate or £x/8psm • Return or rear frontage may affect value • Also, overall method and quantum allowance 7 m frontage Zone A 6m Zone B (valued at half Zone A) 6m Zone C (valued at quarter Zone A) 4m The Principle of ZONING • rental/capital value of shop is dictated by potential level of trade • significant trade is created by spontaneous “window shopping” • thus, the greater the ability to display goods the greater the potential for sales • this “display” potential must be reflected in value • look at these two shops:- Zoning • Used to measure standard retail properties • Reflects fact that trading area nearest the front is the most valuable 7 m frontage Zone A (£x / m2) Zone B (£x/2 / m2) Zone C (£x/4 / m2) 6.1m 6.1 m 4m The Principle of ZONING Both shops have identical floor area 10 m Which is most valuable? Shop 2 because it has a greater display potential 18 m 18 m 1 2 High Street 10 m The Principle of ZONING • So, how do we build in that difference in value? • Answer: we divide the shop into different “zones” of value: • In pre-metric days, these zones were 20’ deep. These days, valuers often use the nearest metric equivalent (6.1m), but different • The most valuable is the one next to the frontage, each subsequent zone is worth 50% of the previous one The Principle of ZONING Using 5m deep zones remainder C B 18m 1 2 10m A High Street The Principle of ZONING Shop 1 Shop 2 Zone A = 5 x 10 = 50 sq.m Zone A = 5 x 18 = 90 sq.m Zone B = 5 x 10 = 50 sq.m Zone B = 5 x 18 = 90 sq.m Zone C = 5 x 10 = 50 sq.m rem = 3 x 10 = 30 sq.m 10 m Let zone A = £1800/sq.m R C 18 m B 18 m 1 2 A High Street 10 m (approx £180/sq.ft) The Principle of ZONING Shop 1 The Valuation Zone A = 5 x 10 = 50 sq.m @ £1,800 = £ 90,000 pa Zone B = 5 x 10 = 50 sq.m @ £900 = £ 45,000 pa Zone C = 5 x 10 = 50 sq.m @ £450 = £ 22,500 pa rem = £ Shop 2 = 3 x 10 = 30 sq.m @ £225 Total rental value Zone A = 5 x 18 = 90 sq.m @ £1,800 6,750 pa £164,250 pa = £162,000 pa Zone B = 5 x 18 = 90 sq.m @ £ 900 = Total rental value £ 81,000 pa £243,000 pa The Principle of ZONING Rental value = £164,250 pa 18 m 1 2 Rental value = £243,000 pa High Street 10 m Zone A rents in West Region LOCATION Prime £/m2/ ann ZP 1 Secondary £/m2/ ann ZP 1 Bournemouth 2,000 1,600 Weymouth 1,200 700 Exeter 2,400 950 950 475 Plymouth 1,950 1,000 Truro 1,750 925 Taunton 1,600 700 Bath 2,650 1,300 Bristol 2,200 1,250 Gloucester 1,600 900 Swindon 2,100 1,000 Barnstaple Source VOA report – Jan 2008 Question • Using the zoning principle, calculate the rental value of the retail property shown. You should use a zone A rate of £1,400/sq.m and 6m deep zones. • Hint: Include all space in the “remainder” at the same rate/sq.m • Have a go! 26m 3m frontage Answer • • • • Zone A = 3m x Zone B = 3m x Zone C = 3m x Rem = 3m x 6m = 18sq.m @ £1,400/sq.m = £25,200 6m = 18sq.m @ £700/sq.m = £12,600 6m = 18sq.m @ £350/sq.m = £ 6,300 8m = 24sq.m @ £175/sq.m = £ 4,200 26m Rem C B • TOTAL RENTAL VALUE = £48,300pa A 3m frontage Question • Shop 2 has just been let for £63,000 pa. Analyse this transaction to find the value of Zone A. • Use this zone A rate to value shop 1 • Use 6m deep zones Try it…. 18m 18m 11 9m 22 4m 4m 12m 12m Answer 18 m • Analyse Shop 2 • Zone A = 4 x 6 = 24 sq.m @ £x/sq.m = 24 X • Zone B = 4 x 6 = 24 sq.m @ £0.5x sq.m = 12 X • • 1 9 m TOTAL area in terms of zone A(ITZA) = 36X let at £63,000 Therefore X (zone A rate) = £1750/sq.m/pa • Apply results to Shop 1 • Zone A = 9 x 6 = 54 sq.m @ £1,750/sq.m =£94,500 • Zone B = 9 x 6 = 54 sq.m @ £875/sq.m =£47,250 • Zone C = 9 x 6 = 54 sq.m @ £437.50/sq.m =£23,625 • TOTAL RENTAL VALUE =£165,375 pa 2 4m 12m Comparison Method: summary • Comparison is both a method and a principle • Comparison method: – Collect and check evidence – Select and adjust value factors – Reconcile comparables and value subject property • Need a good comparable evidence • Comparison metrics – – – – – Rent per square metre or zone A rent per square metre Investment yield Area ITZA Capital value Various YP factors for properties valued as operational entities (or value per bed, room, seat, etc.) – Land values