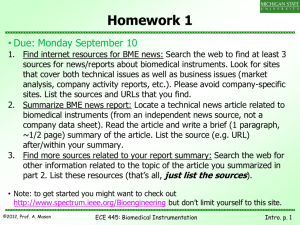

Yzaguirre Scharfhausen_BRUSELAS 24102007

advertisement

BME and MiFID Brussels, October 24 2007 Key operator in Europe 2007 european stock exchanges – Spain, 4th Exchange by size Billions € 3.043 2.906 2.670 1.272 1.395 1.049 1.025 696 Place 1o 2o 3o Turnover 944 523 4o 840 458 5o 6o Capitalisation > BME ranks 4th in equity turnover Source: federation of European Stock Exchanges (FESE). 30/04/2007 2 BME Versus Other Exchanges (capitalisation) € Mill. 22.000 20.000 18.000 16.000 14.000 12.000 10.000 8.000 6.000 4.000 2.000 EX HE L IS E X TS AQ SD O M E BM E LS AS X O T CB IC E E HK E CM X NA NY S E/ E DB NX T 0 Source: BME, 06/06/07 3 Source: FESE, Share Ownership Structure in Europe 4 Source: FESE, Share Ownership Structure in Europe 5 Three drivers for future 1. Liquidity 2. Technology 3. Cost 6 EVOLUTION 2007 / 2006 (SEPTEMBER) turnover and trades 75,00% 70,00% Turnover 65,00% Nº trades 60,00% 55,00% 50,00% 45,00% 40,00% 35,00% 30,00% 25,00% 20,00% 15,00% 10,00% 5,00% 0,00% BME BORSA ITALIA DEUTSCHE BORSE Euronext LSE OMX Turnover 54,36% 46,03% 57,54% 40,07% 43,23% 32,27% Nº trades 59,36% 32,25% 60,84% 45,07% 72,11% 53,78% Source: Borsa italiana, Deutsche Börse, Euronext, London Stock Exchange, OMX y BME. Turnover has been growing above the european average. SIBE turnover growth reaches 22% CAGR between 1999-2006 7 Spanish corporate dynamism Market capitalisation (bill. €) and euro zone ranking May 1996 May 2007 Telecomunic. 9 #4 6 #11 6 #10 7 #4 83 Top 8 : 46.0 bill. € Mket. cap. 21.6 bill.€ Turnover (jan.-may.) Banks Oil & Petrol 10 Utilities 67 #5 Top 8: #3 407.8 bill. € Mket. cap. 29 #1 468.9 bill. € Turnover 14 #3 (jan-may.) 50 #5 2 0 15 30 #6 #6 42 n.a. Transport #1 #3 33 #7 6 Textile /Distrib. 89 #1 45 60 75 0 30 60 90 120 > Spanish companies have increased significantly their international presence through M&A, multiplying by nine the market cap and by more than twenty the turnover since 1996 Source: Bloomberg 8 Highly liquid market spanish blue chips are the stocks with highest liquidity at UEM RK. Company January-Jul 2007 Daily Average Value (€ Bn.) Value (€ Bn.) Relative Weight in EuroStoxx50 (%)(1) 1 174,8 1,18 3,86% 2 151,4 1,02 3,31% 3 141,2 0,95 2,86% 4 117,7 0,80 2,90% 5 106,0 0,73 2,81% 6 104,5 0,71 3,50% 7 100,4 0,68 3,00% 8 98,9 0,67 3,12% 9 97,8 0,67 3,69% 10 90,1 0,61 0,82% 16 70,1 0,47 1,74% 25 49,8 0,34 0,98% Source: Bloomberg (1) As of 07/31/07 9 Equity market: High growth in turnover Equity Turnover (SIBE) > Highest-ever trading volumes on equity market (+61,6%) Billion € > Record order volumes for a single trading day (28 feb) > Technological capacity of SIBE increased threefold in January 1.153,5 859,3 850,4 > Consolidation of MAB as the market for SICAVs 636,9 531,9 494,3 2003 > Advanced in the launch and trading of ETFs > Record number of processed orders in 1Q 2007 : 19.2 Mill. (up +48.1 % from 1Q 2006) 2004 2005 2006 1S/06 1S/07 Source: BME 10 Spanish market historical growth “mid-caps” contribution to the increasing turnover Mid and small market cap turnover Turnover, excluded top ten stocks (bill.€) 288,9 194,4 170,7 122,0 81,1 18,4% 19,5% 19,2% 2002 2003 2004 (*) Jan. - May. 07 39,2% 96,6 43,6% 22,9% 2005 2006 2007(*) % total shares traded > Several spanish “mid-caps” are actively investing abroad and issuing shares in order to finance non-organic growth. Source: BME 11 Highly liquid market BME: The Principal Market for Spanish Shares Weight of trading in Spanish Shares abroad versus total traded in BME 13,63% % 7,50% 5,90% 5,20% 2,80% 1995 1996 1997 1998 2,40% 1,60% 1999 2000 2001 1,30% 0,80% 0,60% 0,60% 0,56% 2002 2003 2004 2005 2006 (1) > BME’s solid background and high liquidity makes BME the principal market for Spanish stocks > During last years, BME has preserved and expanded spanish shares trading Source: BME (1) Increase due to Terra Networks Nasdaq’s listing 12 13 International comparative of liquidity European indexes Efective Spreads 0,450% 0,400% FOR EACH INDEX: 0,350% FIRST COLUMN: EFECTIVE SPREAD OF THE INDEX. SECOND COLUMN: EFECTIVE SPREAD OF THE 30 MOST LIQUID STOCKS OF EACH INDEX. 0,300% 0,250% 0,200% 0,150% 0,100% 0,050% 0,000% Alemania (DAX 30) España (IBEX 35) Francia (CAC 40) Italia (MIB 30) Reino Unido (FTSE 100) HO RQ UILLA INDICE 0,183% 0,191% 0,196% 0,184% 0,407% HO RQ UILLA 30 VALO RES > PO NDERACIO N 0,183% 0,185% 0,190% 0,184% 0,317% 14 State-of-the-Art Technology Competitive and In-House Developed Technology Reliable Competitive Pioneer In-house > High performance; above 99.9% of availability > Full on-line, back up systems > Equity platform capacity increased three fold (January 2007) > Capacity to absorb growing trading volumes > Increasing sales of BME’s in-house systems > BME was the first international stock market to interconnect different stock exchanges (Madrid, Barcelona, Bilbao and Valencia) in 1989 > In-house development: I) providing IT solutions for the entire value chain II) flexibility: fully customised, quick update and risk prevention 15 Competitive Fee Structure Exchange Fees By Country 2006 Exchange Fees By Country 2006 0.6 Basic Points 0.5 0.47 0.38 0.4 0.52 0.51 0.46 0.39 0.40 Spain Canada 0.42 0.3 0.2 0.1 0 France Germany Italy U.K. Sells U.S.A. NYSE U.S.A. NASDAQ Source: Institutional Investor & Elkins/McSherry 16 Fees Comparison Exchange Fees By Country 2006 (< 1 Basic Point) 1 0.9 0.9 0.8 0.69 0.68 0.67 0.66 0.65 0.6 0.54 0.52 0.5 0.51 0.4 0.47 0.46 0.42 0.42 0.4 0.4 0.39 0.38 0.38 0.32 0.3 0.3 0.16 0.2 0.09 0.1 0.01 ly a U. nc S. e -NY SE A U. rge nt S. in -a Na sd aq Ca Ne n ad a th er la nd s Sp a Ge in Ir rm el an an y d -Se lls J ap Ne an w Ze L u ala n xe m d bo ur Po g rt ug a No l rw ay M ex ico 0.05 Fr It a lia Fi n Sw lan d i tz er la n Sw d ed en Au st r De i a nm ar k Be l g U. i K. u m -Se lls 0 Au st ra Basic Points 0.7 Source: Institutional Investor & Elkins/McSherry 17 Fees Comparison Total Cost By Country 2006 (< 35 Basic Point) Market Impact 40 Exchanges Fees 35 Average commissions 30 25 20 15 10 5 0 l k m ls a n nd lia ay ar ga iu el tri de u w la g S s ra l m t r e t a r n s -Au Be No Ze Sw Po d De Au n w a el Ne Ir ly nd la r e i tz w S a It y E s ls n e a aq an ai el an nd YS nc ad d p S a s a N n lr a Sp J rm Fr Na -Ca .he Ge K t . S. e . . U N U S U. Source: Institutional Investor & Elkins/McSherry 18 MiFID aspects for Exchanges > Pre Trade Transparency > Post Trade Transparency > Best Execution (for Investment Services Firms) > Transaction Reporting (special requirements for CNMV) > Orders large in scale > Deferred publication of Blocks > Competitors: Sistematic Internalisers and MTFs 19 BME and MiFID Excellent relation liquidity, cost and technology Strong Competitive position in Best Execution STP process in trading+settlement Risk in market fragmentation due to new competitors IS and MTFs But also new oportunities in data information, market access and client servises. 20