GDP ppt - Alvin ISD

advertisement

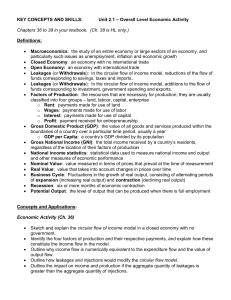

The measures were developed in the 1930’s. Originally the Gross National Product (GNP) was used. Since the 1990’s the GDP has been the official measure. The GDP is measured quarterly. Gross-total before adjustments. National-Production owned by U.S companies Domestic-production in the U.S, even if foreign owned. GDP defined is the total value of all final goods and services produced in a given year. It includes all goods and services citizen or foreign supplied in the USA. GDP measurement is a monetary amount Why? As the GDP of an economy increases, we have economic growth, and is a tracking of long term economic growth. Limitations: does not measure quality of life, leisure time, crime, economic variables. The Income approach: W+R+I+P+Sa=GDP W=wages, compensation R=rents, lease payments I=interest, savings and bond payments P=profits, corporate income tax, dividends and undistributed corporate profits Sa=statistical adjustments-Indirect business taxes(sales, excise, property, customs, licenses, duties), consumption of fixed capital(CFC) is depreciation, net foreign income. The expenditure approach: C+Ig+G+Xn=GDP C=personal consumption of finished goods and services Ig=gross private business investment, construction of new houses, factory equipment G=government Xn=net foreign factor of trade (exports-imports) if Xn is negative, a trade deficit exists Used goods, secondhand sales Gifts, transfer payments(social security, welfare, veterans payments) Stock equity and securities purchased. Unreported business activities done for cash. Illegal, black market activities. Financial transactions between banks and business “intermediate goods” ‘non-market’ activities-volunteer or family work. We only want to count things once!!!!!!!! Leakages are uses of household income not used for consumption in the GDP. Leakages are losses of $$$$ Leakages include: Taxes-government Saving Imports-income created by one economy to purchase output form another. Injections (money into economy) are expenditures by either: Government, Business or foreign sectors on domestic goods and services. This includes exports which inject money (when the dollar is weak on the world market, exports increase because American goods are cheaper.) The government can spend the taxes it collects by making government purchases. Business spends profits on investment, but can retain some profits and capital consumption for later use.