Allocate Profit

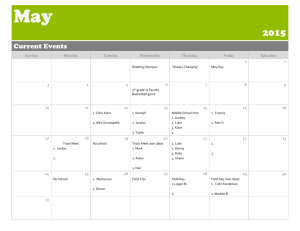

advertisement

Learning Objective 4 Make calculations and journal entries for the operation of partnerships. 10-1 Accounting for Operations of a Partnership • Partners’ accounts ■ Capital accounts ● ● Used to record the initial investment of a partner, any subsequent capital contributions, profit or loss distributions, and any withdrawals of capital by the partner Deficiencies are usually eliminated by additional capital contributions Capital Investment Contributions % Loss % Profit 10-2 Accounting for Operations of a Partnership • Partners’ accounts ■ Drawing accounts ● ● ■ Used to record periodic withdrawals and is then closed to the partner’s capital account at the end of the period Noncash drawings are valued at their market values at the date of the withdrawal Loan accounts ● ● A loan from a partner is shown as a payable on the partnership’s books Unless all partners agree otherwise, the partnership is obligated to pay interest on the loan 10-3 Practice Quiz Question #3 Which of the following would result in a reduction to a partner’s capital account? a. The initial investment. b. The allocation of a profit. c. Additional capital contributions. d. A withdrawal. e. A loan to a partner. 10-4 Practice Quiz Question #3 Solution Which of the following would result in a reduction to a partner’s capital account? a. The initial investment. b. The allocation of a profit. c. Additional capital contributions. d. A withdrawal. e. A loan to a partner. 10-5 Learning Objective 5 Make calculations and journal entries for the allocation of partnership profit or loss. 10-6 Income Allocation Example Assume that in its first year of operation, B&S partnership earns $162,000 of income. What journal entry would B&S make to allocate the profits between the two partners? Profit & Loss Summary 162,000 Capital, Brian 81,000 Capital, Spencer 81,000 10-7 Sharing Profits and Losses • Partners can share profits and losses in any way they choose. • Possible ways include ■ ratios. ■ salary allowances and ratios. ■ imputed interest on capital, salary allowances, and ratios. ■ capital balances only. ■ performance methods. 10-8 Group Exercise 1: Allocating Profit and Loss, No Restrictions The partnership of Alex and James has the following provisions: • Alex and James receive salary allowances of $37,000 and $18,000, respectively. • Interest is imputed at 10% on the average capital investment. • Any remaining profit or loss is shared between Alex and James in a 3:2 ratio, respectively. • Average Capital investments: Alex, $ 50,000; James, 130,000 REQUIRED 1. Prepare a schedule showing how the profit would be divided, assuming the partnership profit or loss is: a. $ 102,000 b. $ 57,000 c. $(34,000) 2. What journal entry should be made to allocate the profit or loss for each of the three cases listed above? 10-9 Group Exercise 1: Solution for part a ALLOCATED TO Alex James Total Profit Salary Interest on Capital Residual Profit Allocate Profit 37,000 5,000 18,000 13,000 17,400 59,400 11,600 42,600 Income Summary 102,000 Capital, Alex Capital, James Total 102,000) (55,000) (18,000) 29,000 (29,000) 0 59,400 42,600 10-10 Group Exercise 1: Allocating Profit and Loss, No Restrictions The partnership of Alex and James has the following provisions: • Alex and James receive salary allowances of $37,000 and $18,000, respectively. • Interest is imputed at 10% on the average capital investment. • Any remaining profit or loss is shared between Alex and James in a 3:2 ratio, respectively. • Average Capital investments: Alex, $ 50,000; James, 130,000 REQUIRED 1. Prepare a schedule showing how the profit would be divided, assuming the partnership profit or loss is: a. $ 102,000 b. $ 57,000 c. $(34,000) 2. What journal entry should be made to allocate the profit or loss for each of the three cases listed above? 10-11 Group Exercise 1: Solution for part b ALLOCATED TO Alex James Total Profit Salary Interest on Capital Residual Profit Allocate Profit 37,000) 18,000) 5,000) 13,000) (9,600) (6,400) 32,400) 24,600) Income Summary 57,000 Capital, Alex Capital, James Total 57,000) (55,000) (18,000) (16,000) 16,000) 0) 32,400 24,600 10-12 Group Exercise 1: Solution for part c ALLOCATED TO Alex James Total Profit Salary Interest on Capital Residual Profit Allocate Profit 37,000) 18,000) 5,000) 13,000) (64,200) (42,800) (22,200) (11,800) Capital, Alex 22,200 Capital, James 11,800 Income Summary Total (34,000) (55,000) (18,000) (107,000) 107,000) 0) 34,000 10-13 Methods to Share Profits and Losses: “To the Extent Possible” Limitations • When a “limit” provision exists: ■ The next lower level method of sharing can be reached if and only if there is still unallocated profit remaining after dealing with the current level. 10-14 Group Exercise 2: Allocating Profit and Loss— “Limit” Assume the same information provided in Group Exercise 1, except that the partnership agreement stipulates the following order of priority: 1.Salary allowances (only to the extent available) 2.Imputed interest on average capital investments (only to the extent available). 3.Any remaining profit in a 3:2 ratio. (No mention is made regarding losses.) REQUIRED: The requirements are the same as for Group Exercise 1 (i.e., calculate the allocations and prepare journal entries). a. $ 102,000 b. $ 57,000 c. $ (34,000) 10-15 Group Exercise 2: Solution for part a ALLOCATED TO Alex James Total Profit Salary Interest on Capital Residual Profit Allocate Profit 37,000) 18,000) 5,000) 13,000) 17,400) 11,600) 59,400) 42,600) Income Summary 102,000 Capital, Alex Capital, James Total 102,000) (55,000) (18,000) 29,000) (29,000) 0) 59,400 42,600 10-16 Group Exercise 2: Solution for part b ALLOCATED TO Alex James Total Profit Salary Interest on Capital * Residual Profit Allocate Profit 37,000) 18,000) 556) 1,444) 0) 37,556) 0) 19,444) Total 57,000) (55,000) 2,000) (2,000) 0) 0) 0) * $2,000 x (5,000 ÷ $18,000) = 556 $2,000 x ($13,000 ÷ $18,000) = 1,444 Income Summary 57,000 Capital, Alex Capital, James 37,556 19,444 10-17 Group Exercise 2: Solution for part c In this case, the partnership agreement is vague. An argument can be made for allocating the loss equally pursuant the UPA 1997 because the partnership agreement is silent with respect to losses. Alternatively, we could presume that losses were intended to be shared in the residual profitsharing ratio. In these cases, the accountant should seek clarification from each partner. 10-18 Practice Quiz Question #4 Matt and Chad created a partnership (M&C) on 12/31/X8 (sharing profits 50/50). Matt contributed equipment from his sole proprietorship having a carrying value of $4,000 and a fair value of $8,000. In 20X9, M&C had profits of $96,000 and borrowed $20,000 from a bank. In 2009, Matt withdrew $35,000 cash. Matt’s Y/E capital balance is a. $11,000. b. $17,000. c. $21,000. d. $56,000. 10-19 Practice Quiz Question #4 Solution Matt and Chad created a partnership (M&C) on 12/31/X8 (sharing profits 50/50). Matt contributed equipment from his sole proprietorship having a carrying value of $4,000 and a fair value of $8,000. In 20X9, M&C had profits of $96,000 and borrowed $20,000 from a bank. In 2009, Matt withdrew $35,000 cash. Matt’s Y/E capital balance is a. $11,000. b. $17,000. c. $21,000 ($8,000 + $96,000/2 - $35,000) d. $56,000. 10-20