Fiscal Federalism

advertisement

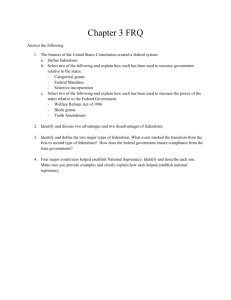

Fiscal Federalism The national Gov.’s patterns of spending, taxation, and providing grants to influence State and local Gov.’s -The national Gov. uses fiscal policy to influence the states through granting or withholding money to pay for programs. (kind of like being whipped) Fiscal Federalism Grant-in-aid -Money and resources provided by the Gov. to fund specific programs or projects. EX: building canals, public works, roads, railroads, and land grants for colleges Fiscal Federalism Categorical Grants -Grants that have a specific purpose, such as sewage treatment facilities or school lunch programs - May require “Matching Funds” from state or local Gov.’s -May be in the form of project grants (awarded on the basis of a competitive application, such as university research grants) - Formula Grants (such as Medicaid) Fiscal Federalism Block Grants -Grants which can be used for a variety of purposes within a broad category, such as education, health care, or public services -Preferred over categorical grants because there's fewer strings attached so state and local Gov. have more freedom in how money is spent Fiscal Federalism Revenue Sharing -A “No Strings Attached” form of aid to state and local Governments -Proposed by the Johnson administration and popular during the Nixon Administration -Could be used for virtually any project but never exceeded more than two percent of revenues - Eliminated during the Reagan administration Fiscal Federalism Mandates -Requirements which are imposed by the National Government on the state and local Gov. -The Americans with Disabilities Act (1990) mandates that all public buildings be accessible to persons with disabilities. -After the mid-term elections of 1994, the Republican-controlled Congress passed the Unfunded Mandate Reform Act, which imposed limitations on Congress’s ability to pass unfunded mandate legislation