IFTA – Considerations for Dual Fuel Vehicle Tax Reporting

advertisement

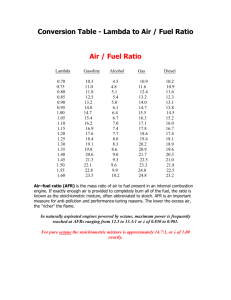

INTERNATIONAL FUEL TAX AGREEMENT IFTA – DUAL FUEL VEHICLE TAX REPORTING Annual IFTA Business Meeting August 21, 2013 Reno, NV Presented by DUAL FUEL WORKING GROUP Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Overview • Dual Fuel Vehicles - 101 • Recommended Reporting Process • Full-Track Ballot #03-2013 Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Dual Fuel Vehicles - 101 • A dual fuel vehicle can use two fuels (e.g., diesel and natural gas at the same time) • Two types of natural gas • Liquefied Natural Gas (LNG): – Natural gas stored as a super-cooled liquid (e.g., -260°F or -170°C) – Energy content comparable to gasoline and diesel fuels – Expect will be used more for long-haul runs – Almost always sold as a liquid measure (e.g., gallons or liters) Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Dual Fuel Vehicles - 101 • Two types of natural gas (continued) • Compressed Natural Gas (CNG) – Natural gas stored as a gas in high-pressure tanks (e.g., 3,000 to 3,600 psi – Lower energy content compared to gasoline and diesel fuels – Often sold as a gaseous measure (e.g., ft3 or m3) Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Dual Fuel Vehicles - 101 • How they operate: • Can operate solely on diesel but not natural gas • At idle and low load conditions the engine burns mostly diesel • At full load, the engine burns up to 95% natural gas (diesel is used solely to trigger combustion) • Overall the same power and performance of normal diesel engines Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Dual Fuel Vehicles - 101 • Why is this engine technology being developed and used: o Significantly lower cost fuel compared to diesel o Environmentally friendly (lower truck emissions) o Domestic supply – less concern about future world price and availability compared to other fuels Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Dual Fuel Vehicles - 101 INTERNATIONAL FUEL TAX AGREEMENT • Challenges • Infrastructure: – Fueling stations with equipment to cool the gas; and – Distribution / fuel supply availability along transportation corridors for long haul trucks • Weight and space considerations (e.g., extra engine components and different fuel tanks capable of keeping LNG cool until used which reduce load-carrying capacity) Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT • Why is this important to IFTA • Anticipate at least 5% of long haul vehicles will be dual fuel within the next 5 years • IFTA tax return was built for reporting one fuel type per vehicle, and we need to agree on a new process to ensure a fair and consistent distribution of taxes Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Questions / Discussion Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Recommended Reporting Process • Considerations: – Accuracy (but not vehicle specific) – Easy to understand (government and industry); – Easy to implement (e.g., integrate into existing systems used by government and industry); and – Easy to audit Celebrating 30 Years of Cooperation and Trust 1983 - 2013 10 INTERNATIONAL FUEL TAX AGREEMENT Recommended Reporting Process • Observations: 1. IFTA is not a perfect reporting system (we accept average fuel consumption for all jurisdictions travelled). 2. IFTA documents are generally silent on how to calculate taxable distances and fuel use Celebrating 30 Years of Cooperation and Trust 1983 - 2013 11 INTERNATIONAL FUEL TAX AGREEMENT Recommended Reporting Process 3. New technology is impacting on IFTA: • New fuel types • New engine types • Onboard devices to track the amount of each fuel used in each jurisdiction are available. However: • Their accuracy needs to be verified • They should not be used since consumption rates under IFTA are an average based on distance and purchase records over a quarter. (Unless we want to change the entire IFTA reporting process) Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Recommended Reporting Process • At a high level: – Dual fuel vehicles must be treated and reported separately (e.g., gasoline fleet, diesel fuel fleet, LNG fleet, dual fuel fleet) – Duel fuel vehicles must be treated and reported as two vehicles: • Separately reporting the distances travelled and fuel purchased • Pro-rating the distances to avoid double counting Fleet Type Pure Diesel Dual Fuel Fuel Type IFTA Return or Return Line Actual Distance Travelled Distances Reported Diesel “D” Return #1 100 100 Diesel “dD” Return #2 100 (pro-rated) 25 LNG “dL” Return #3 (pro-rated) 75 INTERNATIONAL FUEL TAX AGREEMENT Recommended Reporting Process • Dual vehicle distances are pro-rated based on their fuel purchases: dD Distance = Total Distance Travelled * Diesel purchase Total (Diesel + LNG) purchases dL Distance = Total Distance Travelled * LNG purchases Total (Diesel + LNG) purchases Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Recommended Reporting Process Assumptions Total Distance dD (gallons) dL (gallons) Total Fuel J1 8,000 500 J2 2,000 - 1,000 1,000 10,000 500 1,000 1,500 Total - 500 No exempt distances were traveled in either jurisdiction. Calculate MPG Total Distance Total Fuel 10,000 MPG 1,500 Prorate Distances by Jurisdiction Between Fuel Types 6.67 Total Fuel Fuel by Type dD Ratio 500 0.3333 1,000 0.6667 1,500 dL Total Distance Total J1 8,000 J2 2,000 10,000 Ratio 0.3333 0.6667 0.3333 0.6667 (dD) (dL) (dD) (dL) Prorated Distance 2,667 5,333 667 1,333 10,000 15 Recommended Reporting Process • • Pro-rating more complicated if a carrier has exempt distances Developed and tested worksheet which can be used to accurately prorate the “Total Distance” and “Taxable Distance” between fuel types. Pro-Rating Worksheet These fields auto-populate and then transferred to the appropriate dD and dL form/return for each jurisdiction TOTAL DISTANCE TRAVELLED EXEMPT DISTANCE TRAVELLED Total Distance dD Portion J1 8,000 0 2,667 0 2,667 5,333 0 5,333 J2 2,000 0 667 0 667 1,333 0 1,333 Total Miles 10,000 0 3,333 0 3,333 6,667 0 6,667 Exempt Distance Txbl Distance dD Portion Total Distance dL Portion Txbl Distance dL Portion Exempt Distance Recommended Reporting Process Dual Fuel Vehicles – Diesel Fuel Type Jurisdiction Average MPG Total Distance Txbl Distance Txbl Volume Tax Paid Volume Net Txbl Volume 6.67 Tax Rate Tax Due dD J1 2,667 2,667 400 500 -100 0.2000 -$ 20.00 dD J2 667 667 100 0 100 0.1000 $ 10.00 3,333 3,333 500 500 0 -$ 10.00 Sub-total Dual Fuel Vehicles – LPG Fuel Type Jurisdiction Average MPG Total Distance Txbl Distance Txbl Volume Tax Paid Volume Net Txbl Volume 6.67 Tax Rate Tax Due dL J1 5,333 5,333 800 0 800 0.0500 $ 40.00 dL J2 1,333 1,333 200 1,000 -800 0.1000 -$ 80.00 6,667 6,667 1,000 1,000 0 -$ 40.00 10,000 10,000 1,500 1,500 -$ 50.00 Sub-total TOTAL DUAL-FUEL VEHICLES INTERNATIONAL FUEL TAX AGREEMENT Questions / Discussion Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT • Purpose: – Introduce a standard for converting CNG sold in a gaseous measure to a liquid measure (e.g., ft3 to gallons, and m3 to liters) – Ensure a fair and consistent process for reporting and disbursement of taxes between jurisdictions Notes: – This ballot is specific to CNG (i.e., LNG always sold as a liquid measure) – Jurisdictions conversion rates for CNG vary considerably Celebrating 30 Years of Cooperation and Trust 1983 - 2013 19 CNG Conversion Rates Wikipedia 100,000 Conversion (Divide by) 126.67 Alternative Fuels website IRS 100,000 126.67 789 100,000 126.67 789 Oklahoma 100,000 126.67 789 Kansas 100,000 120 833 Montana 100,000 120 833 Minnesota 100,000 114.1 876 Oregon 100,000 (Multiply by) 0.01 1,000 California 100,000 100 1,000 Connecticut 100,000 (Multiply by) 0.012 1,200 Pennsylvania 100,000 (Multiply by) 0.0314 3,140 State/Source Cubic Feet Gallon (Gasoline Equivalent) 789 Source – FTA Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT • Observations: – There is no impact to sovereignty: • A method for restating volumes of CNG and jurisdiction’s tax rate into a different but common unit or measure for use by other IFTA jurisdictions.. • Almost identical to Procedures Manual Section P1300 to convert tax rates and volume measurements between U.S. and Canadian jurisdictions. Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT – By way of an example: • BC's tax rate is converted through a two-part process for IFTA reporting purposes (i.e., litres to gallons, and Canadian currency to US currency) • The result is BC’s tax of 0.2267 cents per litre for diesel set by our legislature is restated to 0.8398 cents per gallon • IFTA has not forced BC to change its tax rate, BC/IFTA are simply restating BC’s tax rate for others to ensure the correct reporting and distribution of taxes between IFTA jurisdictions Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Ballot #03-2013 • What happens if we use different conversion rates? Assumptions Miles dD (gallons) Jurisdiction 1 8,000 500 Jurisdiction 2 Total 2,000 10,000 500 CNG Purchased (ft3) Conversion Factors dC (gallons) 1,000 1,000 dC (gallons) 126,760 126.76 1,000.00 126,760 100.00 1,267.60 Total Fuel 500 1,000 1,500 Ballot #03-2013 • What happens if we use different conversion rates? Total Miles dD Purchased dC Purchased Total Fuel MPG 10,000 500 1,000 1,500 6.67 10,000 500 1,276 1,768 5.66 Miles Jurisdiction 1 8,000 Jurisdiction 1 (at 100 ft3) 8,000 Jurisdiction 2 2,000 Jurisdiction 2 (at 100 ft3) 2,000 Ratio Prorated Distances 0.3333 0.6667 0.2829 0.7171 (dD) (dC) (dD) (dC) 2,667 5,333 2,663 5,737 0.3333 0.6667 0.2829 0.7171 (dD) (dC) (dD) (dC) 667 1,333 566 1,434 Ballot #03-2013 dC @ 126.75 ft3 Total Distance Taxable Distance Taxable Fuel Volume Tax Paid Volume Net Taxable Volume Fuel Type Jurisdiction dC J1 5,333 5,333 800 0 800 0.0500 40.00 dC J2 1,333 1,333 200 1000 (800) 0.1000 -80.00 6,667 6,667 1,000 1000 0 10,000 10,000 1,500 1500 Subtotal TOTAL FOR BOTH FUELS Tax Rate Tax Due -40.00 (50.00) dC @ 100ft3) Taxable Fuel Volume Tax Paid Volume Net Taxable Volume Jurisdiction dC J1 5,737 5,737 1,014 0 1,014 0.0500 50.70 dC J2 1,434 1,434 254 1,268 (1,014) 0.1000 -101.41 7,171 7,171 1,268 1000 0 10,000 10,000 1,768 1500 Subtotal TOTAL FOR BOTH FUELS Total Distance Taxable Distance Fuel Type Tax Rate Tax Due -50.70 (60.70) $ Difference -$10.70 % Difference 21.4% 25 Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT • Next Steps: (Assuming the ballot passes) – Jurisdictions with different conversion rates instruct their carriers, solely for IFTA reporting purposes, to either restate: 1. CNG tax rates/volumes purchased at 100 ft3 (or something else) to rates/volumes at 126 ft3; or 2. CNG tax rates/volumes purchased at 126 ft3 (or something else) to CNG tax rates/volumes at 100 ft3 and then the jurisdiction convert to 126 ft3 for its transmittal purposes. Celebrating 30 Years of Cooperation and Trust 1983 - 2013 26 Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT Notes: • Option #2 will completely address the sovereignty issue. • Either option requires carriers to know what conversion rate is being used by fuel sellers in each jurisdiction they purchase CNG in, and carriers will be required at some point to convert of their purchases: – To a common standard; or – From a common standard to their base jurisdiction’s standard (if different). • Next Steps: – There were several constructive suggestions which the Working Group will be adding Celebrating 30 Years of Cooperation and Trust 1983 - 2013 27 Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT Article R200: Add definitions of Gallon and of Liter, as applied to CNG: • R222 Gallon, as applied to compressed natural gas, means a quantity of compressed natural gas equal to 126.67 cubic feet of natural gas at 60 degrees Fahrenheit and one atmosphere of pressure. In the alternative, Gallon, as applied to compressed natural gas, means a quantity of compressed natural gas that weighs 5.66 pounds. • R237 Liter, as applied to compressed natural gas, means a quantity of compressed natural gas equal to 1.0 cubic meters of natural gas at 15 degrees Celsius and one atmosphere of pressure. In the alternative, Liter, as applied to compressed natural gas, means a quantity of compressed natural gas that weighs 0.7316 kilograms. (No Changes) Celebrating 30 Years of Cooperation and Trust 1983 - 2013 Ballot #03-2013 Article P700: Add to P730 CONVERSION RATES AND MEASUREMENTS: A note referring to the new definition of a gallon and a liter of CNG: • P730 CONVERSION RATES AND MEASUREMENTS When the membership includes a member jurisdiction other than a U.S. jurisdiction, conversion rates and measurements must be printed on all standard tax returns or instructions provided with tax returns. If the conversion rates and measurements are not printed on the tax returns, or if specific instructions including those conversion rates and measurements are not included with tax returns, either the IFTA, Inc. web-site or the base jurisdiction’s web-site shall be referenced on the tax return instructions, provided those sites contain the current conversion rates and measurements. (See IFTA Articles of Agreement Section R222 regarding the definition of a gallon of compressed natural gas, and R237 regarding the definition of a liter of compressed natural gas. Also see Procedures Manual Section P1300 regarding conversion rates and measurements between U.S. and Canadian jurisdictions.) (Green signifies no longer a strike through) Ballot #03-2013 INTERNATIONAL FUEL TAX AGREEMENT Article P1300: Delete section: P1320 FUELS NOT MEASURED IN LITERS OR GALLONS: • P1320 FUELS NOT MEASURED IN LITERS OR GALLONS • For reporting fuels that cannot be measured in liters or gallons (e.g., compressed natural gas), the licensee shall report the fuel in the units of measurement employed by the jurisdiction in which the fuel was used. (No Changes) Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Questions / Discussion Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Dual Fuel Working Group IFTA: Hugh Hughson (BC) Paul Bernander (WI) Tim Ford (CA) Dawn Lietz (NV ) Garry Hinkley (MI) Chuck Ulm (MD) Industry: Robert Pitcher (ATA) Gary Bennion (Con-Way) FTA: Cindy Anders-Robb IFTA, Inc. Advisors: Lonette Turner Amanda Koeller Celebrating 30 Years of Cooperation and Trust 1983 - 2013 INTERNATIONAL FUEL TAX AGREEMENT Thanks! Celebrating 30 Years of Cooperation and Trust 1983 - 2013