Lecture 19 Problems

advertisement

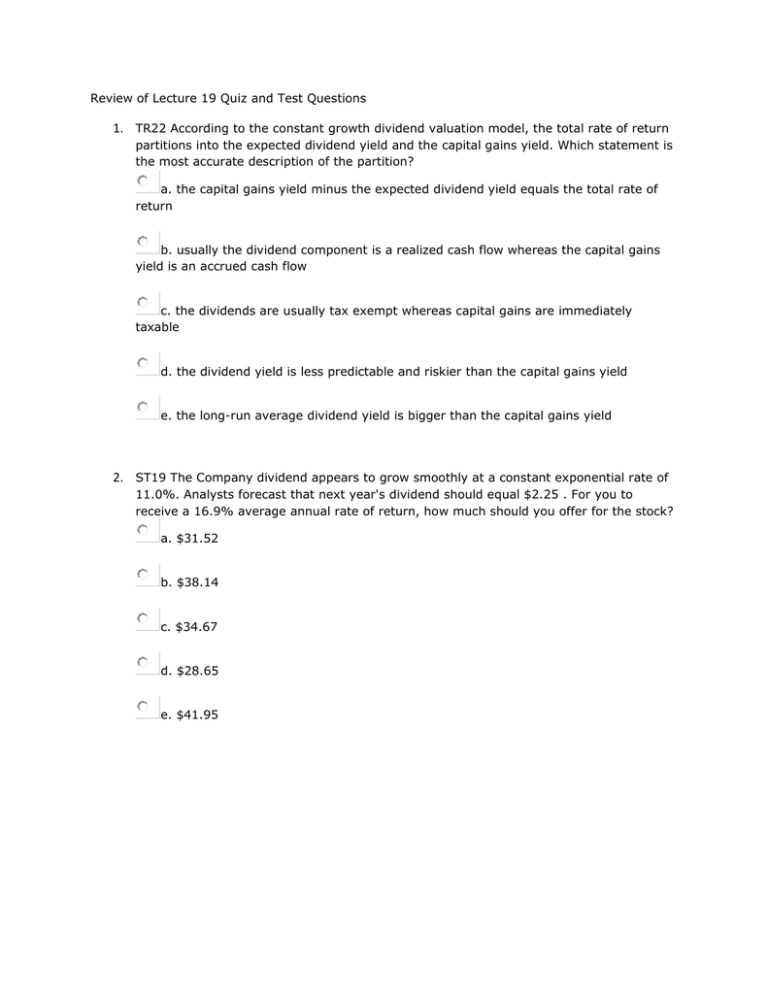

Review of Lecture 19 Quiz and Test Questions 1. TR22 According to the constant growth dividend valuation model, the total rate of return partitions into the expected dividend yield and the capital gains yield. Which statement is the most accurate description of the partition? a. the capital gains yield minus the expected dividend yield equals the total rate of return b. usually the dividend component is a realized cash flow whereas the capital gains yield is an accrued cash flow c. the dividends are usually tax exempt whereas capital gains are immediately taxable d. the dividend yield is less predictable and riskier than the capital gains yield e. the long-run average dividend yield is bigger than the capital gains yield 2. ST19 The Company dividend appears to grow smoothly at a constant exponential rate of 11.0%. Analysts forecast that next year's dividend should equal $2.25 . For you to receive a 16.9% average annual rate of return, how much should you offer for the stock? a. $31.52 b. $38.14 c. $34.67 d. $28.65 e. $41.95 3. ST8 The company just paid its annual dividend of $3.00 . You believe the dividend will grow perpetually at 7.2% per annum. Today's price-to-earnings ratio is 10.7 and the payout ratio always equals 60%. You assess intrinsic value with a 14.8% discount rate. Find the one-year rate of return from buying the stock today and holding it one year, given that next year's share price converges to next year's intrinsic value. a. -6.3% b. -8.4% c. -7.6% d. -6.9% e. -9.2% 4. TR40 The dividend growth valuation model equates a stock's intrinsic value to the discounted sum of the perpetual and smoothly growing dividend stream. The relation between the dividend growth rate (g) and the discount rate (r) is very important. Which statement accurately describes that relation? a. When g equals zero percent then the stock's intrinsic value computes as the present value of a perpetuity, div/r. b. When g exceeds r then the stock's intrinsic value tends to infinity, meaning the stock is priceless. c. The stock's intrinsic value is a decreasing function of the discount rate r. d. Two choices, A and C, are correct e. The three A-B-C choices are all correct 5. TR18 The dividend growth valuation model equates intrinsic value to the discounted sum of the perpetual and smoothly growing dividend stream. When the dividend growth rate (g) exceeds the discount rate (r) the formula gives an intrinsic value that is a negative number. Determine whether the following interpretation of the preceding fact is TRUE or FALSE: the stock's intrinsic value means the stock is worthless. True False 6. ST16 A share of company stock just paid its annual dividend of $8.40. Exactly 5 years ago the dividend was $7.18. Your analyst tells you the stock's expected dividend yield is 4.8%. You believe the constant growth dividend valuation model applies perfectly to this properly valued stock. Find (i) the expected total rate of return and (ii) the stock's current intrinsic value. a. the expected total rate of return is 8.0% and intrinsic value is $180.58 b. the expected total rate of return is 8.0% and intrinsic value is $207.67 c. the expected total rate of return is 6.9% and intrinsic value is $180.58 d. the expected total rate of return is 9.2% and intrinsic value is $207.67 e. the expected total rate of return is 6.9% and intrinsic value is $207.67 7. ST2a The Company is expected to announce their annual dividend tomorrow. One year ago they paid a dividend of $1.40, and 5 years ago they paid $1.17 . You believe that future dividends will grow by the same rate as past ones. You are aware that riskless government securities are yielding 6.3%, and you make an offer to purchase the stock so that you earn 5.1% above the riskless rate. How much is your offer price? a. $22.52 b. $20.47 c. $16.92 d. $18.61 e. $24.77 8. ST13 Yesterday (year-end 2525) the company paid its annual dividend of $4.25. You believe that the stock merits a buy recommendation if it returns 23.8% per year. Your estimate of intrinsic value assumes that dividends grow smoothly in accordance with the constant exponential growth model. The annual dividend history is: year, dividend 2521, $2.35 2522, $3.13 2523, $3.64 2524, $4.22 Find the best estimate of the dividend growth rate and intrinsic value. a. Intrinsic value equals $68.75 and the dividend growth rate is 16.0% b. Intrinsic value equals $59.78 and the dividend growth rate is 13.9% c. Intrinsic value equals $68.75 and the dividend growth rate is 13.9% d. Intrinsic value equals $79.06 and the dividend growth rate is 13.9% e. Intrinsic value equals $59.78 and the dividend growth rate is 16.0% 9. ST17 You pick up the Wall Street Journal and see that riskless government securities are offering 5.6%. You read that the Company just increased their annual dividend by $0.48 cents so that today it is paying a $4.25 dividend per share. You also read that its share price is $116.86. You believe the constant growth dividend valuation model applies perfectly to this properly valued stock. What is the implied risk premium that is earned from owning the stock; that is, by how much does the expected return on the stock exceed the riskless interest rate? a. 10.2% b. 9.3% c. 7.7% d. 11.2% e. 8.4% 10. ST1e Yesterday the Company paid its annual dividend of $2.70 per share, its payout ratio always is 55% (= dividendst / net incomet), and today you wish to purchase the stock while its price-to-earnings ratio (= sharepricet / earnings per sharet) is 14.24. You believe that the dividend growth rate is 7.9%. You believe that a fair total rate of return for this stock is 12.9%. If also you believe the stock is valued according to the dividend growth model, which statement is most consistent with your beliefs? a. Intrinsic value is $58.27 and the share is overvalued b. Intrinsic value is $50.67 and the share is undervalued c. Intrinsic value is $44.06 and the share is overvalued d. Intrinsic value is $44.06 and the share is undervalued e. Intrinsic value is $58.27 and the share is undervalued