Chapter 09 HW

advertisement

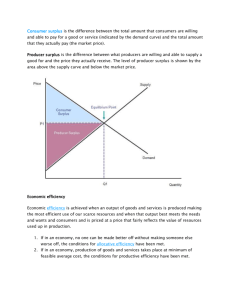

Chapter 09 Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 1. An important factor in the decline of the U.S. textile industry over the past 100 or so years is a. foreign competitors that can produce quality textile goods at low cost. b. lower prices of goods that are substitutes for clothing. c. a decrease in Americans’ demand for clothing, due to increased incomes and the fact that clothing is an inferior good. d. the fact that the minimum wage in the U.S. has failed to keep pace with the cost of living. ____ 2. With which of the Ten Principles of Economics is the study of international trade most closely connected? a. People face tradeoffs. b. Trade can make everyone better off. c. Governments can sometimes improve market outcomes. d. Prices rise when the government prints too much money. ____ 3. A logical starting point from which the study of international trade begins is a. the recognition that not all markets are competitive. b. the recognition that government intervention in markets sometimes enhances the economic welfare of the society. c. the principle of absolute advantage. d. the principle of comparative advantage. ____ 4. What is the fundamental basis for trade among nations? a. shortages or surpluses in nations that do not trade b. misguided economic policies c. absolute advantage d. comparative advantage ____ 5. The principle of comparative advantage asserts that a. not all countries can benefit from trade with other countries. b. the world price of a good will prevail in all countries, regardless of whether those countries allow international trade in that good. c. countries can become better off by exporting goods, but they cannot become better off by importing goods. d. countries can become better off by specializing in what they do best. ____ 6. A tax on an imported good is called a a. quota. b. tariff. c. supply tax. d. trade tax. ____ 7. A tariff is a a. limit on how much of a good can be exported. b. limit on how much of a good can be imported. c. tax on an exported good. d. tax on an imported good. ____ 8. The price of a good that prevails in a world market is called the a. absolute price. b. relative price. c. comparative price. d. world price. ____ 9. If a country allows trade and, for a certain good, the domestic price without trade is higher than the world price, a. the country will be an exporter of the good. b. the country will be an importer of the good. c. the country will be neither an exporter nor an importer of the good. d. Additional information is needed about demand to determine whether the country will be an exporter of the good, an importer of the good, or neither. ____ 10. If a country allows trade and, for a certain good, the domestic price without trade is lower than the world price, a. the country will be an exporter of the good. b. the country will be an importer of the good. c. the country will be neither an exporter nor an importer of the good. d. Additional information is needed about demand to determine whether the country will be an exporter of the good, an importer of the good, or neither. ____ 11. If a country is an exporter of a good, then it must be the case that a. the world price is less than its domestic price. b. consumer surplus is higher than a no trade situation. c. the world price is greater than its domestic price. d. they used an infant-industry argument to protect its producers. ____ 12. Suppose the United States exports cars to Switzerland and imports cheese from France. This situation suggests a. the United States has a comparative advantage relative to France in producing cheese, and Switzerland has a comparative advantage to the United States in producing cars. b. the United States has a comparative advantage relative to Switzerland in producing cars, and France has a comparative advantage relative to the United States in producing cheese. c. the United States has an absolute advantage relative to Switzerland in producing cars, and France has an absolute advantage relative to the United States in producing cheese. d. the United States has an absolute advantage relative to France in producing cheese, and Switzerland has an absolute advantage relative to the United States in producing cars. ____ 13. When a country that imported a particular good abandons a free-trade policy and adopts a no-trade policy, a. producer surplus increases and total surplus increases in the market for that good. b. producer surplus increases and total surplus decreases in the market for that good. c. producer surplus decreases and total surplus increases in the market for that good. d. producer surplus decreases and total surplus decreases in the market for that good. ____ 14. When a country allows trade and becomes an exporter of a good, a. domestic producers gain and domestic consumers lose. b. domestic producers lose and domestic consumers gain. c. domestic producers and domestic consumers both gain. d. domestic producers and domestic consumers both lose. ____ 15. Trade enhances the economic well-being of a nation in the sense that a. both domestic producers and domestic consumers of a good become better off with trade, regardless of whether the nation imports or exports the good in question. b. the gains of domestic producers of a good exceed the losses of domestic consumers of a good, regardless of whether the nation imports or exports the good in question. c. trade results in an increase in total surplus. d. trade puts downward pressure on the prices of all goods. ____ 16. When a country allows trade and becomes an importer of a good, a. both domestic producers and domestic consumers become better off. b. domestic producers become better off, and domestic consumers become worse off. c. domestic producers become worse off, and domestic consumers become better off. d. both domestic producers and domestic consumers become worse off. ____ 17. When a country allows trade and becomes an importer of a good, a. everyone in the country benefits. b. the gains of the winners exceed the losses of the losers. c. the losses of the losers exceed the gains of the winners. d. everyone in the country loses. ____ 18. Trade raises the economic well-being of a nation in the sense that a. the gains of the winners exceed the losses of the losers. b. everyone in an economy gains from trade. c. since countries can choose what products to trade, they will pick those products that are most beneficial to society. d. the nation joins the international community when it begins to engage in trade. ____ 19. When a country allows trade and becomes an exporter of a good, a. the gains of the domestic producers of the good exceed the losses of the domestic consumers of the good. b. the gains of the domestic consumers of the good exceed the losses of the domestic producers of the good. c. the losses of the domestic producers of the good exceed the gains of the domestic consumers of the good. d. the losses of the domestic consumers of the good exceed the gains of the domestic producers of the good. Figure 9-1 The figure illustrates the market for wool in Scotland. Price 75 70 65 Domestic supply 60 A 55 World price 50 B G D 45 H F 40 35 C Domestic demand 30 25 20 15 10 5 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Quantity ____ 20. Refer to Figure 9-1. From the figure it is apparent that a. Scotland will experience a shortage of wool if trade is not allowed. b. Scotland will experience a surplus of wool if trade is not allowed. c. Scotland has a comparative advantage in producing wool, relative to the rest of the world. d. foreign countries have a comparative advantage in producing wool, relative to Scotland. ____ 21. Refer to Figure 9-1. From the figure it is apparent that a. Scotland will export wool if trade is allowed. b. Scotland will import wool if trade is allowed. c. Scotland has nothing to gain either by importing or exporting wool. d. the world price will fall if Scotland begins to allow its citizens to trade with other countries. ____ 22. Refer to Figure 9-1. With trade, Scotland will a. export 11 units of wool. b. export 5 units of wool. c. import 15 units of wool. d. import 6 units of wool. ____ 23. Refer to Figure 9-1. In the absence of trade, the equilibrium price of wool in Scotland is a. $15. b. $45. c. $55. d. $70. ____ 24. Refer to Figure 9-1. In the absence of trade, total surplus in Scotland is represented by the area a. A + B + C. b. A + B + C + D + F. c. A + B + C + D + F + G. d. A + B + C + D + F + G + H. ____ 25. Refer to Figure 9-1. When trade in wool is allowed, consumer surplus in Scotland a. increases by the area B + D. b. increases by the area C + F. c. decreases by the area B + D. d. decreases by the area D + G. ____ 26. Refer to Figure 9-1. When trade in wool is allowed, producer surplus in Scotland a. increases by the area B + D. b. increases by the area B + D + G. c. decreases by the area C + F. d. decreases by the area G. ____ 27. Refer to Figure 9-1. When trade is allowed, a. Scotland producers of wool become better off and Scotland consumers of wool become worse off. b. Scotland consumers of wool become better off and Scotland producers of wool become worse off. c. both Scotland producers and consumers of wool become better off. d. both Scotland producers and consumers of wool become worse off. ____ 28. Refer to Figure 9-1. Relative to the no-trade situation, trade with the rest of the world results in a. Scotland consumers paying a higher price for wool. b. a decrease in producer surplus in Scotland. c. a decrease in total surplus in Scotland. d. All of the above are correct. ____ 29. Which of the following statements is true? a. Free trade benefits a country when it exports but harms it when it imports. b. "Voluntary" limits on Canadian exports of hogs are better for the United States than U.S. tariffs placed on Canadian hog exports. c. Tariffs and quotas differ in that tariffs work like a tax and therefore impose deadweight losses, whereas quotas do not impose deadweight losses. d. Free trade benefits a country both when it exports and when it imports. ____ 30. When a country allows international trade and becomes an importer of a good, a. domestic producers of the good become better off. b. domestic consumers of the good become worse off. c. the gains of the winners exceed the losses of the losers. d. All of the above are correct. ____ 31. When a country that imports a particular good imposes a tariff on that good, a. consumer surplus increases and total surplus increases in the market for that good. b. consumer surplus increases and total surplus decreases in the market for that good. c. consumer surplus decreases and total surplus increases in the market for that good. d. consumer surplus decreases and total surplus decreases in the market for that good. ____ 32. When a country that imports a particular good imposes a tariff on that good, a. producer surplus increases and total surplus increases in the market for that good. b. producer surplus increases and total surplus decreases in the market for that good. c. producer surplus decreases and total surplus increases in the market for that good. d. producer surplus decreases and total surplus decreases in the market for that good. ____ 33. When a country that imports a particular good imposes an import quota on that good, a. consumer surplus increases and total surplus increases in the market for that good. b. consumer surplus increases and total surplus decreases in the market for that good. c. consumer surplus decreases and total surplus increases in the market for that good. d. consumer surplus decreases and total surplus decreases in the market for that good. ____ 34. When a country that imports a particular good imposes an import quota on that good, a. producer surplus increases and total surplus increases in the market for that good. b. producer surplus increases and total surplus decreases in the market for that good. c. producer surplus decreases and total surplus increases in the market for that good. d. producer surplus decreases and total surplus decreases in the market for that good. ____ 35. A tariff is a tax placed on a. an exported good and it lowers the domestic price of the good below the world price. b. an exported good and it ensures that the domestic price of the good stays the same as the world price. c. an imported good and it lowers the domestic price of the good below the world price. d. an imported good and it raises the domestic price of the good above the world price. ____ 36. When a country moves away from a free trade position and imposes a tariff on imports, it causes a. a decrease in total surplus in the market. b. a decrease in producer surplus in the market. c. an increase in consumer surplus in the market. d. a decrease in revenue to the government. ____ 37. Tariffs and quotas are different in the sense that a. tariffs cause deadweight losses, while quotas do not cause deadweight losses. b. tariffs raise revenue for the government, while quotas do not raise revenue for the government. c. tariffs enhance the well-being of domestic consumers, while quotas diminish the wellbeing of domestic consumers. d. tariffs enhance the well-being of domestic producers, while quotas diminish the well-being of domestic producers. ____ 38. An import quota a. is preferable to a tariff since an import quota does not create a deadweight loss. b. is a tax on imported goods. c. reduces the welfare of domestic consumers. d. reduces the welfare of domestic producers. ____ 39. Some goods can be produced at low cost only if they are produced in large quantities. This phenomenon is called a. marginal cost of production. b. marginal benefit of size. c. economies of scale. d. economies of production. ____ 40. When a certain nation abandoned a policy of prohibiting international trade in automobiles in favor of a freetree policy, the result was that the country began to import automobiles. The change in policy improved the well-being of that nation in the sense that a. both producers of automobiles and consumers of automobiles in that nation became better off as a result. b. the gains to automobile producers in that nation exceeded the losses of the automobile consumers in that nation. c. the gains to automobile consumers in that nation exceeded the losses of the automobile producers in that nation. d. even though total surplus in that nation decreased, it was still true that consumer surplus and producer surplus increased. ____ 41. In September 2009, President Obama imposed a 35 percent tariff on a. tires imported from South Korea. b. tires imported from China. c. automobiles imported from South Korea. d. beef imported from Canada. ____ 42. In September 2009, President Obama a. imposed a tariff on tires imported from China; in doing so, the president reneged on an agreement into which the U.S. had entered in 2001. b. imposed a tariff on tires imported from China; the tariff was in accordance with an agreement into which the U.S. had entered in 2001. c. removed a tariff on tires imported from China; the tariff had been imposed by President George W. Bush. d. removed a tariff on tires imported from China; the tariff had been imposed by President Bill Clinton. ____ 43. In 2001, the U.S. agreed to support China’s entry into the World Trade Organization. Under a special “safeguard provision” of that agreement, American companies or workers harmed by imports from China can ask the government for protection by demonstrating that a. imports from China pose a hazard to the health of American citizens. b. China is competing unfairly or selling its products at less than their true cost. c. products that are allegedly “made in China” are actually made in a different country. d. American producers have suffered a “market disruption” or a “surge” in imports from China. ____ 44. In September 2009, China took steps toward imposing tariffs on American exports of a. automotive products and chicken in response to President Obama’s decision to impose tariffs on toys imported from China. b. airplanes and beef in response to President Obama’s decision to impose tariffs on toys imported from China. c. automotive products and chicken in response to President Obama’s decision to impose tariffs on tires imported from China. d. airplanes and beef in response to President Obama’s decision to impose tariffs on tires imported from China. ____ 45. Congressman Smith cites the “jobs argument” when he argues in favor of restrictions on trade; he argues that everything can be produced at lower cost in other countries. The likely flaw in Congressman Smith’s reasoning is that he ignores the fact that a. there is no evidence that any worker ever lost his or her job because of free trade. b. unemployment of labor is not a serious problem relative to other economic problems. c. the gains from trade are based on comparative advantage. d. the gains from trade are based on absolute advantage. ____ 46. “Owners of firms in young industries should be willing to incur temporary losses if they believe that those firms will be profitable in the long run.” This observation helps to explain why many economists are skeptical about the a. national-security argument. b. infant-industry argument. c. unfair-competition argument. d. jobs argument. ____ 47. One should be especially wary of the national-security argument for restricting trade when that argument is made by a. representatives of industry. b. representatives of the defense establishment. c. members of households. d. foreign government officials. ____ 48. About what percent of total world trade is accounted for by countries that belong to the World Trade Organization? a. 54 percent b. 72 percent c. 89 percent d. 97 percent ____ 49. At present, the United States uses a system of quotas to limit the amount of sugar imported into the country. Which of the following statements is most likely true? a. The quotas are probably the result of lobbying from U.S. consumers of sugar. The quotas increase consumer surplus for the United States, reduce producer surplus for the United States, and harm foreign sugar producers. b. The quotas are probably the result of lobbying from U.S. producers of sugar. The quotas increase producer surplus for the United States, reduce consumer surplus for the United States, and harm foreign sugar producers. c. The quotas are probably the result of lobbying from foreign producers of sugar. The quotas reduce producer surplus for the United States, increase consumer surplus for the United States, and benefit foreign sugar producers. d. U.S. lawmakers did not need to be lobbied to impose the quotas because total surplus for the United States is higher with the quotas than without them. ____ 50. Congresswoman Gaga represents a state in which several firms manufacture furniture. She wants to impose tariffs on all imported furniture. Which of the following is the least likely consequence of such tariffs? a. Domestic furniture buyers will lose consumer surplus, have less variety, and will pay higher prices. b. Domestic furniture producers will gain producer surplus. c. Domestic furniture producers will have a higher rate of technological advance. d. Domestic furniture producers will have more market power. ____ 51. Opponents of free trade often want the United States to prohibit the import of goods made in overseas factories that pay wages below the U.S. minimum wage. Prohibiting such goods is likely to a. cause these factories to pay the U.S. minimum wage. b. increase the rate of technological advance in poor countries so that they can afford to pay higher wages. c. increase poverty in poor countries and benefit U.S. firms which compete with these imports. d. harm U.S. firms which compete with these imports. ____ 52. Workers displaced by trade eventually find jobs in a. another country. b. the government sector. c. the industries in which the country has a comparative advantage. d. a different company in the same industry. ____ 53. The infant-industry argument a. is based on the belief that protecting industries when they are young will pay off later. b. is based on the belief that protecting industries producing goods and services for infants is necessary if a country is to have healthy children. c. has the support of most economists. d. is an argument that is advanced by advocates of free trade. ____ 54. Which of the following is the most accurate statement? a. Protection is necessary in order for young industries to grow up and be successful. b. Protection is not necessary for an industry to grow. c. Protection is necessary because if young industries are not protected, they may suffer losses. d. Protection may not always be necessary for infant industries, but it has proven to be useful in most cases. ____ 55. If the Korean steel industry subsidizes the steel that it sells to the United States, the a. United States should protect its domestic steel industry from this unfair competition. b. harm done to U.S. steel producers from this unfair competition exceeds the gain to U.S. consumers of cheap Korean steel. c. harm done to U.S. steel producers is less than the benefit that accrues to U.S. consumers of steel. d. United States should subsidize the products it sells to Korea. ____ 56. The two basic approaches that a country can take as a means to achieve free trade are the a. unilateral approach and the multilateral approach. b. short-run approach and the long-run approach. c. continental approach and the global approach. d. industry approach and the security approach. ____ 57. When a country takes a unilateral approach to free trade, it a. removes trade restrictions on its own. b. reduces its trade restrictions while other countries do the same. c. does not remove trade restrictions no matter what other countries do. d. is willing to trade with multiple countries at once. ____ 58. The North American Free Trade Agreement a. is an example of the unilateral approach to free trade. b. eliminated tariffs on imports to North America from the rest of the world. c. reduced trade restrictions among Canada, Mexico and the United States. d. All of the above are correct. ____ 59. Since World War II, GATT has been responsible for reducing the average tariff among member countries from about a. 40 percent to about 5 percent. b. 40 percent to about 20 percent. c. 80 percent to about 20 percent. d. 20 percent to about 10 percent. ____ 60. The General Agreement on Tariffs and Trade (GATT) was initiated in response to a. in increase in exports of low-priced goods from developing countries to developed countries. b. the replacement of manufacturing jobs with service jobs in developed countries. c. economic dislocations caused by the North American Free Trade Agreement (NAFTA) in the 1990s. d. high tariffs imposed during the Great Depression of the 1930s. ____ 61. The rules established under GATT are enforced by the a. governments of the nations that are involved in GATT. b. North American Free Trade Association. c. World Trade Organization. d. European Union. ____ 62. President Bush imposed temporary tariffs on imported steel in 2002. The reasons for this trade restriction is most consistent with the a. national-security argument. b. infant-industry argument. c. unfair competition argument. d. protection-as-a-bargaining chip-argument. ____ 63. In 2008, the Los Angeles Times asked members of the American public whether free international trade has helped or hurt the economy. Of those surveyed, a. 57 percent said free international trade helped the economy. b. 26 percent said free international trade helped the economy. c. 30 percent said free international trade hurt the economy. d. 16 percent said free international trade hurt the economy. ____ 64. Most economists view the United States’ experience with trade as a. one from which no firm conclusions about the virtues of free trade can be reached, due to the relatively short history of international trade in the U.S. b. one from which no firm conclusions about the virtues of free trade can be reached, due to the lack of trade within the U.S. throughout most of the early history of the U.S. c. an ongoing experiment that confirms the virtues of free trade. d. an ongoing experiment that calls into serious question the notion that free trade enhances the economic well-being of a nation. ____ 65. Economists view the fact that Florida grows oranges, Texas pumps oil, and California makes wine as a. confirmation of the virtues of free trade. b. confirmation of the infant-industry argument. c. confirmation that free trade agreements are not necessary. d. confirmation that specialization in absolute advantage works.