Checking account

advertisement

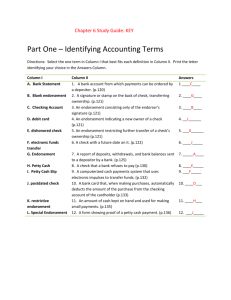

ACCOUNTING CHAPTER 5 Cash Control Systems Accounting Mr. Khatcheressian 11/19/2013 CHAPTER 5 PREVIEW Chapter 5 describes cash control systems for a sole proprietorship. Checking accounts, including writing checks and reconciling bank statements, are covered. Basic procedures are also introduced for electronic funds transfers, debit card transactions, and petty cash usage for a proprietorship. CHAPTER 5 OBJECTIVES Define accounting terms related to using a checking account and a petty cash fund. Identify accounting concepts and practices related to using a checking account. Prepare business papers related to using a checking account. Reconcile a bank statement Journalize dishonored checks and electronic banking transactions. Establish a replenish a petty cash fund. ACCOUNTING IN THE REAL WORLD At Hard Rock Café, customers use cash or credit cards to make purchases. What control problems may occur when employees accept cash for a sale? Answer: A dishonest employee may attempt to take some cash. Or, an employee could accidentally give too much cash back in change. The cash needs to be deposited in a bank. If it is known that there are large amounts of cash on hand, the business might be robbed. INTERNET RESEARCH ACTIVITY Banks offer many services, including savings accounts and loans. If you have a savings account with a bank, the bank pays you interest on the money in the account. If you take out a loan, you pay interest to the bank on the money you owe. Go to a homepage for a bank of your choice. Wells Fargo Capital One Bank of America INTERNET ACTIVITY Find the range of interest the bank offers for its saving accounts. Find the range of interest charged by the bank on an auto loan. Compare the two rates. Why does the bank charge more interest on loans than it pays on saving accounts? Answer: The difference in interest rates is basically how a bank is profitable. The bank charges more for loans than it pays for saving accounts. INTRODUCTION TO LESSON 5.1 In accounting, money is referred to as cash. Most business make major payments via check. Small payments for items such as postage or supplies may be made from a cash fund. Remember the importance of good controls for cash. Cash transactions occur more frequently than other types of transactions, and cash is easy to transfer from one person to another. QUESTION FOR YOU. How many of you have a checking account? What accounting forms are connected with the use of a checking account? Many of these forms are also used for the checking account for a business. ACCOUNTING TERMS Code of conduct a statement that guides the ethical behavior of a company and its employees Checking account a bank account from which payments can be ordered by a depositor. Endorsement a signature or stamp on the back of a check transferring ownership. Blank endorsement an endorsement consisting only of the endorser’s signature. ACCOUNTING TERMS Special endorsement an endorsement indicating a new owner of a check. Restrictive endorsement an endorsement restricting further transfer of a check’s ownership. Postdated check a check with a future date on it. Bank statement a report of deposits, withdrawals, and bank balances sent to a depositor by a bank. Dishonored check a check that a bank refuses to pay. ACCOUNTING TERMS Electronic funds transfer a computerized cash payments system that transfers funds without the use of checks, currency, or other paper documents. (p. 131) Debit card a bank card that automatically deducts the amount of the purchase from the checking account of the cardholder. (p. 132) Petty cash an amount of cash kept on hand and used for making small payments. (p. 134) Petty cash slip a form showing proof of a petty cash payment. (p. 135) ENDORSEMENTS page 120 12 Blank Endorsement Special Endorsement Restrictive Endorsement LESSON 5-1 LET ME EXPLAIN It is important to accurately record additions to and subtractions from a bank account. Lets take a look at how to prepare a deposit slip and a check stub…… DEPOSITING CASH page 119 14 LESSON 5-1 DEPOSIT RECORDED ON A CHECK STUB page 119 15 After the deposit is recorded on the check stub, a checkbook subtotal is calculated. The balance brought forward on Check Stub no. 1 is Zero. The previous balance, $0.00, plus the deposit, $5000.00, equals the subtotal, $5000.00. Cash receipts are journalized at the time cash is received. Later the cash receipts are deposited in the checking account. Therefore, no journal entry is needed for deposits because the cash receipts have already been journalized. ENDORSEMENTS Endorsement a signature or stamp on the back of a check transferring ownership. (p. 120) Blank endorsement an endorsement consisting only of the endorser’s signature. (p. 120) Special endorsement an endorsement indicating a new owner of a check. (p. 120) Restrictive endorsement an endorsement restricting further transfer of a check’s ownership. (p. 120) ENDORSEMENTS •Should be written in ink •Have space limitations on the back of a check for an endorsement •Should be signed exactly as the person’s name appears on the front of the check. •Know that there are similarities and differences in the three kinds of endorsements you are about to see. •The most common bank endorsement is the blank endorsement •Restrictive endorsements should always be used if mailing a deposit to the bank or if endorsing a check before going to a bank. COMPLETED CHECK STUB page 121 1 18 1. Write the amount of the check. 2 3 2. Write the date of the check. 3. Write to whom the check is to be paid. 4 4. Record the purpose of the check. 5. Write the amount of the check. 5 6. Calculate the new checking account balance. 6 LES SON 5-1 COMPLETED CHECK STUBS AND CHECK •The check stub should always be completed before writing out the check •Writing the purpose of the check on the check stub is a good record keeping practice •Remember that numbers should be written very close on a check so no one can change the amount •Remember that if amounts in words and in figures are not the same, a bank may pay only the amount in words •A check should be signed as the signature appears on the signature card. It is important to write the signature the same each time. COMPLETED CHECK page 121 8 20 7 9 10 11 7. Write the date. 8. Write to whom the check is to be paid. 9. Write the amount in figures. 12 10. Write the amount in words. 11. Write the purpose of the check. LES 12. Sign the check. SON 5-1 RECORDING A VOIDED CHECK page 122 21 2 1 1. 2. 3. 4. 5. 4 3 Record the date. Write the word VOID in the Account Title column Write the check number. Place a check mark in the Post. Ref. column. Place a dash in the Cash Credit column. 5 LES SON 5-1 22 TERMS REVIEW page 123 code of conduct checking account endorsement blank endorsement special endorsement restrictive endorsement postdated check LESSON 5-1 APLIA AND ASSIGNMENT Work together and On Your Own 5.1 Application Problem 5.1 Code of Conduct Assignment Go to www.merck.com 1.Obtain access to the code of conduct. 2. Assuming you are a Merck employee, may you: a. Give a physician a gift consisting of a medical textbook. b. Use your cellphone to discuss new research methods with another Merck employee? c. Accept a supplier’s invitation to attend the Super Bowl? LESSON 5-2 Bank Reconciliation ACCOUNTING OBJECTIVES Identify accounting concepts and practices related to using a checking account. Prepare business papers related to using a checking account. Reconcile a bank statement PEOPLE WHO HAVE CHECKING ACCOUNTS. People make errors on their checking account all the time. How do they find out about their errors? In this lesson you will learn how to find errors that you make as well as find errors that the bank may make. PREVIEW OF LESSON 5.2 New Term Bank Statement Bank statement a report of deposits, withdrawals, and bank balances sent to a depositor by a bank. This lesson will discuss a bank reconciliation and special entries necessary for a business checking account. EXPLANATION Using a checking account was introduced earlier in this chapter. The bank periodically sends a report of deposits , withdrawals, and the bank balance to the depositor. The bank’s records and a depositor’s records may differ and both may still be correct? ????????? FOUR REASONS WHY THIS MAY HAPPEN 1. A Service Charge may not have been recorded in the depositor’s business records. 2. Outstanding deposits may be recorded in the depositor’s records but not on a bank statement. 3. Outstanding checks may be recorded in the depositor’s records but not on a bank statement. 4. A depositor may have made math or recording errors. IT IS IMPORTANT TO ALWAYS ANALYZE THE BANK STATEMENT EACH TIME IT IS RECEIVED. BANK STATEMENT page 124 Deposits, Checks, and Service Charges should be verified! •When a bank statement is received, canceled checks can accompany it. •Canceled checks should be compared with check stubs and a check mark placed on each stub for canceled checks LESSON 5-2 Follow the same procedure for deposits! BANK STATEMENT RECONCILIATION balances should be the same. 1 31 1. Date 2. Check Stub 2 Balance 3. Service Charge 6 4. Adjusted Check 3 Stub Balance 5. Bank Statement Balance 6. Outstanding 8 4 Deposits 7. Subtotal 8. Outstanding 10 Checks 9. Adjusted Bank Balance When the Reconciliation is 10. Compare Adjusted Balances completed, the two adjusted page 125 5 7 9 LESSON 5-2 BANK STATEMENT RECONCILIATION page 125 The format for bank statements and the accompanying reconciliation form may vary from bank to bank, but the forms present the same information. LESSON 5-2 RECORDING A BANK SERVICE CHARGE ON A CHECK STUB page 126 33 1. Write Service Charge $8.00 on the check stub under the heading “Other.” 2. Write the amount of the service charge in the amount column. 3. Calculate and record the new subtotal on the Subtotal line. 1 2 3 THE SERVICE CHARGE SHOULD BE WRITTEN ON A CHECK STUB AND DEDUCTED FROM THE ACCOUNT BALANCE SO THAT THE CHECKING ACCOUNT IS NOT OVERSTATED. LESSON 5-2 JOURNALIZING A BANK SERVICE CHARGE page 127 34 The service charge MUST be recorded in the journal and posted to the cash account so that the cash account will also be up to date. The company prepared a memo as a source document to support the journal entry No Check is written for the amount of the service charge. The bank has already deducted it from the account. LESSON 5-2 JOURNALIZING A BANK SERVICE CHARGE page 127 35 August 31. Received bank statement showing August bank service charge, $8.00. Memorandum No. 3. 4 1 3 2 1. Date. Write the date. 2. Debit. Write the title of the account to be debited. Record the amount debited. 3. Credit. Record the amount credited. 4. Source document. Write the source What accounts are affected? document number. Are they increased or decreased, debited or credited? 36 TERM REVIEW page 128 bank statement-a report of deposits, withdrawals, and bank balances sent to a depositor by a bank. (p. 124) 1. 2. 3. 4. 5. TRY APLIA 5.2 WORK TOGETHER ON YOUR OWN APPLICATION PROBLEM Math Review Handout Parts A & B only 6. Exit Ticket (next slide) LESSON 5-2 EXIT TICKET List four reasons why a depositor’s records and a bank’s records may differ. If a check mark is placed on the check stub of each canceled check, what does a check stub with no check mark indicate? LESSON 5-3 Dishonored Checks and Electronic Banking Accounting FRIDAY WARM UP CASES FOR CRITICAL THINKING PAGE 143. Look at cases one and two and answer the questions provided. We will go over together once finished. FRIDAY WARM UP CASES FOR CRITICAL THINKING. Case one: Ms. Merker is following the better procedure. Even though Ms. Velez has a relatively small checking account balance, she still needs to know the correct account balance against which she can write checks. A bank statement should be reconciled when it is received, regardless of the size of the account. FRIDAY WARM UP CASES FOR CRITICAL THINKING. Case two: Mr. K agrees with Ms. Dorset. One of the purposes of a petty cash fund is to provide for small cash payments. Limiting petty cash payments to $50.00 or less is providing for large payments as well as small. Ms. Dorset’s $20.00 limit is more reasonable for petty cash. The size of the fund, whether $100 or $3000, depends upon the size of the company and the number and amount of payments to be made from the fund. OBJECTIVES • Define accounting terms related to using a checking account. • Identify accounting concepts and practices related to using a checking account. • Prepare business papers related to using a checking account. • Journalize dishonored checks and electronic banking transactions. PREVIEW OF LESSON 5.3 New Terminology Dishonored check a check that a bank refuses to pay. (p. 129) Electronic funds transfer a computerized cash payments system that transfers funds without the use of checks, currency, or other paper documents. (p. 131) Debit card a bank card that automatically deducts the amount of the purchase from the checking account of the cardholder. (p. 132) LETS TAKE A LOOK! Dishonored checks are taken very seriously within a bank.-meaning that the depositor has insufficient funds or a forged check is being used. Some stores post signs to inform customers of the charge that will be imposed for a dishonored check. When the check is first received, it was deposited and the amount was added to the bank account. Now when it is dishonored the amount must be subtracted from the bank account. There is usually a fee that is associated with the finding of a dishonored check. RECORDING A DISHONORED CHECK ON A CHECK STUB page 129 45 1 2 3 1. Write Dishonored check $105.00 on the line under the heading “Other.” 2. Write the total of the dishonored check in the amount column. 3. Calculate and record the new subtotal on the Subtotal line. LES SON 5-3 REMINDER…. An entry must be recorded in a journal before it is posted to the account. Only after posting is complete will the cash account reflect the dishonored check. REMINDER…. Also, a transaction must first be analyzed to determine what accounts to debit and credit. Once this analysis is done, an entry can be recorded into a journal. There are four steps used to record entry in the journal. JOURNALIZING A DISHONORED CHECK page 130 48 November 29. Received notice from the bank of a dishonored check from Campus Internet Café, $70.00, plus $35.00 fee; total, $105.00. Memorandum No. 55. 1 4 2 1. Date. Write the date. 2. Debit. Write the title of the account to be debited. 3. Credit. Write the amount credited. 4. Source document. Write the source document number. 3 LES SON 5-3 JOURNALIZING AN ELECTRONIC FUNDS TRANSFER page 131 49 September 2. Paid cash on account to Kelson Enterprises, $350.00, using EFT. Memorandum No. 10. 4 1 2 1. Date. Write the date. 2. Debit. Write the title of the account to be debited. Record the amount debited. 3. Credit. Record the amount credited. 4. Source document. Write the source document number. 3 LES SON 5-3 ELECTRONIC FUNDS TRANSFER EFT means that the business does not have to write a check for this amount. Therefore, there is no check stub for the source document. A memorandum is often used as a source document for EFT payments. JOURNALIZING A DEBIT CARD TRANSACTION There is a difference between an electronic funds transfer and a debit card. When a purchase is made with a debit card, cash is immediately deducted from the account. When using a debit card, it is important to remember to record the entry in the journal. Here are the four steps used to record the entry in the journal. JOURNALIZING A DEBIT CARD TRANSACTION page 132 52 September 5. Purchased supplies, $24.00, using debit card. Memorandum No. 12. 4 1 2 1. Date. Write the date. 2. Debit. Write the title of the account to be debited. Record the amount debited. 3. Credit. Record the amount credited. 4. Source document. Write the source document number. 3 LES SON 5-3 53 TERMS REVIEW page 133 dishonored check electronic funds transfer debit card Try Aplia problems: Work together 5-3 On your own 5-3 Application 5-3 Chapter 5 Study Guide Study tools on text website (c21accounting.com) LESSON 5-3 FINANCIAL LITERACY Page 135- Activity # 1 EXIT TICKET List the six reasons why a bank may dishonor a check? What account is credited when electronic funds transfer is used to pay cash on account? What account is credited when a debit card is used to purchase supplies? LESSON 5-4 Petty Cash OBJECTIVES Define accounting terms related to using a petty cash fund. Establish and replenish a petty cash fund. PICTURE THIS! Picture yourself working in a business that’s uses checks for all cash payments. What would happen if the letter carrier brought an envelope to you with $1.25 postage due? In many businesses it takes days to authorize and write a check. This lesson will illustrate another option for the business 5-4 TERMINOLOGY petty cash-an amount of cash kept on hand and used for making small payments. (p. 134) petty cash slip-a form showing proof of a petty cash payment. (p. 135) HOW IS PETTY CASH USED IN BUSINESSES? To make change for customers or patients To pay for small purchases which require cash, such as food for the office lunch or coffee supplies, or for parking. Most retail businesses keep a cash drawer as do health care practices. MORE ON PETTY CASH… Most large corporations may have several petty cash funds The Petty Cash Account is an asset account with a normal debit balance MORE ON PETTY CASH… Keep as much cash as you need in your cash drawer, but not too much, so it isn't a temptation for employees or robbers. ASK YOURSELF THE FOLLOWING WHEN ANALYZING THE TRANSACTION… •What Accounts are Affected? •Are they Increased or Decreased? •Are they Debited or Credited? Complete the T accounts as the information is provided. ESTABLISHING A PETTY CASH FUND-4 STEPS page 134 64 August 19. Paid cash to establish a petty cash fund, $100.00. Check No. 8. 4 1 2 1. Date. Write the date. 2. Debit. Write the title of the account to be debited. Record the amount debited. 3. Credit. Record the amount credited. 4. Source document. Write the source document number. 3 MAKING PAYMENTS FROM A PETTY CASH FUND WITH A PETTY CASH SLIP page 135 65 MAKING PAYMENTS FROM A PETTY CASH FUND WITH A PETTY CASH SLIP page 135 •When Cash is Paid from a petty cash fund, no formal entry is recorded in a journal. •Only a petty cash slip is prepared. •The entry will be made at a later date. REPLENISHING PETTY CASH The Petty Cash Fund is replenished when the amount in the fund is low or at the end of a fiscal period. The balance in the actual petty cash account has never been reduced by an entry. When cash was paid from the fund, no entry was made in the journal. Therefore, the petty cash account in the general ledger still has a balance of $100.00 page 136 REPLENISHING PETTY CASH (CONT) When cash was paid from the fund, the reason for the payment was recorded on a petty cash slip but no entry was made in the journal. These slips are now used to summarize payments from the fund and to record the payments in the journal. To replenish the fund, debit accounts for which petty cash was used and credit the cash account page 136 ASK YOURSELF THE FOLLOWING WHEN ANALYZING THE TRANSACTION… •What Accounts are Affected? •Are they Increased or Decreased? •Are they Debited or Credited? Complete the T accounts as the information is provided. REPLENISHING PETTY CASH page 136 70 August 31. Paid cash to replenish the petty cash fund, $30.00: miscellaneous expense, $20.00; advertising, $10.00. Check No. 12. 4 1 1. Date. Write the date. 2 2. Debit. Write the title of the first account to be debited. Write the amount to be debited. Write the title of the second account to be debited. Record the amount to be debited. 3. Credit. Record the amount credited. 4. Source document. Write the source document number. 3 TERMS REVIEW petty cash-an amount of cash kept on hand and used for making small payments. (p. 134)\ petty cash slip-a form showing proof of a petty cash payment. (p. 135) ACTIVITY Aplia 5-4, Study Guide www.c21accounting.com Xtra! Study Tools (Chapter 5) Tutorial Quiz (Chapter 5) Research a company or university's petty cash policy and provide a detailed summary of your findings. Make sure you look at what procedures are in place and uses for the account, ect and compare it with another similar company. THINK, PAIR AND SHARE…. Quickly jot down, in note form, the procedures for establishing, maintaining, and replenishing a petty cash fund. When you are finished, pair up and share what you wrote! EXIT TICKET Why do businesses use petty cash funds? Why is Cash and not Petty Cash credited when a petty cash fund is replenished?