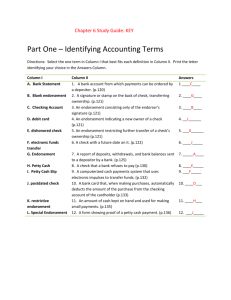

Chapter 5 Notes

advertisement

Cash Control Systems Major cash payments made in checks Small cash payments made out of small cash fund/petty cash Cash transactions occur frequently Errors Lost Transferred to unauthorized individuals Checking Account-A bank account from which payments can be ordered by a depositor Authorized signers for a checking account must sign signature card Deposit Slip-A bank form which lists the checks, currency, and coins an account holder is adding to the bank account Endorsement- A signature or stamp on the back of a check transferring ownership Federal regs state signature has to be in limited space on back of check Blank Endorsement- Consists only of the endorser’s signature Special Endorsement – Indicating a new owner of a check-Pay to the order of Restrictive Endorsement- For deposit only Checks # in order Concept: Objective Evidence- Check stub is source document COMPLETE CHECK STUB 1ST! Banks refuse altered checks Voided Check- A check that cannot be processed because the maker has made it invalid Write VOID in large letters across check Place entry in journal Bank Reconciliation Bank Statement- A report of deposits, withdrawals, and bank balances sent to a depositor by a bank Canceled check- a check which has been paid by the bank Outstanding Checks- Checks written but not cleared through the bank Outstanding Deposits-Deposits made too late to appear on the statement BANK STMT BAL. + Outstanding Deposits Outstanding Checks New Balance = CHECK STUB BALANCE - Service Charge New Balance Must write service charge on next check stub Must write entry to record service chargealways Miscellaneous Expense Dishonored Checks and Electronic Banking Dishonored Check-A check that a bank refuses to pay NSF Check- A check dishonored by the bank because of insufficient funds in the account of the maker of the check Bank will charge depositor a fee for handling NSF check Remove from cash and place back in A/R Write on check stub Write journal entry Electronic Funds Transfer- A computerized cash payments system that transfers funds without the use of checks, currency, or other paper documents Electronic payment is still a cash paymentcheck is not source document Debit Card- A bank card that automatically deducts the amount of a purchase from the checking account of the cardholder Debit card automatically deducts from checking Using a debit card is a cash payment-Check is not source document Petty Cash Petty Cash- An amount of cash kept on hand and used for making small payments Petty cash is an asset-normal balance sides of an asset Petty cash slip- A form showing proof of a petty cash payment Petty cash must be replenished Create a petty cash report to verify amounts paid out. Errors can be made between cash paid out and actual amount on hand Cash Short- A petty cash on hand amount that is less than the recorded amount Cash Over- A petty cash on hand amount that is more than the recorded amount Must fill out report and write entry Cash Over and Short has no normal balance side Most often cash is short Usually classified as an expense