Stocks

advertisement

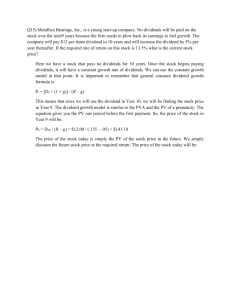

CHAPTER 7 Stocks, Stock Valuation, and Stock Market Equilibrium 1 Topics in Chapter Features of common stock Valuing common stock Preferred stock Stock market equilibrium Efficient markets hypothesis Implications of market efficiency for financial decisions 2 EQUITIES Why? Key to understanding valuations What is investment worth today? Value of: Enterprise Entity Company/Firm Business Application For Investor: Determine value of asset/business/company For Firm: Determine cost of attracting investors & raising equity capital Selling ownership stake to raise $ 3 Equities Valuing companies that don’t pay dividends Alternative valuation methods 4 The Big Picture: The Intrinsic Value of Common Stock Free cash flow (FCF) Dividends (Dt) ValueStock = D2 D1 D∞ ... + + + (1 + rs )1 (1 + rs)2 (1 + rs)∞ Market interest rates Cost of Market risk aversion equity (rs) Firm’s debt/equity mix Firm’s business risk Common Stock: Owners, Directors, and Managers Represents ownership. Ownership implies control. Stockholders elect directors. Directors hire management. Preemptive right. Since managers are “agents” of shareholders, their goal should be: Maximize stock price. 6 When is a stock sale an initial public offering (IPO)? A firm “goes public” through an IPO when the stock is first offered to the public. Prior to an IPO, shares are typically owned by the firm’s managers, key employees, and, in many situations, venture capital providers 7 What is a seasoned equity offering (SEO)? A seasoned equity offering occurs when a company with public stock issues additional shares. After an IPO or SEO, the stock trades in the secondary market, such as the NYSE or Nasdaq. 8 Classified Stock Classified stock has special provisions. Could classify existing stock as founders’ shares, with voting rights but dividend restrictions. New shares might be called “Class A” shares, with voting restrictions but full dividend rights. 9 Tracking Stock The dividends of tracking stock are tied to a particular division, rather than the company as a whole. Investors can separately value the divisions. Its easier to compensate division managers with the tracking stock. But tracking stock usually has no voting rights, and the financial disclosure for the division is not as regulated as for the company. 10 Bonds Issuer (company) vs. Cost Cost (dividends pd out Cap gains int. paid out (i) Bond value or price today Stocks Discount the CFs by (i) (reqr’d return) Cfs = Int pmts; principal PV, PMT,FV,N,i Stock value or price today Discount the CFs by (R) (reqr’d return) Cfs = Dividends 11 Bonds vs. Stocks Bond’s Value or Price Today = sum of the PVs of the future CFs; That is – discount CFs (int Pmts (PMT) & Principal (FV)) by i% over some period (N) to get PV PMT,FV,N,I known; solve for PV Stock’s Value or Price Today = sum of the PVs of the future CFs; Discount CFs (divids) by (R) (reqr’d return) to get Po (PV) 12 Different Approaches for Valuing Common Stock Dividend growth model Constant growth stocks Nonconstant growth stocks Free cash flow method Using the multiples of comparable firms 13 Why Invest in Stock? For Growth in Value From Dividends & Cap Gains Generating Total Return = R Stock Price = Growth = g Dividend Return or Yield = Annual divid / Price of stock= D1 / Po Return on Stock = Return on Divid + Growth (cap gains) R = D1 /Po + g (but want price today) R–g = D1 /Po Finally: Po = D1 / R - g 14 Constant Growth Approach to Equity Valuations Po = D1 / R – g Discounting the Divids (or CFs) by R-g (return adjusted for constant growth) Constant growth model: works when g is constant rate (%) & R > g If g > R, then have supernormal or non-constant growth If so, then look at PVs of CFs generated the stock to determine its price today If we need R (req’d return) to use as disct factor, we can use SML relationship from CAPM SML: Ri = rRF + (RM - rRF)bi . 15 Stock Value = PV of Dividends ^ P0 = D1 (1 + rs)1 + D2 (1 + rs)2 + D3 +…+ (1 + rs)3 D∞ (1 + rs)∞ What is a constant growth stock? One whose dividends are expected to grow forever at a constant rate, g. 16 For a constant growth stock: D1 = D0(1 + g)1 D2 = D0(1 + g)2 Dt = D0(1 + g)t If g is constant and less than rs, then: D0(1 + g) D1 ^ P0 = = rs – g rs – g 17 Dividend Growth and PV of Dividends: P0 = ∑(PV of Dt) $ 0.25 Dt = D0(1 + g)t Dt PV of Dt = (1 + r)t If g > r, P0 = ∞ ! Years (t) 18 What happens if g > rs? ^ P0 = D0(1 + g)1 D0(1 + g)2 (1 + rs)1 If g > rs, then + (1 + rs)2 (1 + g)t (1 + rs)t +…+ D0(1 + rs)∞ (1 + rs)∞ ^ > 1, and P0 = ∞ So g must be less than rs for the constant growth model to be applicable!! 19 Required rate of return: beta = 1.2, rRF = 7%, and RPM = 5%. Use the SML to calculate rs: rs = rRF + (RPM)bFirm = 7% + (5%)(1.2) = 13%. 20 Projected Dividends D0 = $2 and constant g = 6% D1 = D0(1 + g) = $2(1.06) = $2.12 D2 = D1(1 + g) = $2.12(1.06) = $2.2472 D3 = D2(1 + g) = $2.2472(1.06) = $2.3820 21 Expected Dividends and PVs (rs = 13%, D0 = $2, g = 6%) 0 g = 6% 1 2.12 1.8761 1.7599 1.6508 2 2.2472 3 2.3820 13% 22 Intrinsic Stock Value: D0 = $2.00, rs = 13%, g = 6% Constant growth model: ^ P0 = = D0(1 + g) D1 = rs – g rs – g $2.12 0.13 – 0.06 = $2.12 0.07 = $30.29. 23 Expected value one year from now: D1 will have been paid, so expected dividends are D2, D3, D4 and so on. D2 ^ $2.2472 P1 = = rs – g 0.07 = $32.10 24 Return = Dividend Yield + Capital Gains Yield D1 Dividend yield = P0 ^ P1 – P0 CG Yield = = P0 New - Old Old 25 Expected Dividend Yield and Capital Gains Yield (Year 1) D1 $2.12 Dividend yield = = = 7.0%. P0 $30.29 ^ P1 – P0 $32.10 – $30.29 CG Yield = = P0 $30.29 = 6.0%. 26 Total Year 1 Return Total return = Div yield + Cap gains yield. Total return = 7% + 6% = 13%. Total return = 13% = rs. For constant growth stock: Capital gains yield = 6% = g. 27 Rearrange model to rate of return form: D1 ^ P0 = to rs – g D1 ^ rs = + g. P0 Then, ^ rs = $2.12/$30.29 + 0.06 = 0.07 + 0.06 = 13%. 28 If g = 0, the dividend stream is a perpetuity. 0 r = 13% 1 s 2.00 PMT $2.00 P0 = = r 0.13 ^ 2 3 2.00 2.00 = $15.38. 29 Supernormal Growth Stock I Supernormal growth of 30% for first three years, then 6% constant g thereafter. Just paid dividend of $2.00 /sh, & required return for investments of this risk is 13%. What’s the price today (Po)? Can no longer use constant growth model. However, growth becomes constant after 3 years. 30 Nonconstant growth followed by constant growth 0 rs = ? % g=?% Do=?(1+g) 1 2 g=?% D1=? 3 g=?% D2=? 4 g=?% D3=? D4=? ? ? ? ? ^ ?? = P 0 D4 ^ P3 = R-g 31 Nonconstant growth followed by constant growth (D0 = $2): 0 rs = 13% g = 30% Do=2.00(1+g) 1 2 g = 30% D1=2.60 3 g = 30% D2=3.38 4 g = 6% D3=4.39 D4=4.66 2.30 2.65 3.05 46.11 54.11 = P0 ^ $4.66 ^ = $66.54 P3 = 0.13 – 0.06 32 Using Cfs After Determining: CFo = Do CF1 = D1 CF2 = D2 CF3 = D3 + P3 i=R% Po = NPV = ? Future Divs & gk terminal value (price) CFo =0 CF1 = 2.60 CF2 = 3.38 CF3 = 4.39 + 66.54 =70.93 i = 13 % Po = NPV = ? = $54.11 33 Expected Dividend Yield and Capital Gains Yield (t = 0) Today (@ t =0): D1 $2.60 Dividend yield = = = 4.81% P0 $54.11 CG Yield = 13.0% – 4.81% = 8.19%. 34 Expected Divd & Cap Gains Yield (after t = 3) During nonconstant growth, dividend yield and capital gains yield are not constant. If current growth is greater than gk, current capital gains yield is greater than g. After year 3 (t = 3), gk = constant = 6%, so CGY = 6%. Because rs = 13%, after yr 3 div yld = 13% – 6% = 7%. 35 Is stock price based on short-term growth? The current stock price is $54.11. The PV of dividends beyond Year 3 is: =terminal or horizon value in year 3 (P3) discounted ^ to present by req’d Return (R=13%) = $46.11 % of stock price due to “longterm” dividends is: $46.11 = 85.2%. $54.11 36 Intrinsic Stock Value vs. Quarterly Earnings If most of a stock’s value is due to long-term cash flows, why do so many managers focus on quarterly earnings? 37 Intrinsic Stock Value vs. Quarterly Earnings Sometimes changes in quarterly earnings are a signal of future changes in cash flows. This affects current stock price (Po). Sometimes managers have bonuses tied to quarterly earnings. 38 Supernormal Growth Stock II Supernormal growth of 30% for Year 0 to Year 1, 25% for Year 1 to Year 2, 15% for Year 2 to Year 3, and then long-run constant g = 6%. Can no longer use constant growth model. However, growth becomes constant after 3 years. 39 Nonconstant growth followed by constant growth (D0 = $2): 0 rs = 13% g = 30% 1 2 g = 25% 2.6000 3 g = 15% 3.2500 4 g = 6% 3.7375 3.9618 2.3009 2.5452 2.5903 39.2246 ^ 46.6610 = P0 $3.9618 ^ = $56.5971 P3 = 0.13 – 0.06 40 Expected Dividend Yield and Capital Gains Yield (t = 0) At t = 0: D1 $2.60 Dividend yield = = = 5.6% P0 $46.66 CG Yield = 13.0% – 5.6% = 7.4%. (More…) 41 Expected Dividend Yield and Capital Gains Yield (after t = 3) During nonconstant growth, dividend yield and capital gains yield are not constant. If current growth is greater than g, current capital gains yield is greater than g. After t = 3, g = constant = 6%, so the capital gains yield = 6%. Because rs = 13%, after t = 3 dividend yield = 13% – 6% = 7%. 42 Is the stock price based on short-term growth? The current stock price is $46.66. The PV of dividends beyond Year 3 is: ^ P3 / (1+rs)3 = $39.22 The percentage of stock price due to “long-term” dividends is: $39.22 = 84.1%. $46.66 43 Suppose g = 0 for t = 1 to 3, and then g is a constant 6%. 0 rs = 13% g = 0% 1.7699 1.5663 1.3861 20.9895 25.7118 1 2 g = 0% 2.00 3 g = 0% 2.00 4 g = 6% 2.00 ^ = 2.12 P3 0.07 2.12 = 30.2857 44 Dividend Yield and Capital Gains Yield (t = 0) Dividend Yield = D1/P0 Dividend Yield = $2.00/$25.72 Dividend Yield = 7.8% CGY = 13.0% – 7.8% = 5.2%. 45 Dividend Yield and Capital Gains Yield (after t = 3) Now have constant growth, so: Capital gains yield = g = 6% Dividend yield = rs – g Dividend yield = 13% – 6% = 7% 46 Suppose negative growth: If g = -6%, would anyone buy stock? If so, at what price? Firm still has earnings and still pays dividends, so ^ P0 > 0: D0(1 + g) D1 ^ P0 = = rs – g rs – g $2.00(1-.06) $1.88 = = = $9.89. 0.13 – (-0.06) 0.19 47 Annual Dividend and Capital Gains Yields Capital gains yield = g = -6.0%. Dividend yield = 13.0% – (-6.0%) = 19.0%. Both yields are constant over time, with the high dividend yield (19%) offsetting the negative capital gains yield. 48 What if company pays no dividends? Discount Free Cash Flows (CFs which can be returned to investors) instead of dividends Where FCF = NOPAT – Net Capital Spending 49 Uses of Free Cash Flows Pay interest on debt Repay principal on debt Pay dividends to equityholders Repurchase stock from equityholders Buy mrktbl securities or other nonoperating assets 50 Equity Valuation using FCFs A young firm just recorded a $<1.0> million FCF. It expects the FCF 1-yr from today to be $<5.0>million. In yrs 2 & 3, they are expected to become positive at $10 and $20 million. In the 4th yr, a constant growth in FCFs is expected to kick-in at 6%. The required return for investments of this risk is 10%. The firm has $40 million in debt, and 10 million shares outstanding. What’s the price per share today? 51 Equity Valuation using FCFs 0 rs = 10% 1 2 3 4 g=6% FCFo=<1> FCF1=<5> FCF2=10 FCF3=20 *(1+g) FCF4=? ? ? ? ? ^ ?? = P 0 FCF4 ^ P3 = R-g 52 Using Cfs for FCFs Equity Valuation After Determining: CFo = FCFo CF1 = FCF1 CF2 = FCF2 CF3 = FCF3 + P3 i=R% Po = NPV =?= value of firm Future Divs & gk terminal value (price) CFo =0 CF1 = <5> CF2 = 10 CF3 = 20 + 530 =550.00 i = 10 % Po = NPV = ? = $416.94 53 Equity Valuation using FCFs Value of firm = $416.94 - Debt 40.00 =Value of equity $376.94 / 10 mil shrs =price per share of $37.69 54 Market Cap (Capitalization) = Market Value of firm’s equity = (price/sh)*(#shs outstanding) 55 Enterprise Value = Value of firm’s underlying business, unencumbered by Debt, and separate from cash & marketable securities Enterprise Value= MV of equity + Debt - cash Think:: Enterprise Value = Net cost of acquiring a firm’s equity, taking its cash, and paying off debt. In essence, it’s equivalent to owning the unlevered (debt-free) business. 56 Market Cap & Enterprise Value I H.J. Heinz has a share price of $46.78, its shares outstanding were 319.2 million. It has a market-to-book ratio of 8.00, a book debt-equity ratio of 2.62, and cash of $352 million. What’s Heinz’s market cap? What’s its enterprise value? 57 Using Stock Price Multiples to Estimate Stock Price Analysts often use the P/E multiple (the price per share divided by the earnings per share). Example: Estimate the average P/E ratio of comparable firms. This is the P/E multiple. Multiply this average P/E ratio by the expected earnings of the company to estimate its stock price. 58 Multiples Approach I Auto Industry Industry P/E = 5 Pinto Car Co Pinto EPS = $1.50/sh Industry If Pinto trading on NYSE = $9.00 If $4.00 Pinto 5/1 = P/E = ?/$1.50 So Pinto relative price per share (P) = $7.50 =overvalued (sell) =undervalued (buy) 59 Using Entity Multiples The entity value (V) is: the market value of equity (# shares of stock multiplied by the price per share) plus the value of debt. Pick a measure, such as EBITDA, Sales, Customers, Eyeballs, etc. Calculate the average entity ratio for a sample of comparable firms. For example, V/EBITDA V/Customers 60 Using Entity Multiples (Continued) Find the entity value of the firm in question. For example, Multiply the firm’s sales by the V/Sales multiple. Multiply the firm’s # of customers by the V/Customers ratio The result is the firm’s total value. Subtract the firm’s debt to get the total value of its equity. Divide by the number of shares to calculate the price per share. 61 Problems w/ Market Multiple Methods It is often hard to find comparable firms. What are relevant multiples? New Co.’s often lack earnings Average ratio for sample of comparable firms often has a wide range. I.E, ave P/E ratio might be 20, but range from 10 to 50. How do you know whether firm should be compared to low, average, or high performers? Differences between firms in comparables pool i.e: growth rates, risk, cost of capital 62 What if an equity’s dividend is fixed? No g ! ^ P0 = D1 rs – g So, Po = D1 /rs And return = D1 / Po It’s a perpetuity 63 Preferred Stock Hybrid security. Similar to bonds in that preferred stockholders receive a fixed dividend which must be paid before dividends can be paid on common stock. However, unlike bonds, preferred stock dividends can be omitted without fear of pushing firm into bankruptcy. 64 Expected return =?, given Preferred stock share trading at $50 & pays annual dividend = $5 Vps $5 = $50 = ^ rps $5 ^ rps = = 0.10 = 10.0% $50 65 A determinant of Growth Relationship between ROE, Retention Rate, EPS growth, and Dividends A firm has an ROE of 25% & Retention Rate of 80%. If the most recent EPS was $3.00, what’s the expected dividend at the end of the year? 66 Why are stock prices volatile? ^ P0 = rs – g rs = rRF + (RPM)bi could change. D1 Inflation expectations Risk aversion Company risk g could change. 67 Consider the following situation. D1 = $2, rs = 10%, and g = 5%: P0 = D1/(rs – g) = $2/(0.10 – 0.05) = $40. What happens if rs or g changes? 68 Stock Prices vs. Changes in rs and g rs 9% 4% $40.00 g 5% $50.00 10% $33.33 $40.00 $50.00 11% $28.57 $33.33 $40.00 6% $66.67 69 Are volatile stock prices consistent with rational pricing? Small changes in expected g and rs cause large changes in stock prices. As new information arrives, investors continually update their estimates of g and rs. If stock prices aren’t volatile, then this means there isn’t a good flow of information. 70 What is market equilibrium? In equilibrium, the intrinisic price must equal the actual price. If the actual price is lower than the fundamental value, then the stock is a “bargain.” Buy orders will exceed sell orders, the actual price will be bid up. The opposite occurs if the actual price is higher than the fundamental value. (More…) 71 Intrinsic Values and Market Stock Prices Managerial Actions, the Economic Environment, and the Political Climate “True” Expected “True” “Perceived” Expected “Perceived” Future Cash Flows Risk Future Cash Flows Risk Stock’s Intrinsic Value Stock’s Market Price Market Equilibrium: Intrinsic Value = Stock Price In equilibrium, expected returns must equal required returns: ^ rs = D1/P0 + g = rs = rRF + (rM – rRF)b. 73 Expected Return vs. Required Return 16% > 15% reqr’d to invest :: undervalued Stock priced too low so buy b/c bargain As more people buy it, Price & return 10% < :: then reach equilibrium level of return :: overvalued -SELL 74 How is equilibrium established? ^ D1 ^ If rs = + g > rs, then P0 is “too low.” P0 If the price is lower than the fundamental value, then the stock is a “bargain.” Buy orders will exceed sell orders, the price will be bid up until: D1/P0 + g = ^rs = rs. 75 What’s the Efficient Market Hypothesis (EMH)? Securities are normally in equilibrium and are “fairly priced.” One cannot “beat the market” except through good luck or inside information. EMH does not assume all investors are rational. EMH assumes that stock market prices track intrinsic values fairly closely. (More…) 76 EMH (continued) If stock prices deviate from intrinsic values, investors will quickly take advantage of mispricing. Prices will be driven to new equilibrium level based on new information. It is possible to have irrational investors in a rational market. 77 Weak-form EMH Can’t profit by looking at past trends. A recent decline is no reason to think stocks will go up (or down) in the future. Evidence supports weak-form EMH, but “technical analysis” is still used. 78 Semistrong-form EMH All publicly available information is reflected in stock prices, so it doesn’t pay to pore over annual reports looking for undervalued stocks. Largely true. 79 Strong-form EMH All information, even inside information, is embedded in stock prices. Not true—insiders can gain by trading on the basis of insider information, but that’s illegal. 80 Markets are generally efficient because: 100,000 or so trained analysts—MBAs, CFAs, and PhDs—work for firms like Fidelity, Morgan, and Prudential. These analysts have similar access to data and megabucks to invest. Thus, news is reflected in P0 almost instantaneously. 81 Market Efficiency For most stocks, for most of the time, it is generally safe to assume that the market is reasonably efficient. However, periodically major shifts can and do occur, causing most stocks to move strongly up or down. 82 Implications of Market Efficiency for Financial Decisions Many investors have given up trying to beat the market. This helps explain the growing popularity of index funds, which try to match overall market returns by buying a basket of stocks that make up a particular index. 83 Implications of Market Efficiency for Financial Decisions Important implications for stock issues, repurchases, and tender offers. If the market prices stocks fairly, managerial decisions based on over- and undervaluation might not make sense. Managers have better information but they cannot use for their own advantage and cannot deliberately defraud investors. 84 Rational Behavior vs. Animal Spirits, Herding, and Anchoring Bias Stock market bubbles of 2000 and 2008 suggest that something other than pure rationality in investing is alive and well. People anchor too closely on recent events when predicting future events. When market is performing better than average, they tend to think it will continue to perform better than average. Other investors emulate them, following like a herd of sheep. 85 Conclusions Markets are rational to a large extent, but at time they are also subject to irrational behavior. One must do careful, rational analyses using the tools and techniques covered in the book. Recognize that actual prices can differ from intrinsic values, sometimes by large amounts and for long periods. Good news! Differences between actual prices and intrinsic values provide wonderful opportunities for those able to capitalize on them. 86