Your Money

advertisement

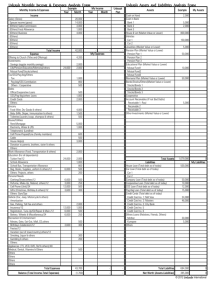

Your Money Spending it, Borrowing it, Saving it, Protecting it The stock market Stock: Equity or ownership in a corporation. Why stock? Buy it because you expect it to increase in value, or expect the corporation to pay part or all of their profits (dividends) Some stocks provide both: appreciation in value (growth) and income Corporation gets proceeds from initial sale (initial public offering (IPO) only Stocks… All proceeds from subsequent sales go to the owner of the stock (stockholder) Price of the stock, as with other commodities, depends on the supply of and the demand for the stock Market for shares P S Q* = total # of outstanding shares D Q * Q Common vs. preferred stock Common stocks: Most stocks; no guarantee of making money (growth or income) Value of common stocks may increase or decrease May or may not receive dividends risky endeavor, compensated with potential return (growth or income) Preferred stock (less risky) certain dividend guaranteed; but only that income but limited growth (capital gain) Chips and splits Blue chips: typically used to denote stocks in large companies that were most valuable Generally largest, most consistently profitable firms Not necessarily the case today Stock splits: change in the number of total outstanding shares Stock split When the price of stock gets fairly high, company may decide to ‘split’ the share to reduce the price of each share result: more shares, lower price E.g. share sells for $100. You own 10 shares. Total value = $100 x 10 = $1000 Company decides a ‘2 for 1’ split those with 1 share now have 2, total value same. New price = $1000/ (2x 10) = $50 each Price changes Price of a stock can change at any time (market price risk) Can use a supply and demand diagram to understand the change Notice that many people on ‘Atkins’ diet. So you want to invest in Atkins Nutritionals, Inc. Others may think the same, demand for Atkins stock increases. (D1) If hear that Atkins is bad for you, then want to get rid of stock. (D2) Market for Atkins stock P S Q* = # shares outstanding P1 D1 P* D P2 Q* Q Value of stock Price of stock is one measure of value. Return on investment: another measure of value = the amount earned on the stock (profit/ investment) Cyclical stocks: company performance depends heavily on that of the economy. If economy is doing well, so will these e.g. Airlines, Hotels Value of stock Factors that determine stock value: • Earnings (growth rate) Competition in industry Availability of new markets Management strengths and weaknesses Overall environment of economy Bottoms-up analysis Buying stocks About 43% of Americans own stock Owned either directly or through mutual funds, pensions or insurers Types of investors: Institutional: invests own assets or those of others it holds in trust e.g. mutual funds, pension funds CalPERS (California Public Employees’ Retirement System) worth $207 B as of 1/06; 64% in stocks Buying stocks Individual investors: account for 45% of all trades; average $10 000 Investment styles: Buy and hold: long-term view, buy stock and wait for it to appreciate Day trading: extremely short-term view, looking to make quick profits (less than 17% of individuals made profit this way) Investment clubs: get together with some friends, pool your money, make investments Beardstown Ladies Buying styles Dollar- cost averaging: regardless of the price of the stock, you buy the same amount each month. At times you pay more, at times less, but works out on average. Reading stock tables WSJ – business publication Most often used by professionals Also can find many places online e.g. money website 52 wks Hi & Lo – for the past 52 weeks Yld % - dividend as % of current price PE – Price/ Earnings ratio – relationship between stock price and earnings for the last 4 quarters often used to compare stocks (here past earnings not future) Forward PE – uses expected earnings (forecast) Reading stock tables Volume - # of shares traded the previous day (x 100 to get actual shares) Large volume typically indicates some information revealed Hi, Lo, Close – stock price of previous day Net change – compared to closing from previous day Sym – stock symbol (unique to company) Keeping up with the (Dow) Joneses… Stock market activity is reported daily in averages and indexes designed to assess the state of the economy Price changes of one stock matters more to stockholder, but market as a whole is a measure of economic activity Market activity typically reported via indexes: Indices… DJIA (Dow Jones Industrial Average) – the Dow – most widely reported; composed of prices of 30 major industrial companies S&P 500 (Standard & Poor’s 500) - a representative sample of 500 leading companies in leading industries of the U.S. economy More indices… NYSE composite index: all stocks traded on the NYSE Russell 2000: follows 2000 of the smallest companies Wilshire 5000: nearly all stocks traded in US markets What’s good for the index is good for the… Why indexes? They serve as important tools for measuring the overall health of stock market; also benchmarks for comparing your own portfolios This past year: DJIA: last 52 wks ~8% S&P 500: 52 wks ~10% Up and down and up and down and… Stock market has cycles (ups and downs) – hard to predict these, but can be explained As people invest in the market – generally market goes up As people pull out of the market – generally it goes down Few other factors (political, social and economic also affect peoples’ decision to invest) Risks: Financial: probability that initial investment not recovered Liquidity: ability to turn money into cash Inflation: higher the inflation, lower the real rate of return Fraud: schemes and scams Market Price Risk Factors Positive Factors Negative Factors Ample money supply Tight money supply Tax cuts Tax increases Low interest rates High interest rates High employment rate High unemployment rate Political stability conflicts; unstable govt Bulls and bears and lions and… Bull market: rising market (values are increasing, indexes are increasing) Typically a reflection of a booming economy as well people are spending money, low unemployment Bear market: falling market (approx 20% of value) Usually bear markets last shorter than bull markets Though drops is market occur quickly (1929 (12.8%), 1987(22.6%)), rises tend to take a while Let the chips fall where they may… Blue chip stock performance during the two crashes: 1929 (market -12.8%): AT&T: - 12.7% Kodak: -18.7% Sears: -12.5% 1987 (market -22.6%): AT&T: - 21.2% Kodak: - 30.2% Sears: - 25.3% Reflecting the economy Stock market activity affected by economy, since companies affected by economy Business cycles in the economy (ups and downs in GDP) related to cycles in stock market Scenario Imagine a scenario: Profits decrease in a company (people sell shares in the firm, ‘wealth’ of stockholders decreases) Firm slows down, lays off employees Unemployment rises Wages fall people less ‘wealthy’ (those laid off sell their shares) Company makes money higher profits (market value increases (stock price) for those holding shares) Scenario More workers hired since company doing well Unemployment decreases Wages rise people wealthy again (invest once again in stock market, where prices have been rising) Profits decrease cycle starts all over How to smooth cycles? Interest rates play a huge role in the economy affects borrowing by corporations, individuals affects economy (lower spending, lower GDP) Fed controls interest rates How? Increases rates to cause economic slowdown, lowers rates to encourage economic growth, through money supply and rate it charges bankers Fed and stocks How does the Fed influence the stock market? Raises interest rates to combat inflation Higher rates, negative impact on people wanting to invest in stock market stock prices fall Economy slows down (higher rates) prices and wages fall companies start coming back to profitability Can Anyone tell you how to spend your money? (Ch 9) Pecuniary emulation up with the Joneses’ wondering how they could afford it? ‘Keeping People spend their money differently, but there are average patterns. Table 5 (p 45) Majority of expenses: Shelter, Transportation Spending patterns As income rises, most expenditures as a percent of income decrease (total amount spent does not change too much) except for insurance, pension & SS (usually a certain % spent, regardless of income), savings & taxes more money, ability to save more Also varies with age As age increases, spend more (%) on food, utilities and health care; less on taxes, SS Back to money… Paper bills get worn out pretty quick. Need to be replaced. Average lifespan of $1: between 13 – 18 months. How does new currency get into your hands? The treasury ships new money to the Federal Reserve banks. New Money Federal Reserve banks return old money to the treasury, who shred and burn it. The Fed then distributes the money to individual banks in its regions. The banks send back old worn out bills back to the Fed branch. The banks distribute the new money to its customers (in exchange for old ones, of course!) They get used, world goes around ($$)… Other forms of money Currency is not the only type of money. Checks Debit cards Not credit cards 1998: 70% of all households have at least 1 credit card Estimated that roughly 84% of those pay their bill in full monthly. Federal Reserve System Monetary Policy: the Fed injects and withdraws money from the economy in order to regulate it. Money supply: the amount of money that people have available to spend (cash, checking accounts) Federal Reserve system If money supply is increased, typically economy grows quickly, companies hire more workers, people spend more If money supply is decreased, economy slows down, unemployment increases etc. More money there is in the economy, the higher is the price level, less purchasing power (inflation) As fed changes money supply, the interest rate changes. Increase Ms interest rate falls, decrease Ms interest rate rises. Do you need a budget? (Ch 10) If living within paycheck, paying all bills on time, saving money and doing all without a budget, then one is not needed. But, even if one of the above not met, then need a budget. Four main elements to a budget: income, expense categories, time period and implementation. Budget woes… Income to Use: wages and salaries, rental income, regular investment income (bonds, dividends etc), pension income, and any other regular income received. If want to account for taxes, use gross income, else use net income (after taxes). Loans are not income expense Budget expenses Most important category Categories need to be neither too broad nor too specific. Break down of categories: either as food, clothing, utilities etc Or as based on locations (furniture,gas etc) Pg 50 Budget Time Period: monthly, weekly, yearly Best to do monthly, since major expenses occur once a month: rent / mortgage, utilities, car payments, credit cards. Some get paid once a month, others bi-weekly; either way make sure your expenses and income are of the same time period Budget Implementation: hardest part Save receipts, cancelled checks for all payments made in a month Account for all income. Cars: To lease or own? For same car, lease payments less than loan payments since not paying for whole car Leasing: only paying for value of car during time you lease it (paying for the depreciation) ‘Loaning’ : paying for whole value Cars depreciate most in first two years typically when leased When lease? If you want a new car every couple of years, businesses Best strategy: Buy (new car) and hold (it for a long time) How much debt is too much? (Ch 12) If own a house, probably the largest share of your debt. Other forms: student loans, credit cards, etc. How much is too much? 20% rule If credit payments (excluding mortgage) are more than 20% of take- home pay trouble! Comes from typical spending patterns once all essentials accounted for, typically have 20% left over average Example Achilles takes home $2000 every month. He pays $300 for his 4-horsepower vehicle. He also owes $200 a month to a creditor, Lenderus. Is Achilles headed for trouble? Achilles monthly credit payments: $300+200 = 500 Take home: $2000 % = 500/ 2000 x 100 = 25% According to the rule, he is headed for trouble. Now you try it! Patroclus takes home $1500 a month. He pays $175 for his wagon, gives $550 to Lenderus as mortgage payments, pays $50 towards his student loan, taken to study under Achilles. Is he, like his master Achilles, headed for trouble? How you can get out of debt (Ch 13) How do you get into trouble with debt? Take on too much Maintain your debt, but suffer drastic drop in income 2nd alternative usually occurs during recessions, with layoffs. How to get out of debt? No more debt Spending control reduce ‘other spending’ and pay off debt Regular payment schedule to pay off debt entirely How you can get out of debt Step 1: No more debt! Stay away from the mall, don’t look at ads! Step 2: Reduce ‘other’ expenses dieting: just ‘eat’ less! Hard to do Start thinking of cheaper alternatives (watch Martha Stewart living) Like Step 3: Rigid monthly plan See table 9, pg 66 Example Paul owes $8000 on his Visa. The annual percentage is 18%. He can afford $200 per month. How long before he pays it off completely? Divide total debt by monthly payment. 8000/ 200 = 40 Locate the interest rate column on the table. Look down column until number closest to step 1 result. Example 2 Suppose Peter wants to pay off his loan in 3 years. He owes $8000 as well and pays 18% interest to his credit card. What would he have to pay monthly to accomplish this task? Find the interest rate column (18%). Find the month row (36 months = 3 yrs). Use the number (27.66) to calculate monthly payment: Debt/ number = Monthly payment 8000/ 27.66 = $289.23 Now you try it! I owe $14, 000 to my neighborhood ‘shark’ who is a nice guy and charges me 13% on my ‘loan’. How long before I can pay him off, if I pay him $155 per month? I owe $6, 000 to my bank. They charge me 6%. What monthly payments do I need to make to pay off my loan in 5 years? Debt Calculator Are all interest rates the same? (Ch 14) Now you decide you want a loan: debt consolidation, house, car etc. How do you know which is the lowest possible rate you can get? 2 possible types: Tax favored Fixed vs. adjustable rates Tax-favored The interest that you pay on these loans is tax deductible. These deductions reduce your taxable income, which reduces the actual tax you pay. Most commonly loans for homes. Choice difficult when facing 8% tax-favored loan or 6% loan? How calculate? Using tax bracket Which is the better rate? 1. 2. 3. 4. Two loans: 8% tax- favored vs. 6% Find your tax bracket (from chap 21). Tax-favored rate x tax bracket Tax-favored rate – result from 2. = after tax, taxfavored rate Compare result from 3. to 6% (rate which is not tax – favored): if tax- favored rate lower, then better choice, or else the other rate is better. Example One Harry needs a new car when returning to Hogwarts this fall. He is offered a loan of 6% by Mr. Jigger, the local car salesman. When his uncle’s family passed away due to some unfortunate spell, he became the sole owner of their house. Thus he can also get a taxfavored 8% loan from the Bank of the Kappas. What should Harry do? (Assume his tax bracket is 28%) Example One 1. 2. 3. 4. Tax bracket: 28% .28 x 8% = 2.24% 8% - 2.24% = 5.76% 5.76% < 6%, so Harry better off going to the Kappas. Now you try it Harry’s best friend, Ron Weasley, also wants to buy a new car. He owns a house left to him by Agrippa, a wizard. He has the same options as Harry for financing his new ride (8% from the Kappas, or 6% from Mr. Jigger). However, being slightly less wealthy, Ron’s tax bracket is 15%. What do you suggest he do? Fixed vs. Adjustable Rates Fixed rate: never changes for the duration of the loan, regardless of what interest rates do. Adjustable rate: rises and falls with interest rates. Typically fixed rates > adjustable rates When fixed? If interest rates low and expected to rise in the future When adjustable? If rates high and expected to fall. Rule of thumb If own house for shorter time period, better off with adjustable rate (may not go up much in the short time you own the house) Rule of thumb: Own house less than 5 yrs, go with adjustable rate mortgage (ARM), if more than 5 years, go with fixed. How else can you lower the rates on a mortgage? Points… What’s the point? Point: paying the lender to lower the rate on your mortgage One point = one % of mortgage loan If loan is for $100,000, then need to pay $1,000 to have lower mortgage rate. How much lower? Depends on the deal. Typically, longer stay in a house, the better it is to pay the points Why not increase down payment with available cash? Typically better to pay points than reduce loan amount. How can you save money? (Ch 15) Life-cycle of saving: saving depends largely on stage in life: young, middle-age, retirement. Young households: typically spend more than they earn and hence borrow money Middle-age households: typically spend less than they earn and hence save. Retired : again spend more than they earn Savings investment economic growth How much should you save? (Ch 16) Say saving for college, retirement uncertainty since do not need the money for 18 – 20 years (need to account for purchasing power) Easier to save later in life than earlier Nominal rate = real rate + inflation Real rate of interest: more predictable and rarely fluctuates much (0 – 3 % typically, lower risk investments closer to 0) Keeping it real If inflation > nominal rate, then real rate is negative. E.g. Japan in the early ’90s. If you are paid 4% return on your investment, and inflation is 5% per year, then your ‘real’ rate is -1%. Use Table 10 to figure out what you need to save. More conservative, the lower the real interest rate (closer to 0) E.g. if invest primarily in bonds, use 0%; if mix of stocks and bonds, use 3%; if primarily stocks and other risky ventures, use 7%. Keeping it real 1. 2. 3. 4. 5. Select the real interest rate, say 3% Pick the number of years the money will be needed for. E.g. college = 4 yrs; retirement = 30 yrs. LHS column, # of yrs of saving (say can save for the next 30 yrs, for retirement) Find the intersection of 1, 2 and 3. Multiply the amount by x/1000, where x is the amount/ yr you will need. example 1. 2. 3. 4. 5. 6. I want to retire in 30 years. I will be around for 30 years after I retire. I think conservatively (real return is 3%). I will need $30,000 in today’s dollars to have a good life. How much do I need to save per month in the first year? Real rate = 3% # of yrs $ needed = 30 # of yrs of saving = 30 Future purchase (today’s $) = 30,000/1000 = 3 From table: $34 x 3 = $102/ month Increase with inflation. Example 2 John and George want to get into business together. They calculate that they need $8000 for a down payment on their business loan, if they bought the business today. They plan to save up for the next 5 years to have the down payment. If they can expect a real rate of interest of 7%, how much should they save per month in the first year?