Working With Financial Statements

advertisement

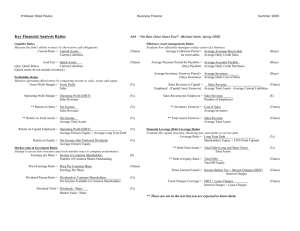

3 Working With Financial Statements 0 1. 2. 3. 4. Know how to standardize financial statements for comparison purposes Know how to compute and interpret important financial ratios Be able to compute and interpret the DuPont Identity Understand the problems and pitfalls in financial statement analysis 1 Numbers in millions, except EPS & DPS Revenues 5,000 Cost of Goods Sold (2,006) Expenses (1,740) Depreciation (116) EBIT 1,138 Interest Expense (7) Taxable Income Taxes 1,131 (442) Net Income 689 EPS 3.61 Dividends per share 1.08 2 Numbers in millions, except EPS & DPS Revenues 5,000 100% Cost of Goods Sold (2,006) (40.1) Expenses (1,740) (34.8) Depreciation (116) (2.3) EBIT 1,138 22.8 (7) (0.1) 1,131 22.6 (442) (8.8) 689 13.8 Interest Expense Taxable Income Taxes Net Income EPS 3.61 Dividends per share 1.08 3 Common-Size Balance Sheets ◦ Compute all accounts as a percent of total assets Common-Size Income Statements ◦ Compute all line items as a percent of sales Standardized statements make it easier to compare financial information, particularly as the company grows They are also useful for comparing companies of different sizes, particularly within the same industry 4 2005 Revenues Cost of Goods EBIT Net Income Cost of Goods EBIT Net Income 2007 2008 5000 6000 6500 7000 2006 2230 2400 2700 1138 1300 1400 1450 689 730 751 770 2005 Revenues 2006 2006 2007 2008 100% 120% 130% 140% 100% 111% 119% 135% 100% 114% 123% 127% 100% 106% 109% 112% 5 6 Ratios also allow for better comparison through time or between companies As we look at each ratio, ask yourself what the ratio is trying to measure and why that information is important Ratios are used both internally and externally 7 Short-term solvency or liquidity ratios Long-term solvency or financial leverage ratios Asset management or turnover ratios Profitability ratios Market value ratios 8 Numbers in millions, except EPS & DPS Revenues 5,000 Cost of Goods Sold (2,006) Expenses (1,740) Depreciation (116) EBIT 1,138 Interest Expense (7) Taxable Income Taxes 1,131 (442) Net Income 689 EPS 3.61 Dividends per share 1.08 9 Numbers in millions 2007 2006 2007 2006 Cash 696 58 A/P 307 303 A/R 956 992 N/P 26 119 Inventory 301 361 Other CL 1,662 1,353 Other CA 303 264 Total CL 1,995 1,775 Total CA 2,256 1,675 LT Debt 843 1,091 Net FA 3,138 3,358 C/S 2,556 2,167 Total Assets 5,394 5,033 Total Liab. & Equity 5,394 5,033 10 Current Ratio = CA / CL Quick Ratio = (CA – Inventory) / CL Cash Ratio = Cash / CL NWC to Total Assets = NWC / A Interval Measure = CA / average daily operating costs ◦ 2,256 / 1,995 = 1.13 times ◦ (2,256 – 301) / 1,995 = .98 times ◦ 696 / 1,995 = .35 times ◦ (2,256 – 1,995) / 5,394 = .05 ◦ 2,256 / ((2,006 + 1,740)/365) = 219.8 days 11 Total Debt Ratio = (A –E) / A ◦ (5,394 – 2,556) / 5,394 = 52.61% Debt/Equity = D / E ◦ (5,394 – 2,556) / 2,556 = 1.11 times Equity Multiplier = A / E = 1 + D/E ◦ 1 + 1.11 = 2.11 Long-term debt ratio = LTD / (LTD + E) ◦ 843 / (843 + 2,556) = 24.80% 12 Times Interest Earned = EBIT / Interest ◦ 1,138 / 7 = 162.57 times Cash Coverage = (EBIT + Depreciation) / Interest ◦ (1,138 + 116) / 7 = 179.14 times 13 Inventory Turnover = Cost of Goods Sold / Inventory ◦ 2,006 / 301 = 6.66 times Days’ Sales in Inventory = 365 / Inventory Turnover ◦ 365 / 6.66 = 55 days 14 Receivables Turnover = Sales / Accounts Receivable ◦ 5,000 / 956 = 5.23 times Days’ Sales in Receivables = 365 / Receivables Turnover ◦ 365 / 5.23 = 70 days 15 Total Asset Turnover = Sales / Total Assets NWC Turnover = Sales / NWC Fixed Asset Turnover = Sales / NFA ◦ 5,000 / 5,394 = .93 ◦ It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets ◦ 5,000 / (2,256 – 1,995) = 19.16 times ◦ 5,000 / 3,138 = 1.59 times 16 Profit Margin = Net Income / Sales ◦ 689 / 5,000 = 13.78% Return on Assets (ROA) = Net Income / Total Assets ◦ 689 / 5,394 = 12.77% Return on Equity (ROE) = Net Income / Total Equity ◦ 689 / 2,556 = 26.96% 17 Market Price = $87.65 per share Shares outstanding = 190.9 million PE Ratio = Price per share / Earnings per share ◦ 87.65 / 3.61 = 24.28 times Market-to-book ratio = market value per share / book value per share ◦ 87.65 / (2,556 / 190.9) = 6.55 times 18 ROE = NI / E Multiply by 1 (A/A) and then rearrange ◦ ROE = (NI / E) (A / A) ◦ ROE = (NI / A) (A / E) = ROA * EM Multiply by 1 (Sales/Sales) again and then rearrange ◦ ROE = (NI / A) (A / E) (Sales / Sales) ◦ ROE = (NI / Sales) (Sales / A) (A / E) ◦ ROE = PM * TAT * EM 19 ROE = PM * TAT * EM ◦ Profit margin is a measure of the firm’s operating efficiency – how well it controls costs ◦ Total asset turnover is a measure of the firm’s asset use efficiency – how well does it manage its assets ◦ Equity multiplier is a measure of the firm’s financial leverage 20 Bal. Sheet (1/28/06) Data (millions, $U.S.) ◦ ◦ ◦ ◦ Cash = 225.27 Inventory = 91.91 Other CA = 22.16 Fixed Assets = 164.62 Computations ◦ TA = 503.96 ◦ TAT = 2.39 ◦ EM = 1.77 2006 Inc. Statement Data (millions, $U.S.) ◦ ◦ ◦ ◦ ◦ Sales = 1,204.35 COGS = 841.87 SG&A = 227.04 Interest = (3.67) Taxes = 55.15 ◦ ◦ ◦ ◦ NI = 83.96 PM = 6.97% ROA = 16.66% ROE = 29.49% Computations 21 ROE = 29.49% ROA = 16.66% EM = 1.77 x PM = 6.97% TAT = 2.39 x NI = 83.96 Total Costs = - 1,120.39 + Sales = 1,204.35 Sales = 1,204.35 Sales = 1,204.35 TA = 503.96 Fixed Assets = 164.62 + Current Assets = 339.34 COGS = - 841.87 SG&A = - 227.04 Cash = 225.27 Interest = - (3.67) Taxes = - 55.15 Other CA = 22.16 Inventory = 91.91 22 A firm has an equity multiplier of 1.90, an asset turnover of 1.2 and a profit margin of 8%. What is the firm’s ROA, and ROE. 23 Liquidity ratios ◦ Current ratio = 1.40x; Industry = 1.8x ◦ Quick ratio = .45x; Industry = .5x Long-term solvency ratio ◦ Debt/Equity ratio (Debt / Worth) = .54x; Industry = 2.2x. Coverage ratio ◦ Times Interest Earned = 2282x; Industry = 3.2x 24 Asset management ratios: Profitability ratios ◦ Inventory turnover = 4.9x; Industry = 3.5x ◦ Receivables turnover = 59.1x (6 days); Industry = 24.5x (15 days) ◦ Total asset turnover = 1.9x; Industry = 2.3x ◦ Profit margin before taxes = 10.6%; Industry = 2.7% ◦ ROA (profit before taxes / total assets) = 19.9%; Industry = 4.9% ◦ ROE = (profit before taxes / tangible net worth) = 34.6%; Industry = 23.7% 25 Internal uses External uses 26 Ratios are not very helpful by themselves; they need to be compared to something Time-Trend Analysis ◦ Used to see how the firm’s performance is changing through time ◦ Internal and external uses Peer Group Analysis ◦ Compare to similar companies or within industries ◦ SIC and NAICS codes 27 There is no underlying theory, so there is no way to know which ratios are most relevant Benchmarking is difficult for diversified firms Globalization and international competition makes comparison more difficult because of differences in accounting regulations Varying accounting procedures, i.e. FIFO vs. LIFO Different fiscal years Extraordinary events 28 Enron - a natural gas, natural gas liquids, electricity, exploration and production, operator of power plants and natural gas pipelines. Enron stock price fell from $75 to nothing due to bankruptcy. One aspect of their collapse was the way they managed to keep debt off their balance sheet and hid commitments to honor the debt. Without full disclosure, no one knew the true situation. 29 Make companies and managers look good because return on capital looks better. Investors and regulators do not freak out when debt balloons. Spreads confusion These off balance sheet debt obligations are typically triggered (parent requited to pay debt) if stock falls bellow a certain level or its debt is downgraded. That is why the SEC is taking care of these issues. 30 How do you standardize balance sheets and income statements and why is standardization useful? What are the major categories of ratios and what are they good for? What are some of the problems associated with financial statement analysis? 31 XYZ Corporation has the following financial information for the previous year: Sales: $8M, PM = 8%, CA = $2M, FA = $6M, NWC = $1M, LTD = $3M Compute the ROE using the DuPont Analysis. 32 A Simple Cycle of Operations: CASH CASH RAW MATERIALS INVENTORY RECEIVABLES RECEIVABLES FINISHED GOODS INVENTORY 33 34 Assume: AVG. Inventory – 352.5; AVG AR=285; AVG AP=235; COGS=480; Sales (all on credit) = 710 – calculate cash cycle: 35