Resources

advertisement

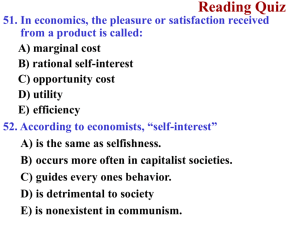

Celio/Maher: 2013-14 Briar Woods High School Advanced Placement Economics 2013- 2014 Mr. Celio: steve.celio@lcps.org Mr. Maher: wmaher@lcps.org Resources Textbook: McConnell, C. and Brue, S. (2009). Economics, 18th Edition, New York: McGraw-Hill. Textbook supplement: Ellison, L. (2009). AP Achiever: Advanced Placement exam prep guide for microeconomics and macroeconomic. New York: McGraw-Hill. Outside reading #1: Hazlitt, Henry (1988 reprint). Economics in One Lesson. Outside reading #2: Wheelan, Charles (2002). Naked economics. New York: Norton. Course Overview and Objectives: Economics is about how we, as a society, allocate scarce resources. Who gets what? How much? When? What price? Who makes it? These are all questions that economists answer. In this class, you will be taking TWO college courses and preparing for TWO AP exams. Our first goals are to become economically literate, and to learn how to improve decision making through economic thinking. By working to meet those goals, you will be well prepared for both exams. Advanced Placement Economics is a two semester course. (Syllabus: Micro and Macro) First Semester: The focus of study during the first semester is Microeconomics. The central goal in this course is to help students gain an understanding of and appreciation for the principles of economics that affect how individuals, households and businesses make economic decisions. Students will learn how to generate charts and graphs to describe economic concepts. Second Semester: The focus of study during the second semester is Macroeconomics. The central goal in this course is to help students gain an understanding of and appreciation for the principles of economics that apply to the American economic system as a whole. Students will study the nature and functions of product markets and particular emphasis will be placed on national income, fiscal and monetary policy, economic performance measures, economic growth and open economies. Celio/Maher: 2013-14 Microeconomic Outline (1st Semester) (THIS OUTLINE IS SUBJECT TO CHANGE. FOR A DETAILED AGENDA AND OUTLINE PLEASE CHECK THE CLASS CMS WEB PAGE !) 1st Quarter Unit 1: Basic Economic Concepts (Chapters 1, 2, 4 & 5, McConnell & Brue) A. Founding Principles Scarcity, the economizing problem Tradeoffs and Opportunity Cost Free-market system (Adam Smith’s invisible hand) B. Types of Economics Microeconomics vs. macroeconomics Positive economics vs. normative economics C. Production Possibilities Graph Straight vs. bowed PPF Underutilization, full employment, and unattainable Law of increasing opportunity cost 3 shifters of the PPF Consumer goods vs. capital goods D. Circular Flow Model Product market, Factor market, and Public/Private sector E. Specialization and Trade Absolute advantage Comparative advantage Unit 2: Supply, Demand, And Consumer Choice (Chapters 3, 6, & 7. McConnell & Brue) A. Demand (graph) Law of demand Market demand curve Determinants of demand Normal vs. inferior goods Substitutes and complements B. Supply (graph) Law of supply Market supply curve Determinants of supply C. Equilibrium and Efficiency (graph) Equilibrium price and quantity Disequilibrium: surplus and shortages (graphing) D. Government Policies (graphs) Price floors and Price ceilings Excise taxes, Subsidies, Tariffs, Quotas Celio/Maher: 2013-14 E. Elasticity Price, Income, and Cross Price elasticity of demand The total revenue test (graph) F. Consumer Choice Law of diminishing marginal utility, Substitution effect, Income effect Marginal benefit/cost Utility maximizing rule Unit 3 Costs of Production and Perfect Competition (Chapters 8 & 9. McConnell & Brue.) A. Economists vs. Accountants Total revenue Explicit and Implicit costs Economic costs and profits B. Costs of Production (graph) Fixed Costs, Variable costs, and Total costs Per-unit costs (AVC, AFC, ATC) Shifts in MC, ATC. AVC, and AFC Marginal costs and Marginal revenue Sunk costs C. Law of Diminishing Marginal Returns (graph) Stage I: increasing returns Stage II: decreasing returns Stage III: negative returns D. Long-run Production Costs (graph) Economies of scale, Constant Returns to scale, Diseconomies of scale E. Characteristics of Perfect Competition Price takers Demand = MR= Price Graph: Firm vs. industry (market) Short-run (profit or loss) Long-run equilibrium (New firm enter and exit) Normal profit Shutdown decision (P< AVC) Productive efficiency (P = Min ATC) Allocative efficiency (P = MC) 2nd Quarter Unit 4 Imperfect Competition (Chapters 10 & 11. McConnell & Brue) A. Characteristics of Monopolies Barriers to entry MR below demand (graphs) Profit-maximizing price and quantity Natural monopoly Celio/Maher: 2013-14 B. Effects on overall economy Compared to competitive industry Dead-weight loss X-efficiency C. Price discrimination (graph) Purpose and results Graph (MR=D) D. Regulation Unregulated price, Fair return price, and Socially optimal price Taxes and subsidies E. Characteristics of Monopolistic Competition Long-run equilibrium (graph) Excess capacity Non-price competition Product differentiation F. Characteristics of Oligopolies Kinked demand curve-competitive pricing Game theory (chart) price leadership Collusion and cartels Unit 5 Resource Market (Chapters 12, 13 & 14. McConnell & Brue) A. Demand for labor Derived demand Marginal revenue product Marginal resource cost B. Perfectly competitive labor market (graph) Wage makers Perfectly elastic supply of labor C. Monopsony (graph) Wages and quantity compared to perfectly competitive labor market D. Labor Unions Goals and methods E. Effects of Minimum Wage F. Wage differentials Investment in human capital vs. physical capital G Rent, Interest and Profit Distribution of Income Capital and Interest Loanable Funds market Unit 6 Market Failures and Government Involvement (Chapters 16, 17 & 20. McConnell & Brue) A. Public goods Demand for public goods Supply of public goods Free-rider problem Non-excludability and Non-rivalry Celio/Maher: 2013-14 B. Positive externalities/spillover benefits (graph) Marginal social benefits vs. private benefits Underallocation Government remedy C. Negative externalities/spillover costs (graph) Marginal social cost vs. private cost Overallocation Government remedy D. Economics of Taxation (Tax Burden) Progressive Regressive Proportional E. Income distribution Lorenz curve (graph) Tax incidences Macroeconomic Outline (2nd Semester) Third Quarter Unit 7: Macroeconomic Data and Measurement (Chapters 23 & 24 McConnell & Brue) A. Introduction to Macro Basic Concepts Long Run vs. Short Run Demand Shock vs. Supply Shock (Sticky Prices) B. GDP (Nominal and Real values) Expenditure approach Income Approach Unit 8: Inflation and Unemployment (Chapters 25 & 26 ) A. Economic Growth Rate of Economic Growth Real GDP Economic Growth and PPC Labor Productivity B. Business Cycle C. Inflation CPI Demand- Pull and Cost Push D. Unemployment Types of unemployment GDP Gap and Okun’s Law Celio/Maher: 2013-14 Unit 9: Consumptions vs. Savings (Chapters 27 & 28) A. Average and marginal Propensities to Consume and Save MPC and MPS as Slopes B. Interest Rates Expected Rate of Return Real Interest Rates C. Multiplier Effect Changes in Spending and changes in Real GDP D. International Trade and the Public Sector Recessionary Gap vs. Inflationary Gap Fourth Quarter Unit 10: Aggregate Demand and Aggregate Supply (Chapters 29 & 35) A. Aggregate Demand Changes in Aggregate Demand Aggregate Demand Curve Determinants of AD B. Aggregate Supply Output in Immediate Short Run, Short Run and Long Run Aggregate Supply Curve Determinants of AS C. Fiscal Policy Expansionary vs. Contractionary Fiscal Policy Built in Stabilizers Crowding Out effect Unit 11: Money and Banking & Long Run AS (Chapter 30, 31, 32, 33 & 35) A. Money M1 M2 B. Banking\ Federal Reserve System Globalization of Financial markets C. Money Creation and Monetary Policy Reserve Requirement and Discount Rate Reserve Ratio Monetary Multiplier Interest Rates Taylor Rule (Federal Funds Rate) D. Long Run Aggregate Supply Short Run AS vs. Long Run AS Long Run Equilibrium Demand –Pull Inflation Phillips Curve and Stagflation Celio/Maher: 2013-14 E. Supply Side Theory Laffer Curve Application of Supply Side Theory Unit 12: Exchange Rates/ Trade Deficit (Chapter 37 & 38) A. International Trade Key facts and Basis for Trade PPC Gains from Trade Free Trade vs. Protectionist Theory (WTO) B. Balance of Payments C. Flexible Exchange Rates D. Fixed Exchange Rates Macroeconomics Final Exam Course Requirements and Resources: Notebook organization: You will need a three-ring binder for this. The front page will be the table of contents. All work will be logged on this this in the order that it is given, and points possible and points earned should be added as well. The actual assignments will be numbered and placed in the correct order behind the table of contents. This will be collected and reviewed for a grade near the end of the quarter, but the main purpose of the assignment is to enhance your organization and aid your success in this course. Problem Sets: These will be handed out for each unit, and will be due two blocks before the unit test. They will include multiple choice, short answer, and free response questions, and will double as a test review. Key vocab terms: (these are the most significant terms in each chapter, but this is not a comprehensive list of what you need to know) Chapter 1: Economics, utility, marginal utility, scarcity, opportunity cost, production possibilities curve, capital goods, consumer goods, economic growth, factors of production (identify), comparative advantage Chapter 2: Money, barter, command economy, market economy, competition, invisible hand, dollar votes Chapter 4: Durable v. non-durable goods, monopoly, externality, public good, free-rider problem, transfer payment, externality, marginal tax rates, excise tax Chapter 3: Demand, law of demand, diminishing marginal utility, income effect, substitution effect, inferior goods, normal goods, substitute good, complementary goods, supply, determinants of supply, equilibrium price/quantity, surplus, shortage, productive efficiency, allocative efficiency Chapter 6: Price elasticity of demand, unit elasticity, elastic demand, inelastic demand, perfectly elastic demand, perfectly inelastic demand, total revenue test, price elasticity of supply, market period, short run, long run, cross-elasticity of demand, income elasticity of demand, consumer surplus, producer surplus, efficiency loss Chapter 7: Utility, law of diminishing marginal utility, total utility, marginal utility, rational behavior, budget constraints, consumer equilibrium, income effect, substitution effect Chapter 8: Opportunity cost, explicit costs, implicit costs, normal profit, economic profit, total product, marginal product, average product, law of diminishing returns, fixed costs, variable cost, total cost, marginal costs, economies of scale, returns to scale, minimum efficient scale, natural monopoly Chapter 9: Pure competition, imperfect competition, price taker, average revenue, total revenue, marginal revenue, break- even point, MR=MC rule, short-run supply curve, constant-cost industry, increasing cost industry, [productive efficiency, allocative efficiency, consumer surplus, producer surplus in context] Celio/Maher: 2013-14 Chapter 10: Pure monopoly, barriers to entry, simultaneous consumption, network effects, X-inefficiency, price discrimination, socially optimal price, fair-return price Chapter 11: Monopolistic competition, product differentiation, non-price competition, Four-firm concentration ratio, Excess capacity, oligopoly, Mutual interdependence, game theory, collusion, price war, cartel Chapter 12: Derived demand, marginal product, marginal revenue product, marginal resource cost, MRP=MRC rule, elasticity of resource demand, least-cost combination of resources, profit-maximizing combination of resources Chapter 13: Wage rate, nominal wage, real wage, purely competitive labor market, monopsony, minimum wage, wage differentials, human capital Chapter 14: Economic rent, incentive function, time-value of money, nominal interest rate, real interest rate, Explicit costs, implicit costs, economic profit, normal profit Chapter 16: Private goods, public goods, free-rider program, cost-benefit analysis, externalities, Coase Theorem, asymmetric information, moral hazard problem, adverse selection problem Chapter 17: Public Choice Theory, logrolling, special-interest effect, benefits received principle, ability to pay principle, progressive tax, regressive tax, proportional tax, efficiency loss of a tax Chapter 20: Lorenzo Curve, Gini ratio, equality efficiency trade off Chapter 23: The business cycle; recession; real gross domestic product (GDP); nominal GDP; unemployment, financial investment, economic investment, demand shocks, supply shocks, sticky prices, inflation. Chapter 24: National income accounting; value added; expenditures approach (know parts- C, I, G & X); income approach (know parts), national income; personal income; disposable income; price index Chapter 25: Economic growth; real GDP per capita; labor productivity; infrastructure; human capital Chapter 26: Peak; trough; expansion, labor force; unemployment rate; three types (frictional, structural and cyclical) of unemployment, full rate of unemployment, natural rate of unemployment, Okun’s law; Consumer Price Index (CPI); Demand-pull v. cost-push inflation; deflation; nominal income, real income, cost-of-living adjustments, hyperinflation Chapter 27: Consumption schedule, saving schedule, break even income, Average propensity to consume (save), Marginal propensity to consume (save), Wealth effect, Expected rate of return, Multiplier Chapter 28: Planned investment, Investment schedule, Aggregate expenditures schedule, Equilibrium GDP, leakage, injection, net exports, recessionary expenditure gap, inflationary expenditure gap Chapter 29: Aggregate demand-aggregate supply (AD-AS) model, Aggregate demand, Interest rate effect, Determinants of aggregate demand, Aggregate supply, Short-run aggregate supply curve, Determinants of aggregate supply, Productivity, Equilibrium price level, Equilibrium real output Chapter 30: Fiscal policy, Budget deficit/surplus, built-in (automatic) stabilizers, progressive tax system, crowding out effect, public debt, US securities Chapter 31: Liquidity, M1, M2, commercial banks, Federal Reserve System, Federal Open Market Commission Chapter 32: Fractional reserves banking system, balance sheet, required reserves, reserve ratios, Federal funds rate, monetary multiplier Chapter 33: Monetary policy, interest, transactions demand, asset demand, open market, discount rate, Federal Funds Rate, prime interest rate, Taylor Rule Chapter 35: Phillips Curve; Stagflation; Aggregate supply shocks; Long-run vertical Phillips Curve, Supplyside economics; Laffer Curve Chapter 37: Comparative advantage (again), Terms of trade; Trading possibilities line,, gains from trade,world price, domestic price, export supply curve, tariffs (types), nontariff barrier, Dumping, World Trade Organization (WTO) Chapter 38: Balance of payments; Current account; Trade deficit; Trade surplus; Official reserves, Floating exchange rate system; Fixed-exchange-rate system; Purchasing power parity theory; Currency intervention; Exchange controls Celio/Maher: 2013-14 Chapter Quizzes: There will be one quiz for almost every chapter, although in rare instances there will be two or none. These will consist primarily of multiple-choice questions covering both vocabulary and content. Unit Tests: These will consist of 50 multiple choice questions which will account for 100 points and two free-response questions that will count for 50 points, although they will not always be 25 points each Application Exercises: This will generally be one or two free responses designed to reinforce the concepts learned in the unit, AS WELL AS EARLIER UNITS. Classroom Activities: These are typically practice problems, graphing activities, or short answer questions designed to reinforce the content covered that day. They will be done in an individual/pair format. Grades AP Economics is primarily a reading, lecture, discussion and theory course. All major tests will be announced well in advance and will be multiple-choice questions and free response questions. Frequent reading/vocabulary quizzes will be given to assess students’ understanding of their reading. All grades will be on a point system for each quarter. All though there will be exceptions, each assignment generally will be worth the following number of points: Grades: Assignment Points Assignment Test 150 Application Exercises Problems Sets 50-75 Class Activities Reading/Vocabulary Quiz 10-20 Projects **Each student is expected to monitor his or her own progress via Clarity** Points 15-20 5-10 100 1. All tests, quizzes, projects and homework will be assigned a point value. Your quarter grade will be determined by the total number of points earned, versus the total number of points assigned. 2. There will be a major project worth 100 points assigned each quarter. 1st Quarter: Economic Literacy Project 2nd Quarter: Book Report (Economics in One Lesson) 3rd Quarter: Book Report (Naked Economics) 4th Quarter: TBA 3. Students will have frequent reading/vocabulary quizzes. (5-10 points each) 4. Late work policy: 1. For tests/quizzes missed for excused absences/tardiness, the student is responsible for scheduling a make-up time to be completed within one week of their return to class. Failure to do so will result in a grade of 50% being assigned. Missed test or quizzes for unexcused absences or tardiness will result in a grade of 50% being assigned. 2. The current event notebooks and class notebooks will be due on the dates identified on the calendar, and will be assessed a 50-point penalty for each day they are late. 3. Homework assignments will not be accepted late except in the cases of excused absences. A grade of 20% will be given for missed homework assignments. 4. Upon return from an absence check with Mr. Maher to see what you missed. Get any assignments and complete them for the next class. If you missed notes please get them from a classmate. Celio/Maher: 2013-14 5. Students will take a mid-term and final exam. ALL STUDENTS ARE REQUIRED TO TAKE THE MID–TERM AND FINAL EXAM (LCPS Senior Exemption Policy will be followed) Grading Distribution: 1st quarter 20% 2nd quarter 20% Mid-term exam 10% 3rd quarter 20% 4th quarter 20% Final exam 10% Frequently Asked Questions: When are the AP Economics Exams? Thursday, May 15, 2014 (Macro is in the morning, Micro in the afternoon). Will there be separate finals for Macro and Micro? Yes. The Micro final will be the mid-term exam and the Macro final will be the final exam. Time will determine when we do the Macro final. After our last Macro unit, we’ll go back and review Micro and then spend a week in preparation for the AP Exams. What is the structure of the AP exams? The exam is the same format for micro and macro: 60 multiple choice questions in 70 minutes, and 3 free response (1 long and 2 short) in 50 minutes (the long question is worth 50% of the free response score). The multiple choice section is worth 2/3 of the total score. Typically, getting 60% of the multiple choice correct is enough to pass the exam (assuming the free responses are similarly competent). What schools offer credit for these exams? Check with your schools directly. College-Board also has a good way to do it on-line at http://www.collegeboard.com/ap/creditpolicy. Some schools offer credit for threes, many for fours, and at some, credit is only offered for fives. A very few do not offer credit. Guidelines for Success: 1. 2. 3. 4. 5. Read and outline chapters, complete the multiple choice sections for each chapter. Correct mistakes on your assignments. Fix the errors that exist in your mind before moving on! Learn and love the graphs used in Economics, and maintain a graph section in your notebook. Create study groups and work together, but find students with work ethics similar to your own. Review, review and review some more. The more you review information, the more you will remember. Important Notes: 1. 2. All school rules (e.g. Honor Code, tardy policy, phone/iPod rules, etc.) will be enforced in class. Many items will be sold in this class to demonstrate a variety of economic activities. All net proceeds will be pooled and used at the end of the year to pay for breakfast on the day of the exam or other class food purchases. Due : __________ ____________________________________ Student Signature Date ____________________________________ Student name (print) _________________________________ _____________ Parent Signature Date Mr. Maher (Room T-4) * Parents please read and discuss these grading policies and procedures with your son or daughter before signing. This form must be returned to the teacher. A duplicate copy will be offered in exchange for a signed copy. Thank you for your cooperation.