TRO Memorandum corrections

advertisement

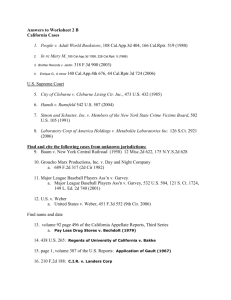

1 2 3 V1.6-8 Faith Lynn Brashear 1095 Lowry Ranch Road Corona, California 92881 Tel: 951-268-4042 Fax: 855-204-0859 4 Plaintiff in pro se 5 6 7 SUPERIOR COURT OF CALIFORNIA 8 COUNTY OF RIVERSIDE – Historic Courthouse 9 10 FAITH LYNN BRASHEAR, an individual, 11 Case No.: ___________________________ Assigned to Hon. ______________, presiding Plaintiff 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Request for Immediate Stay Order vs. HONGKONG AND SHANGHAI BANKING CORPORATION DBA HSBC BANK USA, NATIONAL ASSOCIATION, as Trustee of the Holders of the Deutsche Alt-A Securities, Inc., Mortgage Loan Trust, Mortgage PassThrough Certificates Series 2007-OA4; THE MORTGAGE LAW FIRM, PLC, as Trustee and Agent of a Beneficiary; as agent for Wells Fargo Bank, N.A.; RYAN REMINGTON, an agent of The Mortgage Law Firm, PLC; SPECIALIZED LOAN SERVICING LLC, as servicer for HSBC Bank USA, National Association, as Trustee for the Holders of the Deutsche Alt-A Securities, Inc., Mortgage loan Trust, Mortgage Pass-Through Certificates Series 22007 –OA4; AMI MCKERNAN, an officer and agent of Specialized Loan Servicing LLC, and All persons and entities claiming any right to real property located at 1095 Lowry Ranch Road, Corona CA 92881 and Does 1-20, inclusively, Defendants 1st MEMORANDUM TO TRO AND THE COMPLAINT PLAINTIFF’S DECLAIRATION IN FAVOR OF TEMPORARY RESTRAINING ORDER AND ORDER TO SHOW CAUSE FOR PRELIMINARY INJUNCTION TO ENJOIN ILLEGAL FORECLOSURE SALE Supporting state, federal, community property laws and exhibits. 24 hours’ Notice given: _______, 2015 Date: ___________, 2014 Time: ___________ AM/PM Dept. ________ Filed with Verified Complaint (CCP §529, et al.) 27 - 1 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 2 3 4 TO ALL PARTIES AND THEIR COUNSEL OF RECORD, Plaintiff Faith Lynn Brashear hereby submits this Memorandum to TRO. This is a talking Memorandum in testimony by an original source witness to both the TRO and the Complaint with supporting state, federal, community property laws and exhibits. 5 6 7 8 9 PLAINTIFF’S DECLAIRATION IN FAVOR OF TEMPORARY RESTRAINING ORDER AND ORDER TO SHOW CAUSE FOR PRELIMINARY INJUNCTION TO ENJOIN ILLEGAL FORECLOSURE SALE The purpose of this Memorandum is to outline the background justification of the TRO request. It is not a mandatory requirement of the courts to establish “standing” with a memorandum attachment that is for solely the purpose of judicial notice, as the TRO itself 10 focuses specifically on Immediate Core violations that enable these courts to grant the 11 immediate relief requested. Plaintiff would move these courts to a permanent injection and/or 12 immediate sanctions should it please these courts with the additional information provided 13 14 15 herein as a professional courtesy to these courts from which to draw upon should these courts deem it fit. Plaintiff will always respectfully ask these courts to look within their authority, as the loan in question was a 2009 TILA rescinded loan where clear TILA and RESPA violation are 16 factually and historically evident. Under TILA, These courts have no discretion to deny 17 damages, once a violation of this nature has been discovered no matter how small. Since this 18 specific issue has not been properly tried, it is not barred from these humble requests for these courts to take such notice as Plaintiff was within her 3 year rights, has rescinded and continues 19 20 21 22 23 to assert loan recession under TILA. Officers of the court who many come in contact with the matter of Goodner versus Disaster Services are noticed under authority of the supremacy and equal protection clauses of the United States Constitution and the common law authorities of Haines v Kerner, 404 U.S. 519-421, Platsky v. C.I.A. 953 F.2d. 25, and Anastasoffv. United States, 223 F.3d 898 (8th Cir. 2000). In re Haines: pro se litigants are held to less stringent pleading standards than bar 24 25 26 27 licensed attorneys. Plaintiff has striven to uphold a higher standard as try not to burden these courts, but still remains a lowly layman. Regardless of the deficiencies in Plaintiffs past pleadings, pro se litigants are entitled to the opportunity to submit evidence in support of their claims. In re Platsky: court errs if court - 2 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 dismisses the pro se litigant without instruction of how pleadings are deficient and how to repair 2 pleadings. In re Anastas off. litigants' constitutional rights are violated when courts depart from 3 precedent where parties are similarly situated. Plaintiff was clearly denied remedy to this 4 continued problematic situation. It has taken plaintiff and additional two years of intense studies and direct dealings with litigation advocates across this nation as well as a university 5 6 7 8 professor of law, to better understand the complexities of these courts in how to properly convey these issues. The merits of the underlying cases are not at issue before these courts in this complaint. However it is clear to Plaintiff that a judge who acts in the absence of subject matter jurisdiction may be held liable for his judicial act. Stump v. Sparkman, 435 U.S. 349, 98 S. Ct. 1099, 55 L. 9 Ed. 2d 331 (1978) and Bradley v. Fisher, 80 U.S. (13 Wall.) 335, 20 L. Ed. 646 (1872). A 10 judge's private, prior agreement to decide in favor of one party is not a judicial act. Rankin v. 11 Howard, 633 F. 2d 844 (9th Cir. 1980), cert. Denied, 451 U.S. 939, 101 S. Ct. 2020, 68 L. Ed. 12 2d 326 (1981). Judge is deprived of immunity where the judge willfully accedes to fraud. Cite 13 omitted. These exhibits attached to this memorandum are respectfully submitted by Plaintiff who 14 is a past volunteer Federal witness of mortgage crimes in the inland empire whose wholesale 15 mortgage brokered Countrywide loans were called to grand jury See Exhibit #11. Plaintiff 16 brokered said loan to herself, and since it was not the intent for Plaintiff to breach fiduciary with 17 herself, she has come forth upon her discovery of these predicate crimes full scope of underlying intent, as of March 2015. It simply would have been impossible to come forth any 18 sooner as information has been, and is still being, concealed from Plaintiff. 19 The loan in question has been identified as the same type of loan admitted by 20 Countrywide to our California State Attorney General in violation of state and federal laws. 21 Plaintiff obtained the additional forensic audits in 2009 submitted in this case exhibits, to try 22 and negotiate restructures upon the identified predicate in default loan. The TILA and RESPA violations outlined within these professional reports and cross verified by myself, outline 23 24 25 26 violations that exceed the market value of the home. Multiple unresolved novation attempts were made in attempts to work these issue out. These attempts were ignored, or blatantly met with deliberate foreclosure attempts. This has been a 7-year hostile, adverse and open dispute since 6/1/2008, as evidenced by the Exhibit #12 27 - 3 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 3 4 V1.6-8 title recordings. At this point in time, Color of Title now applies and this loan has been respectfully and undeniably voided by operation of law as summarized herein. NOVATION ATTEMPS documenting ongoing hostile dispute. 1. Chapter 11 restructure attempt (03/2009) Case Number: 09−20772−TTG 2. Chapter 13 2012 6:12-bk-34738 - and NACA submitted modification, with evidence of 5 6 7 8 duel tracking and additional illegal foreclosure attempts. OPEN ACTIVE HOSTIL DISPUTE DOCUMENTATIONS – SLS 3. Exhibit # 9 4. Documented demands for compliance under 2923.55 outlining the refusal of SLS and BofA to provide an accurate QWR, show ligitimate transfer, or prived alternatives to 9 foreclosure .See In re Parsley, No. 05-90374 (Bankr. S.D. Tex. Feb. 12, 2007 and Jones 10 v. Wells Fargo Home Mortgage.) Referenced as CFBP Case numbers: 140221-002071, 11 Case number: 140508-001150, 140515-000623, 140515-000636, 140509-000318, 12 140515-000623, 140930-000635, 140508-001150, 140606-001215, 140609-000800, 13 140922-000297, 140922-000193, 140922-000207, 140922-000191, 140922-000211, 140922-000208, 141001-000235, 141001-000324, 141001-000306, 141001-000286, 14 141001-000356, 140922-000043, 141001-000379, 141215-000178, 141215-000144, 15 150102-000468, 150105-000714, 150102-000468, 150312-000857, 150318-000451, 16 150318-001551, 150318-001601, 150318-001560, 150318-001536, 150318-001585, 17 150324-000657, 150324-001726, 150318-001536, 150401-001922, and 150331-001704. Including but not limited to 18 19 20 21 22 CONTINUED FALSE ASSURANCES AND DECIETFUL COLLECTION ACTIVITIE Most egregious displays of contempt. 5. Exhibit #8 - Assurances that no foreclosure action would come forth until after the appeal hearing of Plaintiffs State case surrounding the issues with the prior servicer. See Attorney email of Bank of America’s Assurance. – redacted 6. Transfer of the 100% predicate in default loan while Bank of America was under a 23 Ginnie mae ban not to transfer these Countywide loans. Article -3 §203 transfers cannot 24 be made if the transferee engaged in fraud or illegality affecting the instrument. See: 25 Mortgage Servicing News “ Ginnie Mae Nixes Bank of America Mortgage Servicing 26 Transfer” Once a Nunc Pro Tunct loan is transferred it turns any voidable portion of the contract void by operation of law. 27 - 4 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 7. (Plaintiff personal favorite); Laying false claims the non-bank servicer “had the wrong 2 address” when the last known address was attached to the 2nd Amended complaint 3 directly served to Bank of America and recorded at this same State Supreme Court when 4 service notice rights were challenged. 8. Failure to produce a substitution of trustee. 5 9. Failure to explain how, when the nunc pro tunc loans acceleration date clearly outlined 6 in the first HSBC / Recon Trust Notice of Default that identified the loans DUE DATE 7 aka its acceleration date as 6/1/2008, would not be breach of statue limitations. Doc 8 2012-0129568 3/20/12. U.C.C. - ARTICLE 3 - NEGOTIABLE INSTRUMENTS (2002) § 3-118. 9 STATUTE OF LIMITATIONS. (a) Except as provided in subsection (e), an 10 action to enforce the obligation of a party to pay a note payable at a definite time 11 must be commenced within six years after the due date or dates stated in the note 12 or, if a due date is accelerated, within six years after the accelerated due date. 13 10. Failure to explain how Defendant HSBC legitimately come forth to act upon a January 2008 SUSPENDED/ TERMINATED trust’s behalf, that failed to securitize the 14 DOT? HSBC cannot lay claims they were unaware of this as the 5-year old DOT 15 (questionably) transfers to the “holders” of the REMIC conduit trust, and not the trust 16 itself. Defendants simply do not hold the note as the REMIC conduit trust was swapped 17 out into another undisclosed investment conduit before consummation of the security instrument took place. 18 11. Intengan v. BAC Home Loans Servicing LP, 214 Cal. App. 4th 1047 (2013): 19 A court may take judicial notice of the existence of a declaration from a servicer 20 asserting compliance with the notice requirements in former CC § 2923.5, but cannot 21 take judicial notice of the contents of that declaration. If disputed by the borrower, it 22 is a matter of fact to be determined at trial whether or not a servicer actually attempted to make contact with the borrower 30 days prior to recording a notice of 23 24 25 26 default. Plaintiff absolutely disputes this. 12. No legal standing to foreclose exists making the recording of a Notice of Trustee Sale, in violation of PENAL CODE SECTIONS 470-483.5 13. NOTE: The complexities of Plaintiff’s State case were difficult to convey and even more difficult to understand at the time. The case was dismissed for failure to 27 - 5 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 properly state a cliam without a ruling upon the merits. CONLEY VS. GIBSON (1957), 2 355 U.S. 41, 45, 46, 78 S.Ct. 99, 102, 2LEd 2d 80; SEYMOUR VS. UNION NEWS 3 COMPANY, 7 Cir., 1954, 217 F.2d 168; and see rule 54c, demand for judgment, 4 FEDERAL RULES OF CIVIL PROCEDURE, 28 USCA: “**every final judgment shall grant the relief to which the party in whose favor it is rendered is entitled, even if the 5 party has not demanded such relief in his pleadings.” U.S. V. WHITE COUNTY 6 BRIDGE COMMISSION (1960), 2 Fr Serv 2d 107, 275 F2d 529, 535. 7 8 14. The TILA rescission was not properly pleaded in the complaint, and these courts did not look within themselves to enforce the operation of state and federal laws in which relief should have been granted because, at the time, Jeneski was still on the 9 fence. Regardless, The full scope of these predicate crimes were not fully discovered 10 until March 2015 by Plaintiff therefore it would have been impossible to either plead or 11 to properly rule at that time, nor could these courts rule until the Supreme law was set. 12 13 15. Plaintiffs earlier complaint is currently in appeal D067442, which means that it would be inequitable to require tender where the circustances are being litigated for fraud claims not only of the validity of the note, but for failure to enter a substance for 14 substance agreement at any level. Pfeifer v. Countrywide Home Loans, 211 Cal. App. 15 4th 1250 (2012) and Williams v. Wells Fargo Bank, N.A., 2014 WL 4809205 (N.D. 16 Cal. Sept. 25, 2014) for attempts to further collect in penalties in interest exceeding 17 the fair market value of the home going beyond mere breach of contract. Plaintiff believes here discoveries are are the reason behind why CalPERs retirements are not 18 19 20 21 22 being properly paid. Plaintiff has found over 500 pass-through securities trusts that follow this same pattern on the SEC. 16. It is the assertion of the Plaintiff that the above described Deed of Trust and all obligations have been satisfied per operation of law, as no evidence of security can be brought forth to substantiate a claim against said property. See Exhibit #8 - SEC Trust Termination and/or suspended. CCP 1688. RECINDED PER OPERATION OF LAW 23 24 25 26 TILA1635 (f) (3). The first recession of Plaintiffs mortgage loans took place in 2009 as evidenced in Exhibit # 6. 17. CC 2924(g)(d) prevents foreclosure sales from happening following a dismissal of an action brought by the borrower. There is a private right of action implied in CC § 2924(g)(d), as it would be rendered useless without one. Plaintiff hereby asserts per the 27 - 6 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 3 4 V1.6-8 power granted to her through Congress, loans that are automatically voided by law, cannot be foreclosed upon. 18. No recorded assignment of trustee can legally exist under (ii) 2934a(1)(A) assigning The Mortgage Law Firm PLC, or HSBC to act as a legitimate trustee by MERS. Further, beneficiary assignments recorded by Bank of America to Bank of 5 America would call into question the authenticity of a Robo signed document 6 transferring “all beneficiary interests” of State suspended beneficiary MERS of alleged 7 security instrument, with no “For valuable consideration” to Bank of America upon an 8 invalid Trust Deed Assignment. No secure obligation in favor of MERS currently can exist under these circumstances. MERS could not act as beneficiary on the NOD. 9 19. Therefore let this hereby serve as notice - a public recorded declaration, 10 reasonably asserted, has been made and said trustee sale is INVALID therefore 11 dismissed, rescinded, null and void. See U.S. Bank v. Cantartzoglou, 2013 WL 443771 12 (Cal. App. Div. Super. Ct. Feb. 1, 2013) See Tang v. Bank of Am., N.A., 2012 WL 13 960373 (C.D. Cal.Mar. 19, 2012) Patel v. U.S. Bank, 2013 WL 3770836 (N.D. Cal. July 16, 2013) 14 Points and Authorities in Support of Complaint and TRO 15 16 17 18 The following operations of law that have already extinguished this loan. WHEARAS, Faith Brashear (FNA Donna Beltz) as the Original Trustor, the original lender as Countrywide Bank FSB, the original Trustee ReconTrust and Mortgage Electronic Registration Systems Inc (“MERS”) as the Original beneficiary, under that certain Deed of Trust and recorded Dated: 5/14/2007 as Instrument No as Docket No. 2007-0319880 Dated: 19 20 21 22 23 5/2/2007, inclusive of the Legal Description .84 Acres M/L in Lot 47 MB 365/084 TR 29617 Official Records of the County of Riverside, State of California And WHEREAS, MERS as beneficiary was suspended by the CA Secretary of State and the Franchise Tax Board (2002-2010). Both the lender Countrywide Bank FSB and Recon Trust are dissolved. 24 25 26 And WHERAS, Faith Lynn Brashear rescinded her mortgage loans in March 2009 after forensic audits positively identified her loan as a 100% predicate in default loan. The Bifurcated 27 - 7 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 3 4 V1.6-8 Countrywide Promissory Note was fully discharged on 03/09/09 filing 6:08-bk-25762-PC and no evidence of proper securitization can be brought forth to substantiate a claim. And WHERAS, The Countrywide loan has been identified as the same 100% predicate in default negative amortization loan (stated income pay option arm) admitted to the California 5 Attorney General to be in violation of State and Federal laws. See People of the State of 6 California v. COUNTRYWIDE Financial Corporations, et al Stipulated Judgment and 7 Injunction Complaint No. LC083076, Superior Court of the State of California, County of Los 8 Angeles, Northwest District (2008) (“COUNTRYWIDE Stipulated Judgment”). Sarkar v. World Savings FSB, 2014 WL 457901 (N.D. Cal. Jan. 31, 2014) 9 10 And WHEREAS Countrywide as the originator of the Deutsche Alt-A Securities, Inc 11 Mortgage Loan Trust, Mortgage Pass-though Certificates Series 2007-OA4. Countrywide 12 irrevocably sold all right, title and interest in Plaintiffs’ mortgage loan, for value received (as 13 further evidenced upon the DOT via the MERS Member Identification Number), to the Deutsche Alt-A Securities, Inc Mortgage Loan Trust, Mortgage Pass-though Certificates Series 14 2007-OA4 a private label mortgage-backed securities trust with a Real Estate Mortgage 15 Investment Conduit election and continuing qualification. See BURKE v .JPMORGAN CHASE 16 BANK, NA; 17 And WHEREAS, (ii) 2934a(1)(A) says “all beneficiaries” must execute the Substitution of 18 Trustee (the applicable California law when a lender seeks to substitute the trustee and 19 pursue a foreclosure sale), and the substitution of trustee document must be RECORDED to 20 be effective, if not, the resulting sale is VOID. No such document exists on county record to 21 assign; Sage Point Lender Services, LLC, or The Mortgage Law Firm PLC, or HSBC trustee on 22 behalf of the Trust as “Substitute Trustee” by the “beneficiary” MERS on the DOT… And 23 WHEREAS Bank of America prepared an assignment of Deed with a known robo 24 signer acting on behalf of Mortgage Electronic Registration Systems, Inc. recorded DOC#2011- 25 0411709 with “all beneficial interests” and NO “for value consideration” as the loan was not 26 attached ie no value. A legal beneficiary would have transferred an abandoned Deed the security trust, however this transfer evidences a transfer to Bank of America the “servicer” with 27 - 8 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 “ALL beneficiary interest” thereby transferring to Bank of America prepared by Bank of 2 America naming themselves as the new Beneficiary under a regular Deed of Trust transfer with 3 no “For Valuable Consideration”. 4 5 And WHEREAS Bank of America, the “servicer” altered a Corporation Assignment of Deed of Trust/Mortgage and recorded a Corporation Deed Transfer to HSBC Bank USA, National 6 Association, as Trustee for the “Holders” of the Deutsche Alt-A Securities, Inc Mortgage Loan 7 Trust, Mortgage Pass-though Certificates Series 2007-OA4. Doc# 2012-0129567. 8 And WHEREAS No “Actual” transfer into above trust to securitize the loan exists. It is not 9 only beyond the 90 day pooling and servicing agreements of a legitimate security trust to be 10 able to do so, said was terminated/suspended swapped out in 2008 rendering it nunc pro tunc, 11 extinguished null and void to the point where it can no longer be placed into the trust which in 12 turn extinguishes all beneficiary interests to the trust. Cheung v. Wells Fargo Bank, N.A., 987 F. 13 Supp. 2d 972 (N.D. Cal. 2013). Further Said Trust was utilized for the purpose of issuing pass through certificates attached to the manipulated LIBOR Index. 14 15 16 17 And WHEREAS said trust became the property of unknown “holders” having non-claimable beneficiary “desires of interest”. These recorded Documents evidencing these events, renders any sale action against this property void therefore tender is no longer required. Aniel v. Aurora Loan Servs., LLC, 550 F. App’x 416 (9th Cir. 2013), Engler v. ReconTrust Co., 2013 WL 18 6815013 (C.D. Cal. Dec. 20, 2013)CC § 2934a(a)(1) 19 And 20 WHERAS, In 2010 Dodd-Frank Act was enacted to bar traders from intentionally 21 interfering with the “orderly execution” of transactions that determine settlement prices. 7 22 U.S.C. § 9 (2012) Prohibition regarding manipulation and false information. Wall Street Reform and Consumer Protection Act (Dodd-Frank), Pub. L. No. 111-203, tit.VII (2010) 23 Title 17 : §240.3a67-8 (c). 24 And 25 WHERAS, Evidence of a 10k report filed for larger entities over 300 persons existed 26 after the termination or suspension recorded Exhibit #13.- This is a recordation of a Termination of Registration under Section 12(g) of the Securities Exchange Act of 1934, per 17 27 - 9 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 CFR 240.12g-4 (b) If the suspension resulted from the issuer's merger into, or 2 consolidation with, another issuer or issuers, the certification shall be filed by the 3 successor issuer. This swap out intents are identified in the P&S agreement as the “Certificate 4 5 Swap Out Agreement Schedule” and “Floor Agreement schedules”. Note the swaps finalize in August 2008 outlined in the P&S under the “Floor Agreement schedules”. The Certificate Swap Agreement, dated as of June 29, 2007,was between HSBC Bank USA, National 6 Association, as trustee, as trustee on behalf of the Supplemental Interest Trust, and the 7 Certificate Swap Provider. 8 And WHEREAS, The MERS Member Identification number referenced herein as MIN NO: 9 1001337-0002108190-9 documents the MERS member 1001337 as Countrywide Bank, FSB 10 and further documents an unidentified pass-through loan number 0002108190 tendering loan 11 number 00016536826405007 as recorded on DOC # 2007-0319880. Recession was exercised 12 under 2941 sub (b)(1)(A-C) upon discovery of the un-securitized instrument and additional 13 verification of its lack of legality upon inception. It would be Inequitable to demand additional tender. Moya v. CitiMortgage, Inc., 2014 WL 1344677 (S.D. Cal. Mar. 28, 2014):Rigali v. 14 15 16 17 OneWest Bank, No. CV10-0083 (Cal. Super. Ct. San Luis Obispo Co. Feb. 14, 2013) See Exhibit P - details on how the Mers system works. And WHEREAS, The nunc pro tunc loans acceleration date is clearly outlined in the first HSBC / Recon Trust Notice of Default which identified the loans DUE DATE aka acceleration 18 date as 6/1/2008. Doc 2012-0129568 3/20/12,. U.C.C. - ARTICLE 3 - NEGOTIABLE 19 INSTRUMENTS (2002) § 3-118. STATUTE OF LIMITATIONS. (a) Except as provided in 20 subsection (e), an action to enforce the obligation of a party to pay a note payable at a definite 21 time must be commenced within six years after the due date or dates stated in the note or, if a 22 due date is accelerated, within six years after the accelerated due date. No legal standing to foreclose exists making the recording of a Notice of Trustee Sale, in violation of PENAL 23 CODE SECTIONS 470-483.5 24 And 25 WHEREAS CC 2923.5 Claim Unavailable if Servicer Rescinds NOD Doc#2014- 26 0188942. Thereby nullifying Doc#2014-0488544. And since this issue is currently in litigation… Pfeifer v. Countrywide Home Loans, 211 Cal. App. 4th 1250 (2012) it would be 27 - 10 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 inequitable to require tender where the circumstances being litigated for fraud claims of not 2 only the validity of the note and lack of securitization, but for potential RICO claims still within 3 statue to bring forth. Williams v. Wells Fargo Bank, N.A., 2014 WL 4809205 (N.D. Cal. Sept. 4 25, 2014) for attempts to further collect in penalties in interest matching the fair market value of the home going beyond mere breach of contract. 5 6 7 8 And WHEREAS, under TILA Section 131(f)(2) evidence of a securitized trust does not exists. The SEC Trust the Nunc Pro Tunc Pre-Bifurcated loan was placed into attached “Terminated/Suspended” REMIC trust without the deed. Said REMIC trust was used to commit securities fraud prior to being “swapped out” in a trust refinance attached to the 9 manipulated ISDAfix index, fully extinguishing the security instrument prior to deed transfer 10 after said REMIC distributed certificates attached to the manipulated LIBOR index. Operation 11 of Law violations: Civil code 1689.2, Civil code 1689 (b)(5), and Civil Code§ 1962(a). 12 Termination and or/suspended REMIC in 2008 (attached Certification and Notice of 13 Termination of Registration under Section 12(g) of the Securities Exchange Act of 1934). Operation of Law extinguishment the Deed CCP 1688. 14 15 16 17 And WHEREAS A terminated/swapped out trust nullifies the transaction, extinguished the note, and forever disables the ability to fully consummate a legal transaction. Thus the SEC cannot enforce the “tender” Rule pursuant to 14d-10 under the Securities Exchange Act 1934. See: Lerro v. Quaker Oats Co., 84 F. 3d 239(7th Cir. 1996). 18 19 And WHEREAS, § 9-315. SECURED PARTY'S RIGHTS ON DISPOSITION OF 20 COLLATERAL AND IN PROCEEDS.(e) [When perfected security interest in proceeds 21 becomes unperfected.] If a filed financing statement covers the original collateral, a security 22 interest in proceeds which remains perfected under subsection (d)(1) becomes unperfected at the later of: (1) when the effectiveness of the filed financing statement lapses under Section 9-515 23 or is terminated under Section 9-513; § 9-513. TERMINATION STATEMENT. (d) [Effect of 24 filing termination statement.] or (2) the 21st day after the security interest attaches to the 25 proceeds. 26 Except as otherwise provided in Section 9-510, upon the filing of a termination statement with the filing office, the financing statement to which the termination statement 27 - 11 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 relates ceases to be effective. Except as otherwise provided in Section 9-510, for purposes of 2 Sections 9-519(g), 9-522(a), and 9-523(c), the filing with the filing office of a termination 3 statement relating to a financing statement that indicates that the debtor is a transmitting utility 4 also causes the effectiveness of the financing statement to lapse. Since the instrument was never perfected, once terminated it can never be perfected. 5 6 7 8 And WHEREAS, under TILA1635 (f) (3) consummation never took place thereby extinguishing the seven-year rescinded instrument by OPERATION OF FEDERAL LAW. Jesinoski v. Countrywide Home Loans, Inc 729 F. 3d 1092 - Court of Appeals, 8th Circuit, 2013 LAW OF THE LAND RULING. Matter of State Law. 12 C.F.R. pt. 226,. 2(a)(13). 9 10 And WHEREAS, Article -3 §203 transfers cannot be made if the transferee engaged in 11 fraud or illegality affecting the instrument. Once a Nunc Pro Tunct loan is transferred it turns 12 any voidable portion of the contract void by operation of law. Transfers of predicate loans used 13 to perpetuate frauds to any non-bank servicer violates CALIFORNIA ROSENTHAL FDCPA section 1788.17 (a) 1- 4. 14 15 16 17 And WHEREAS, A Trademark System is not a beneficiary. MERS does not exist as a legal company in the State of California. MERSCORP holds the MERS “trademark” system only and is not listed as a beneficiary upon the aforementioned contract. Non-response is an Acquiesce of Silence through 7 years of continued demands, 3 years of unanswered court 18 ordered subpoenas, and one year of documented demands through the CFPB upon a transfer of 19 the loan while under restrictions to do so by the Federal Government, thereby creating an 20 inability to be able to state a claim in recoupment. Rule 12(b)(6) FRCP. 21 22 And WHEREAS If a borrower contends the validity of the foreclosure sale itself and can act with reasonable assertion of that fact to prevent undue harm, no tender is required. Tamburri v. 23 Sunset Mortg., 2012 WL 2367881 (N.D. Cal. June 21, 2012). The DOT does not contain 24 language “providing for a conclusive presumption of the regularity of sale,” and therefore is 25 defective notice, the sale is considered void. Little v. C.F.S. Serv. Corp., 188 Cal. App. 3d 1354, 26 1359 (1987). See also: Bain v. Metro. Mortg. Group, Inc., et al., 175 Wn.2d 83, 285 P.3d 34 (2012). 27 - 12 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 Glasky v. Bank of America (2013), San Francisco Supreme CRT. 2 Subramani v. Wells Fargo Bank, N.A., 2013 WL 5913789 (N.D. Cal. Oct. 31, 2013 3 Cheung v. Wells Fargo Bank, N.A., 987 F. Supp. 2d 972 (N.D. Cal. 2013) 4 Rotella v. Wood 528, 549, 560-61,120 S. Ct. 1075, 145 L. Ed. 2d 1047(2000). 15 U. S. C. §1601(a) - §1635(a) (2006 ed.) - §1635(g) 5 6 7 8 Kemp v Countrywide Case 08-02448-JHW Doc 25 NOTE: Countrywide is outlined within both the Prospectus and the Pooling and Servicing Agreements as a party to the REMIC conduit trusts. Plaintiff is proximity to REMIC conduit pass through Trust as she originated her own loan on behalf of Countrywide, who was the Originator of the Trust itself. This would make her proximity 9 to the REMIC conduit trust through granted privilege. Plaintiff has the right to challenge 10 assignments per her wholesale mortgage agreements as both a defrauded consumer and a 11 defrauded wholesale mortgage broker. 12 13 These illegal actions breached all mortgage brokers ability to provide a fiduciary duty to all consumers under 2923.1 to their consumers, as the banking industry placed their own economic interest above that of the consumer. As an originator for a pass 14 through trust utilized to perpetuate frauds on the SEC, a fiduciary duty was owed 15 Plaintiff at all levels. It was not Plaintiffs intent to defraud herself or her clients. These 16 actions turned Plaintiff into an unlicensed securities dealer on behalf of a Securities 17 REMIC Pass Through Conduit Trust. Case on Point - See: YVANOVA vs NEW CENTURY MORTGAGE CORPORATION 18 APPELLANT’S REPLY BRIEF ON THE MERITS and BRIEF OF THE CONSUMER 19 ATTORNEYS OF CALIFORNIA IN SUPPORT OF REAL PARTIES IN INTEREST AS AMICUS 20 CURIAE. 21 22 To establish a prima facie case in an action to foreclose a mortgage, the bank must establish “the existence of the mortgage and mortgage note, ownership of the mortgage and note, and the Defendant’s default in payment.” Campaign v. Barba, 23 AD3d 327 (2nd Dept. 23 2005). The PSA is the insurance existing specifically to protect the banks from homeowner’s 24 default, which by its terms always pays any defaulting mortgage and other fees, including real 25 estate taxes. Logically, if the bank is paid then there is no default or damage to the bank. How 26 can a loan be in default if the servicer advanced every payment to cover any alleged default? 27 - 13 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 3 4 V1.6-8 Bearing in mind that the fund utilized for the transaction itself were pass-through investors funds and not the banks own funds to begin with. The PSA for the OA4 trust, names not one but two servicers as Wells Fargo Bank, N.A. (the master servicer and securities administrator) and Countrywide. The master servicers is responsible to advance payments to protect all mortgaged property in the trust in the event a 5 6 7 8 9 homeowner defaults in payment (at Pooling and Servicing Agreement Section 4.4 Advances.) as follows: Advances. If the Monthly Payment on a Mortgage Loan that was due on a related Due Date and is Delinquent other than as a result of application of the Relief Act and for which the applicable Servicer was required to make an advance pursuant to 10 this Agreement exceeds the amount deposited in the Master 11 Servicer Collection Account that will be used for a Advance with 12 respect to such Mortgage Loan, the Master Servicer will deposit in the Master Servicer Collection Account not later than the 13 Distribution Account Deposit Date immediately preceding the 14 related Distribution Date an amount equal to such deficiency,” 15 Defendants and the TRUST are not holders or holders in due course of the NOTE and 16 17 18 Defendants and the TRUST are not beneficiaries under the DOT. More importantly, the certificate holders of the TRUST have not suffered any financial harm, as follows: a) The TRUST’s Master Servicer is required to make payments to the TRUST when loan payments are not made; 19 b) The Master Servicer is not a party with legal or equitable interest in the DOT; 20 c) TRUST passes payments made by the Master Servicer through to the 21 certificate holders; d) These payments are received as interest and not as a loan; 22 e) 1009 forms issued by the Trustee to each investor, through belief, treats each 23 advance as a payment of interest and not as a loan which must be repaid by the 24 investor; 25 f) The Master Servicer’s claim is not secured; 26 27 - 14 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 g) The requirement for the Master Servicer to make payments is a concession 2 given by the Master Servicer as an inducement to convince the Trustee to use its 3 service; 4 h) The payments were not made for the benefit of the borrower. Plaintiff has not directly damaged defendants and the original creditor has in fact 5 been paid as evidenced herein, a default simply does not exist under these circumstances. 6 Plaintiff asserts REMIC stands for Real Estate Mortgage Investment Conduit as the name 7 implies. Security is not in the title or else it would be RESIC. REMICs are used for the pooling 8 of mortgage loans and issuance of mortgage-backed securities, they were not purposed for direct foreclosure action. The fact that this REMIC conduit trust offered un-backed certificates 9 10 11 12 13 attached to the manipulated LIBOR index means the REMIC conduit trust and the MERS members assigned within them, acted beyond the REMIC conduits scope and their own scope. The Holder of a Terminated REMIC conduit Trust cannot enforce a judicial foreclosure on behalf of a NY trust whose internal structure in its very setup, has already been closed out and settled. This would be nothing less than grand theft initiated by HSBC, which does not in fact hold the note. HSBC merely holds a terminated trust that held at one point prior to 2008, 14 held an un-backed note. Plaintiff asserts, this REMIC conduit trust has nothing to do with her 15 or her property, nor is it her fault that such egregious illegal activities have been perpetuated 16 through these REMIC conduits with the use of a fraudulent loan. 17 Plaintiff asserts there can be no doubt that the pass through Transaction Summary chart is nothing more than structured money laundering flowchart. 18 Plaintiff not only has the right to challenge the Pooling and Servicing Agreements 19 through granted privilege of the Originator of the Trust that allowed Plaintiff to broker this loan 20 to herself, but as a defrauded consumer who’s signature was used as a promise to an 21 undisclosed pass through funding source for the purpose of offering certificates against the 22 manipulated LIBOR index (Page 1 of the supplemental Prospectus) back to these investors of these broken trusts. 23 Plaintiff has the absolute right to challenge the Deed Transfers, inappropriately recorded 24 on title 5 years after the fact and demand retribution for the banks failure to correct their records 25 back in 2009 upon Plaintiffs initial discovery of the TILA violations upon this identified 26 predatory loan used to perpetuate frauds at both a national and international level. Since consummation of a substance for substance contract did not take place on any level, this 27 - 15 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 contract can never meet its 3-day right to rescind, let alone its 3 years so the actual notice in 2 2009 to the banks – further the exhibited forensic audits where performed and delivered directly 3 to the servicer within the perceived 3 years, this audits note that proper recession notices were 4 not delivered to Plaintiff nor were they acknowledged by Plaintiff. TILA is clear. Section 1635 gives consumers the right to rescind a loan until midnight 5 of the third business day following (1) consummation (closing) of the transaction FAILED, (2) 6 delivery of the required rescission forms FAILED, and (3) delivery of the material TILA 7 disclosures FAILED, whichever is later. – Banks who ignore the law by pushing SOL’s upon 8 the consumer in ignorance, are acting in contempt of the law. Jeneski ruling – stands. Cases to support Ultra Virus activities through the use of the REMIC Pass- 9 10 through Conduit Trusts. Article I, Section 10 of the United State Constitution, gives us the unlimited right to 11 contract, as long as we do not infringe on the life, liberty or property of someone else. 12 Defendant’s participation in these recent historical events are forever forged into the minds of 13 14 every American across this Nation recognized on an international scale as “the Mortgage Crisis”. Defendant’s actions were enabled by the repeal of specific portions of the Glass-Steagall 15 Act by the 1999 Gramm–Leach–Bliley Act, which allowed the bypassing of the secondary 16 security market by using promissory notes as un-backed bearer notes through privileged 17 membership through a ill conceived system. These historical events succeeded in turning any contractual duty owned utilized by this 18 system, unenforceable, null and void under UCC § 3-305(b)(1)(ii)(iii). Illegality based in fraud 19 that induced the obligor to sign the instrument with neither knowledge nor reasonable 20 opportunity to learn of its character or its essential terms. 21 22 UNTRA VIRES CASE LAW Howard & Foster Co. vs. Citizens National Bank of Union, 133 S.C.202; 130 SE 758, 23 (1927), it was stated, “It has been settled beyond controversy that a national bank, under Federal 24 law, being limited in it’s power and capacity, cannot lend it’s credit by guaranteeing the debt of 25 another. All such contracts being entered into by its officers are ultra vires and not binding upon 26 the corporation.” An activity constitutes an incidental power if it is closely related to an express power and is useful in carrying out the business of banking. 27 - 16 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 A National bank’s charter requires that they protect customers money first, and make 2 money second. National banks are only allowed to make money in order to protect people’s 3 money so one serves the other, but the priority is to protect. In Central Transp. Co. v. Pullman, 4 139 U.S. 60, 11 S. Ct. 478, 35 L. Ed. 55, the court said: “A contract ultra vires being unlawful and void, not because it is in itself immoral, but because the corporation, by the law of its 5 creation, is incapable of making it, the courts, while refusing to maintain any action upon the 6 unlawful contract, have always striven to do justice between the parties, so far as could be done 7 consistently with adherence to law, by permitting a property or money, parted with on the faith 8 of the unlawful contract, to be recovered back, or compensation to be made for it. In such case, however, the action is not maintained upon the unlawful contract, nor according to its terms; but 9 on an implied contract of the defendant to return, or failing to do that, to make compensation 10 for, property or money which it has no right to retain. To maintain such an action is not to 11 affirm, but to disaffirm, the unlawful contract.” a. “When a contract is once declared ultra vires, 12 the fact that it is executed does not validate it, nor can it be ratified, so as to make it the basis of 13 suitor action, nor does the doctrine of estoppel apply.” Fand PR v. Richmond b. “A national bank cannot lend its credit to another by becoming surety, endorser, or guarantor for him, such 14 15 16 17 an act; is ultra vires…” Merchants Bank v. Baird 160 F 642. “Mr. Justice Marshall said: The doctrine of ultra vires is a most powerful weapon to keep private corporations within their legitimate spheres and to punish them for violations of their corporate charters, and it probably is not invoked too often. Zinc Carbonate Co. v. First National Bank, 103 Wis 125, 79 NW 229. American Express Co. v. Citizens State Bank, 194 NW 18 430.“A bank may not lend its credit to another even though such a transaction turns out to have 19 been a benefit to the bank, and in support of this a list of cases might be cited, which-would like 20 a catalog of ships.” [Emphasis added] Norton Grocery Co. v. Peoples Nat. Bank, 144 SE 505. 21 151 Va 195.“It has been settled beyond controversy that a national bank, under federal Law 22 23 being limited in its powers and capacity, cannot lend its credit by guaranteeing the debts of another. All such contracts entered into by its officers are ultra vires…” Howard and Foster Co. v. Citizens Nat’l Bank of Union, 133 SC 202, 130 SE 759 (1926). 24 25 26 COMMUNITY PROPERTY LAWS 27 - 17 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 3 4 5 V1.6-8 JOHN E. DROEGER, Plaintiff and Appellant, v. FRIEDMAN, SLOAN & ROSS, Defendant and Respondent.(Superior Court of the City and County of San Francisco, No. 877550, Alex Saldamando, Judge.fn. * ) Both spouses must join in executing any conveyance or encumbrance on community property. Thus a creditor who holds a DOT on community property that contains only one signature has no enforceable security interest. Plaintiff asserts that her husband signature is not on any of these loans. Plaintiff further asserts plaintiff’s husband would not have given consent in knowing the underlying terms and conditions of these loans. 6 7 8 9 10 11 12 13 14 15 16 1102. (a) Except as provided in Sections 761 and 1103, either spouse has the management and control of the community real property, whether acquired prior to or on or after January 1, 1975, but both spouses, either personally or by a duly authorized agent, must join in executing any instrument by which that community real property or any interest therein is leased for a longer period than one year, or is sold, conveyed, or encumbered. II. Section 5127 Section 5127, which applies to the management and control of community real property, states in part, "either spouse has the management and control of the community real property ..., but both spouses either personally or by duly authorized agent, must join in executing any instrument by which such community real property or any interest therein is leased for a longer period than one year, or is sold, conveyed, or encumbered [No. A029755. Court of Appeals of California, First Appellate District, Division Three. July 24, 1987.]JOAN CLAR et al., Plaintiffs and Appellants, v. THOMAS CACCIOLA et al., Defendants and Appellants. Third party creditors of a married couple lack standing to challenge the validity of a mortgage executed by only one spouse. 17 18 19 20 (Harris v. Harris (1962) 57 Cal.2d 367, 369-370 [19 Cal.Rptr. 793, 369 P.2d 481]; Head v. Crawford (1984) 156 Cal.App.3d 11, 17-18 [202 Cal.Rptr. 534]; Andrade Development Co. v. Martin (1982) 138 Cal.App.3d 330, 333-335 and fn. 2 [187 Cal.Rptr. 863]; Mitchell v. American Reserve Ins. Co. (1980) 110 Cal.App.3d 220, 223 [167 Cal.Rptr. 760]; Gantner v. Johnson (1969) 274 Cal.App.2d 869, 876-877 [79 Cal.Rptr. 381]; Horton v. Horton (1953) 115 Cal.App.2d 360, 364 [252 P.2d 397].) 21 22 California Cases 23 Adler v. Newell (1895) 109 Cal. 42 24 Alliance Mortgage Co. v. Rothwell, 10 Cal.4th1226 (1995) 25 Angell v. Superior Court, 73 Cal.App.4th 691 (1999) Atkinson v. Golden Gate Tile Co.,(1913) 21 Cal.App. 168 26 Aubry v. Tri-City Hospital Dist., 2 Cal.4th962 (1992) 27 - 18 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 Auto Equity Sales, Inc. v. Superior Court,(1962) 57 Cal.2d 450 2 Biakanja v. Irving, 49 Cal.2d 647 (1958) 3 City of Stockton v. Superior Court, 42 Cal.4th730 (2007) 4 Cockerell v. Title Ins. & Trust Co., 42 Cal.2d 284 (1954) Common Wealth Insurance Systems, Inc. v. Kersten, 40 Cal.App.3d 1014 (1974) 5 Connerly v. State of California, 229 Cal.App.4th457 (2014) 6 Connor v. Great Western Savings & Loan Association, 69 Cal.2d 850 (1968) 7 Cooper v. Leslie Salt Co., 70 Cal.2d 627 (1969) 8 Dunn v. Warden,(1915) 28 Cal.App. 202 Evans v. City of Berkeley, 38 Cal.4th1 (2006) 9 Fleet v. Bank of America, 229 Cal.App.4th1403 (2014) 10 Fontenot v. Wells Fargo Bank, N.A., 198 Cal.App.4th256 (2011) 11 Glaski v. Bank of America, 218 Cal.App.4th1079 (2013) 12 Globe Indemnity Co. v. Larkin,(1944) 62 Cal.App.2d 891 13 14 Gomes v. Countrywide Home Loans, Inc.,(2011) 192 Cal.App.4th 1149 Herrera v. Deutsche Bank National Trust Co., 196 Cal.App.4th 1366 (2011) Jenkins v. JPMorgan Chase Bank, N.A., 216 Cal.Ap.4th497 (2013) 15 Joslin v. H.A.S. Insurance Brokerage, 184 Cal.App.3d 369 (1986) 16 Latham v. Santa Clara County Hospital,(1951) 104 Cal.App.2d 336 17 Lo v. Jensen, 88 Cal.App.4th1093 (2001) Loshonkohl v. Kinder,(2003) 109 Cal.App.4th 510 18 Martinez v. Socoma Cos., 11 Cal.3d 395 (1974) 19 Mata v. Citimortgage,(C.D. Cal. 2011) 2011 WL 4542723 20 Mirkin v. Wasseman, 5 Cal.4th 1082 (1993) 21 Moeller v. Lien, 25 Cal.App.4th 822 (1994) 22 Munger v. Moore, 11 Cal.App.4th1 (1970) Naranjo v. SBMC Mortgage,(S.D. Cal. 2012) 2012 WL 3030370 23 Neptune Society Corp. v. Longanecker, 194 Cal.App.3d 1233 (1987) 24 Ord v. McKee,(1855) 5 Cal. 515 25 People v. McGuire,(1872) 45 Cal. 56 26 People v. Perez,(2010) 182 Cal.App.4th 231 Powerine Oil Co. v. Superior Court, 37 Cal.4th377 (2005) 27 - 19 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 Priceline.com Inc. v. City of Anaheim,(2010) 180 Cal.App.4th 1130 2 Pro Value Properties, Inc. v. Quality Loan service Corp., 170 Cal.App.4th579 (2009) 3 Ram v. OneWest Bank, 223 Cal.App.4th1 (2015) 4 Reichert v. General Ins. Co., 68 Cal.2d 822 (1968) Seidell v. Tuxedo Land Co., 216 Cal. 165 (1932) 5 StorMedia, Inc. v. 6 Superior Court, 20 Cal.4th449 (1999) 7 United Steelworkers of America v. Board of Education,(1984) 162 Cal.App.3d 823 8 Vielehr v. State Personnel Bd.,(1973) 32 Cal.App.3d 187 Wall v. Sonora Union High Sch. Dist.,(1966) 240 Cal.App.2d 870 9 Washington Mutual Bank v. Superior Court, 24 Cal.4th906 (2001) 10 WSS Indus. Const., Inc. v. Great West Contractors, Inc., (2008) 162 Cal.App.4th 581 11 Yvanova v. New Century Mortgage Corporation,(2014) 226 Cal.App.4th 495 12 13 Federal Cases Carpenter v. Longan, 83 U.S. 271 (1873) 14 Rajamin v. Deutsche Bank National Trust Co., 757 F.3d 79 (2d Cir. 2014) 15 California Statutes 16 Civil Code section 1646 17 Civil Code section 2923.4 Civil Code section 2924 (a) (6) 18 Civil Code section 2924.17 (b) 19 Code of Civil Procedure section 472c 20 California Rules of Court rule 8.504(d) 21 Federal Statutes 22 29 U.S.C. § 860A (a) 29 U.S.C. § 860D (a) 23 Law Review Article 24 Oppenheim, et al., Deconstructing the Black Magic of Securitized Trusts, 41 25 Stetson.L.Rev. 745 26 (2012) Supporting Cases 27 - 20 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 V1.6-8 Deutsche Bank National Trust Company v. Maraj,(2008), 18 Misc.3d 1123(A), 856 N.Y.S.2d 497 In re Foreclosure Cases,(N.D.Ohio, Oct. 31, 2007) 2007 WL 3232430 3 In re Veal,(9th Cir. B.A.P. 2011) 450 B.R. 897 4 TREATISES 5 Financial Crisis Inquiry Report, Financial Crisis Inquiry Committee (January 2011) 6 (“FCIC”) at 7 FCIC.pdf.) . p. 25, available at http://www.gpo.gov/fdsys/pkg/GPO-FCIC/pdf/GPO- Adam J. Levitin, Robo Signing, Chain or Title, Loss Mitigation, and Other Issues in 8 Mortgage Servicing, Testimony before the House Financial Services Committee Subcommittee 9 on Housing and Community Opportunity (November 18, 2010), Executive Summary . 10 11 Adam J. Levitin , “The Paper Case: Securitization, Foreclosure, and the Uncertainty of Mortgage Title," Duke Law Journal, 63 Duke L.J. 637 . 5 Witkin, Cal.Proc., Pleadings, §§ 675, 676 12 FEDERAL EXHIBITS IN SUPPORT OF DECLAIRATION 13 Exhibit A - pg 17-47 14 15 Wall Street and the Financial Crisis Anatomy of a Financial Collapse US Senate Staff report. Exhibit A Pages 17-47 April 13 2011 Exhibit B – 16 Public Policy Issues Raised by the Report of the Lehman Bankruptcy Examiner: Hearing 17 before the Committee on Financial Services, United States House of Representatives, (April 20, 18 2010). – Statement of William K. Black, Associate Professor of Economics and Law) 19 Exhibit C - 20 Testimony before the Financial Crisis Commission, Miami Florida, (September 21st, 21 2010) - Statement of William K. Black, Associate Professor of Economics and Law) Exhibit D - 22 William K. Black, Neo-classical Economic Theories, Methodology and Praxis Optimize 23 24 25 26 Criminogenic Environments and Produce Recurrent, Intensifying Crisis, Creighton Law Review (2010) Exhibit E William K. Black, Lenders Put the Lies in Liar’s Loans and Bear the Principal Moral Culpability, New Economic Perspectives (October 2011) 27 - 21 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 2 3 4 V1.6-8 Exhibit F Adam B. Ashcroft & Til Schermann Understanding The Securitization of Subprime Mortgage Credit, Federal Reserve Bank of New York (2007) Exhibit Gmers-membership list 5 Exhibit H- 6 United States of America Department of the Treasury Comptroller of the Currency// 7 Board of Governors of the Federal Reserve System/ Federal Deposit Insurance 8 Corporation/ Office of the Thrift Supervision/Federal Housing Financial Agency In the Matter of MERSCORP, Inc and the Mortgage Electronic Registration System, Inc. 9 Order to Cease and Desist. MERS MERSCORP and MERS MEMBERS April 12,2011 10 Exhibit I- 11 HVCC Mandates Decrease Market Competition and Increased Pricing, (diagram) 12 Exhibit J- 13 Securitized Total Consumer Loans, Board of Governors of the Federal Reserve System (graph), 14 Exhibit K- 15 S&P/Case-Shiller Home Price Indices, McGraw-Hill Financial (January 2012). 16 Exhibit L- 17 Yvanova v New Century et al 2d Div 1 case B247188 Appellant’s reply brief on the MERITS. 18 Amicus Brief of the Attorney General In Support of appellant Tsetana Yvanova 19 Exhibit M – Structured Money laundering chart THE DEUTSCHE ALT-A 20 SECURITIES INC MORTGAGE PASSTHROUGH CERTIFICATE SERIES 2007-OA4. 21 22 Exhibit N Wells Fargo Home Mortgage Foreclosure Attorney Procedure Manual, Version 1 Exhibit O - 23 2014.ULC.ForeclosureProceduresAct 24 Exhibit P - 25 Whistleblower Jurat Affidavit of Gregory C. Morse, Affiant In Support of Department 26 of the Treasury - Internal Revenue Service and United States Securities and Exchange Commission 27 - 22 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL. 1 V1.6-8 Exhibit Q - 2 The Expert Report of the Questioned Bausch Loan Documents and Affidavit by Dr. 3 James Madison Kelly March, 2015 4 Exhibit R United States of America vs Bank of America et al - Broken assurances 5 EXHIBIT S 6 over 500 suspended/terminated un-backed Mortgage Pass-Through Certificates, Series 7 REMIC conduit trusts used to perpetuate the mortgage crisis. 8 9 Dated:_______________________ ______________________________ 10 Faith Lynn Brashear, in pro se 11 12 Verification of Memorandum to TRO and Complaint by Plaintiff 13 I, Faith Lynn Brashear, am the plaintiff in this action and have read the content of the 14 facts as alleged herein and verify under penalty of perjury that the foregoing facts, apart from 15 any arguments, are true and correct. I hereby certifies under penalty of perjury as a professional 16 witness to these frauds that I was granted privilege as agent of Countrywide to unknowingly 17 perpetuate further frauds by these very loan instruments, which contributed in part to the mortgage crisis. Had I known then what I now know, I would have never done business with 18 any of them. 19 20 21 2. Signed in Riverside, California on __________________, 20___. 22 ________________________________ Faith Lynn Brashear, Plaintiff in pro se 23 24 25 26 27 - 23 28 Ex parte application for TRO, et al. BASHEAR V. BANK OF AMERICA, ET AL.