Myths and Realities of Doing Business in Mexico

advertisement

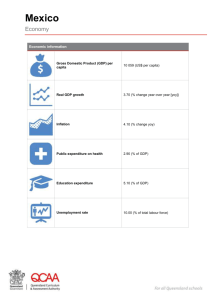

Jerry Pacheco Executive Director – International Business Accelerator jerry@nmiba.com Mexico Myths ‘Not a significant market, other than basic goods’ ‘Continuous economic crises – no stability’ ‘The peso is worthless, inflation is rampant’ ‘Technological backwardness’ ‘Industry is dominated by US-led maquiladoras’ ‘Mexican culture is not conducive to business’ Corruption Land of mañana ‘Mexico is a failed narco-state’ Myth: Mexico is too poor to be a significant market for anything but basic goods Reality: Mexico is a middle-income country GDP per capita (nominal / PPP): $8,143 / $14,335 Comparable w/ Russia, Arg., Chile, Brazil, Turkey, Malaysia 2.5X the GDP/capita of China and 6X that of India US GDP per capita - $45,989 / $ 45,989 China GDP per capita - $3,650 / $6,828 India GDP per capita - $1,134 / $3,270 2nd most important metropolitan market for high-end luxury goods in the Americas – Mexico City 2nd largest market for US exports (exports to Mex > exports to China + Japan) Myth: Mexico has constant economic crises, the peso is worthless, & inflation is high Reality: Cycle of econ. crises (1976, 1982, 1986-87, 1994) was broken in 2000 and 2006 Avoided contagion from emerging market crises (e.g., Southeast Asia, Argentina) Peso – stronger & more stable than US$ for much of the last decade (until recently) Inflation < 5%; investment grade status Myth: Mexican industry is technologically backward and dominated by US-led maquilas Reality: Technologically-advanced engineering & production capabilities Approximately 75 Mexican companies with revenues greater than US$1billion/year An emerging entrepreneurial culture Dominant role of maquiladoras is limited to border Myth: Mexican culture is not conducive to business: corruption, land of mañana Reality: Carlos Fuentes: “The Mexican mañana does not mean putting things off till the morrow. It means not letting the future intrude on the sacred completeness of today.” Comparatively moderate levels of corruption & largely limited to government Workforce is young and ambitious, with strong technical skills and work ethic Important to recognize the distinction between social culture and business culture Myth: Mexico is now a failed narco-state Reality: Violence & insecurity are a huge social problem, but the economic impact has been limited so far Murder rate of US citizens (50/year for 1.5-2 million people) = 1/2 of Albuquerque’s or 1/4 of Houston’s. Violence is concentrated in key states and among those involved in drug trade, security, media JP Morgan Chase estimates economic cost at 1.0-1.5% of GDP Risk is no higher/lower than US in much of Mexico, just different Huge challenge as violence spreads to unexpected areas (e.g., Monterrey) and in unpredictable patterns Pre-Columbian Era to the Revolution Mexico City – focal point of civilization 1500-100K inhabitants, 30M in Mexico Architecture, irrigation, engineering, writing Feudal system: caciques and tribute 1520-1810 – Spanish imperialist economy Emergence of ‘la raza’ 1810-1910 – Incomplete independence Spanish control displaced, but feudal system remained (caudillos) The Revolution and the ‘Institutionalized Revolution’ 1910-Díaz regime ousted Zapata, Villa, Carranza, Obregón The revolution never ended, but was ‘institutionalized’ (PRI) Economic system inspired by the revolution, but patterned after colonialism Unequal development; closed economy Poor separation of firm & state The Technocrats and ‘The Crisis’ Pattern of sexenio crises, 1976-1994 Curse of oil & ‘administering the abundance’ Technocrat Presidents De la Madrid and the ‘lost decade’ (1980s) Salinas de Gortari – renewed hope, shattered dreams, and the ‘errors of December’ (1994) Zedillo – weak but transformational sexenio Economic Reforms, 1980-2000 Monetary & Fiscal Policy Inflation reached 100+%, now under 5% Balanced budgets Deregulation & Privatization Privatization of banks, rail, telcom, industry FDI & franchise laws; increased transparency Trade Liberalization – Export Orientation GATT (max tariffs from 100% to 20%) NAFTA (nearly all tariffs eliminated by 2003) New Millenium: A ‘New’ Mexico? Political change 2000 elections: Vicente Fox (PAN) Political pluralism = Political Gridlock PAN – Presidency PRI – Senate and Chamber of Deputies PRD – Governorships, Mayor of Mexico City 2006 elections: Felipe Calderon (PAN) AMLO (Andres Manuel Lopez Obrador) factor Gridlock continues 2012 elections: The Pena Nieto Administration New Federalism in Estados Unidos Mexicanos Increasing importance of states & municipios Recent Economic Performance: Reasons for Renewed Optimism Consistent economic growth 1995-2000 Change in GDP under Zedillo: 1995: - 6.2% 1996: +5.1% 1997: +6.8% 1998: +4.9% 1999: +3.9% 2000: +6.6% Stagnation under PAN, 2000-2010 Change in GDP under Fox/Calderon: 2001: - 0.2% 2002: +0.8% 2003: +1.4% 2004: +4.2% 2005: +3.2% 2006: +4.8% 2007: +3.2% 2008: +1.8% 2009: -6.5% 2010: +5.4% 2011: +5.0% Lingering Pessimism: Limits to Development Economic, Political & Social Issues: ‘So far from God, so close to the US…’ Dependence on oil, maquiladoras, exports Unequal living standards/poverty/stagnant real wages Drugs & drug-related violence, lawlessness Immigration & the loss of human capital The natural environment & water Indigenous issues & Chiapas Legal, tax, labor reforms Deregulation (telecommunications, electricity) Demographics 2010 Population: 110 Million (1950-25M) 93% literacy Education expenditures: 6% of GDP (US-5%) Life expectancy: 75 years (US-78 years) Urbanization: 77% (US-82%) Access to potable water: 83% (Korea-83%) Physicians/100,000 people: 120 (US-280) GDP/capita (nom/PPP) = $8,143 / $14,335 The Many Mexicos: Mexico City The Capital: 25M inhabitants Largest city in the world (along with others) Distrito Federal: Seat of power for government, financial, & corporate (domestic & MNCs) sectors No manufacturing Los chilangos: Fast-paced, chaotic lifestyle Cosmopolitan, status-conscious culture The Many Mexicos: Monterrey The Sultan of the North Economic Sectors: Traditional strength in heavy industry (steel, autos, other manufacturing) Migrating to new economy & higher value-added Cemex, Alfa (Alpek, Nemak), Vitro, Femsa Los regiomontanos: The Texans of Mexico The Many Mexicos: Jalisco Guadalajara: The ‘Mexican’ City Economy oriented toward: Traditional sector (textiles, furniture, ceramics, tequila, mariachis) High-Tech (IBM, Acer, other telcom/IT equip) Los tapatios: Unique mixture of traditional Mexico with global orientation The Many Mexicos: The Border 2,000 miles and 10%-25% of Mexico’s pop. Historical importance is less than the rest of Mexico 1940-1970: Border population grew 10 times High interdependence with US economy For better and for worse Does NAFTA make the border more relevant, or less relevant? Manufacturing Traditional strength: low-tech & heavy mfg. Steel, auto parts, products for domestic market Low-end export items (golf club shafts) Transformation of Mexican manufacturing: Emphasis on ISO 9000 Capital-intensive activities From wire harnesses to electronics systems Maquiladoras ~$120B/year in exports (half of Mexico’s total) But only ~1/5 is value added Highly cyclical, vulnerable to global econ. Sectors: autos, electronics, apparel Locations: Cd. Juárez, Tijuana, border First-generation maquilas no longer competitive; upgrading is essential Non-Maquila Manufacturing There’s more to manufacturing in Mexico than the maquiladoras; line is blurring IMMEX: new umbrella for maquila, Pitex (preferential tariff treatment for temporary imports), other The border v. the interior. Border plants tend to follow ‘twin-plant’ model. Plants in the interior are more likely to serve the Mexican market. Financial Sector Tumultuous history of banking sector Nationalized, then privatized, then bankrupt, then sold off to foreigners; now stable Bank loans as % of GDP: 40% in 1994, then down to 10%, now 15% (global average=136%) Leading players are foreign: Citibank (Banamex), BBVA (Bancomer), Santander (Serfin) (Re-)Emergence of middle class creating opportunity for insurance/other fin. Services Interest rates have declined, but credit is still scarce for the private sector Credit available for consumption, not investments Other Sectors Energy: continued state dominance Pemex (oil), CFE (electricity) Tourism Traditional emphasis on state-led developments Transition to diffused & sustainable development Professional services Potential competitive advantage for NM & Hispanicowned firms The ‘Grupos’ Importance of the diversified conglomerate Relation to other emerging markets Spin-offs of historic Grupo Monterrey Alfa, Vitro, Femsa and many subsidiaries Other important grupos: Grupo Carso (America Movil, Telmex, Telcel, Prodigy, Sanborns, CompUSA, Xignux, Frisco, banks) Grupo Bimbo Televisa Entrepreneurship in Mexico There’s more to Mexico than maquilas, PEMEX, and the grupos. Mexico has one of the highest rates of entrepreneurship in the world. Entrepreneurial activity is driven both by necessity and by opportunity. Economic activity in Mexico remains regionalized or localized. Growth in microfinance & social entrepreneurship New Mexico and Old Mexico Where does NM stand in terms of trade and investment ties with Mexico? NM exports are climbing to $500/year to Mexico (of $1.5B/year to all countries) Mexico is #1 market for NM in dollar terms and in number of products. NM imports about $652M/year from Mexico, of $2B total 35th state in exports to Mexico; 46th in exports to world BUT, we must account for the nature of NM’s economy. 43rd state in terms of exports as % of GSP 20th state in terms of exports to Mexico as % of GSP