Section 8 Income and Rents: Michael Reardon

advertisement

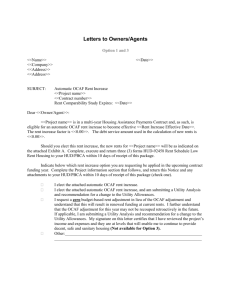

IPED HUD Multifamily Housing Compliance Arlington, Virginia May 10 – 11, 2007 Section 8 Income and Rents Michael H. Reardon, Esq. Nixon Peabody LLP th 401 9 Street, NW, Suite 900 Washington, DC 20004 (202) 585-8304 mreardon@nixonpeabody.com Section 8 Income Levels Basic Section 8 Income Requirements: Families must be Low-Income (80% or less of AMI) or Very LowIncome (50% or less of AMI) – Units First Available Prior to Oct. 1, 1981: at least 75% of units must be rented to Very Low-Income Families. – Units First Available After Oct. 1, 1981: at least 85% of units must be rented to Very Low-Income Families. – Exceptions: owner must demonstrate a need for broad range of incomes, insufficient Very Low-Income families, State requirements or to prevent displacement. Section 8 Income Levels (cont’d) Additional Income Targeting Requirements – Of Section 8 dwelling units that become available for occupancy in any fiscal year, not less than 40% shall be available for leasing only by families that are Extremely LowIncome (30% or less of AMI) at the time of admission Section 8 Project-Based Rent Requirements Tenant Rent: Section 8 project-based programs, the total tenant rent is the total tenant payment minus the utility allowance – TTP: generally 30% of family’s adjusted income. – Utility Allowance: estimate of monthly cost of reasonable consumption of utilities by an energy conservative household of modest circumstances consistent with requirement of safe, sanitary and healthy living approved by PHA or HUD. – Utility Reimbursement: amount, if any, by which utility allowance exceeds the TTP Minimum Rent: for section 8 project-based programs, the minimum rent is $25 with exceptions for financial hardship. Section 8 Project-Based Rent Adjustments Need to review the specific section of your HAP Contract Three Basic Methods: – AAF – Budget-Based Rent Increase – OCAF (for LIHPRHA) Section 8 Project-Based Rent Adjustments (continued) Special Adjustments: For substantial general increases in real property taxes, assessments, utility rates, security costs and other similar costs beyond control of the owner. Rent Reasonableness: No material difference between rents charged for assisted units and those for comparable unassisted units. Project-Based Contract Renewals MAHRAA – Multifamily Assisted Housing Reform Act of 1997 – Provides renewal terms of all section 8 project-based contracts Contract renewals administered by PHAs under PBCA contracts with HUD Rent Comparability Studies Project-Based Contract Renewal Options Mark-Up-To-Market OCAF / Budget-Based Rent Increase Mark-To-Market Project-Based Contract Renewal Options (continued) Exception projects Demonstration and Preservation projects Opt-Out Rent Adjustments After Renewal Option 1: Mark-Up-To-Market Entitlement MUTM – Property Condition – Ownership – Current Rent Levels – Use Restriction Option 1: Mark-Up-To-Market (continued) Discretionary MUTM – Vulnerable Populations – Low Vacancy or Rural Area – Community Support Option 1: Mark-Up-To-Market (continued) Non-Profit Eligibility – Not eligible for MUTM – Eligible for Mark-Up-To-Budget (Chapter 15 of the Renewal Guide) Option 2: Current Rents At or Below Comparables Renewal Rents: adjusted by OCAF or Budget Capped by Comparable Rents Option 3: Referral to OAHP Criteria – FHA-insured mortgage (not risk-sharing) – Rents above comparable market rents Full versus Lite Option 3: Referral to OAHP (continued) OAHP Lite Contracts – Rents reduced to market rents without mortgage restructuring based on RCS – Potentially Troubled Option 3: Referral to OAHP (continued) Full Restructuring – PAE and OAHP negotiate mortgage restructuring plan with owner which generally will result in reduction in first mortgage and inclusion of balance in 2nd and 3rd mortgages – Rent reduced to comparable market rents Option 4: Exception Projects Eligibility Criteria – No FHA insurance (e.g., 202 and 515 projects) – Rents above comparable market rents – State or local financing with FHA insurance (conflict with State or local law) Option 4: Exception Projects (continued) Initial Renewal – Can choose Options 1, 2 or 4 – Under option 4: initial rent is set at the lesser of existing plus OCAF or budget-based rent Subsequent Renewal – Have options and subject to lesser of test Subsequent Rent Adjustments – OCAF or Budget Option 5: Demonstration & Preservation Projects Portfolio Reengineering Demonstration – Mortgage Restructured/Rents Reduced 5 Year adjustment at OCAF At end of 5 years, RCS and eligible for Option 1 and 2 – No Mortgage Restructuring May be referred to OAHP Option 5: Demonstration & Preservation Projects (continued) Preservation Projects – Approved Plan of Action – Generally no ability to opt out, but in exception cases owner must submit plan as to how owner can comply with use agreement – POA versus Use Agreement Option 6: Owner Opt Out Importance of Tenant Notification If not provided, tenant cannot pay more than 30% of adjusted income as rent Short term renewal to comply Residual Receipts and Reserve for Replacements Residual Receipts v. Reserve for Replacement “Old” Regulation v. “New” Regulation