Ch9MF - hioa

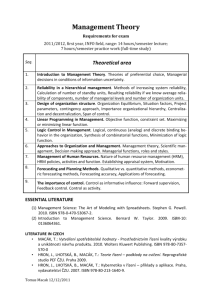

advertisement

Chapter 9 Forecasting Exchange Rates Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Chapter Objectives • • • To explain how firms can benefit from forecasting exchange rates. To describe the common techniques used for forecasting. To explain how forecasting performance can be evaluated. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Why Firms Forecast Exchange Rates • MNCs need exchange rate forecasts for their: – – – – – – hedging decisions short-term financing decisions short-term investment decisions capital budgeting decisions earnings assessments long-term financing decisions Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Corporate Motives for Forecasting Exchange Rates Decide whether to hedge foreign currency cash flows Forecasting exchange rates Decide whether to invest in foreign projects Home 1QA\ cash flows Decide whether foreign subsidiaries should remit earnings Decide whether to obtain financing in foreign currencies Value 1QA\ of the firm Cost of capital International Financial Management, 2nd edition. Jeff Madura and Roland Fox ISBN 978-1-4080-3229-9 © 2011 Cengage Learning EMEA Forecasting Techniques • The numerous methods available for forecasting exchange rates can be categorized into four general groups: 1. 2. 3. 4. technical fundamental market-based mixed Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Technical Forecasting • Technical forecasting involves the use of historical data to predict future values. – E.g. time series models. • Speculators may find the models useful for predicting day-to-day movements. • However, since the models typically focus on the near future and rarely provide point or range estimates, they are of limited use to MNCs. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Fundamental Forecasting (1) • Fundamental forecasting is based on the fundamental relationships between economic variables and exchange rates. – E.g. subjective assessments, quantitative measurements based on regression models and sensitivity analyses. • Note that the use of PPP to forecast future exchange rates is inadequate since PPP may not hold and future inflation rates are also uncertain. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Fundamental Forecasting (2) • In general, fundamental forecasting is limited by: – the uncertain timing of the impact of the factors, – the need to forecast factors that have an immediate impact on exchange rates, – the omission of factors that are not easily quantifiable, and – changes in the sensitivity of currency movements to each factor over time. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Market-Based Forecasting • Market-based forecasting uses market indicators to develop forecasts. • The current spot/forward rates are often used, since speculators will ensure that the current rates reflect the market expectation of the future exchange rate. • For long-term forecasting, the interest rates on risk-free instruments can be used under conditions of IRP. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Mixed Forecasting • Mixed forecasting refers to the use of a combination of forecasting techniques. • The actual forecast is a weighted average of the various forecasts developed. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Efficient Markets Approach • If Financial Markets are efficient prices reflect all available and relevant information. • If this is so, exchange rates will only change when new information arrives, thus: St = E[St+1] and Ft = E[St+1| It] • Predicting exchange rates using the efficient markets approach is affordable and is hard to beat. Cost and Management Accounting: An Introduction, 7th edition Colin Drury ISBN 978-1-40803-213-9 © 2011 Cengage Learning EMEA Alan Greenspan • “My experience is that exchange markets have become so efficient that virtually all relevant information is embedded almost instantaneously in exchange rates to the point that anticipating movements in major currencies is rarely possible. ”…Despite extensive efforts on the part of analysts, to my knowledge, no model projecting directional movements in exchange rates is significantly superior to tossing a coin. I am aware that of the thousands who try, some are quite successful. So are winners of coin-tossing contests. "The seeming ability of a number of banking organizations to make consistent profits from foreign exchange trading likely derives not from their insight into future rate changes but from market making.” Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA DNB still forecasts… Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Forecasting Services • The corporate need to forecast currency values has prompted some consulting firms and investment/commercial banks to offer forecasting services. • One way to determine the value of a forecasting service is to compare the accuracy of its forecasts to that of publicly available and free forecasts. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Evaluation of Forecast Performance (1) • An MNC that forecasts exchange rates should monitor its performance over time to determine whether its forecasting procedure is satisfactory. • One popular measure, the absolute forecast error as a percentage of the realized value, is defined as: | forecasted value – realized value | realized value Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Absolute Forecast Errors over Time Using the Forward Rate as a Forecast for the British Pound Evaluation of Forecast Performance (2) • MNCs are likely to have more confidence in their forecasts as they measure their forecast error over time. • Forecast accuracy varies among currencies. A more stable currency can usually be more accurately predicted. • If the forecast errors are consistently positive or negative over time, then there is a bias in the forecasting procedure. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Forecast Bias over Time for the British Pound Graphic Evaluation of Forecast Performance (1) Realized Value z Region of downward bias (underestimation) Perfect forecast line Region of upward bias (overestimation) x x Predicted Value z Graphic Evaluation of Forecast Performance (2) • If the points appear to be scattered evenly on both sides of the perfect forecast line, then the forecasts are said to be unbiased. • Note that a more thorough assessment can be conducted by separating the entire period into subperiods. Cost and Management International Accounting: FinancialAn Management, Introduction, 2nd7th edition edition Jeff Colin Madura Drury and Roland Fox ISBN 978-1-40803-213-9 ISBN 978-1-4080-3229-9 © 2011©Cengage 2011 Cengage Learning Learning EMEAEMEA Forecast Bias in Different Subperiods for the British Pound