guide to financial assessment reports

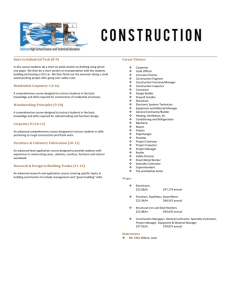

advertisement