Turkey's FDI Policy and Chinese Foreign Direct Investments in

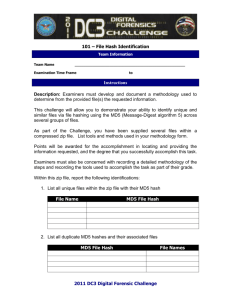

advertisement

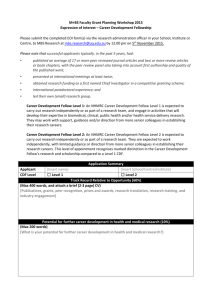

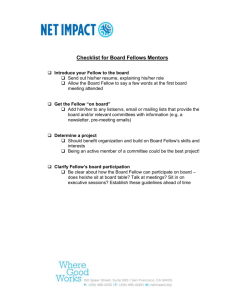

Managing people – Foreign MNCs in China and Chinese MNCs abroad Overview of the session Part I: Key features of and changes in employment relations (ER) in China Part II: Characteristics of ER in western MNCs in China Part III: Motives of Chinese firms investing abroad Major challenges to ER of Chinese MNCs in different parts of the world Case study of a leading Chinese IT MNC – Huawei Technologies Ltd Questions and discussions Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 1 Part I: Key features of and changes in ER in China Key elements influencing employment relations Industrial sector (e.g. manufacturing v. service) Ownership forms (e.g. state-owned, private, foreign-funded) Labour market characteristics (e.g. bargaining power of the workers) Employment legislation (level of provision and effectiveness) Strength and role of the trade unions (e.g. level and nature of representation) Product market competition and level of globalisation (pressure on employers) Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 2 Traditional employment relations in the state sector in China A dominant sector (80% of all urban employment in 1970s to less than 24% in 2005) State-sponsored miniature society with extensive welfare and jobfor-life Centralisation, formalisation and standardisation of personnel policies and practices (e.g. job allocation, wage determination) Personnel department at organisational level only play administrative role Employees had no real voice in the business but could expect to be relatively well looked after as ‘the master of the country’ Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 3 Changes in HR policies in the state-sector in the 1990s The need to revitalise the state sector and improve productivity and service quality ‘Three Systems’ reform in SOEs: Fixed-term employment contract – the end of job-for-life Performance-related pay (wage linked to position, compete for the post) New welfare schemes in tripartite system between employer, employee and the insurance company Withdrawal of other welfare benefits, e.g. housing Mass scale laid-offs since mid 1990s (27 millions from SOEs) Privatisation of small SOEs Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 4 Table 1. Employment growth in the private and other forms of ownership between 1990-1999 Year 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 Average growth National growth 155,100 13,900 11,700 12,500 12,400 11,100 13,300 10,900 5,100 9,000 11,100 State-owned Collective ForeignSelfPrivategrowth (%) ly-owned owned employed owned growth growth (%) growth (%) (%) 2.35 1.34 40.43 8.45 1,700,000 3.07 2.23 150.00 9.64 1,840,000 2.11 -0.19 33.94 6.93 2,320,000 0.28 -6.30 30.32 19.12 3,730,000 2.69 -3.18 40.97 28.44 6,480,000 0.42 -4.20 26.35 22.19 9,560,000 -0.15 -4.16 5.26 8.73 11,710,000 -1.78 -4.41 7.59 8.45 13,500,000 -17.98 -31.91 1.03 12.37 17,100,000 -5.37 -12.79 4.26 2.08 20,220,000 -2.06 -7.78 28.07 12.84 Privateowned growth (%) 3.66 8.24 26.09 60.78 73.73 47.53 22.49 15.29 26.67 18.25 31.67 Sources: China Statistics Yearbook, 2000; Forty Years of China Industry and Commerce Administration Management, 2000. Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 5 6 Employment relations in the new forms of ownership Privately-owned companies and self-employed businesses Once marginal and marginalised sector at odds with socialist ideologies Growth since the 1980s an outcome of shift from state-controlled planned economy towards a free market economy The need to revitalise the economy and create employment opportunities More flexible, smaller in scale, less employment protection, worse employment terms and conditions (e.g. longer working hours, lower level of pay, labour rights), higher labour turnover rate Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 6 Employment relations in the new forms of ownership (cont…) Foreign-funded businesses, Sino-foreign joint ventures An outcome of the ‘Open Door’ policy since late 1970s China as the second largest FDI recipient country Only allowed partial freedom in the 1980s, but now full operating rights within regulations Blue chip MNCs as well as sweatshops HRM practices differ from domestic Chinese firms Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 7 Employee representation (1) The role of the trade unions Only one union recognised – All-China Federation of Trade Unions (no ‘trade’ characteristics) Welfare role and training role under the leadership of the Communist Party Unionisation level high in the state sector but low in private sector Union presence has little impact on wage level Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 8 Employee representation (1) (cont…) The role of the trade unions Trade unions more organised and competent in certain sector (e.g. large SOEs) Misguided perceptions of managers and TU reps about their role Union reps lack of collective bargaining or negotiation skills and other resources Low opinion of workers on the effectiveness of the TU Trade Union Law (1950, 2001) Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 9 Employee representation (2) Workers’ Congress Made up of workers’ representatives to supplement the TU Little effect of Workers’ Congress – annual meetings not regularly held Many companies do not have the forum in place Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 10 Table 2. Union membership level in organisations where unions were established No. of grassroots unions (1,000 units) No. of employees (1,000 persons) 1952 207 13,932 -- 10,023 -- 71.9 53 1962 165 26,671 -- 19,220 -- 72.1 86 1979 329 68,972 21,717 51,473 -- 74.6 179 1980 376 74,482 25,186 61,165 -- 82.1 243 1985 465 96,430 35,967 85,258 31,492 88.4 381 1990 606 111,569 42,910 101,356 38,977 90.8 556 1995 593 113,214 45,153 103,996 41,165 91.9 468 2000 859 114,721 45,345 103,615 39,173 90.3 482 2001 1,538 129,970 50,879 121,523 46,966 93.5 -- 2002 1,713 144,615 51,576 133,978 46,652 92.6 472 2003 906 133,016 50,793 123,405 46,012 92.8 465 2004 1,020 144,367 55,026 136,949 51,353 94.9 456 Year No. of Female employees (1,000 persons) Membership (1,000 persons) No. of female members (1,000 persons) Membership density (%) No. of fulltime union officials (1,000 persons) Source: adapted from the China Statistics Yearbook 2005, p.777. Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 11 Employment legislation in China Framework: The Labour Law of China (1995) The Trade Union Law (amended 2001) Equal opportunity regulations Minimum wage regulations (1993) Other regulations specific to sector (e.g. The Civil Servants Law), ownership (e.g. MNCs and JVs), or HR function (e.g. training and recruitment) Labour Contract Law (2008) Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 12 Employment legislation in China (cont…) Effectiveness? Loopholes in the regulations themselves (e.g. age differences in retirement, minimum wage) Low level of awareness of regulations from employers and workers Tolerance from workers of employers’ unlawful behaviour for fear of job losses Unsympathetic attitude of labour officials towards (rural migrant) workers Dilemma of/conflict between law enforcement and employment pressure for the state Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 13 Part II. Characteristics of ER in western MNCs in China Employers of choice for young graduates Sophisticated selection and assessment process for recruitment More extensive training and career development opportunities, including overseas training and assignments More focus on performance management for pay as well as development purposes Higher level of pay for regulations and competition reasons Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 14 Part II. Characteristics of ER in western MNCs in China (cont…) Pay more closely related to performance level instead of seniority Higher level of adoption of western oriented HRM practices, e.g. org. culture mgnt, quality mgnt, EI to enhance performance, talent mgnt, work-life balance initiatives Proactive in CSR but pragmatic approach to trade unionism Key HR challenges: – retention – motivation – management competence Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 15 For years, MNC like Wal-Mart have resisted the call for union recognition Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 16 Part III. Chinese firms investing abroad Four major motives for FDI (Dunning and Narula, 2004): Marketing-seeking Resource-seeking Asset-seeking Efficiency-seeking Exactly where firms can fulfil these motives are often locationspecific Firms engage in FDI not only to transfer their resources to a host country (asset exploitation), but also to learn, or gain access to, the necessary strategic assets available in the host country (asset seeking). J. Dunning and R. Narula, Multinationals and Industrial Competitiveness: A New Agenda, (Cheltenham: Edward Elgar, 2004) Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 17 Motives of Chinese firms investing abroad Pull strategies by foreign governments – tax incentives and other favourite conditions Push strategy by the Chinese government – ‘Go global’, tax incentives, subsidies, national bank loans with preferential terms Energy resource seeking – oil, gas, mining Financial factors – bankrupting firms sold at cheap price, access to international fund (with low interest), to avoid trade quotas, money laundering Knowledge and know-how seeking – to acquire technology and management know-how through M&As and JVs in R&D centres Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 18 Motives of Chinese firms investing abroad (cont…) Brand name product building – to form strategic alliance (often through acquisitions) with well-known western firms to overcome poor image of Chinese products Market access – to gain access to well-connected distribution networks (often through partnership with reputable firms in the West) Aspiration to be international players, e.g. SAIC, Haier Increased competition or reduced demands at home – need to seek overseas market (e.g. bicycles, cars, household electronic goods) Expansion and support of export – setting up branch offices and services centres, establishing a presence in the market Foreign exchange reserves – if the company makes a profit Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 19 Case study of a leading Chinese IT MNC – Huawei Technologies Ltd Established in 1988 as an IT product trading firm in Shenzhen Internationalization drive since 2001, now serving ¾ of the top 50 IT operators in the world HW has rep offices in over 100 countries and over 1 billion users Now employing over 60,000 employees, 48% of whom working in R&D Business strategy: innovation, high quality, low cost, and excellent customer service Globalization strategy: less developed countries first, then developed countries; occupy market first (loss-making) then make profit through maintenance and upgrades Motives of overseas expansion: marketing and asset seeking, etc Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 20 Huawei Headquarters 总部风光 Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 21 Huawei R&D Centre Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 22 Huawei HQ Staff Condominium 员工公寓百草园 Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 23 HW’s global HR strategy and challenges in ER HR strategy: Deployment of Chinese expatriate to set up operations first Localization to overcome language and cultural problems, also to show commitment to local economy and observation to local labour law Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 24 HW’s global HR strategy and challenges in ER (cont…) HR challenges: Retention due to lower pay than western MNCs Low competence of employees in poor countries (low PC literacy and project management skills) Cultural differences in work values Cross-cultural issues between Chinese expat & local employees Lack of identification of local employees with HW’s corporate culture or HW as their employer Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 25 HW’s global HR strategy and challenges in ER (cont…) HR responses: Promote local employees to ranks which they will not get in western MNCs Introducing local practices to suit local employees (e.g. bank loan guarantee letters) Cross-cultural team building through social events Sending key local employees to HW’s HQ for training and development Deployment of locals as deputy managers to look after personnel issues Learning by doing in developing HR practices to suit local needs, e.g. borrow western MNCs’ good HR practices Deployment of emotional intelligence in understanding local employees needs and provide support Fang Lee Cooke, MBS, UK ANBS Fellow, Australia 26 ???? Questions????? ………. and answers Fang Lee Cooke, MBS, UK ANBS Fellow, Australia !!!!!!! 27