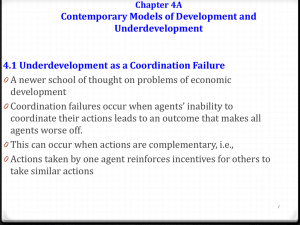

Economic Development Theories: Lecture Outline

advertisement

Lecture 4B: Contemporary Theories of Economic Development Lecture Outline Introduction <<Dissatisfaction with the Solow Model>> 1-Externalities, Technical Progress and Growth A-Positive and Negative Externalities B-Romer (1986) Model C-Complementarities and Multiple Equilibria II-Moving from Bad to Good Equilibria: The Big Push A- A graphical model B- Situation in which Big Push is needed C- Why Problems cannot be solved by the Super-Entrepreneur III-Kremer’s O-ring Theory of Development or Zidane Clustering Theorem Dissatisfaction with Classic Theories • How do we reconcile huge observed differences in per capita income with modest predictions of the Solow model (similar y*)? • Can we be satisfied to have long-term growth come from exogenous parameters: population growth and TFP growth (outside of the model)? • How do we reconcile theory (capital, labor, and small exogenous TFP to tell the whole story of production) with -no difference in the rate of return to capital between rich and poor countries -no massive capital flows from capital scarce to capital-abundant countries -debate on the importance of contribution of capital to growth (Krugman (1994), Young (1995) against Klenow and Rodriguez-Clare (1999) The Solow Model Solow Model of growth explains everything but long-run growth – an obviously unsatisfactory situation. However, there was true difficulty of including technological change in a neoclassical framework. -Technology involves the creation of non-rival ideas: public goods -Returns to scale (RTS) tend to increase if non-rival inputs are included as factors of production. This difficulty was not solved until Romer’s (1987, 1990) research: -escape from the straightjacket of neoclassical growth model -incorporation of R&D theories and imperfect competition into the growth framework Since buoyant research (creation and diffusion of technology: population growth) -close attention to empirical implications and to the relation between theory and data. I-Externalities, Technical Progress and Growth A-Positive and negative externalities (Viner, 1923): -”positive externalities” – when benefits cannot be fully “internalized” by the producer as extra profits -”negative externalities” – when pain suffered from surroundings cannot be fully “compensated” by the producer. Externalities are a pervasive feature of economic life. We will explore how externalities severely distort decision-making away from desirable outcomes Externalities, Technical Progress and Growth Idea – capital accumulation by one firm has a positive impact on the productivity of other firms Model – a firm i’s production function: internal constant returns to scale Yi AKi Li1 K AK L1 I-Externalities, technical progress and growth Two Cases: -All firms in the economy are owned by a benevolent planner: externality is internalized. -Firms are all separately owned: no firm values the positive externalities it has on others. Implications -In the latter case, firms tend to under-invest in capital accumulation since private marginal benefits from investment is less than the social marginal benefits -constant returns at the level of the firm can coexist with increasing returns at the level of society g [1 ] I-Externalities, technical progress and growth C-Complementarities Particular type of externality that relates not to the level of utility, or monetary reward, that others experience when an action is taken, but to the ranking of the alternatives that they have. Example: A single individual that takes some action results in increases in the eincentives for other to take the same (or similar) action. Externalities, technical progress and growth Yi AKi Li1 K Illustration Productivity depends on the future path of average capital accumulation by all firms in the economy Actions of others increase your relative preference for choosing similar actions. Illustration: Private Rational Decision Where does the shape come from? Examples of complementarity Equilibria in this type of problem Expected Decision by other agents Equilibrium –situation in which everyone is doing what is best for them, given what they expect others to do, which in turn matches what others are actually doing. Implications - An economy can get stuck in a low growth rate largely because the economy is expected to have a low investment rate. -Market forces bring to one of the equilibria, but they are not sufficient to ensure that the best equilibrium will be achieved Thus, the need for coordination Changing expectations may not be enough since there is an incentive not to be the first mover. This implies that there room for government policy. II-Moving from Bad to Good Equilibria: The Big Bush A – A graphical model of the Big Push Challenge to initiate industrialization in a subsistence economy: coordination failure (Rosenstein-Rodan, 1943) Potential externalities from first manufacturing firm for followers -increase sales -provide trained employees -provide ideas to copy Implications -No incentive to be the First Mover -But if no one moves, no industrialization: “Circular Cusation.” -Typical coordination failure II-Moving from Bad to Good Equilibria: The Big Bush Assumptions Progress in our understanding without sacrificing generality - Economy is closed - most conclusions will remain when trade is allowed. - Factors – only 1 factor of production: labor is fixed in supply, L - Market structure – 2 sectors; traditional and modern: Tradition – constant returns to scale, free entry, and no economic profits, the wage (marginal cost of production) = price of goods: Modern –increasing returns to scale, profits but competition with Traditional forces price to be the same as Traditional. -Factor payment – labor has 2 sectors: traditional (wage =1) numeraire; modern wage >1. II-Moving from Bad to Good Equilibria: The Big Bush Assumptions -Domestic demand – There are N (large) types of products on which consumers spend an equal amount national income Y : Y/N is spent on each product (whatever is produced with modern or traditional technology). So each product will be produced with L/N workers before industrialization starts. -Technology – In the Traditional Sector- constant returns to scale (each worker produces 1 unit). In the Modern Sector – increasing returns to scale; at least F workers are required to start production but after that, workers are more productive: marginal labor requirement is c (c<1) for 1 unit of output. Labor requirement to produce Q is L = F+cQ; c<1. II-Moving from Bad to Good Equilibria: The Big Bush Traditional Production Function for each product Traditional Sector Production : 45 degree Output = Q line means that 1 worker produces 1 unit. Also, Price = Wage=1 Q1 Labor =L L/N Modern Sector Production Function: Starts at F and is steeper than the 45˚line. 1 worker produces more than 1 unit of output Output = Q Q1 F L/N Modern Sector Production Function for each product Labor = L II-Moving from Bad to Good Equilibria: The Big Push What does it take for the modern firm to enter, (i.e. adopt modern technology to produce a product)? -needs to be profitable: What do profits depend on? -Output value (price =1) -Costs: F and c (Fixed cost and marginal labor requirement for extra unit of output respectively) corresponds to the technology What is the output that the first modern firm will produce if it enters? -the maximum that it can sell: Y is unchanged so output is still Y/N II-Moving from Bad to Good Equilibria: The Big Push (continued) The outcome depends on the wage level in the Modern Sector: Examine 3 scenarios -Wage is W1 -Wage is W2 -Wage is W3 What outcome is Pareto-enhancing under these different scenarios? Gist: The problematic cases occur when the wage bill line passes between A and B: it is efficient to industrialize, but the market will not achieve this on its own. Why? Because of coordination failure. Divergence between advocates of balanced growth (Nurkse) and unbalanced growth (Hirschman). -Big Push refers to coordinated, broadly based investment program: balanced growth as problems of bottlenecks -Unbalanced growth stresses upstream-downstream industry linkages Backward linkages exist when the growth of an industry leads to the growth of the industries that supply it (demand linkages) Forward linkages (cost linkages): exist when increases in output in the upstream creates pecuniary opportunities for the downstream. B-Other cases in which a Big Push may be necessary -Intertemporal effects -Urbanization effects -Infrastructure -Training effects II-Moving from Bad to Good Equilibria: The Big Push (continued) C-Why the problem cannot be solved by the Super-Entrepreneur -Capital market -Limits to knowledge -Monitoring Costs -Communication failures -Empirical reason that no private agent has been observed playing the role of a SuperEntrepreneur III-Kremer’s O-Ring or Zidane Clustering Theorem of Economic Development -The name (O-Ring) comes from the 1986 Challenger shuttle explosion: a catastrophe caused by the failure of one small part –the O-Ring. The O-Ring, worth a couple of bucks at most, was defective and caused the explosion of a multimillion dollar spacecraft and the loss of seven lives. The O-Ring Theory in essence postulates that in otherwise equal production processes, the worst input factor (or 'weakest link') will determine the overall quality level of the final product. -Henning Voepel from the World Economic Institute in Hamburg, reapplied the theory to team sports and found that like in the economic theory, the weakest player on a team (the 'weak link') determines the overall quality of a team. Focus Proposes that tasks of production must be executed proficiently together in order for any of them to be of high value. The key feature of this model is positive assortative matching – people with similar skill levels work together. III-Kremer’s O-Ring or Zidane Clustering Theorem of Economic Development Hypotheses -firms are risk-neutral -labor markets are competitive -workers supply labor inelastically -workers are imperfect substitutes for one another -a sufficient complementarity of tasks III-Kremer’s O-Ring or Zidane Clustering Theorem of Economic Development Production Function -Production is broken down to n tasks. -Laborers can use a multitude of techniques of varying efficiency to carry out these tasks depending on their skill (denoted by q, where 0 ≤ q ≤ 1). -Output is determined by multiplying the q values of each of the n tasks together: for 2 workers i and j, F(qi,qj)=qiqj. Important Implication of this production is positive assortative matching as illustrated by a hypothetical 4-person economy with 2 low-skill workers (ql) and 2 high-skill workers (qH). -Productive Efficiency of skill matching: qH 2qH2 + qL2 > 2qLqH Analogy to Becker’s famous “marriage market.” III-Kremer’s O-Ring or Zidane Clustering Theorem of Economic Development Implications 1. Workers performing the same task earn higher wages in a high-skill firm/country than in a low-skill firm/country. 2. Wages will be more than proportionately higher in developed countries than would be assumed by measurements of skill levels, because wages increase in q at an increasing rate. Illustration of increasing returns to skill: 6-worker economy. i. 3 have q = 0.4 and are grouped together while the other 3 have q = 0.8 ii. Now suppose that due to training, the q of one of the workers in the first firm rises from 0.4 to 0.5 and that 1 worker in the second firm rises from 0.8 to 1.0. iii. Firm 1: from (0.4)(0.4)(0.4) = 0.064 to (0.4)(0.4)(0.5) = 0.080 – a point change of 0.016. Firm 2: from (0.8)(0.8)(0.8) = 0.512 to (0.8)(0.8)(1.0) = 0.640 – a point change of 0.128. Impact: Point value is eight times greater for a doubled point-vale investment (0.016 x 8 = 0.128). Implications 3. Workers will consider human capital investments in the light of similar investments by those around them. This type of complementarity should by now be a familiar condition in which multiple equilibria can emerge. 4. Magnification of the effect of local bottlenecks because such bottlenecks have a multiplicative effect on other production, which also reduce the expected returns to skill. 5. O-Ring or Zidane Clustering Theorem effects across firms (bad inputs from suppliers provide no incentive to upgrade) can create national low-production quality traps (in case of the O-Ring) or (a) Over time, the performance of a given player will improve if he is surrounded by high quality teammates (i.e. those who are more likely to complete their task successfully) and vice versa and (b)The higher the initial quality of a given player, the more his performance will improve over time if playing with high quality teammates (The Zidane Clustering Theorem ) III-Kremer’s O-Ring or Zidane Clustering Theorem of Economic Development Conclusions 1. Two-edged sword of policies: government, therefore has great potential for good or ill through its influence on the long-term rate of growth 2. Bad equilibria (people doing inefficient things) are rational: there is no incentives to be the first mover to get out. 3. Fundamental problem of coordination failure cannot be solved by the market: government policy and aid will be necessary to overcome the resulting vicious circles of underdevelopment. 4. Points to the necessity to account for market failures and complementarities: capital injection will not be enough: incentives are the key.