Ch9 Market Segmentation and Target Marketing 9.1: Why Do Market

advertisement

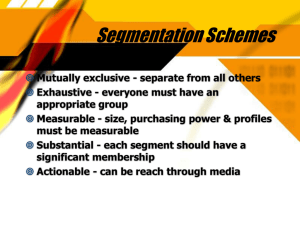

Ch9 Market Segmentation and Target Marketing 9.1: Why Do Market Segmentation and Target Marketing Make Sense? Market segmentation is the process by which a market is divided into distinct subsets of customers with similar needs and characteristics that lead them to respond in similar ways to a particular product offering and marketing programme. Target marketing requires evaluating the relative attractiveness of various segments (in terms of market potential, growth rate, competitive intensity, and other factors) and the firm’s mission and capabilities to deliver what each segment wants, in order to choose which segments it will serve. Brand positioning entails designing product offerings and marketing programmes that collectively establish an enduring competitive advantage in the target market by creating a unique image, or position, in the customer’s mind. These three decision processes – market segmentation, target marketing, and positioning – are closely linked and have strong interdependence. All must be well considered and implemented if the firm is to be successful in managing a given product-market relationship. In the unusual case where a firm can afford to serve all market segments, it must determine the most appropriate allocation of its marketing effort across segments. I. Most Markets Are Heterogeneous Variation among market segments in product preferences, size and growth in demand, media habits, and competitive structures further affect the differences and response rates. Thus, markets are complex entities that can be defined (segmented) in a variety of ways. The critical issue is to find an appropriate segmentation scheme that will facilitate target marketing, product positioning, and the formulation of successful marketing strategies and programmes. By focusing their initial efforts on high-performance distance runners, a clearly defined and very narrow market segment, II. Today’s Market Realities Often Make Segmentation Imperative Market segmentation has become increasingly important in the development of marketing strategies for several reasons. First, population growth has slowed, and more product-markets are maturing. Second, such social and economic forces as expanding disposable incomes, higher educational levels, and more awareness of the world have produced customers with more varied and sophisticated needs, tastes, and lifestyles than ever before. This has led to an outpouring of goods and services that compete with one another for the opportunity of satisfying some group of consumers. Third, there is an increasingly important trend toward micro segmentation in which extremely small market segments are targeted. This trend has been accelerated in some industries by new technology such as computer-aided design, which has enabled firms to mass customize many products as diverse as designer jeans and cars. Finally, many marketing organizations have made it easier to implement sharply focused marketing programmes by more sharply targeting their own services. 9.2: How Are Market Segments Best Defined? There are three important objectives entailed in the market segmentation process: Identify a homogeneous segment that differs from other segments. The process should identify one or more relatively homogeneous groups of prospective buyers with regard to their wants and needs and/or their likely responses to differences in the elements of the marketing mix – the 4 Ps (product, price, promotion, and place). Specify criteria that define the segment. The segmentation criteria should measure or describe the segments clearly enough so that members can be readily identified and accessed, in order for the marketer to know whether a given prospective customer is or is not in the target market and in order to reach the prospective customer with advertising or other marketing communication messages. Determine segment size and potential. Finally, the segmentation process should determine the size and market potential of each segment for use in prioritizing which segments to pursue, a topic we address in more detail later in this module. 1 Marketers divide segmentation descriptors into three major categories for both consumer and organizational markets: demographic descriptors (which reflect who the target customers are), geographic descriptors (where they are), and behavioral descriptors (how they behave with regard to their use and/or purchases of a given category of goods or services). 1- Demographic Descriptors While firm demographics (age of firm, size of firm, industry, etc.) are useful in segmenting organizational markets, we usually think of demographics in terms of attributes of individual consumers, as shown below. Some examples of demographic descriptors used to segment consumer markets are as follows: Age Sex Income: higher-income households purchase a disproportionate number of cellular phones, expensive cars, and theatre tickets. Occupation: The sales of certain kinds (e.g. work shoes, automobiles, uniforms, and trade magazines) are tied closely to occupational type. Education: there is a strong positive correlation between the level of education and the purchase of travel, books, magazines, insurance, theatre tickets, and photographic equipment. Race and ethnic Origin: more and more companies are targeting these segments via specialized marketing programs. Geography Exhibit 9.2 some of the more commonly used demographic descriptors Demographic descriptors Examples of categories Age Under 2, 2–5, 6–11, 12–17, 18–24, 25–34, 35–49, 50–64, 65 and over Sex Male, female Income Under $15 000, $15 000–$24 999; $25 000–$74 999, etc. Occupation Professional, manager, clerical, sales, supervisor, blue collar, homemaker, student, unemployed Education Some high school, graduated from high school, some college, graduated from college Geography Regions, countries, cities, metropolitan areas, counties, Zip codes and blocks Race and ethnic origin Anglo-Saxon, African-American, Italian, Jewish, Scandinavian, Hispanic, Asian Others include marital status, home ownership, and presence and age of children. Demographic descriptors are also important in the segmentation of industrial markets, which are segmented in two stages. The first, macro segmentation, divides the market according to the characteristics of the buying organization using such descriptors as age of firm, firm size, and industry affiliation (SIC code in the US). The international counterpart of SIC is the trade-category code. The second stage, micro segmentation, groups customers by the characteristics of the individuals who influence the purchasing decision – for instance, age, sex, and position within the organization. International markets are segmented in a similar hierarchical fashion, starting with countries, followed by groups of individuals or buying organizations. 2- Geographic Descriptors Different geographic areas vary in their sales potential, growth rates, customer needs, cultures, climates, service needs, and competitive structures, as well as purchase rates for a variety of goods. Geographic segmentation is used in both consumer and organizational markets and is particularly important in retailing and many services businesses, where customers are unwilling to travel very far to obtain the goods or services they require. Thus, one way to segment retail markets is by distance or driving time from a particular location. The area included within such a geographically defined region is called a trade area. 3- Geo-demographic Descriptors Many segmentation schemes involve both demographic and geographic factors. National demographic Systems and other sources offer low-cost reports based on census data that show the demographic profile of the population residing within any given radius of a particular street corner or shopping center location. These reports are useful in assessing the size and market potential of a market segment defined by a particular trade area. Geodemographics also attempts to predict consumer behavior 2 by making demographic, psychographic, and consumer information available at the block and Zip code levels. 4- Behavior Descriptors There is no limit to the number of insightful ways successful marketers have segmented markets in behavioral terms. In virtually every consumer and organizational market there are probably segments like these just waiting to be identified and targeted by insightful marketers. Behavioral descriptors can take many forms, including those based on consumer needs; on product usage patterns; on more general behavioral patterns, including lifestyle, which often cuts across demographic categories or varies within them; and, in organizational markets, on the structure of firms’ purchasing activities and the types of buying situations they encounter. - Consumer Needs Customer needs are expressed in benefits sought from a particular product or service. Different customers have different needs and thus attach different degrees of importance to the benefits offered by different products. In the end, the product that provides the best bundle of benefits – given the customer’s particular needs – is most likely to be purchased. Consumers evaluate product or brand alternatives on the basis of desired characteristics and how valuable each characteristic is to the consumer – choice criteria. Marketers can define segments according to these different choice criteria in terms of the presence or absence of certain characteristics and the importance attached to each. In organizational markets, customers consider relevant benefits that include product performance in different use situations. - Product-Related Behavioral Descriptors Product usage is important because in many markets a small proportion of potential customers makes a high percentage of all purchases. In organisational markets, the customers are better known, and heavy users (often called key accounts) are easier to identify. Market segmentation based on sources of purchase influence is relevant for both consumer and organizational markets. - General Behavioral Descriptors Behavioral descriptors, including lifestyle and social class, are commonly used in consumer markets. In organization markets, prospective customers differ in how they structure their purchasing activities and in the nature of the buying situations they are engaged in. Lifestyle o Segmentation by lifestyle, or psychographics, groups’ consumers on the basis of their activities, interest, and opinions. From such information it is possible to infer what types of products and services appeal to a particular group, as well as how best to communicate with individuals in the group. o Stanford Research Institute (SRI) has created an improved US segmentation service (called VALS 2), which builds on the concept of self-orientation and resources for the individual. Self-orientation is based on how consumers pursue and acquire products and services that provide satisfaction and shape their identities. o Principle-oriented consumers are motivated by abstract and idealized criteria, while status-oriented consumers shop for products that demonstrate the consumer’s success. Action-oriented consumers are guided by the need for social or physical activity, variety, and risk taking. o Resources include all of the psychological, physical, demographic, and material means consumers have to draw on. They include education, income, self-confidence, health, eagerness to buy, intelligence, and energy level – on a continuum from minimal to abundant. o Based on these two dimensions, VALS 2 defines eight segments that exhibit distinctive behavior and decision making – actualizers, fulfillers, achievers, experiencers, believers, strivers, makers, and strugglers. Nielsen and similar commercial organizations identify each of the respondents as to their VALS type, thereby permitting a cross-classification of VALS type with the product usage and personal information collected by such companies. Thus, users can determine what each VALS segment bought, what their media habits are, and similar data. The VALS system has been further developed in Europe and Asia Social Class 3 o Every society has its status groupings based largely on similarities in income, education and occupation. o In international field, one has to be careful in using social class as a segmentation variable since the differences among classes can become blurred, as they do in the Scandinavian countries. - Organizational or Firm Behavioral Descriptors Purchasing structure and buying situation segmentation descriptors are unique to organizational markets. Purchasing structure is the degree to which the purchasing activity is centralized. In such a structure the buyer is likely to consider all transactions with a given supplier on a global basis, to emphasize cost savings, and to minimize risk. In a decentralized situation, the buyer is apt to be more sensitive to the user’s need, to emphasize product quality and fast delivery, and to be less cost-conscious. Some marketers segment their markets accordingly and target customers whose purchasing structure is similar (companies who buy centrally from one location to meet their global needs, for example). The buying situation descriptor includes three distinct types of situations: straight rebuy, a recurring situation handled on a routine basis; modified rebuy, which occurs when some element, such as price or delivery schedules, has changed in a client–supplier relationship; and a new buying situation, which may require the gathering of considerable information and an evaluation of alternative suppliers. 5- Innovative Segmentation: A Key to Marketing Breakthroughs Three objectives of the market segmentation process: Identify a homogeneous segment that differs from others Specify criteria that define the segment Determine segment size and potential Often, combinations of different descriptors are used to more precisely target attractive combinations of different descriptors are used to more precisely target an attractive segment: perhaps some behavioral dimension together with a carefully defined demographic profile within some geographic region. Understanding the demographic profile of a target market enables the marketer to better choose targeted advertising media or other marketing communication vehicles. Marketers with superior market knowledge are probably more likely to generate the insights necessary to define market segments in these innovative and meaningful ways. 9.3: Choosing Attractive Market Segments: A Five- Step Process But not all segments represent equally attractive opportunities for the firm. To prioritize target segments by their potential, marketers must evaluate their future attractiveness and their firm’s strengths and capabilities relative to the segments’ needs and competitive situations. It is often better to apply a common analytical framework across segments. With this approach, managers can compare the future potential of different segments using the same set of criteria and then prioritize them to decide which segments to target and how resources and marketing efforts should be allocated. One useful analytical framework managers or entrepreneurs can use for this purpose is the marketattractiveness/competitive-position matrix. As we saw in Module 2, managers use such models at the corporate level to allocate resources across businesses, or at the business-unit level to assign resources across product-markets. Exhibit 9.6 Steps in constructing a market attractiveness/competitive position matrix for evaluating potential target markets 4 The exhibit above outlines the steps involved in developing a market-attractiveness/competitive-position for analyzing current and potential target markets. Underlying such a matrix is the notion that managers can judge the attractiveness of a market by examining market, competitive, and environmental factors that may influence profitability. The first steps in developing a market-attractiveness/competitive-position matrix, is to identify the most relevant variables for evaluating alternative market segments and the firm’s competitive position regarding them and to weight each variable in importance. 1. Step 1: Select Market-Attractiveness and Competitive-Position Factors Managers can assess both dimensions on the basis of information obtained from analyses of the environment, industry and competitive situation, market potential estimates, and customer needs. To make these assessments, they need to establish criteria, such as those shown in Exhibit 9.6, against which prospective markets or market segments can be evaluated. Both market and competitive perspectives are necessary. Exhibit 9.6 Factors underlying market attractiveness and competitive position Market attractiveness factors Competitive position factors Customer needs and behavior Opportunity for competitive advantage Are there unmet or underserved needs we can satisfy? Market potential in units, revenue, number of prospective customers Growth rate in units, revenue, number of prospective customers Might the target segment constitute a platform for later expansion into related segments in the market as a whole? Macro trends: are they favorable, on balance? Can we perform against critical success factors? Stage of competing products in product life cycle: is the timing right? Firm and competitor capabilities and resources Market or market segment size and growth rate Can we differentiate? Management strength and depth Brand image Financial and functional resources: marketing, distribution, manufacturing, R&D, etc. Relative market share Attractiveness of industry in which we would compete Demographic Sociocultural 5 Threat of new entrants Threat of substitutes Economic Political/legal Technological Physical Buyer power Supplier power Competitive rivalry Industry capacity Driving forces: are they favorable, on balance? - 2. 3. Market-Attractiveness Factors assessing the attractiveness of markets or market segments involves determining the market’s size and growth rate and assessing various trends – demographic, sociocultural, economic, political/legal, technological, and physical – that influence demand in that market. An even more critical factor in determining whether to enter a new market or market segment, however, is the degree to which unmet customer needs, or needs that are currently not being well served, can be identified. In the absence of unmet or underserved needs, it is likely to be difficult to win customer loyalty, regardless of how large the market or how fast it is growing. ‘Me-too’ products often face difficult going in today’s highly competitive markets. - Competitive- Position Factors Of more immediate and salient concern, however, is the degree to which the firm’s proposed product entry into the new market or segment will be sufficiently differentiated from competitors, given the critical success factors and product life-cycle conditions already prevalent in the category. Similarly, decision makers need to know whether their firm has or will be able to acquire the resources it will take – human, financial, and otherwise – to effectively compete in the new segment. Simply put, most new goods or services need to be either better from a consumer point of view or cheaper than those they hope to replace. Entering a new market or market segment without a source of competitive advantage is a trap. Step 2: Weight Factor: A numerical weight is assigned to each factor to indicate its relative importance in the overall assessment. Step 3: Rate Segments on Each Factor, Plot Result on Matrices This step requires that evidence be collected to objectively assess each of the criteria identified in step 1. - Market-attractiveness Factors Unmet customer needs for lateral stability, cushioning, and lightweight shoe have been identified. Score: 10. The distance runner segment is quite small, though growing, but it might lead to other segments in the future. Score: 7. Macro trends are largely favorable: fitness is ‘in,’ number of people in demographic groups likely to run is growing, global trade is increasing. Score: 8. - Competitive-position Factors Opportunity for competitive advantage is somewhat favorable; proposed shoes will be differentiated, but shoe category seems mature, and Blue Ribbon Sports, as a new firm, has no track record. Score: 7. Resources are extremely limited, though management knows runners and distance running; Bowerman has strong reputation. Score: 5. Five forces are largely favorable (low buyer and supplier power, little threat of substitutes, low rivalry among existing firms), driving forces attractive. Score: 7. It is especially important to undertake a detailed analysis of key competitor’s, especially with regard to their objectives, strategy, resources, and marketing programmes. Compelling evidence that a proposed entry into a new segment will satisfy some previously unmet needs, and do so in in a way that can bring about sustainable competitive advantage, is called for. Both qualitative and quantitative marketing research results are typically used for this purpose. Once these assessments have been made, the weighted results can be plotted on a marketattractiveness/competitive-position matrix. Exhibit 9.8 Matrix showing the attractiveness of a Blue Ribbon Sport’s target segment based on a matching of market attractiveness and competitive position 6 4. 5. Step 4: Project Future Position for Each Segment Forecasting a market’s future is more difficult than assessing its current state. Managers or entrepreneurs should first determine how the market’s attractiveness is likely to change over the next three to five years. The starting point for this assessment is to consider possible shifts in customer needs and behavior, the entry or exit of competitors, and changes in their strategies. Managers must also address several broader issues, such as possible changes in product or process technology, shifts in the economic climate, the impact of social or political trends, and shifts in the bargaining power or vertical integration of customers. Managers must next determine how the business’s competitive position in the market is likely to change, assuming that it responds effectively to projected environmental changes but the firm does not undertake any initiatives requiring a change in basic strategy. The expected changes in both market attractiveness and competitive position can then be plotted on the matrix in the form of a vector (arrow) that reflects the direction and magnitude of the expected changes. Anticipating such changes may be critically important in today’s Internet age. Step 5: choose Segments to Target, Allocate Resources Managers should consider a market to be a desirable target only if its strongly positive on at least one of the two dimensions of market attractiveness and potential competitive position and at least moderately positive on the other. a business may decide to enter a market that currently falls into one of the middle cells under these conditions: (1) managers believe that the market’s attractiveness or their competitive strength is likely to improve over the next few years; (2) they see such markets as stepping-stones to entering larger, more attractive markets in the future; or (3) shared costs are present, thereby benefiting another entry. The market-attractiveness/competitive position matrix offers general guidance for strategic objectives and allocation of resources for segments currently targeted and suggests which new segments to enter. Thus, it can also be useful, especially under changing market conditions, for assessing markets or market segments from which to withdraw or to which allocations of resources, financial and otherwise, might be reduced. Exhibit 9.9 Implications of alternative positions within the market-attractiveness/ competitive-position matrix for target market selection, strategic objectives and resource allocation 7 9.4: Different Targeting Strategies Suit Different Opportunities Most successful entrepreneurial ventures target narrowly defined market segments at the outset. One, doing so puts the nascent firm in position to achieve early success in a market segment that it understands particularly well. Second, such a strategy conserves precious resources, both financial and otherwise. But segmenting the market into narrow niches and then choosing one niche to target is not always the best strategy, particularly for established firms having substantial resources. Three common targeting strategies are niche-market, mass-market and growth-market strategies. 1. Niche- Market Strategy Involves serving one or more segments that, while not the largest, consist of sufficient numbers of customers seeking somewhat-specialized benefits from a product or service. Such a strategy is designed to avoid direct competition with larger firms that are pursuing the bigger segments. 2. Mass-Market Strategy A business can pursue a mass-market strategy in two ways. First, it can ignore any segment differences and design a single product-and-marketing programme that will appeal to the largest number of consumers. The primary object of this strategy is to capture sufficient volume to gain economies of scale and a cost advantage. This strategy requires substantial resources, including production capacity, and good massmarketing capabilities. Consequently, it is favored by larger business units or by those whose parent corporation provides substantial support. A second approach to the mass market is to design separate products and marketing programmes for the differing segments. This is often called differentiated marketing. 3. Growth-Market Strategy It is a strategy often favored by smaller competitors to avoid direct confrontations with larger firms while building volume and share. Most venture capital firms invest only in firms pursuing growth-market strategies, because doing so is the only way they can earn the 30 per cent to 60 per cent annual rates of return on investment that they seek for portfolio companies. Such a strategy usually requires strong R&D and marketing capabilities to identify and develop products appealing to newly emerging user segments, plus the resources to finance rapid growth. The problem, however, is that fast growth, if sustained, attracts large competitors. 9.5: Global Market Segmentation and Target Marketing The traditional approach to global market segmentation has been to view a country or a group of countries as a single segment comprising all consumers. This approach is seriously flawed because it relies on 8 country variables rather than consumer behavior, assumes homogeneity within the country segment, and ignores the possibility of the existence of homogeneous groups of consumers across country segments. More and more companies are approaching global market segmentation by attempting to identify consumers with similar needs and wants reflected in their behavior in the marketplace in a range of countries. This inter-country segmentation enables a company to develop reasonably standardized programmes requiring little change across local markets, thereby resulting in scale economies. Some companies go international to defend their home position against global competitors that are constantly looking for vulnerability. Another reason a firm may go overseas and target a specific country is to service customers who are also engaging in global expansion. Firms also enter overseas markets to earn foreign exchange and, in some cases, are subsidized by their governments to do so. the selection of overseas target markets follows essentially the same patterns as for domestic markets, although given the magnitude of economic, social, and political change in the world today, companies are paying considerably more attention to political risk. 9