Kazakhstan Duties and Taxes Exemption Certificate Application

advertisement

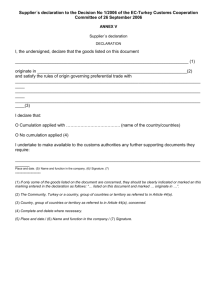

Kazakhstan Duties and Taxes Exemption Certificate Application Procedure Information The following documents must be provided by the originating agent: * Rated way bill or transportation cost on letterhead of carrier; * Detailed packing list with value and country of origin for each item; * Copy of the consignee's passport; * Valued inventory in English or Russian. The following documents (obtained locally at the destination) must be provided by the consignee: * Copy of consignee's valid Kazakhstani visa; * Power of attorney on letterhead of employer; * Confirmation of employment on letterhead of employer; * Notarized power of attorney for rail terminal handling charges to be obtained directly by the shipment's consignee; Customs brokerage agreement to be signed and stamped by consignee. The customs authorities may request any additional information and/or documents at their discretion. a) Certificate of origin of goods When goods are imported into Kazakhstan, a certificate of origin for the product may be required in the following cases: -If the product benefits from tariff preferences under an international treaty; -If the customs body has reason to believe that the product originates in a country from which imports are regulated by non-tariff regulatory measures; -If a certificate is called for by international treaties to which Kazakhstan is a party. b) Declaration Under the tax code, a declaration of goods must be presented. Goods are declared by providing a customs body with a statement (written, oral, implied or electronic) that contains reliable information about the goods, their customs treatment, and other customs data. Types of customs declarations: Cargo customs declaration; Customs value declaration; Passenger customs declaration. c) Filing a customs declaration A customs declaration must be submitted not more than 30 days after producing the goods and vehicles to the customs body of Kazakhstan. A permit for registering goods and ve?hicles in a place other than a legal entitys registered location can be issued by the customs authority. This is done at the place of registration following written application by the recipient (or forwarder) and is contingent on certain conditions being followed. The permit is valid for one year provided that the conditions of issue are not broken during this period. A customs declaration must be submitted together with the following supporting documents: A document authorizing the declarer to submit the customs declaration on his or her behalf; A foreign trade contract, a sale or exchange contract, or any other document proving ownership of the goods being registered; Transport documents; Invoice, pro-forma invoice, product specifications and other documents required for declaration and defining customs value; A declaration or certificate of origin of the goods; A document certifying that customs duties and taxes have been paid or will be paid. This will depend on the terms of the customs treatment and any applicable exemptions; A delivery control document or other documents required by international treaties to which Ka?zakhstan is a party; Documents required by foreign exchange legislation; A phytosanitary (quarantine) certificate or veteri?nary certificate. This is only necessary in specific cases defined under Kazakh law. The Kazakh customs body has ten days from receipt of the declaration and all the required documents to check the declaration and inspect the goods and vehicles, including those received via express delivery. If goods are declared in advance, the customs declaration and supporting documents will be checked within ten days. This term can be extended by ten days from the date of receiving a customs declaration on the written ap?proval of the head of the customs body of Kazakh?stan. This does not include express deliveries. The following documents must be submitted to confirm the customs value of the goods declared: 1) Customs value declaration; 2) Any agreements or contracts that contain data that may affect the determination of the customs value; 3) Invoice or pro-forma invoice (with respect to transactions other than purchase-and-sale transactions); 4) Payment documents proving the value of the goods. These are only necessary if, at the time the customs declaration is submitted and according to the payment terms, payment has been fully or partially made; 5) Transport and insurance documents if, under the terms of delivery, expenses for transportation and insurance are paid by the buyer; 6) Transportation invoice or officially certified receipt for transport expenses in cases when transport expenses were not included in the invoice, but were paid by the buyer; 7) Copy of the customs declaration of the country of departure, if possible. If these documents are not sufficient to confirm the declared customs value, the declarant has the right to submit the following additional documents to prove the customs value: 1) License documents of the person transporting the goods; 2) Contracts with third parties related to the transaction; 3) Invoices for payments made to third parties in favor of the seller; 4) Invoices for commissions or brokerage services related to transactions with the goods; 5) Excerpts from the buyers accounting documents, proving the value of the goods; 6) Licensing or royalty contracts; 7) Storage receipts; 8) Delivery orders; 9) Catalogues, specifications, price lists of manufacturing companies; 10) Calculations by the manufacturing company for the goods; 11) Anything else that may aid in confirming the value of the goods. Process to be followed (step by step / flowchart) 1) Submission of the cargo customs declaration and accompanying documents to appropriate customs officials; 2) Acceptance of the declaration (additional information might be requested by customs officials before the declaration is accepted); 3) Review of the documents; 4) Inspection of the goods; 5) Release of the goods in accordance with the appropriate customs regime. b) Submission of the cargo customs declaration A party declaring goods at a customs office in Kazakhstan is responsible for submission of paper and electronic copies of customs declarations (one copy of each per shipment), as well as the following additional documents: 1) Documents certifying the ownership (management) rights of the goods. Examples include foreign trade contracts and agreements; 2) Transportation documents certifying that goods actually crossed (or will cross) Kazakhstans customs border; 3) Documents confirming the customs value of the goods; 4) Documents indicating the origin of goods; 5) Documents confirming payment (or guarantee of payment) of customs duties and taxes; 6) Documents confirming the legal rights of the individual submitting the declaration and accompanying documents (letter granting power of attorney given to a staff member or a contract signed with a customs broker). Additional documents might be required depending on the type of customs regime that applies to the goods being declared. Non-submission of accompanying documentation (including items 1-6 listed above) is not grounds for rejection of the cargo customs declaration. However, if accompanying documentation is not provided at the time the declaration is submitted, customs officials will issue a request for additional documentation. Requested documents will have to be submitted by the declaring party within a time limit (not to exceed 10 days) specified by the customs officials. Acceptance of the cargo customs declaration is the beginning of the clearance process. Accepted declarations are passed on to document control and inspection. c) Review of the documents and inspection In Kazakhstan, the review and inspection of customs documents proceeds as follows: 1) Review of the harmonized code under which the goods are declared, the country of origin, and the applicability of non-tariff regulatory measures; 2) Currency control and review of the declared customs value; 3) Customs duties and tax control; 4) Inspection and release of goods. Customs officials have the right to ask for additional supporting documentation if approved by the head of the customs office. At each stage, customs officials have to sign off on the documents indicating either their agreement with the information provided or the need to submit additional documents. If customs officials have no objections, the documents are then passed on for final inspection and release of the goods. If there are any objections or requests for additional documentation, documents are sent back to the first stage of the clearance process.