Chapter 3 Global Economic Development

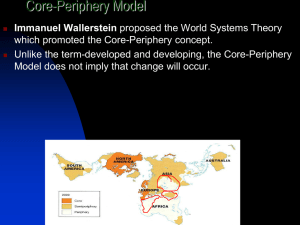

advertisement

Chapter 3 Global Economic Development • Introduction – Nature of Technology, Global Distribution of Technology, Elements in Economic Development • World Levels of Development – Regional Growth • Problems of Development – Regional Economic Change, Growth Pole Theory, Circular and Cumulative Causation, The Bell Shaped Development Model • Concluding Thoughts and Summary Introduction • The Nature of Technology “technology … refers to the application of scientific knowledge and methods to economic activity, resulting in changes in productivity” p. 35 • The basic problem in engineering economics and management science - defining products/services, and optimal combinations of factor inputs to produce them • Component technologies: (1) transport & communications, (2) manufacturing, (3) agriculture, (4) urban-service • Energy consumption as an indicator of the stock of technology (Table 3.1); vehicles per capita (Figure 3.2) Elements in Economic Development Population Characteristics Cultural Attributes Economic Development Technology Energy and Resource Base World Levels of Development • Figure 3.4 • Regional Growth: Rostow’s stages of growth model (1) traditional societies, (2) preconditions for takeoff, (3) takeoff, (4) drive to maturity, (5) high mass consumption • The process of diffusion of development • ? Inevitability of Rostow’s sequence? Changing Composition of Employment in the U.S. 100% 90% 80% 70% Services 60% Manufacturing 50% Construction Mining 40% Farm 30% 20% 10% 2001 1995 1989 1987 1982 1977 1972 1967 1958 1947 1939 1929 1919 1909 1899 0% Development of the U.S. Service Sector 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% State & Local Government Federal Government Services Finance, Insurance, Real Estate Retail Wholesale Transportation, Communications & Utilities 1940 1970 2002 Decomposition of Services 100% 90% 80% 70% 60% Consumer Services 50% Health Services 40% Producer Services 30% 20% 10% 0% 1940 1970 2002 Development: The Circular Model of Capital Flow Stock of Productive Capacity Industrial Output Investment •Interest rates •Tax policy & public investment Final Consumer Demand “Savings” Business Income (Value Added) Payments to Households “Savings” - retained earnings, household savings, institutional investors, international capital sources Regional Economic Change: Initial Triggers to Development Vance’s model - contrast of “old model” of endogenic development (internal growth theory) - versus “new model” of exogenic growth Local examples: fur trade Hudson’s Bay Co trading posts Oregon Trail settlers Puget Sound timber trade Jacksonville OR gold mining Vance’s Exogenic And Endogenic Model Internal Development after Initial Triggers to Development Retail and other service functions ? Location relative to export activity? Crossing thresholds with growth, substituting local production for imports, exploiting scale economies Static versus dynamic relations Impact of Scale Economies on Market Division B Market Division A Market Division P P P a a I II distance t t P t a a I II Impact of Transport Improvement C Market Division P P I II Process of Regional Specialization 18 18 16 16 14 14 12 12 10 10 8 8 6 6 4 4 2 2 0 0 Bread Lumber Iron Region A Cameras Bread Lumber Iron Cameras Region B Initial Condition: No Interregional Trade Local Production Equals Location Consumption Process of Regional Specialization, Continued Exports To B 30 35 25 30 Exports to A 25 20 20 15 15 10 10 5 5 0 0 Bread Lumber Iron Cameras Region A Imports from B Bread Lumber Iron Cameras Region B Imports from A Process of Regional Specialization, Continued Interregional Exports 45 60 40 50 35 30 40 25 30 20 20 15 10 10 5 0 0 Bread Lumber Production for Local Use Iron Cameras Bread Interregional Imports Lumber Iron Cameras Production for Local Use Perroux’s Growth Pole Model “Growth does not appear everywhere at the same time; it becomes manifest at points or poles of growth, with variable intensity; it spreads through different channels with variable terminal effects on the whole economy.” Growth Poles versus Growth Centers Propulsive Industries & Lead Firms - large size; fast growth; strong linkages; innovative ? Geographic clustering of pole components? ? Use of I/o data to identify poles?? Uneven Development: Spatial Outcomes at varying scales • Role of lead industries, growth poles • Regional economic base as a platform for development over time • The outcome of Perroux’s arguments: uneven development, where there is: (1) a dominant center or core, and (2) a subdominant periphery that materializes (a) locally; (b) nationally, (c) globally Core-Periphery: Shifting Scales Global: Nation State Level: Developed-Developing Urban Perspective: Global Cities (New York, London, Tokyo) - peripheral cities - e.g. Seattle National: The Industrial NE Vs. the agriculture & resource dependent South and West Regional: Seattle & Portland as central-place core cities, rural peripheries Local: Seattle CBD Vs. lower order urban centers The classic core-periphery model: Myrdal & Friedmann Demands from center for goods/services yields payments to periphery Abundant Labor Supply of materials and products Abundant Capital Scarce Labor Center Capital flows to periphery Periphery Shortage of labor in center creates stimulus for labor migration from periphery Supply of labor from periphery will create labor shortage in periphery and raise wages and incomes Adequate Labor Adequate Capital Scarce Capital Core-periphery Model: Spread Effects Demands by Center for goods & services; labor movements; capital flows to meet investment needs: ? “Trickle-Down” leading to equilibrium? BUT: (1) Distance attenuating effects - related to transportation & communications (2) Hierarchical impacts with stronger access to resources in higher order places Core-Periphery Model: Backwash/ Polarizing Effects Overtake Spread Effects 1. Goods/Service purchase in periphery (a) inelastic demand for peripheral goods (historically owned by core industrialists) (b) Offset by peripheral demand for goods and services produced in the core 2. Migration: historically selective 3. Capital: net flows often favor the core Result: Convergence, Divergence, Persistent Imbalance Backwash Circuits Capital Investment Migration and Employment Capital attracted to center Young workers migrate to center Lack of investment in periphery Wider Gap C-P Retarded growth in periphery Wider Gap C-P Decreased Services and Infrastructure attraction for Reduced Investment new activity and new jobs in periphery Widened gap between C-P Decline in local services Smaller local market, purchasing power Aging labor force in periphery Pred’s Model of Circular and Cumulative Growth Enhanced chance of invention and innovation Entry of new industry or expansion of existing industry Initial Multiplier Effect Attraction of linked industries: forward linkages backward linkages New local or regional threshold New Construction Activity Expanded Tertiary Sector Secondary multiplier effects Expanded Public Utilities Invention or Innovation