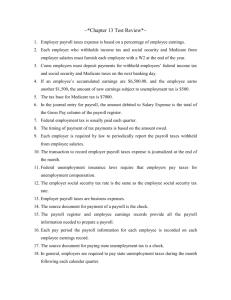

Chapter 13 Payroll Taxes * Journalizng, Reporting and Paying

advertisement

Chapter 13 Payroll Taxes – Journalizng, Reporting and Paying • EVERY PAY PERIOD: So… – Pay employees every pay period • Payroll Register • Employee Earnings Record – Use Memorandum to journalize employer payroll taxes (contributions) • General Journal • MONTHLY: – Pay employee and employers contributions electronically (formerly Federal Deposit Coupon) • Use Cash Payment Journal • QUARTERLY: – Report employee and employers payroll taxes using a 941 form • ANNUALLY: – Send a W-3 Transmittal to the Federal government – Send a NJ W-3 Transmittal to the State government – Send W-2s to your employees 13-1: Journalizing • Where? Cash payment special journal – Check number of payroll transfer Salaries Expense Debit - Total Earnings Withholding Payables Credits – Each payroll tax Cash Credit – Net amount of check Use T accounts (Text p. 370) WT 13-1, OYO 13-1, App 13-1 13-2: Employer Contributions • Payroll Register shows EMPLOYEE contributions • EMPLOYER contributions must be made: – Social Security – 6.2% with a maximum of $87,000 – Medicare – 1.45% – Federal Unemployment Tax (FUTA) – 0.8% max of $7,000 – State Unemployment Tax (SUTA) – 5.4% max of $7,000 13-2: Employer Contributions HOBBY SHACK Taxable Earnings For December 15, 2013, Pay Period Employee Accumulated Earnings as of Nov 30, 2013 Aranda, Susan A. Total Earnings for Dec. 15, 2013 Pay Period Unemployment Taxable Earnings (Max $7,000) Social Security Taxable Earnings (Max $87,000) 21,115.00 968.00 -- 968.00 5,595.25 550.00 550.00 550.00 Kellogg, Janice P. 39,840.00 1,910.00 -- 1,910.00 Mendel, Ann M 2,030.00 240.00 240.00 240.00 Selby, Rick E 22,746.00 1,137.00 -- 1,137.00 Young, Justin L. 19,816.00 906.40 -- 906.40 5,711.40 790.00 5,711.40 Drew, Paul S. TOTALS Social Security Tax Payable, 6.2% ___________354.11_ Medicare Tax Payable, 1.45% ____________82.83__ Unemployment Tax Payable – Federal, 0.8% _____________6.32__ Unemployment Tax Payable – State, 5.4% ____________42.66__ Total Payroll Taxes (Employer Contributions) ____________485.91_ Practice: WT 13-2 • 13-2 Yer Contributions\13-2 WT Yer Contributions.xls Complete OYO 13-2 – Employer Payroll Tax Chart 13-2: Employer Contributions • Journalized each payroll period as a payable – Not paid til quarter or year end – Use Memorandum GENERAL JOURNAL Date 9 15 ACCOUNT TITLE Payroll Taxes Expense 10 Social Security Tax Payable 11 Medicare Tax Payable 12 Unemployment Tax Payable - Federal 13 Unemployment Tax Payable – State Page 12 DOC NO. M63 POST REF. DEBIT CREDIT 9 485.92 354.11 10 82.83 11 6.32 12 42.66 13 14 14 15 15 Practice • 13-2 WT • 13-2 Yer Contributions\13-2 WT Yer Contributions.xls Complete 13-2 OYO PUT IT ALL TOGETHER: Application Problem 13-2 13-3: The W-2 Employer Annual Report to Employees of Taxes Withheld • At year end, prepare a W-2 (Text p. 378) – Submitted to: Federal and State governments, employee, and filed in company files • • • • • • Business’s name, address and EIN Employee’s name, address and SS # Total Wages (Box 1, 3 and 5) Total Fed income tax withheld (Box 2) Total SS withheld (Box 4) Total Medicare withheld (Box 6) Employees use this W-2 to file their personal income taxes. 13-3: The W-3 Employer Annual Reporting of Payroll Taxes • At year end, prepare a W-3 (Text p. 381) – Submitted to: Federal and State governments, and filed in company files • • • • • • Business’s name, address and EIN Employee’s name, address and SS # Total Wages for the Business (Box 1, 3 and 5) Total Fed income tax withheld for the Business (Box 2) Total SS withheld for the Business (Box 4) Total Medicare withheld for the Business (Box 6) The total of all employees’ W-2s 13-3: The 941 – Employer’s Quarterly Federal Tax Return (Text p. 379) • Filed the month following each fiscal quarter – Due April 30th, July 30th, Oct 30th, Jan 30th – Reports the amount of employees’ withholding plus employer contributions that is owed and has been paid Form 941 at irs.gov publications Practice: 13-3 Work Together With a partner: 13-3 OYO Independently: 13-3 App 13-4: Form 8109, Federal Deposit Coupon • Coupons are no longer in use • File electronically - MONTHLY • Once payment is filed, need to journalize Debit: Employee Income Tax Payable Social Security Tax Payable Medicare Tax Payable Credit: Cash w/ check number paid for employee and employer taxes • EVERY PAY PERIOD: So… – Pay employees every pay period • Payroll Register • Employee Earnings Record – Use Memorandum to journalize employer payroll taxes (contributions) • General Journal • MONTHLY: – Pay employee and employers contributions electronically (formerly Federal Deposit Coupon) • Use Cash Payment Journal • QUARTERLY: – Report employee and employers payroll taxes using a 941 form • ANNUALLY: – Send a W-3 Transmittal to the Federal government – Send a NJ W-3 Transmittal to the State government – Send W-2s to your employees