To record disbursements

advertisement

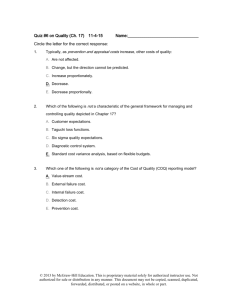

CHAPTER 21 Financial Management © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-2 Learning Outcomes (cont.) 21.1 Summarize the importance of and how to establish good bookkeeping and banking practices. 21.2 Compare single-entry, double-entry, and write-it-once bookkeeping systems. 21.3 Outline patient related financial transactions. 21.4 Identify negotiable instruments and the items that must be present for a check to be negotiable. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-3 Learning Outcomes (cont.) 21.5 Describe the different types of check endorsements and the steps in creating a bank deposit. 21.6 Carry out the process of reconciling the office bank statement. 21.7 List several advantages to electronic banking. 21.8 Implement setting up, classifying, and recording disbursements in a disbursement journal. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-4 Introduction • Medical practices require sound financial management • Employees must understand financial management procedures © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-5 The Medical Practice as a Business • To succeed - income must exceed expenses. • Accounting • Responsibilities of medical assistant – Bookkeeping ~ a systematic record of business transactions – Banking © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-6 The Medical Practice as a Business (cont.) • Accuracy – Strive for 100% – Records form a chain of information – Errors can result in • Double billing • Omitting bank deposits • Improper payments to suppliers © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-7 Establishing Procedures • Be organized • Be consistent • Use markers • Write clearly • Check your work © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-8 Apply Your Knowledge What can be the result of errors in billing? ANSWER: Errors can result in billing a patient twice for same service, omitting bank deposits, and making improper payments to suppliers. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-9 Medical Office Accounting Methods • Computerized – most common • All methods record – Income – Charges • Manual Systems – Disbursements – Single-entry – Double-entry – Pegboard – Other financial information © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-10 Electronic Bookkeeping • Bookkeeping on the computer – Performs same tasks as manual method – Saves time • Performs repetitive tasks • Performs math calculations • Has built-in tax tables © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-11 Manual Bookkeeping Systems • Single-entry – Transaction listed once each to • Patient ledger • Daily log • Checkbook – Disadvantages • Not self-balancing • Does not detect errors as readily © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-12 Manual Bookkeeping Systems (cont.) • Double-entry – Transactions are listed twice – Assets = Capital + Liabilities – As payments are made on the asset both side of the equation continue to balance Example: Asset - $15,000 ECG machine Capital = amount of total cost paid Liability = the amount still owed $15,000 = $5000 + $10,000 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-13 Manual Bookkeeping Systems (cont.) • Write-it-once (pegboard) system • Entry written one time – Daily log sheet – Patient ledger card – Charge slip © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-14 Manual Bookkeeping Systems (cont.) • Daily log – Chronological list of charges, payments, and adjustments – Journalizing – Post from the log to patient ledger © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-15 Manual Bookkeeping Systems (cont.) • Patient ledger card – Patient information – Financial transactions of patient account • Payments • Adjustments • Balance owed – Information from daily log © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-16 Manual Bookkeeping Systems (cont.) • Accounts receivable – Total owed to the practice – Total on accounts receivable = balances on patient ledger cards • Accounts payable – Amount owed to vendors – Keep accurate records © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-17 Manual Bookkeeping Systems (cont.) • Record of office disbursements – List of payments made – Information on record • • • • • Payee Date Check number Amount paid Type of expense © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-18 Manual Bookkeeping Systems (cont.) • Summary of charges, receipts, and disbursements – Comparison of income and expenses – Analyzing summaries • Areas of profitability • Amount charged and payments received • Cost of running the office • Categories of expenses © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-19 Apply Your Knowledge What types of bookkeeping methods might you use in a medical office? ANSWER: You might use these bookkeeping systems in a medical office: Single-entry Double- entry Pegboard © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-20 In Office Patient Transactions • Starting the Business Day – Set up peg board with daily log sheet – Layer superbills • Patient Process – ledger card under next superbill • Attach the Superbill to the Patient Chart © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-21 In Office Patient Transactions (cont.) • Patient Checkout – place superbill and ledger card on appropriate space of daily log • Payments After the Patient Visit – Record payments appropriately – Make adjustments as required © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-22 In Office Patient Transactions (cont.) • Returned Checks – Add back to patient balance – Add bank fees • Overpayments • End of day – Total columns – Correct errors © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-23 Apply Your Knowledge Mr. Adams check does not clear because of nonsufficient funds. What adjustments do you make to his account? ANSWER: The amount of the check is added back to the patient’s balance. A fee for the returned check as well as any fees incurred as a result of the NSF check may also be added to the patient’s balance. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-24 Banking and Negotiable Instruments • Banking tasks – Writing checks – Accepting checks – Endorsing checks – Making deposits – Reconciling bank statements © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-25 Checks • Bank draft or order for payment • Negotiable – Signed by payer – Amount to be paid – Payable to payee – Dated – Name of bank © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-26 Checks (cont.) • Cashier’s check – issued by bank • Certified check – money certified available • Voucher check – stub for record keeping • Limited check – time limited © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-27 Checks (cont.) • Counter check – withdrawals • Traveler’s check – established denominations • Money order – guaranteed payment © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-28 Checks (cont.) • Check codes – ABA number • Fraction on upper edge • Geographic area and bank – Magnetic ink character (MICR) code • Numbers and characters • Read by computer © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-29 Checks (cont.) • Payer • Payee • Date line • Amount box • Check number • Amount line • ABA number © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-30 Checks (cont.) • Bank information • Account number • Memo line • Check number • Payer signature line • MICR recording area • Routing number © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-31 Checks (cont.) • Accepting checks – Review check before accepting it – Third-party checks – Checks marked “payment in full” • Checking Accounts – Personal – Business ~ office expenses – Interest-earning ~ for special expenses – Power of attorney © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-32 Apply Your Knowledge What is a negotiable instrument? ANSWER: A negotiable instrument is a check that is legally transferable from one person to another. A check must: • Be signed by the payer • Include the amount of money to be paid • Be made payable to the payee or bearer • Be made payable on demand or on a specific date • Include the name of the bank that is directed to make payment. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-33 Preparing a Bank Deposit • Endorsement – Blank ~ payee’s signature – Restrictive ~ specifies “for deposit only” – Special ~ third-party endorsement – Qualified ~ used by attorneys © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-34 Preparing a Bank Deposit • Endorsement – Endorse immediately – Endorse in appropriate place – Endorse in ink or use stamp © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-35 Completing the Deposit Slip • Post the payment to the patient ledger card BWW Medical Associates, PC 305 Main St. Port Snead YZ, 12345-9876 xx • Put the check with others to be deposited • Fill out a deposit slip © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-36 Making the Deposit • Make deposits in person • Obtain deposit receipt • Electronic Deposits – Electronic funds transfers (EFTs) © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-37 Apply Your Knowledge What are the types of check endorsements? ANSWER: There are four principal types of endorsement: Blank endorsement - simply the payee’s signature. Restrictive endorsement – specifies how the check may be redeemed. Special endorsement – a third-party endorsement Qualified endorsement – used by attorneys, who may accept a check on behalf of their client, © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-38 Reconciling Bank Statements • Reconciliation – Comparing the office financial records with the bank statement – Ensure that they are consistent and accurate – Performed once a month © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-39 Reconciling Bank Statements Bank Statement Balance 10,900.00 (deposit) + 2,000.00 12,900.00 (Outstanding checks) - Checkbook 12,600.00 (auto-pay) - 500.00 12,100.00 800.00 12,100.00 © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-40 Apply Your Knowledge How do you reconcile a bank statement? ANSWER: You compare the office financial records (checkbook or disbursements journal) with the bank statement to be sure they are accurate. In the checkbook, you should mark all items that have cleared the bank to be sure all are accounted for. Once outstanding checks are subtracted from the bank’s balance it should match the checkbook balance. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-41 Electronic Banking Advantages - improves productivity, cash flow, and accuracy Traditional Banking You record each check and determine new balance Electronic Banking Computer calculates new balance You reconcile office bank statement You lock up banking materials at end of day Computer reconciles the statement automatically You use computer password for security © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-42 Electronic Banking (cont.) • Computer software will – Record deposits – Pay bills – Display checkbook – Reconcile the bank statement • Check bank’s safeguards © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-43 Electronic Banking (cont.) • Record Deposits • Display checkbook – Enter each deposit – Verify checks – Print deposit slip – Check withdrawals and deposits • Pay bills – Check balance – Log checks – Electronic bill pay © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-44 Electronic Banking (cont.) • Balance checkbook – Program displays checks and deposits – Mark those appearing on the statement – Enter balance from statement – Program performs the reconciliation © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-45 Apply Your Knowledge What are the advantages of electronic banking? ANSWER: Electronic banking improves productivity, cash flow, and accuracy. Computerized banking programs facilitate recording deposits, paying bills, displaying the checkbook and reconciliation of the account. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-46 Accounts Payable and Managing Disbursements • Three types: – Payments for supplies, equipment, and practice-related products and services – Payroll – Taxes © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-47 Disbursements • Payments for goods or services • Recording disbursements 1. Set up disbursement journal 2. Enter check information and amount 3. Determine expense category © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-48 Disbursements 4. Record check amount under appropriate category 5. Split amount if necessary and enter total in check amount column © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-49 Writing Checks • Account balance must cover the check • Enter on disbursement log then write check • Have the doctor sign the check • Mark invoice with date, check number, and amount paid; place copy in file • Mail check © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-50 Writing Checks (cont.) • Disbursement log – Total and track expenses by category – Check calculations – Tracking • Look for changes • Helps control expenses © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-51 Understanding Financial Summaries • Statement of income and expense • Cash flow statement – shows money available to cover expenses • Trial balance – Check periodically – Expenses should match amount in check column © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-52 Apply Your Knowledge How do you record disbursements in a disbursement journal? ANSWER: To record disbursements: 1. Enter check information and amount 2. Determine expense category 4. Record check amount under appropriate category 5. Split amount if necessary and enter total in check amount column © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-53 In Summary 21.1 Procedures to be established to help maintain consistency in financial practices include being organized and consistent. Write clearly and use markers to keep track of your current location. Check your work frequently and correct any errors using the approved. All entries must be kept readable at all times. Finally, keep all figure columns straight so that decimal points line up. Following through on these procedures can help ensure that your work will be concise and accurate. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-54 In Summary (cont.) 21.2 The single-entry accounting system, where an entry is written once on the patient ledger, on the daily log, and in the checkbook, contains no checks and balances for accuracy. The double-entry system, based on assets = capital & liabilities, has checks and balances, but can be cumbersome and complicated. The write-it-once system allows all transactions to be recorded in one procedure, using carbonless forms on all necessary documents. Many computerized office management software packages are based on the write-it-once concept. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-55 In Summary (cont.) 21.3 Patient related financial transactions include starting the day, patient process, attaching the superbill to the patient chart, patient check out, after visit payments, returned checks, refunds, uncollectable accounts, and end of day procedures. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-56 In Summary (cont.) 21.4 A negotiable instrument is one that is legally transferable from one person to another. To be negotiable a check • must be written and signed by the payer or maker, • include the amount of money to be paid, • be made payable to the payee or bearer, • be made payable on demand or on a specific date, • include the name of the bank that is directed to make payment. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-57 In Summary (cont.) 21.5 The types of check endorsements are blank, restrictive, special, and qualified. To make a bank deposit, follow the steps outlined in Procedure 21-5. 21.6 Following the guidelines outlined in Procedure 21-6, the student should successfully be able to reconcile a mock bank statement with a mock office checkbook. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-58 In Summary (cont.) 21.7 The computer software calculates each new balance, reconciles the monthly bank statement automatically and a computer password and security system is used to keep the information safe and confidential. 21.8 Following Procedure 21-7, the student should set up a mock disbursements journal consisting of several columns of expenses. Once set up, given a list of several “bills” to be paid, the student should document the check information and record the disbursement amount in the correct column(s) of the journal. © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 21-59 End of Chapter 21 Never spend your money before you have earned it. ~ Thomas Jefferson © 2014 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.