No1410830amJSMSLIDESAug102015bySAHINOGLUetal

GAME THEORETIC DECISION-MAKING TO

COST-OPTIMIZE TYPE I (P

RODUCER

’

S

R

ISK

) AND

II (C

ONSUMER

’

S

R

ISK

) ERROR PROBABILITIES

IN STATISTICAL HYPOTHESIS TESTING

@JSM M

ONDAY

8/10/15, 8:30

AM

N

O

:141 S

EATTLE

/WA/USA

by Dr. M. Sahinoglu et al*, Director, Informatics Institute

E-mail address:

MeSa@aum.edu

Univ. Tel.:

334 244 3769

* Rasika Balasurya, David Tyson

Dr. M.Sahinoglu

1

Introduction

A) When establishing a test procedure to investigate statistically the credibility of a stated hypothesis, several factors must be considered one of which is the size of the sample. However the most significant of all these is no doubt to optimize Type I and II errors. Statisticians have by rule of thumb always selected

, such as α=0.05, or 0.01 or 0.1, none for β depending on the Ha.

B) There have been attempts by Grant to compute “α” by deriving the first and second derivatives of the standard normal distribution curve whereby determining the second derivative to reach maximum at z= ±1.732.05 which corresponds to a p-value of 0.083, or when the maximal curvature occurs at z= ±1.749.83 that will correspond to a p-value of 0.08 by Kelley

.

C) This first-time research examines the contribution of the Game-theoretic risk computing to optimize the Type-I and Type-II error probabilities, α and β, when cost and utility factors are involved. The concept of Game theory has been brought to Hypothesis testing earlier but at a theoretical level involving the establishment of finite sample bounds on the general theme of statistical inference by Schlag (2008). He used Game theory to establish the minimal type

II error (Beta) whereby the associated randomized test was characterized as part of Nash equilibrium.

However this did not lead to an algorithmic simple usage by the layman.

Savage noted that game theory can be used to solve statistical problems (1954). The underlying idea is to solve worst case problems by invoking the minimax theorem for zero-sum games developed by von

Neumann (1928) who further improved it with Morgenstern at Princeton(1944). 2

Introduction

D) The issue with these conventional approaches is that they are detached form the market realities such as cost (loss) or utility (gain) associated with varying risk values (α and β), or non-risk values (1-α) and (1-β) and their cross products, such as [ α * β], [α * (1- β)], [(1-α) * β)] and [(1-α) *

(1β)] in the form of producer’s (α ) risk and consumer’s risk (β).

E) Why? Simply because, hundreds of marketed products are subject to producer’s risk: α (underappreciated or declared bad by the consumers while essentially H

0

:good product, costing the producer an unjust financial loss ) or consumer’s risk, β (over appreciated or declared good by the consumer while the essentially H

A

: bad product, costing the user and the producer irreparable bad reputation and PR in a ripple effect) or both happening at various levels by different consumers in so-called partial risks, where one of each type (I or II) is involved

α *(1- β) or (1α)*β .

F) Finally the best scenario occurs when no risks incurred at all which cost the producers and consumers zero financial loss with complete market satisfaction and utility gain (vs. cost) in bringing revenue; i.e. (1β)*(1-α): the cross-product of power and confidence.

NOTE : [α * β] + [(1-α)*β)] + [α*(1- β)] + [(1-β)*(1-α)] = 1.0 is always true!

3

Game-Theory

Game Theory is a branch of mathematics, devoted to the logic of decision making in social or political interactions, concerns the behavior of decision makers whose decisions affect each other. Note each decision maker has only partial control over the outcome. Game theory is a generalization of decision theory where two or more decision makers compete by selecting each of the several strategies; while

Decision Theory is essentially a one person game theory. In general, any game involves the following:

1) Players: An individual or a group of individuals can be considered a player such as individuals, teams, companies, political candidates and contract bidders.

CO: consumers (users) vs. PR :producers (marketers)!

2) Actions: The set of moves to choose from each player .

Accept/Reject; Rel/NRel!

3) Outcomes: An outcome in a game is the act of each player choosing a move from its action set so that numerical payoffs reflecting these preferences can be assigned to all players for all outcomes .

Expected Cost

4) Preferences: Each player prefers some outcome to others based on payoffs or utilities associated with these outcomes. The combination of rivaling strategies defines the game’s worth to the competing players .

PR may re-manufacture, adjust price, extend warranty, increase advertising or offer quantity discounts. CO may turn to other markets for a better value!

4

Data Nomenclature

P

11

= αβ

P

12

= α(1-β)

P

21

= (1α)β

+ P

22

= (1α)(1-β)

1.00

α = P

11

β = P

11

+ P

12

+ P

21

= αβ + α(1-β) = α + αβ – αβ = α ; QED.

= αβ + (1-α)β = β + αβ – αβ = β; QED.

P

11

= Composite Riskiness = CR = α * β

P

22

= Non-CR (Non-Riskiness) =Confidence*Power=(1α)*(1- β)=1-α-β+ α *β

P

12

+ P

21

= Partial Riskiness (PR) due to TypeI(α) or Type-II(β) = α(1- β) + (1- α) β

C

11

($) = Positive multiplier of P

11 financed by the producer as per unit marketing cost

C

12

($) = Positive multiplier of P

12 financed by the producer as per unit marketing cost

C

21

($) = Positive multiplier of P

21 financed by the producer as per unit marketing cost

C

22

($) = Negative multiplier of P

22 made by the producer as per unit marketing revenue

Expected Cost (EC) = C

11

($)* P

11

+ C

12

($)* P

12

+ C

21

($) * P

21

+ C

22

($) * P

22

Loss($) = Game-theoretic variable to minimize toward the Neumann mixed-strategy equilibrium.

The higher the input Loss ($) value entered, the more the marketer is planning to invest so to redeem risks the lower the EC gets, the less α and β are given C ij

. The set of sensible {.01<α, β<.1} define

! Note,

5

LOSS.

LP with Game Theoretic Constraints

We now apply LP to Neumann’s game-theoretic risk computing where Min

LOSS is the objective function subject to 14 constraints covering eqns 1- 14 :

P

11

C

11

– LOSS ≤ 0, (1)

P

12

C

12

– LOSS ≤ 0, (2)

P

21

C

21

– LOSS ≤ 0, (3)

P

22

C

22

– LOSS ≤ 0; (4)

P

22

≥ P

11

, (5)

P

22

≥P

12

, (6)

P

22

≥P

21

; (7)

P

11

P

21

≤ 1, (8)

P

12

≤ 1, (9)

≤ 1, (10)

P

22

≤ 1, (11)

LOSS ≥ LOSS min

(12)

P

11

+ P

12

Π (α, β, C ij

+P

21

) = P

+ P

22

=1 (13)

11

C

11

+ P

21

C

21

+ P

12

C

12

+ P

22

C

22

≤ 0 (14)

6

Examples

Table 1. Cost Input Table for Example 1

Figure 1. Game-Theoretic Expected Total Cost (negative: utility) vs. Loss Factor for Ex. 1 Figure 2. Game-theoretical optimized alpha and beta values vs Loss Factor for Ex. 1

7

Results

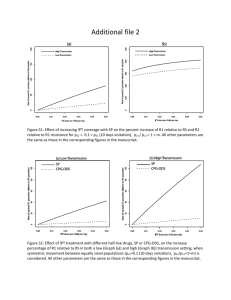

Optimal Results: Utilizing equations (1-14), solutions to the unknown vector, [P ij

]= [P

11

, P

12

, P

21 ,

P

22

]; we get α = P

.071429= .077678 ( or 7.77%) and β = P

11

+ P

11

21

+ P

12

= .006249 +

= .006249 + .024999 =

.031248 (or 3.13%) given that LOSS($)= 5.

Expected Cost: ΣP ij

C ij

=.006245*$ 800 + .07143* $70 + .0245*$ 200 +

.897321*( -$400 ) = -$343.92, which is a favorable utility gain for the overall .

See Ho vs. Ha and OC: @Ha=7.95 on x-axis, y-axis=.0313 & @Ha=5 on x-axis, y-axis=1-.0777=.9223

☺

Fig 3. Optimal hypothesis plan with α and β for Table 1, Ex. 1 with n=100 Fig. 4. OC Curve with optimized α and β for Table 1 for Ex. 1 for n=100, σ=9>1

8

Discussions and Conclusion(1) -From the Manuscript

A) In this new approach to calculating cost-optimized Type-I and II error probabilities, the principal author follows an innovative Game-theoretic avenue where the probabilistic and cost-related constraints as well the five input parameters ( C ij and LOSS ) have to be selected by the analyst to reflect the market conditions for a profitable business model. We first covered Example 2 in Section 5. Whereas, in Example 2 with [ C ij

800, 70, 200, -400] and LOSS = $5 resulting in α = 7.77% and β=

=

3.13%, we incur a negative cost of -343.92 which signifies a profitable utility (gain) for the business plans in 2.A and 2.B supported by figures and sampling plans of 5.A-F and the OC curve of 5.G.

B) Lastly, in Example 3 with [ C ij

= 800, 70, 200, -100] and LOSS = resulting in α = 10.87% and β= 4.37%, we incur a negative cost of -

$7

64.63 which signifies a profitable utility (gain) for the business plan

Figure 6.A and 6.B followed and supported by figures and sampling plans of 7.A-F and the OC curve 9.G. In these plans, we tried varying sample sizes, n=1, 2, 10, 50, 100 and varying sample standard deviations such as σ=1 and σ=9.

9

Discussions and Conclusion (2)-From the Manuscript

D) In usual hypothesis testing we select an “α” and sample size “n”, and Ha, as it does not get any better than this so-far-so-good status-quo. As common knowledge dictates; α↑ increases with β↓ decreasing and vice versa for given sample size, n, and Ha. Another way to reduce β (=Type–II error probability) is to increase sample size n↑ for a specified non-varying α and δ = µ

1

µ

0

. That is, we may elevate the power of the test (i.e. Power=1β) by increasing the sample size. However, all these concepts being fine, one cannot enter the market dynamics in terms of dollar- or euro-based costs or utility without any notion of optimizing (in this case, minimizing producer’s and consumer’s risks) provided the market controls the costs of incurring risks.

E) It is this research paper’s task to open a new avenue for discussions leading to an evolved game-theoretic but market-realistic optimal solution of Type-I and II error probabilities (also known as producer’s and consumer’s risks) in contrary to selecting them per judgment calls devoid of cost or utility constraints in a businessplan-state-of-mind. It falls upon the authors to further state that the most challenging task in this game-theoretic proposition is to generate the most-fitting rightful and authentic market-centric input data for the firmware, cyberware or any other commodity market about which the tests of hypotheses are being conducted. This will necessitate another series of econometric data collection studies so as to generate the most compatible input data sets for the problem proposed in this research so as to give life and meaning to the cost factors explained .

10